Get the free Business Loan Application

Get, Create, Make and Sign business loan application

How to edit business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application

How to fill out business loan application

Who needs business loan application?

Business Loan Application Form: A Comprehensive How-to Guide

. Understanding Business Loan Applications

Business loans serve as a vital financial resource for entrepreneurs seeking to start, expand, or maintain their enterprises. Understanding the nuances of business loans can empower business owners to make informed decisions. The right loan type can help bridge cash flow gaps, finance equipment, or facilitate growth through inventory purchases and marketing.

There are several types of business loans available, primarily categorized into secured and unsecured loans. Secured loans require collateral, reducing risk for lenders and potentially securing lower interest rates. Unsecured loans, on the other hand, don’t require collateral but usually come with higher interest rates due to increased risk. Additionally, loans can be further classified based on duration: short-term loans often provide immediate access to funds for urgent needs, while long-term loans are more suitable for substantial investments that require lengthy repayment periods.

Common questions surrounding business loans include eligibility criteria, application timelines, and the impact of credit scores on loan approval. Understanding these factors can streamline the application process and enhance the chances of approval.

. Preparing for Your Business Loan Application

Before diving into the application process, it’s essential to thoroughly assess your business needs. Start by determining the specific loan amount required. This figure should be directly aligned with your financial goals and operational needs. Without a clear understanding of the amount necessary, you risk either falling short on funds or overspending, which could lead to repayment difficulties.

Next, identifying the purpose of the loan is crucial. Whether you’re looking to purchase new equipment, hire additional staff, or invest in marketing efforts, clarity on your intended use of the funds helps in presenting a compelling case to potential lenders.

Evaluating your business financials is the following step, as lenders will require a comprehensive view of your company’s economic standing. Collect income statements, balance sheets, and thoroughly review your credit score and history. Lenders are generally looking for businesses that demonstrate sound financial management and a solid track record.

