Get the free Nyc-400b - 2025

Get, Create, Make and Sign nyc-400b - 2025

Editing nyc-400b - 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyc-400b - 2025

How to fill out nyc-400b - 2025

Who needs nyc-400b - 2025?

Comprehensive Guide to the NYC-400B - 2025 Form

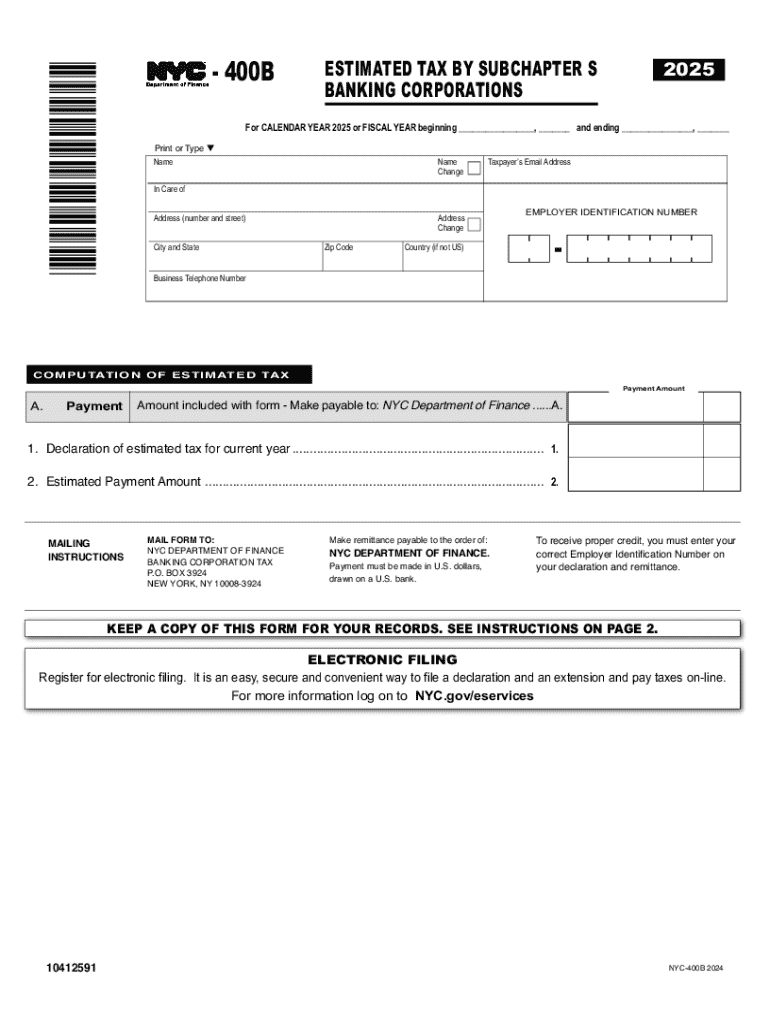

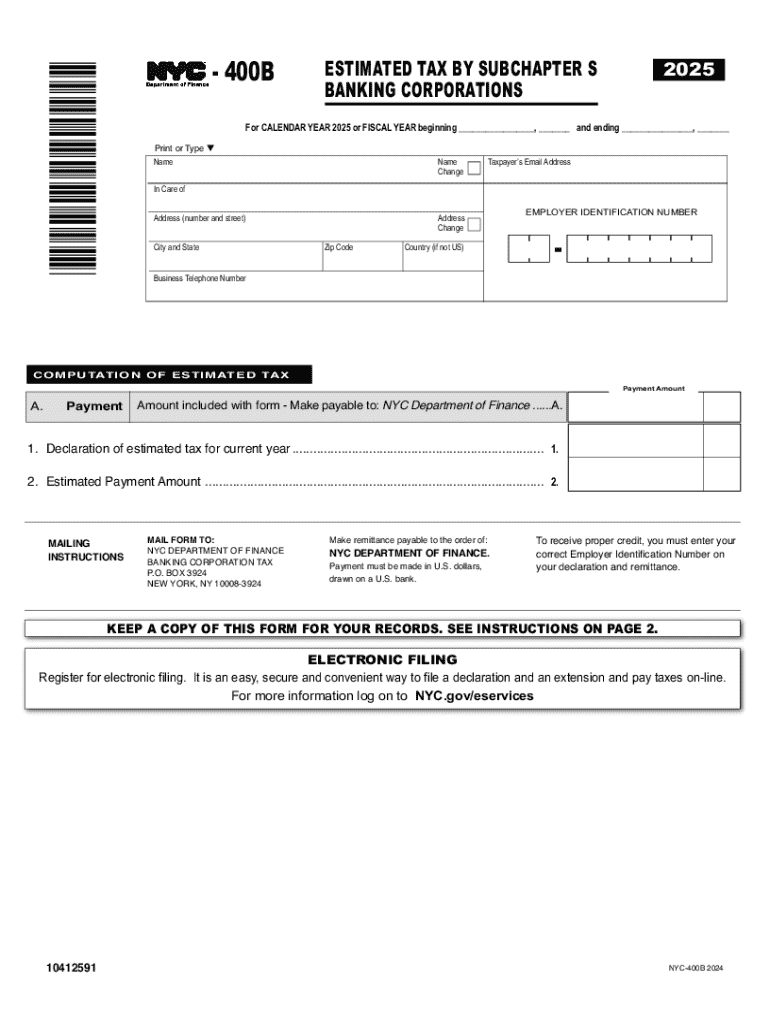

Understanding the NYC-400B Form

The NYC-400B Form is a crucial document for corporations operating within New York City, specifically designed for reporting estimated taxes for the 2025 tax year. It assists businesses in calculating their expected tax liabilities to avoid underpayment penalties.

