Get the free One Time Ach Payment Authorization

Get, Create, Make and Sign one time ach payment

How to edit one time ach payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out one time ach payment

How to fill out one time ach payment

Who needs one time ach payment?

One Time ACH Payment Form: A Comprehensive Guide

Understanding one time ACH payment authorization

ACH payments, or Automated Clearing House payments, are electronic money transfers made between banks. They are widely used for various types of transactions, including direct deposits and bill payments. A one time ACH payment is a specific type of transaction where funds are moved from one bank account to another on a single occasion. This payment method is known for its efficiency and reliability, making it an ideal choice for both individuals and businesses.

One-time ACH payments hold significant importance in many transactions today. They allow for quick processing without the need for checks or cash, reducing administrative workload for businesses and providing a secure payment option for consumers. With benefits such as lower transaction fees compared to credit cards, customer convenience, and streamlined record-keeping, ACH can substantially improve handling of payments.

Overview of the one time ACH payment form

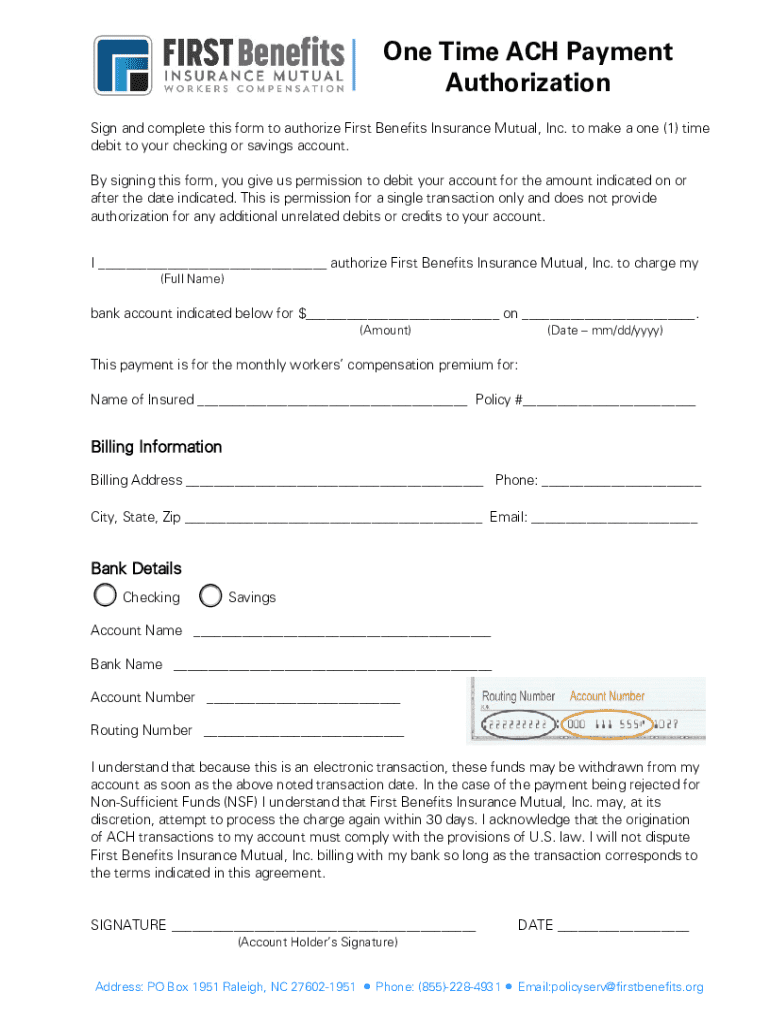

The one time ACH payment form is a document used to authorize a bank to transfer funds from one account to another for a single payment. This form captures all necessary information for the transaction, ensuring that the transfer is executed correctly. The form typically includes fields for personal details, payment information, and bank account information.

Various industries utilize the one time ACH payment form, including utility companies, subscription-based services, and real estate transactions. In each case, the form acts as an authorization tool that facilitates seamless payment processing while providing documented consent from the payer.

In addition to understanding how to fill out the form, it is essential to be aware of regulatory compliance. Entities processing ACH payments must comply with NACHA (National Automated Clearing House Association) guidelines, ensuring both payer and payee are adequately informed and protected throughout the transaction process.

Preparing to complete the one time ACH payment form

Before you start filling out the one time ACH payment form, it's vital to gather all necessary information. Obtain personal identification information, including your name, address, and phone number. You'll also need the payment amount and the specific bank account details from which the funds will be withdrawn, including routing and account numbers.

Ensuring the accuracy of the information provided is crucial for preventing payment delays or errors. Mistakes can lead to bounced transactions or unauthorized charges, so verifying your data before submission can save time and avoid complications down the line.

Step-by-step instructions to fill out the one time ACH payment form

Following a structured approach to completing the one time ACH payment form helps ensure success. Here’s a step-by-step guide:

Editing and managing your one time ACH payment form

After submitting your one time ACH payment form, you may want to make changes or corrections. If you notice an error post-submission, it’s crucial to contact your bank or payment processor immediately to rectify any issues. Prompt action can help prevent complications.

In terms of document management, it's advisable to store your completed forms securely for future reference. Digital documents can be stored encrypted on cloud platforms, ensuring that sensitive information remains safe from unauthorized access.

Using pdfFiller to enhance your ACH payment experience

pdfFiller provides an intuitive solution for managing your one time ACH payment forms. With its robust editing features, you can customize your forms to meet specific needs while ensuring all required data fields are appropriately included.

The platform also boasts advanced e-signature capabilities, allowing you to collect signatures effortlessly. Furthermore, collaborative tools enable teams to work on the same document in real-time, ensuring everyone is on the same page.

Frequently asked questions (FAQs) about one time ACH payment forms

Addressing common concerns regarding one time ACH payment forms can demystify the process. Below are answers to frequently asked questions:

Best practices for one time ACH payments

Adhering to best practices when handling one time ACH payments can improve the user experience and ensure transactions occur smoothly. Track each payment through your banking app or portal, and set up notifications for confirmations to keep yourself informed.

Implementing security measures is vital as well. Ensure that your documents are shared only with trusted entities and are stored securely. Utilizing security features like two-factor authentication for your accounts can also be beneficial in safeguarding your payment information.

Additional tips for individuals and teams

When customizing your one time ACH payment forms, pdfFiller offers simplicity. You can easily add your branding or unique elements to ensure consistency across all documentation. This customization can enhance your business's professional image and help convey essential brand values.

Moreover, leveraging pdfFiller's accessibility and collaboration features can greatly benefit remote teams. With real-time editing capabilities, teams can work on documents simultaneously, leading to increased productivity and fewer miscommunications.

Harnessing the power of pdfFiller

The versatility of pdfFiller allows users to access documents from anywhere, ensuring you can manage your one time ACH payment forms on the go. This cloud-based solution allows for a fully equipped digital workspace tailored to your document management needs.

In addition, pdfFiller's collaborative capabilities ensure that team members can engage with documents in real-time, enhancing teamwork and maintaining workflow efficiency. Meeting compliance requirements can also be done more easily, as all modifications and signatures are tracked and stored securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my one time ach payment in Gmail?

Can I create an electronic signature for signing my one time ach payment in Gmail?

How do I fill out one time ach payment on an Android device?

What is one time ach payment?

Who is required to file one time ach payment?

How to fill out one time ach payment?

What is the purpose of one time ach payment?

What information must be reported on one time ach payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.