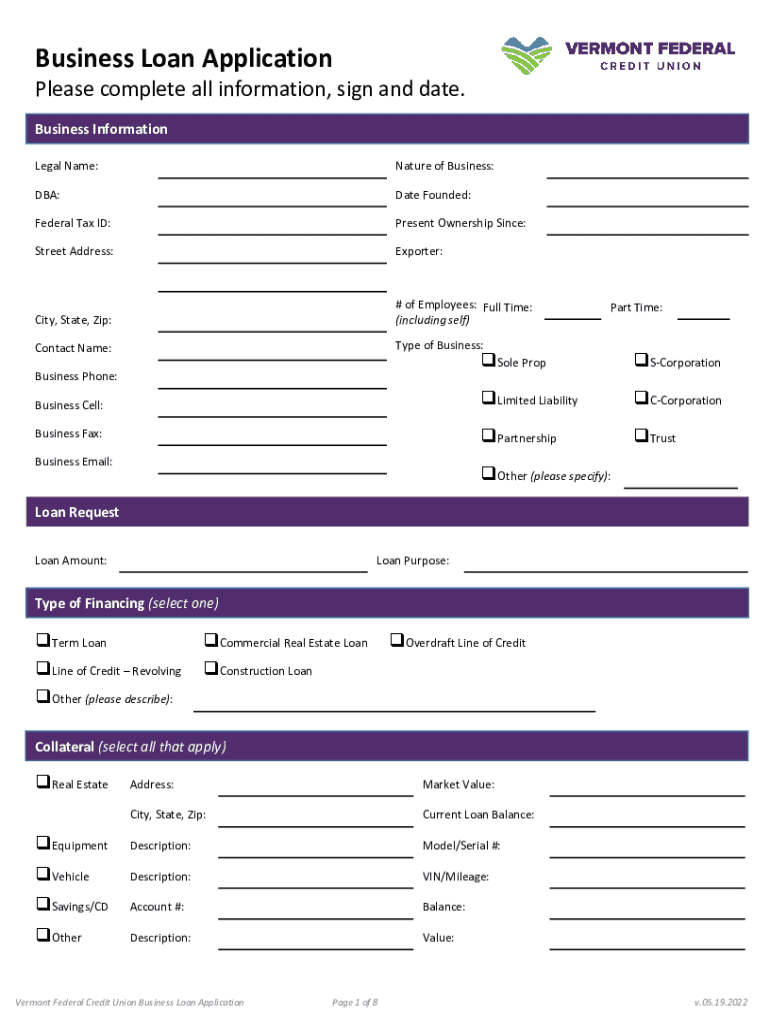

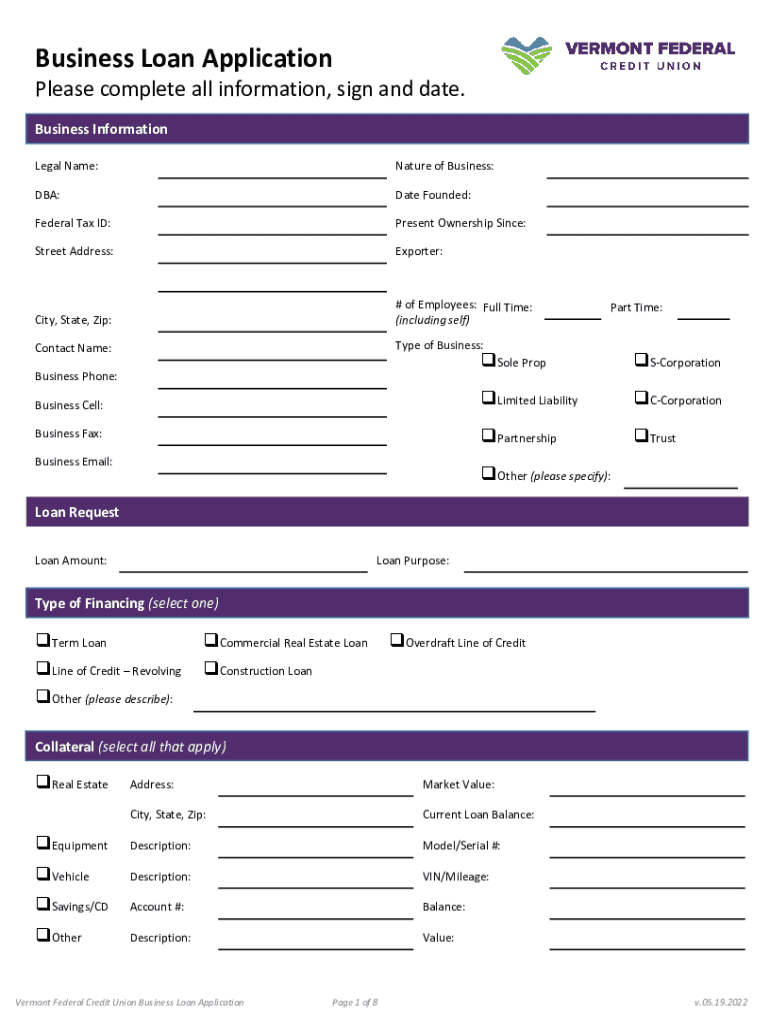

. Exploring the Components of the Business Loan Application Form

A business loan application form typically contains several essential components that capture both the personal and financial status of your business. Providing accurate information is key to a successful application. The first segment often requests fundamental details about your business, such as its name and structure—whether it’s a sole proprietorship, partnership, or corporation.

Owner’s information, including personal identification, background, and business experience, plays a critical role. Lenders want to ensure that the individuals behind the business possess the requisite skills and knowledge to navigate operational challenges.

Financial information, which usually encompasses revenue projections and details about current debts and obligations, allows lenders to evaluate the risk of lending to your business. To support your application, you must also gather documentation, such as legal papers, tax returns, and copies of business licenses and permits. These documents provide additional transparency into your business operations.

. Step-by-Step Guide to Filling Out the Business Loan Application Form

Filling out the business loan application form can be an enlightening process when approached systematically. Begin with the personal information section, where clarity and accuracy are paramount. This section typically includes your personal details, such as name, address, and social security number. Ensure that everything is correct; inaccuracies can lead to delays or denials.

Once you’ve navigated the personal section, move on to the business information segment. This part outlines your business model, industry, and how long you’ve been operating, along with any unique selling propositions (USPs). Showcasing what sets your business apart can significantly strengthen your application.

The final, and perhaps most crucial, section focuses on financial information. Outline your current revenue, debts, and provide any relevant financial ratios that can give lenders insight into your business's health. Be transparent—this builds credibility, and lenders appreciate honesty.

