Get the free Pa 3679

Get, Create, Make and Sign pa 3679

How to edit pa 3679 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pa 3679

How to fill out pa 3679

Who needs pa 3679?

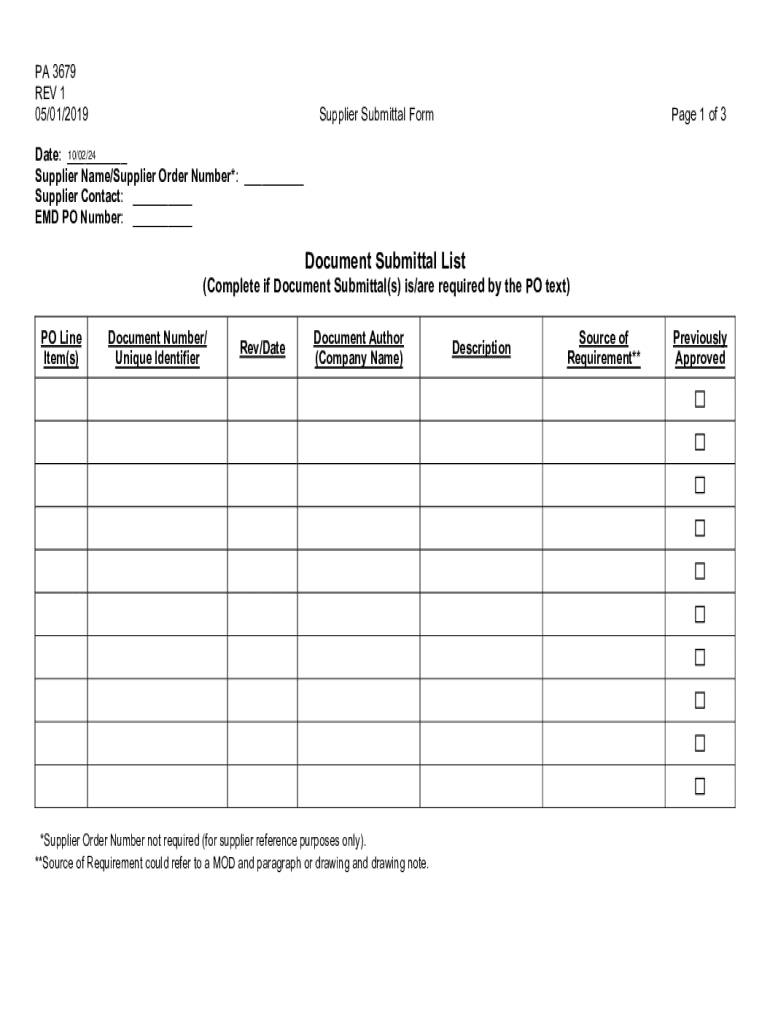

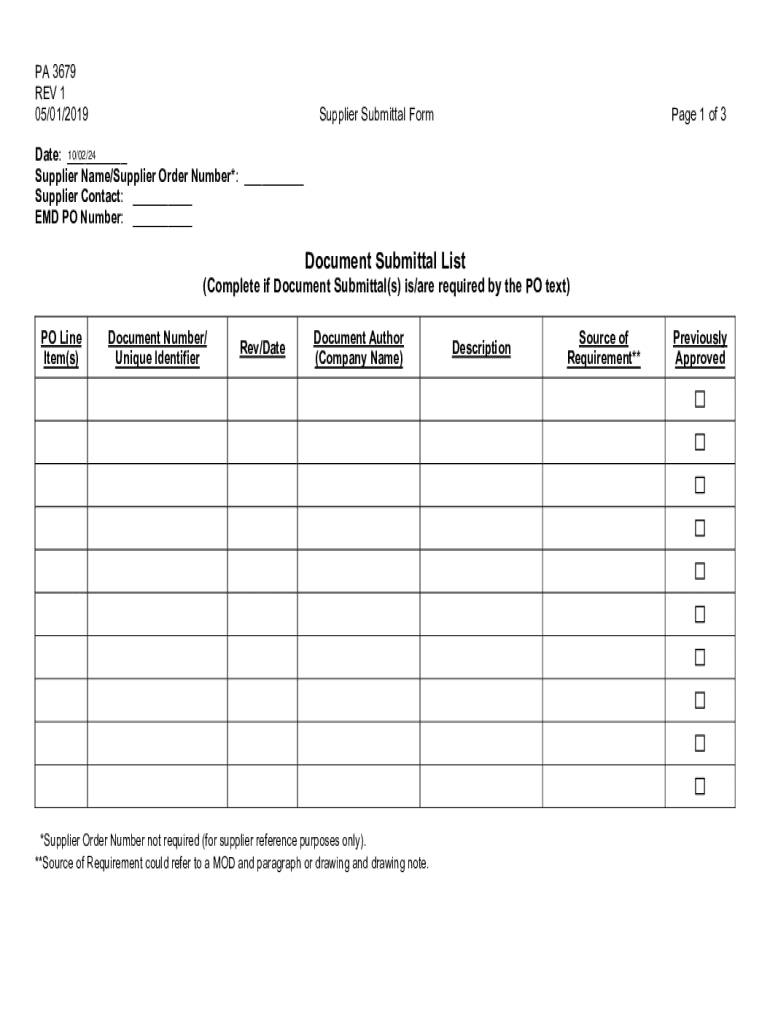

Complete guide to the PA 3679 form

Understanding the PA 3679 form

The PA 3679 form is a critical document utilized primarily within the Pennsylvania Department of Revenue for various tax-related purposes. This form is designed to facilitate the collection of essential information from taxpayers, ensuring compliance with state tax regulations. Its significance extends beyond mere data collection; it plays a vital role in determining eligibility for certain tax benefits and ensuring accurate assessments of tax obligations.

