Get the free Nc-5500

Get, Create, Make and Sign nc-5500

Editing nc-5500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nc-5500

How to fill out nc-5500

Who needs nc-5500?

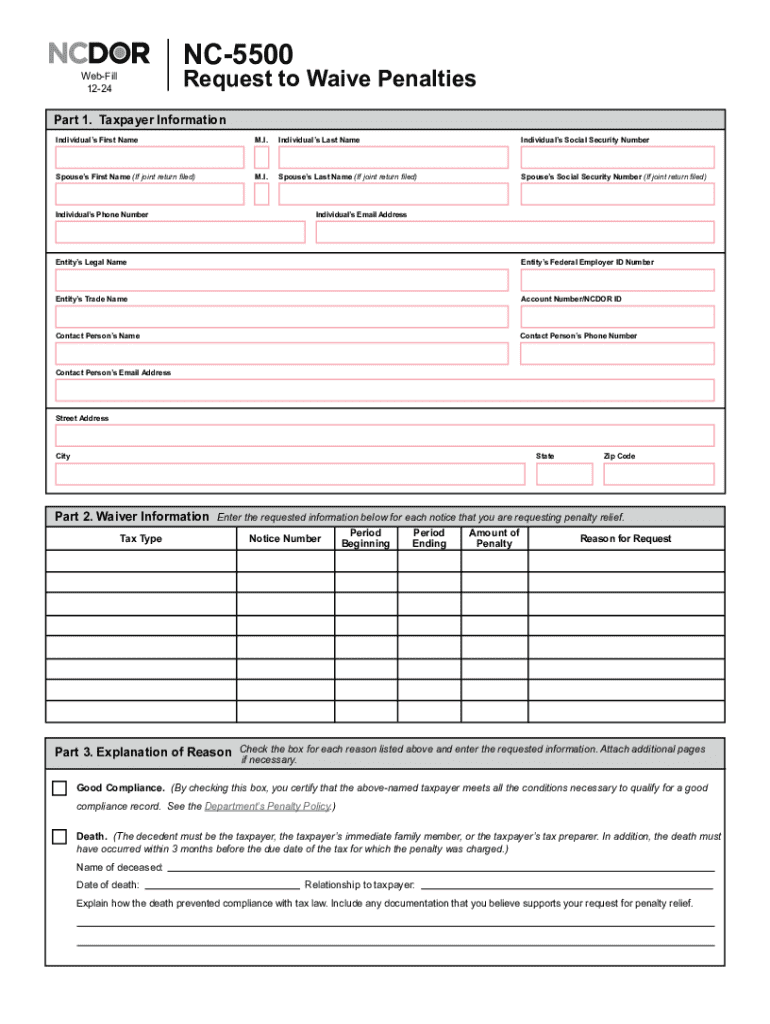

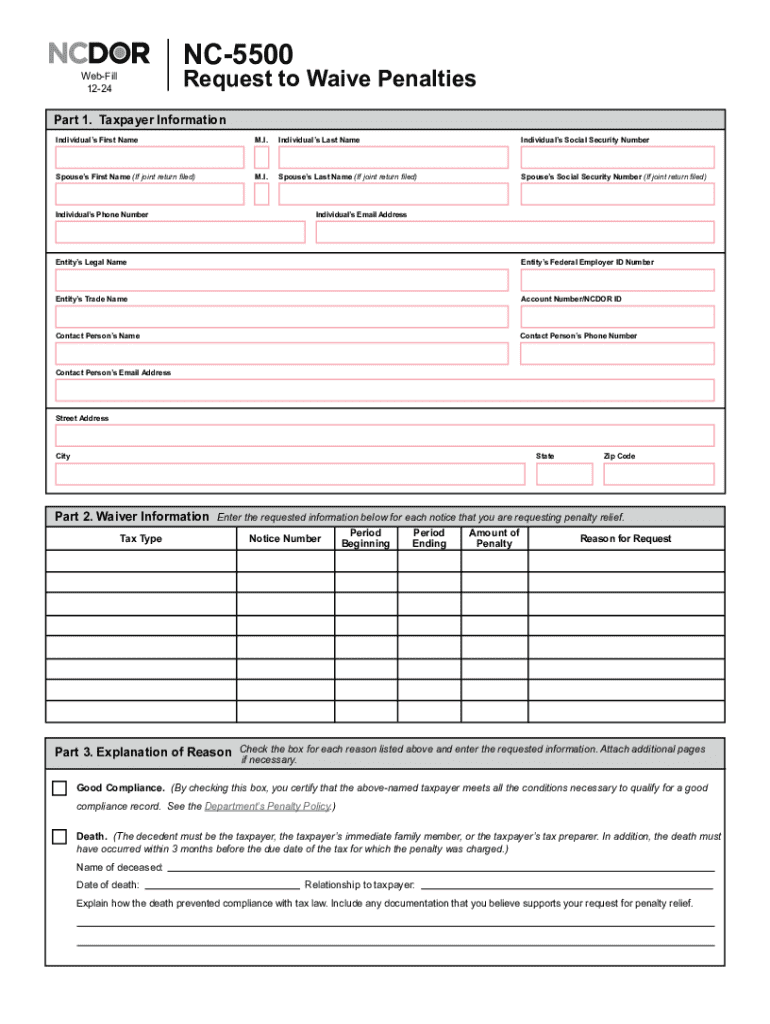

A comprehensive guide to the NC-5500 form

Understanding the NC-5500 form

The NC-5500 form is a crucial document for taxpayers in North Carolina, serving as the state’s annual income tax return. It plays an essential role in reporting income, deductions, and tax credits to determine one’s tax liability. Understanding the NC-5500 form is not merely an obligation, but a way for individuals and businesses to align with North Carolina's tax regulations, ensuring they contribute fairly to state revenues.

The form provides a comprehensive overview of a taxpayer's financial activities over the fiscal year, ensuring accountability and compliance with state laws. Moreover, it serves to identify any tax credits or deductions that may lower one’s tax burden. Failure to understand the intricacies of this form can lead to missed opportunities, potential penalties, or audits.

Who needs to file the NC-5500?

Filing the NC-5500 is mandatory for a variety of entities, including individuals, corporations, and nonprofit organizations. Individual taxpayers, especially those who earn an annual income exceeding a specific threshold, are required to submit the form. Similarly, corporate entities operating within North Carolina must report their earnings to comply with state tax laws.

