Get the free Fy25-26 Income Verification Forms

Get, Create, Make and Sign fy25-26 income verification forms

Editing fy25-26 income verification forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fy25-26 income verification forms

How to fill out fy25-26 income verification forms

Who needs fy25-26 income verification forms?

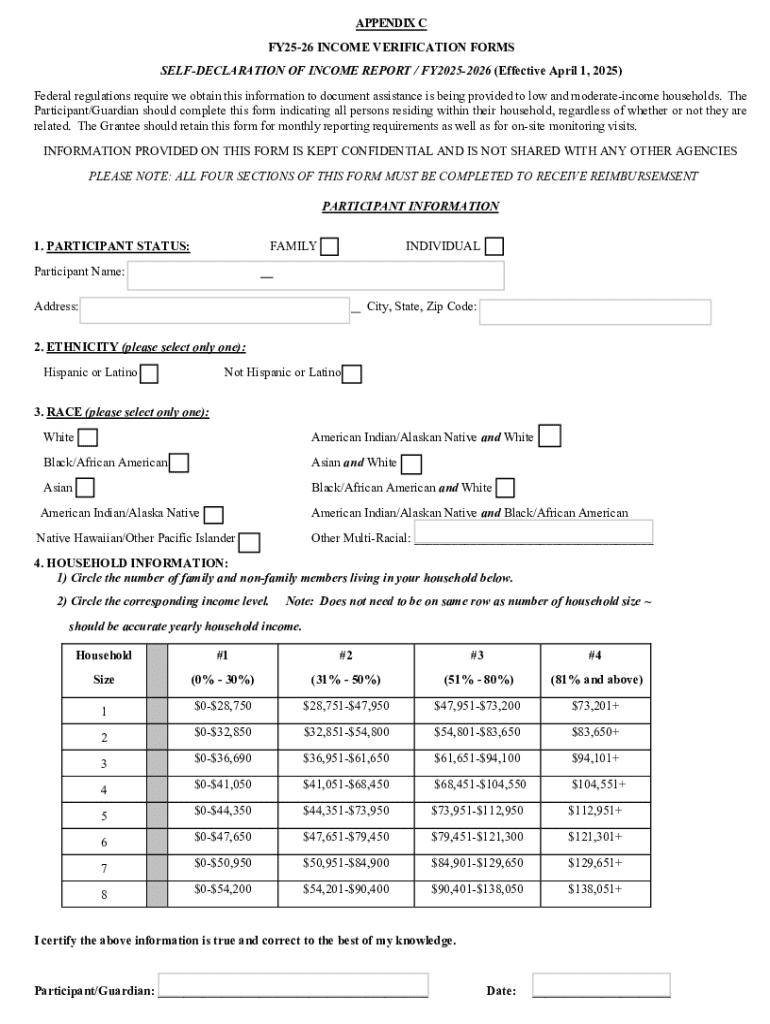

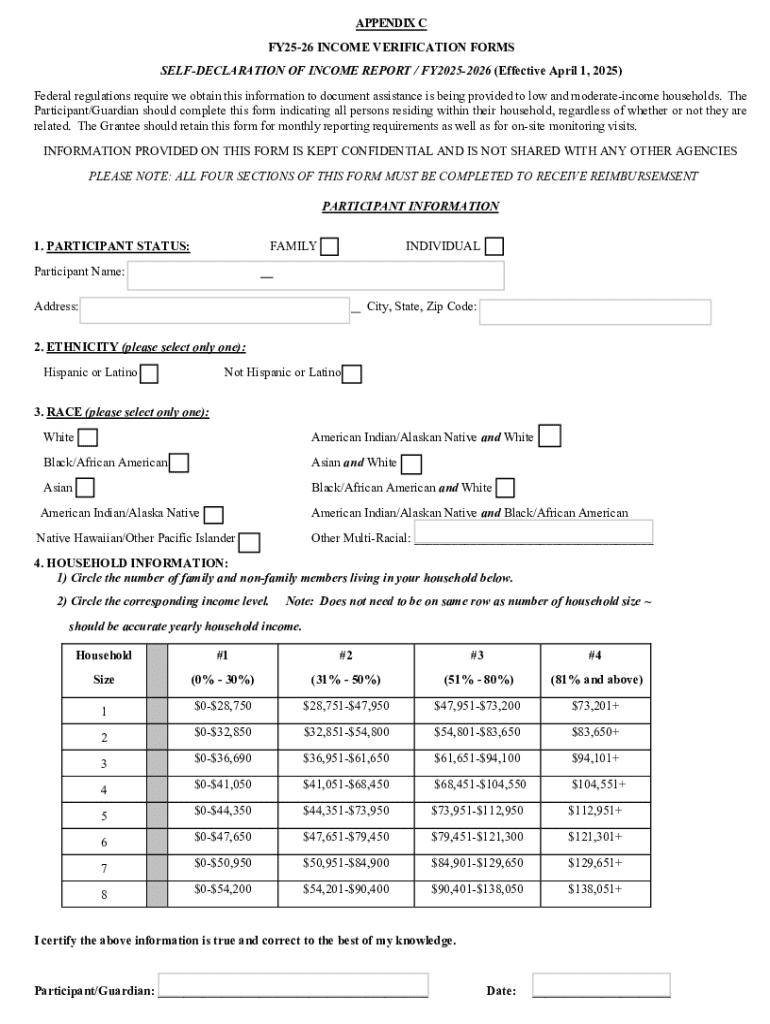

Understanding FY25-26 Income Verification Forms

Understanding income verification forms

Income verification forms are essential documents used to confirm an individual or entity's earnings. They play a crucial role in various financial transactions, ranging from securing loans to obtaining government benefits. By presenting these forms, individuals validate their income, ensuring that financial institutions or agencies can make informed decisions based on reliable data.

