Get the free Jc Credit Card Agreement/application

Get, Create, Make and Sign jc credit card agreementapplication

Editing jc credit card agreementapplication online

Uncompromising security for your PDF editing and eSignature needs

How to fill out jc credit card agreementapplication

How to fill out jc credit card agreementapplication

Who needs jc credit card agreementapplication?

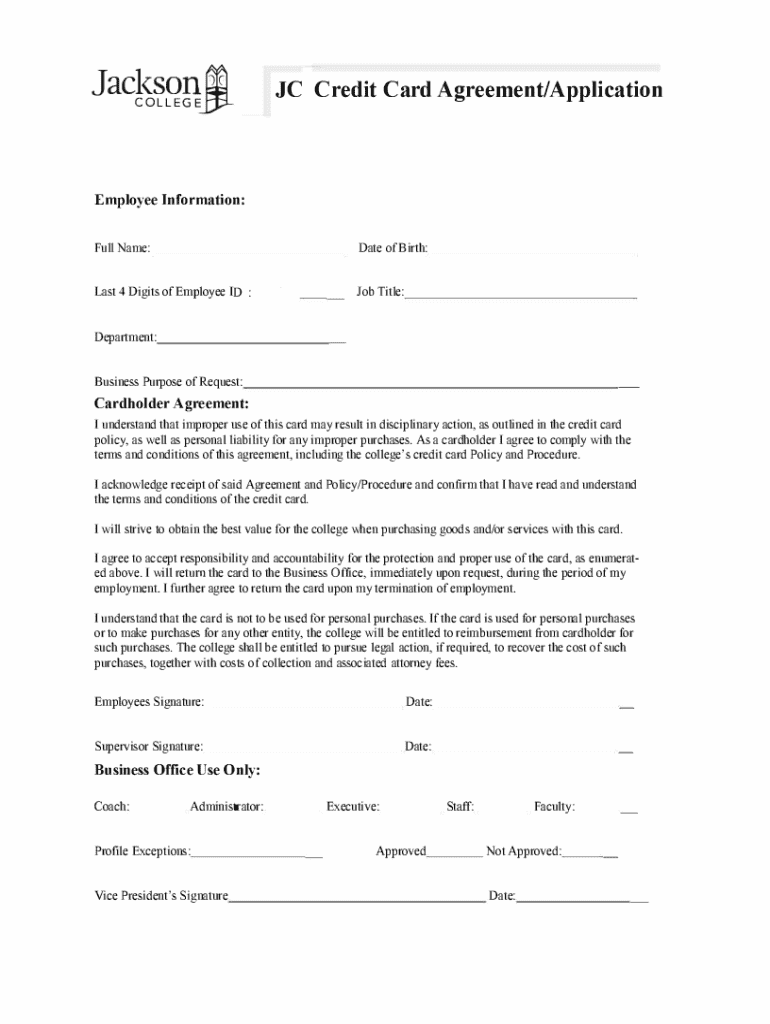

Understanding the JC Credit Card Agreement Application Form

Overview of the JC credit card agreement

A JC credit card agreement serves as a crucial document outlining the terms and conditions associated with your credit card. This agreement not only defines your rights and responsibilities as a cardholder but also specifies the lender's obligations. Understanding this agreement can help you avoid pitfalls in credit usage and navigate the financial landscape effectively.

Key terms such as interest rates, fees, payment schedules, and penalties for late payments are commonly included in the agreement. Knowing these can empower you to make informed financial decisions, ensuring you're not caught off guard by unexpected charges.

Benefits of having a JC credit card

Holding a JC credit card comes with several benefits. Primarily, it offers financial flexibility, allowing you to make higher-value purchases you might not afford outright. This capability is crucial for unexpected expenses, helping you manage cash flow effectively.

Moreover, many JC credit cards provide rewards programs, which can include cashback on purchases, travel rewards, or discounts at specific retailers. Utilizing these benefits can enhance your purchasing power and add additional value to your expenditures.

