Get the free Business Loan Application

Get, Create, Make and Sign business loan application

How to edit business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application

How to fill out business loan application

Who needs business loan application?

Business Loan Application Form: How-to Guide

Understanding business loans

Business loans are financial products designed to provide entrepreneurs and businesses with necessary funding to operate, expand, or modernize their enterprises. These loans can be crucial for startups seeking initial capital, established businesses aiming for growth, and companies that need liquidity for day-to-day operations.

There are various types of business loans available, including short-term loans which are typically meant to cover immediate financial needs, and long-term loans intended for larger investments over an extended repayment period. Another distinction exists between secured loans, which require collateral, and unsecured loans, which do not. This classification influences both loan approval chances and interest rates imposed by lenders.

For entrepreneurs, business loans serve as a lifeline to realize their ambitions. They can fund research and development, purchase inventory, hire staff, or invest in marketing strategies crucial for gaining a competitive edge.

Importance of a well-structured application form

Lenders require application forms to gain a comprehensive understanding of the potential borrower's financial health, business operations, and loan purpose. A well-structured application form is essential as it presents the entrepreneur's case clearly and professionally.

Common pitfalls in business loan applications include incomplete information, poor organization, and lack of supporting documentation. These issues can lead to delays or outright denials. Conversely, a comprehensive loan application can significantly enhance approval chances by showcasing the entrepreneur’s preparedness and financial responsibility.