The PA 3679 form is particularly important in contexts such as income tax claims, exemptions, and other financial benefits that residents might be eligible for. By accurately filling out this form, individuals and businesses can streamline their interactions with the Department of Revenue and ensure they receive all the benefits to which they are entitled.

Who needs to use the PA 3679 form?

The primary audience for the PA 3679 form includes Pennsylvania residents who are either filing income taxes or seeking particular tax credits and benefits. This includes individuals, families, and businesses that may qualify for exemptions due to specific circumstances, such as low income or special status.

To utilize the PA 3679 form, individuals must meet specific eligibility criteria, which often revolve around income levels, residency status, and the nature of their financial activities within the state. Understanding these criteria is crucial for ensuring that users are correctly navigating their tax obligations.

Key features of the PA 3679 form

The PA 3679 form consists of several critical sections, each designed to capture specific information necessary for tax processing. Notably, the form typically includes sections for personal information, tax situation, and any relevant exemptions being claimed. Breaking down these sections helps users focus on the required details without feeling overwhelmed.

Understanding these sections is essential for accurate completion. For instance, personal identification details must match state records, while tax situations need to be categorized correctly. Below are some common sections:

Common mistakes to avoid

Filling out the PA 3679 form can be daunting, leading to mistakes that may delay processing. Common errors include providing incorrect personal information, failing to include all income sources, and miscalculating claimed exemptions. Such errors can lead to complications, including audits or delays in receiving benefits.

To prevent these mistakes, here are useful tips:

Step-by-step instructions for completing the PA 3679 form

Completing the PA 3679 form requires careful attention to detail and an organized approach. Begin by gathering all necessary documents, including W-2 forms, previous tax returns, and records of any additional income. Having this information on hand simplifies the process and increases accuracy.

Next, proceed to fill out the form, following these steps:

Once completed, sign and date the form. Ensure that the signature aligns with the name provided in the personal information section to avoid discrepancies.

Finally, submit the form. There are two main methods for submission: online through the Pennsylvania Department of Revenue website or by mailing it to the designated address provided in the form's instructions.

Editing the PA 3679 form

Editing the PA 3679 form before submission is vital for ensuring accuracy and compliance. A thorough review can save you time, money, and the frustration of dealing with errors post-submission.

To edit the form effectively, using a tool like pdfFiller can enhance your experience:

By following these guidelines, users can ensure that their form is polished and free of errors before sending it off.

eSigning the PA 3679 form

An electronic signature (eSignature) is a digital equivalent of a handwritten signature but is legally recognized and accepted in many jurisdictions, including Pennsylvania. Using an eSignature greatly accelerates the process, allowing for instant validation without the need for physical paperwork.

To eSign the PA 3679 form via pdfFiller, follow these steps:

Compared to traditional signing methods, eSigning is much more efficient and can be completed remotely, eliminating the need for physical mail.

Collaborating on the PA 3679 form

Collaboration on the PA 3679 form can streamline the process and reduce errors significantly. When multiple parties are involved, the ability to work together efficiently is paramount to ensure accuracy and completeness.

Using pdfFiller enhances teamwork through its innovative features. Here are the benefits of collaboration:

Such collaborative efforts can lead to a more thorough and well-reviewed document, ultimately increasing the chances of successful submission.

Managing your PA 3679 form documents

After completing the PA 3679 form, effective document management becomes essential to avoid confusion and ensure easy future access. Best practices for organizing your forms include categorizing documents by year and type, allowing for quick retrieval in case of audits or future tax filings.

Storing completed forms also comes with its own set of challenges. Utilizing pdfFiller’s cloud storage solutions offers several advantages:

Overall, effective document management not only saves time but also reduces stress at tax season.

FAQs about the PA 3679 form

Many users have questions regarding the PA 3679 form. Addressing common queries can significantly alleviate concerns and streamline the process for new users.

Here are some frequently asked questions:

Providing clear, informative answers to these questions can help demystify the process and make it more accessible for all users.

In addition to FAQs, it’s important to address common issues users may face during the filing process, such as document retrieval or signature concerns.

Additional features of pdfFiller for document management

In addition to facilitating the completion and submission of the PA 3679 form, pdfFiller offers a wide range of related tools that can help enhance document management and collaboration. From forms template creation to automated reminders for document submissions, the platform empowers users to streamline their processes.

Success stories from users highlight the effectiveness of pdfFiller in managing forms like the PA 3679. Users have reported improved accuracy, faster turnaround times, and heightened confidence in their tax-related submissions.

By leveraging these tools, individuals and teams can navigate the complexities of tax forms like the PA 3679 with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pa 3679 to be eSigned by others?

Where do I find pa 3679?

How do I make changes in pa 3679?

What is pa 3679?

Who is required to file pa 3679?

How to fill out pa 3679?

What is the purpose of pa 3679?

What information must be reported on pa 3679?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.