Avoiding common mistakes is vital; double-check all entries for accuracy and ensure that you present your business in its best light. Minor oversights can result in unnecessary delays, detracting from your loan application experience.

. Editing and Customizing Your Business Loan Application Form

In today’s digital age, utilizing tools like pdfFiller enables streamlined editing and customization of your business loan application form. With pdfFiller, users can easily edit pre-existing forms, allowing for quick adjustment of details without starting from scratch. Whether you're integrating new financial data or simply correcting an address, pdfFiller’s platform provides an arsenal of tools to assist.

Importing your existing form into pdfFiller can be done easily. Once uploaded, the interactive tools available facilitate editing, allowing you to add text, images, or even annotate as necessary. Each component can be customized for clarity and completeness.

Best practices for document customization include adding digital signatures where required and utilizing collaborative options if team input is necessary. This not only enhances the credibility of your application but also increases the likelihood of a favorable outcome.

. Submitting Your Business Loan Application

Choosing the right lender is a critical step in the loan application process. While traditional banks have longstanding reputations, online lending platforms have surged in popularity, often providing quicker approval times and more flexible terms. Community banks and credit unions can also be appealing for their personalized service and community focus.

When you’re ready to submit your application, you have various submission methods at your disposal. pdfFiller allows for easy digital submission, ensuring your application reaches lenders quickly. If you prefer a physical submission, ensure you follow any specific guidelines required by the lender for mailing or hand-delivery.

Once submitted, it’s wise to maintain a follow-up checklist. This checklist helps ensure that you track significant timelines and stay informed about the status of your application. Follow-up calls can be beneficial, but ensure they are made at reasonable intervals.

. Managing Your Loan Application Process

After submitting your application, managing the process becomes essential. Tools that monitor the status of your application can greatly ease the uncertainty often experienced during this stage. Most lenders will provide timelines, and being proactive about follow-ups can enhance communication and streamline the waiting period.

Understand that after applying, you might be called in for an interview or be asked to provide additional information. Lenders may need clarification on any specific points within your application, and being prepared for these discussions can improve your chances of approval.

. Handling Common Challenges in the Application Process

Despite thorough preparation, it’s possible to face rejection of your business loan application. Understanding the reasons behind denial is crucial for addressing weaknesses in future applications. Common reasons can include insufficient credit history, low credit scores, or incomplete documentation.

If denied, consider this an opportunity to improve. Review lender feedback diligently and make adjustments before reapplying. Key adjustments may include strengthening your financial documentation, improving your credit score, and reframing the purpose of the requested funds to better align with lender expectations.

. Leveraging pdfFiller for Ongoing Document Management

Using pdfFiller offers extensive benefits for ongoing document management beyond the initial loan application. As a cloud-based document solution, it ensures that all your important files are organized and accessible from anywhere. This accessibility is particularly crucial for business owners who often need to engage with documents on the go.

Features like collaboration tools and secure signing help businesses to streamline operations and support effective teamwork. By keeping all documents in one place, pdfFiller allows your team to maintain application records securely while encouraging a collaborative environment for managing follow-ups and additional requirements.

. Frequently Asked Questions about Business Loan Applications

Navigating the business loan application process can raise several questions. First, how long does the application process typically take? Generally, the timeline can range from a few days to several weeks, depending on the lender and complexity of your application.

Another common query involves lender-specific requirements; these can vary widely, so it’s essential to check with each lender regarding their unique criteria. Finally, many business owners wonder if applying for multiple loans at once is advisable. While it’s possible to apply to several lenders, be mindful of how this can impact your credit score—each application generally results in a hard inquiry.

. Useful Tips and Best Practices for Business Loans

To enhance your chances of securing a business loan, maintaining a strong credit history is paramount. Lenders prefer borrowers with a credit score above 700, as it demonstrates reliability and responsible financial management. Regularly reviewing your credit report for inaccuracies or issues can help you stay ahead.

Building relationships with lenders is equally important. Establishing rapport with local banks or credit unions through networking can lead to more favorable loan terms. Additionally, having a firm understanding of loan terms and conditions is essential. Knowing what you are agreeing to can prevent unforeseen complications down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit business loan application from Google Drive?

How can I send business loan application to be eSigned by others?

Can I create an electronic signature for signing my business loan application in Gmail?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.