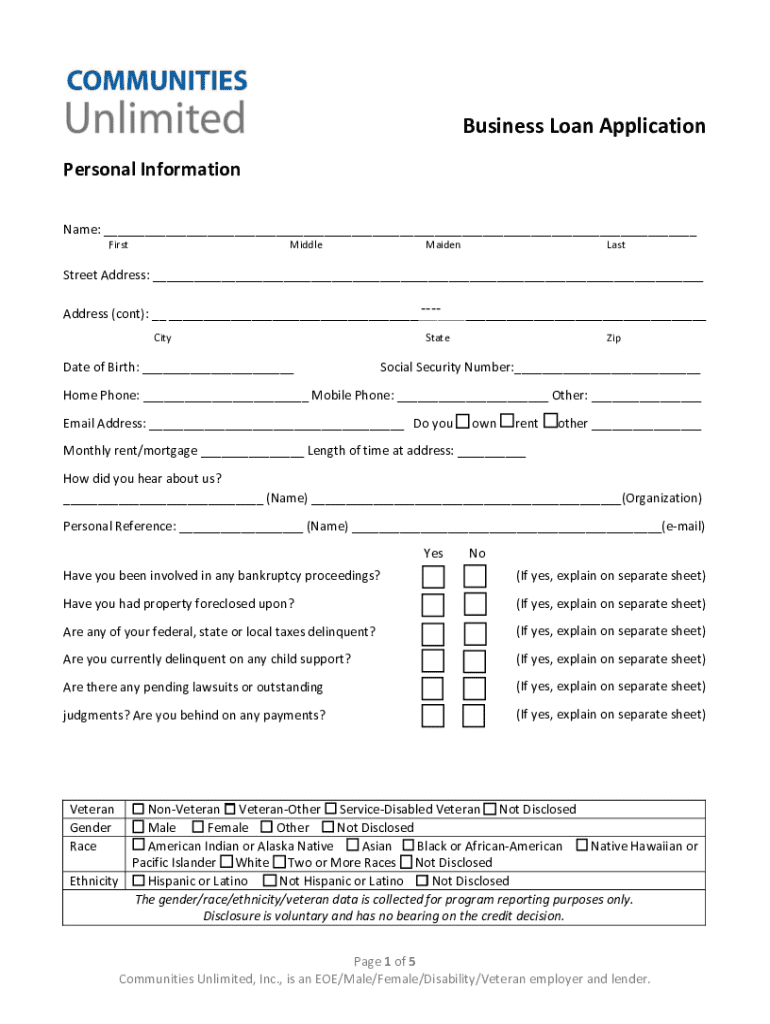

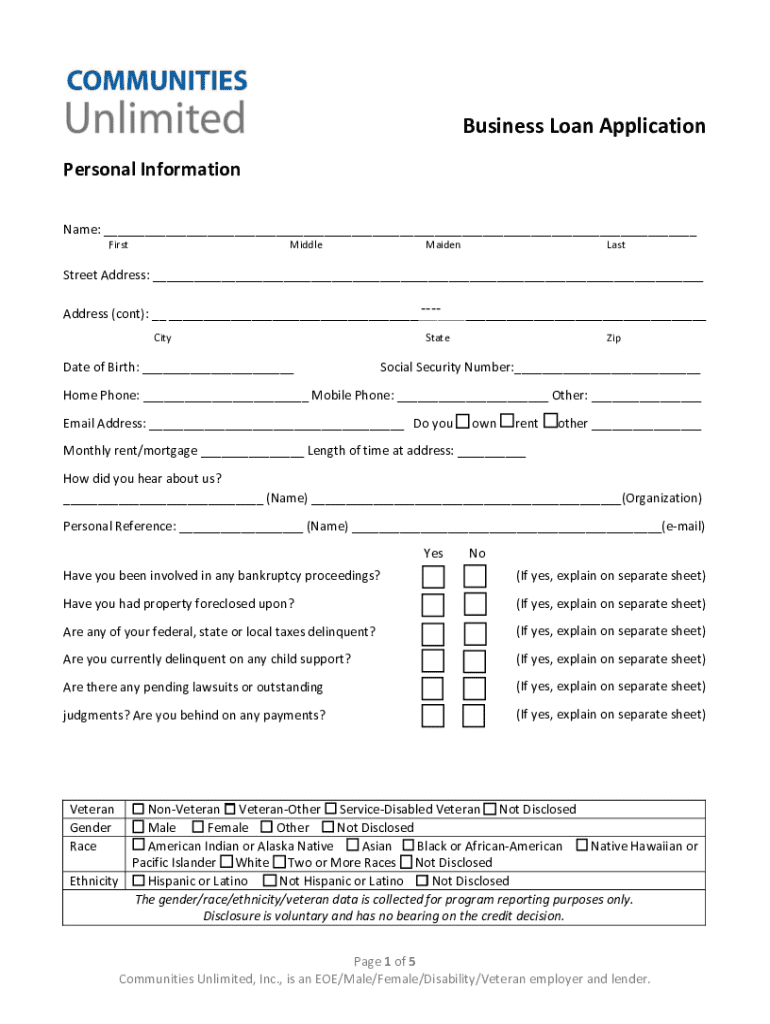

Key components of a business loan application form

A complete business loan application form consists of several critical sections. Starting with the personal information section, applicants should clearly provide their name, address, and contact information while specifying their business structure, such as whether it's an LLC, corporation, or partnership.

The business overview section should detail the business name and address, a description of products or services offered, and an overview of market analysis to demonstrate competitiveness. Financial information is paramount, encompassing current financial statements, credit history and scores, alongside realistic financial projections to illustrate future profitability.

Lastly, applicants must indicate the loan amount they need, specifying how these funds will be utilized, whether for expansion, equipment purchase, or operational expenses. This clarity helps lenders assess the viability of the request.

Step-by-step guide to filling out the business loan application form

To effectively complete a business loan application form, follow these steps. First, gather all necessary documents including financial documents such as tax returns and bank statements as well as business licenses and permits.

Next, complete the personal information section accurately. Once done, proceed to fill out the business overview, providing essential details about operations and market positioning. The subsequent step should focus on providing detailed financial information which is critical for lender assessment.

After detailing financials, make sure to clearly indicate the loan amount required and specify its intended purpose. Finally, review and proofread your application thoroughly to eliminate any errors or missing information prior to submission.

Interactive tools for application support

Utilizing online tools can enhance the business loan application experience. Online loan calculators assist in understanding potential repayments, ensuring that the proposed financial plans are achievable.

Additionally, document templates specific to business loan applications can help streamline the process, reducing the chances of omitting important information. eSigning tools also facilitate quick submission of documents, making the process more efficient.

Common questions about the business loan application process

After submitting a business loan application, applicants often wonder what comes next. Typically, lenders will review the application and may request additional documentation or clarifications. The average processing time can range from a few days to several weeks, depending on the lender's guidelines.

In the event that a loan application is denied, applicants should inquire about the specific reasons behind the decision. This feedback allows entrepreneurs to address shortcomings in future applications or explore alternative funding options.

Leveraging pdfFiller for your business loan application

pdfFiller offers a unique platform that empowers users to create and manage their business loan application forms efficiently. With easy-to-use editing tools, users can customize their documents to meet specific lender requirements.

The cloud-access feature allows users to manage their documents from anywhere, making it feasible to collaborate on applications among team members seamlessly. Furthermore, collaboration features ensure that all stakeholders can contribute to the business loan application process, streamlining approval efforts.

Tips for a successful business loan application

To enhance the success rate of your business loan application, present a robust business plan that illustrates your strategy and projected growth. This plan plays a critical role in convincing lenders of your commitment and capacity to repay.

Establishing a solid relationship with potential lenders is also important; open communication can lead to better terms or a more supportive borrowing experience. Finally, be transparent about your financial health, including past challenges. Authenticity can build trust, making lenders more likely to approve your application.

Final checks before submission

Prior to submitting a business loan application, it’s crucial to conduct a final review. Create a checklist to ensure all required documents are included and verify that every section of the application is filled out accurately.

Double-checking the information provided is essential; even minor errors can lead to complications later in the process. Ensuring all details reflect your business's current situation will give lenders confidence in your application.

Understanding your rights as a borrower

As a borrower, it's important to know your rights. There are key fair lending laws and regulations designed to protect you during the application process. Understanding these rights helps ensure that you are treated fairly and equitably by lenders.

Additionally, being aware of your responsibilities as a borrower is crucial. This includes adhering to repayment terms and maintaining open communication with lenders throughout the loan's duration. By acknowledging both your rights and responsibilities, you foster a positive borrowing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business loan application in Gmail?

How can I modify business loan application without leaving Google Drive?

How do I complete business loan application on an iOS device?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.