Non-profit organizations, while often exempt from certain taxes, must still file the NC-5500 to maintain transparency and accountability, particularly if they engage in unrelated business income. Overall, understanding who needs to file is crucial for remaining compliant with NC tax regulations.

Key components of the NC-5500 form

The NC-5500 form consists of several key components that ensure a thorough taxation process. At the outset, the Identification Information section is essential. Here, taxpayers must provide their name, address, and employer identification number (EIN). This information is used to accurately identify and correspond with the taxpayer.

The Income Reporting section of the NC-5500 is critical, as it requires detailed reporting of various income types. This could include wages, tips, interest income, and rental income. Supporting documentation is essential to validate these claims, which might include W-2 forms, 1099s, and other financial documents.

Likewise, the Deductions and Credits sections of the form allow taxpayers to claim eligible tax benefits. Common deductions available include contributions to retirement accounts and educational expenses. Tax credits, which reduce the amount owed directly rather than just the taxable income, are also available but require specific eligibility criteria.

Step-by-step instructions for filling out the NC-5500

Preparing to fill out the NC-5500 requires organization and attention to detail. Start by gathering the necessary documents, such as previous tax returns, W-2s, 1099 forms, and any receipts for deductible expenses. It's essential to familiarize yourself with important deadlines, typically set for April 15th, ensuring your filing is timely.