The importance of these forms extends to compliance with tax regulations and eligibility assessments for grants or loans. Inaccuracies or omissions on these documents can lead to serious financial repercussions, making it vital for individuals and businesses to understand and accurately complete the required paperwork.

Types of income verification forms for FY25-26

There are various income verification forms relevant for FY25-26. Each form serves a distinct purpose and applies to different income scenarios, which include:

Who needs to use income verification forms?

Income verification forms are necessary for a variety of individuals and entities. For individuals, these forms are vital when applying for loans, housing assistance, or food stamps. They help substantiate claims by providing verified financial information. Business owners, too, must present these forms when seeking funding or completing transactions that require proof of income.

Teams responsible for handling financial documentation—such as human resources personnel, accountants, and financial advisors—must be adept at managing these forms. They ensure that the information presented is accurate and compliant with current regulations.

Detailed breakdown of FY25-26 income verification forms

W-2 form specifics

The W-2 form is provided by employers and details an employee's total earnings along with the taxes withheld for that year. Employees should focus on key sections like Box 1, which lists the total taxable wages and Box 2, reflecting federal income tax withheld. Ensuring accuracy in these sections is critical to avoid issues with tax filings.

1099 form essentials

There are several types of 1099 forms, including the 1099-MISC for reporting miscellaneous income and the 1099-NEC specifically for non-employee compensation. Understanding the distinctions helps ensure that the correct form is used for payment reporting. Individuals must review the details outlined for clarity on what income is being reported.

Self-employment income statements

For self-employed individuals, compiling accurate income statements is vital. These statements should encompass all income sources, including invoices and payment records. Additionally, it’s crucial to maintain organized records of business expenses that may help in tax deductions, thereby presenting a clear financial picture.

Step-by-step instructions for completing income verification forms

Gathering necessary information

Start by identifying all income sources, including regular employment, freelance projects, or any passive income. Compile previous tax records and documents, as these will provide a reference for accurate and truthful reporting.

Filling out the forms

When filling out the forms, it's crucial to input accurate figures, as any discrepancies can lead to delays or complications. Double-check that all required fields have been addressed. Common mistakes to avoid include transposing numbers and leaving sections blank.

Reviewing completed forms

Prior to submission, utilize a checklist to ensure that all information is accurate. Confirm that each figure is correct and that dates and signatures align with the form's requirements. Conducting a thorough review can eliminate costly errors.

Editing and updating income verification forms

Using PDF editor features

Editing income verification forms can be accomplished easily using tools like pdfFiller. Start by uploading the form to the platform, then utilize the editing tools to make changes as necessary. Ensure that all modifications maintain the accuracy and integrity of the data.

Ensuring compliance

As regulations may change, always check that the form you are using is valid for FY25-26. Utilize resources such as the IRS website or seek guidance from professionals to ensure compliance with the latest requirements.

Signing and submitting income verification forms

Electronic signature options

Signing income verification forms can be done electronically using tools like pdfFiller's integrated eSigning features. Here, users can create legally recognized digital signatures. This simplifies the process and ensures that documents can be processed quickly.

Submission channels

When it comes to submission, options may vary based on the recipient. Common submission methods include online uploads, mailing a physical copy, or in-person drop-off. Always follow the specific instructions provided by the organization requesting the forms.

FAQs about FY25-26 income verification forms

Many users often have similar questions regarding income verification forms. A common query is when these forms should be submitted. Generally, it is recommended to submit these forms as soon as they are requested to avoid delays in processing. Practicing good documentation habits will facilitate smoother transactions.

Additional resources and tools

To streamline the process of completing and managing income verification forms, pdfFiller offers various interactive tools. Users can find document templates specific to FY25-26 as well as help resources for troubleshooting common issues. These resources are particularly useful for individuals and businesses striving for efficiency.

Contact support for further assistance

If you encounter any challenges while filling out or submitting income verification forms, reaching out to pdfFiller customer support is essential. They provide tailored assistance, addressing specific inquiries related to income verification forms, ensuring that users can resolve issues swiftly.

Related templates and documents

Several templates are frequently used alongside income verification forms, including expense reports, payroll templates, and profit and loss statements. Accessing these templates through pdfFiller not only enhances the document preparation process but also ensures users have the necessary resources to support their income verification efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fy25-26 income verification forms directly from Gmail?

Can I create an electronic signature for the fy25-26 income verification forms in Chrome?

How can I fill out fy25-26 income verification forms on an iOS device?

What is fy25-26 income verification forms?

Who is required to file fy25-26 income verification forms?

How to fill out fy25-26 income verification forms?

What is the purpose of fy25-26 income verification forms?

What information must be reported on fy25-26 income verification forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.