The significance of the 2025 tax year lies in the adjustments in tax rates and regulations that businesses must consider. Certain corporations are required to file this form if their estimated tax liability exceeds $500. Understanding who must file is critical, as failure to do so could result in penalties and interest.

The NYC-400B differs from the NYC-400; it specifically caters to businesses that are not subject to the Business Corporation Tax. This distinction is vital for corporations looking to fulfill their tax obligations accurately.

Key components of the NYC-400B Form

The NYC-400B Form comprises several critical sections that must be filled out accurately to ensure compliance. These include Identification Information, Estimated Tax Calculation, and Payment Information.

In the Identification Information section, businesses are required to provide their name, address, and EIN (Employer Identification Number). The Estimated Tax Calculation section guides businesses in estimating their tax based on projected income. Lastly, the Payment Information section details how and when to remit payments.

Alongside the form, certain documentation is necessary, including financial statements and prior year returns. Ensuring the completeness of required documents helps mitigate issues during the filing process.

Step-by-step guide to completing the NYC-400B Form

Completing the NYC-400B Form involves a systematic approach that begins with gathering all necessary financial data. This helps create an accurate financial picture needed for the estimated tax calculation.

When filling out each section, specific steps must be followed:

Common pitfalls to avoid include miscalculating estimated tax amounts and missing submission deadlines, which can lead to penalties or additional scrutiny from tax authorities.

Strategies for effective tax planning

Effective tax planning is essential for ensuring that businesses do not underestimate their tax liabilities. To calculate estimates accurately, assess historical tax returns, as they provide a base for forecasting future liabilities.

Another excellent strategy is assessing your current financial situation rigorously. Reviewing recent profit and loss statements gives insights into how your business is performing and what tax obligations may arise.

Submitting your NYC-400B Form

Once the form is completed, businesses need to submit it to the New York City Department of Finance. Submission can be done electronically via e-filing or through traditional paper submission methods.

It's crucial to pay attention to compliance deadlines for the 2025 tax year, as submissions after the due date may incur penalties. After submission, retain proof of submission and be prepared to track your filing status with the department.

Making payments and managing your taxes

Making timely estimated tax payments is critical in maintaining compliance. There are several convenient options available, including online payment portals and traditional check payments.

When using check payments, ensure that they are addressed correctly and mailed with sufficient time to meet payment deadlines. Additionally, setting reminders for payment due dates can significantly aid in staying organized.

Understanding the penalties associated with late payments can motivate timely compliance. Penalties can accumulate quickly, negatively impacting your business finances.

Tools and resources available

Utilizing available tools and resources can make the process of filing the NYC-400B Form more accessible. For instance, interactive calculators can help estimate your tax liabilities accurately.

Additionally, downloading the NYC-400B Form from official sources can provide you with the most current version. Seeking past years' forms may also help in understanding changes and requirements over time.

Department of Taxation and Finance contacts

For assistance with your NYC-400B Form, the Department of Taxation and Finance is an invaluable resource. They provide official guidelines and support for any inquiries you may have while completing your tax filings.

Moreover, the department has a wealth of Frequently Asked Questions available on their website, catering specifically to the NYC-400B Form. Additionally, consulting with tax professionals may further clarify any complex issues you encounter.

Related forms and templates

In addition to the NYC-400B, businesses should also be aware of related forms that may be required for their specific tax situations. The NYC-400: Declaration of Estimated Tax by General Corporations is one such example worth considering.

Other pertinent forms for the 2025 tax year may also be relevant, depending on the business structure and operations. Utilizing recommended resources can help keep your business filings compliant and up to date.

Staying informed on tax changes

Keeping abreast of potential tax changes is essential for businesses using the NYC-400B Form. Tracking updates from the Department of Taxation and Finance can provide timely information on regulations that may affect your tax filing.

The implications of new tax laws could drastically impact your filing process. Therefore, subscribing to newsletters or following reliable platforms will ensure you remain informed about vital tax updates.

Community engagement and feedback

Community engagement plays a significant role in understanding collective experiences with the NYC-400B. Inviting discussions among users can create a platform for sharing insights and best practices.

Additionally, providing feedback on the NYC-400B process helps tax authorities improve the form and its accompanying systems, ensuring a smoother experience for all filers. Engaging in forums and online communities can also facilitate knowledge exchange among business owners.

Innovative solutions with pdfFiller

Utilizing pdfFiller simplifies the process of editing and e-signing the NYC-400B Form. With cloud-based solutions, users can efficiently manage documents, making collaboration seamless.

The benefits of using pdfFiller extend beyond mere editing; it enhances workflow efficiency, allowing users to focus on their business rather than paperwork. Testimonials from users highlight successful filing experiences, reinforcing pdfFiller's position as a valuable resource in the tax management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the nyc-400b - 2025 in Gmail?

How do I fill out the nyc-400b - 2025 form on my smartphone?

How do I edit nyc-400b - 2025 on an iOS device?

What is nyc-400b?

Who is required to file nyc-400b?

How to fill out nyc-400b?

What is the purpose of nyc-400b?

What information must be reported on nyc-400b?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.