When filling out the form, follow a section-by-section guide. Begin with identification information, checking for accuracy. As you move to income reporting, carefully denote all income types and supply corresponding supporting documentation. Pay particular attention to deductions and credits, promptly applying any that are relevant to your financial situation.

Utilizing pdfFiller's editing tools can enhance your accuracy and ensure you don’t overlook critical elements. The platform enables digital completion and easily transforms your entries into a formal document, supporting seamless submission.

Electronically filing the NC-5500

Filing the NC-5500 electronically carries numerous benefits, making it a preferred choice for many taxpayers. First and foremost, electronic submission results in faster processing times. The system is designed to swiftly handle e-filed forms, often resulting in quicker refunds versus paper submissions.

Additionally, electronic filing offers immediate confirmation of receipt. Taxpayers gain peace of mind knowing their submissions have been received successfully. To submit via pdfFiller, users can use built-in eSignature features, facilitating a secured and streamlined submission process.

Common mistakes to avoid when filing the NC-5500

One of the most common mistakes when filing the NC-5500 form is providing incomplete information. Double-checking entries is essential, as even minor errors can lead to discrepancies that complicate your tax situation. Inaccurate information may not only delay the processing of your form but can also trigger audits.

Additionally, missing deadlines can have serious consequences, including fines or penalties. Taxpayers should keep a calendar reminder to avoid submitting their forms late. Lastly, erroneously claiming deductions or tax credits often results in complications; hence, using features available in pdfFiller, such as auto-checks, can help in reducing these errors.

Managing your NC-5500 documentation

Recordkeeping after submitting the NC-5500 is vital for both personal reference and compliance. Generally, it's recommended to keep copies of submitted forms for at least three years, during which the IRS may audit returns. Proper documentation ensures that you have the necessary information on hand should any questions arise.

Organizing your documents using a cloud solution like pdfFiller can simplify this process. Cloud storage eliminates the risk of losing important paperwork while also enabling collaboration with team members or tax professionals when discussing tax-related issues.

Understanding the implications of your NC-5500 filing

The NC-5500 form's accuracy significantly influences your tax liability, meaning that any errors can lead to financial loss. Consistently accurate filings minimize potential tax burdens by ensuring entitled deductions and credits are utilized. This helps taxpayers find a more manageable financial balance regarding their annual tax responsibilities.

If a mistake is discovered after submission, it’s crucial to take the necessary steps for amendments. Taxpayers can file a correction through the same channels as their original submissions. Utilizing tools like pdfFiller can simplify making corrections and resubmitting modified forms, ensuring compliance without excessive hassle.

Frequently asked questions about the NC-5500 form

Taxpayers often have questions about their NC-5500 filing status, especially when facing unique circumstances. For instance, if unsure about filing status, it is advisable to consult with a tax professional or visit the North Carolina Department of Revenue's website for guidance based on current regulations. This ensures accurate classification and correct filing.

Amending the NC-5500 is fully permissible, provided that taxpayers follow the appropriate amendment procedures. It is wise to review the instructions from the tax authority when submitting corrections. Lastly, checking on the status of filed NC-5500 forms can generally be done online through the North Carolina Department of Revenue, allowing taxpayers to remain informed throughout the process.

Leveraging pdfFiller for efficient document management

pdfFiller provides a robust set of features to assist users in document creation, editing, and management. This platform not only allows for creating and filling out forms like the NC-5500 seamlessly but also features comprehensive editing tools for an enhanced user experience. Users can leverage eSigning integrations, facilitating secure and efficient submission of tax forms.

To maximize the use of pdfFiller for NC-5500 and other tax forms, tutorials on advanced features can be of immense value. The platform also boasts customer testimonials showcasing successful use cases, indicating that many users have streamlined their tax filing processes through effective use of this versatile tool.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nc-5500 for eSignature?

How can I edit nc-5500 on a smartphone?

Can I edit nc-5500 on an iOS device?

What is nc-5500?

Who is required to file nc-5500?

How to fill out nc-5500?

What is the purpose of nc-5500?

What information must be reported on nc-5500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.