Understanding the application process

The application process for a JC credit card involves several straightforward steps, making it manageable for most individuals. It's crucial to follow these steps diligently to increase your chances of approval.

The first step is to confirm your eligibility. Most JC credit cards require applicants to be at least 18 years old, have a stable source of income, and meet a minimum credit score threshold, which can vary by issuer.

Step-by-step guide to applying for a JC credit card

Once you've confirmed your eligibility, it's time to gather your documents. You'll need to have your identification handy, which may include your driver's license or Social Security Number. Additionally, proof of income may be required, such as pay stubs or tax returns for the last two years.

When it's time to fill out the application form, approach it section by section to ensure accuracy. Start with your personal information, followed by your employment details. Be honest about your financial situation; any discrepancy could lead to denial during the review process.

Detailed instructions for completing the JC credit card application form

The application form comprises various sections that need careful attention. The personal information section includes your full name, current address, phone number, and email address. Make sure to double-check all entries for typos or inaccuracies.

Next is financial information where you'll provide details about your employment status, monthly income, and any other income sources. Be prepared to answer questions regarding your existing debts and credit history, as these help lenders assess your creditworthiness.

Finally, take the time to review the application before submitting it. This can prevent unnecessary delays due to incomplete information or errors, ensuring a smoother approval process.

Editing and signing your JC credit card application form

Using pdfFiller to manage your application form provides an efficient way to edit and sign your documents seamlessly. To edit, simply upload your application form to the platform, where you can make necessary changes or add annotations directly on the document.

Once edits are finalized, you can electronically sign the document. This process is straightforward and ensures your signature is secure while maintaining the document's integrity. Electronic signatures are legally recognized, making them a convenient choice for most applications.

Managing your JC credit card application

After submission, it’s essential to keep track of your application status. Most financial institutions offer online portals where you can check real-time updates regarding your application. You might receive notifications or emails detailing the progress of your application or requesting additional information.

If additional information is requested, promptly respond to ensure your application doesn’t linger in review longer than necessary. Understanding how the review process works can alleviate concerns about timing and approval.

Common issues and troubleshooting tips

Despite carefully following the application process, it’s not uncommon for applicants to face denials. Common reasons include insufficient income or a poor credit history. Identifying these issues early is crucial for your financial wellbeing.

If your application is denied, take time to review your credit report and address any negative factors impacting your score. Consider strategies like paying off existing debts or maintaining consistent payment schedules to improve your score before reapplying.

Related forms and applications

Aside from the JC credit card agreement application form, various other credit card applications may be available. It's valuable to compare these options to find the card that best fits your financial needs. Each credit card may offer distinct benefits, so understanding the nuances will help you make an informed choice.

Additionally, keep in mind the importance of collateral documents like credit reports and bank statements, which strengthen your application and reflect your financial behavior.

Frequently asked questions (FAQs)

Many applicants often inquire about what happens after submitting their JC credit card application. Typically, you can expect a confirmation email indicating that your application has been received. The review process can vary, but most approvals or denials are communicated within a week.

Another common question is whether applicants can make updates after submission. Generally, changes can be made if the application is still in process; however, it’s advisable to contact customer support for specific instructions.

Using pdfFiller for future document needs

pdfFiller is an empowering tool for document management, extending beyond just credit card applications. Its capabilities for editing, signing, and managing various forms make it ideal for individuals and teams seeking efficient solutions.

Using pdfFiller allows you to save and store your application securely in the cloud, ensuring that your important documents are always accessible from anywhere. This level of convenience is essential in today's fast-paced world.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify jc credit card agreementapplication without leaving Google Drive?

How do I execute jc credit card agreementapplication online?

How do I complete jc credit card agreementapplication on an iOS device?

What is jc credit card agreementapplication?

Who is required to file jc credit card agreementapplication?

How to fill out jc credit card agreementapplication?

What is the purpose of jc credit card agreementapplication?

What information must be reported on jc credit card agreementapplication?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.