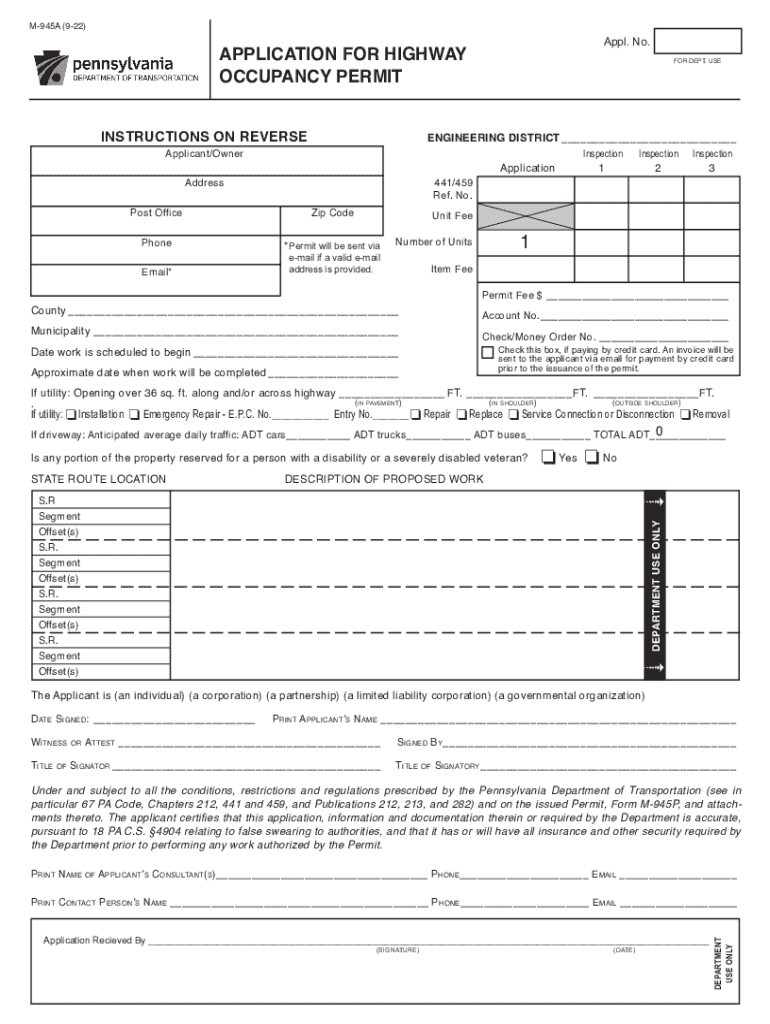

Get the free M-945a

Get, Create, Make and Sign m-945a

Editing m-945a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out m-945a

How to fill out m-945a

Who needs m-945a?

A comprehensive guide to the -945A form

Understanding the -945A form

The M-945A form plays a crucial role in various administrative processes, serving as a standardized document that facilitates the collection and processing of specific information required for compliance and reporting. This form is frequently used across multiple sectors, allowing organizations to gather consistent data conveniently.

The purpose of the M-945A form is to streamline operations in environments that require detailed tracking of employment and financial records. Its importance stems from ensuring that sensitive information is compiled accurately and securely, thus meeting legal standards and simplifying audit processes.

When to use the -945A form

The M-945A form is essential in various scenarios, such as during employment verification, tax submissions, or financial reporting. Any organization that needs to assess or report on employment conditions, income details, or benefits may find this form particularly useful.

Individuals responsible for payroll, human resources, or compliance typically need to fill out the M-945A form. Often, this includes HR personnel, finance teams, and even independent contractors who need to provide financial data for tax purposes.

Step-by-step guide to completing the -945A form

Preparation before you begin

Before completing the M-945A form, gather all required information such as personal identification, employment history, and financial records. Understanding the instructions carefully will also make the filling-out process much smoother, ensuring that no crucial information is missed.

Once you are fully prepared, you can begin by filling out each section of the form diligently.

Detailed walkthrough of each section of the form

The M-945A form consists of several key sections that require careful attention.

To avoid common mistakes, double-check all entries for accuracy and ensure you have filled out every required field before submission.

Editing the -945A form

Editing the M-945A form can be straightforward with tools available on pdfFiller. Whether you need to change details or adapt the form for specific requirements, understanding the editing tools at your disposal will be beneficial.

Using pdfFiller's editing tools

pdfFiller provides versatile text editing options, allowing you to modify existing information or add new sections according to your needs. Users can add or remove information easily, ensuring that the M-945A form suits their personal context.

Signing the -945A form

Signing the M-945A form is critical as it validates the information contained within. An eSignature provides a secure way to sign documents electronically, ensuring compliance with legal standards without the need for physical paperwork.

Using pdfFiller to eSign the M-945A form is a breeze. Simply create your eSignature using their intuitive interface and place it in the designated area.

Managing your -945A form

After completing the M-945A form, it’s essential to manage it correctly. Saving and storing your completed form securely will ensure you have quick access whenever needed. pdfFiller enables users to implement effective document management practices.

Sharing the M-945A form with others can enhance collaboration, especially within teams. With pdfFiller's collaborative features, users can not only share but also set permissions and access controls to protect sensitive data.

Troubleshooting common issues

Encountering issues with the M-945A form can be frustrating, but many common questions can resolve most concerns. Understanding how to address form submission errors can save time and effort.

In the case of unresolved queries, contacting support can provide the necessary assistance. Companies should ensure their teams are aware of the available support channels to expedite issue resolution.

Case studies and testimonials

Users of the M-945A form have shared numerous success stories regarding its efficient handling of necessary documentation. From small businesses to large corporations, the form has proven to facilitate smoother operations related to employment and financial reporting.

Testimonials highlight the benefits individuals and teams have experienced, including clearer compliance and reduced processing times. pdfFiller has empowered its users by providing tools that simplify the management of the M-945A form.

Additional features of pdfFiller relevant to the -945A form

Beyond the basics of filling out and managing the M-945A form, pdfFiller offers additional features that enhance user experience. Integrations with other software and tools allow for seamless data transfer and improved workflow.

Accessibility features also contribute to making pdfFiller an inclusive platform, ensuring that users with varying needs can effectively manage their documents. Utilizing a cloud-based platform for document management significantly enhances flexibility and accessibility.

FAQs about the -945A form

Navigating the M-945A form can come with various frequently asked questions. Common queries focus on legal aspects, submission guidelines, and best practices for effective form management.

Providing clear answers can alleviate concerns and enhance understanding. Resources available on pdfFiller can guide users through the entire process of managing the M-945A form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send m-945a for eSignature?

How do I edit m-945a straight from my smartphone?

Can I edit m-945a on an iOS device?

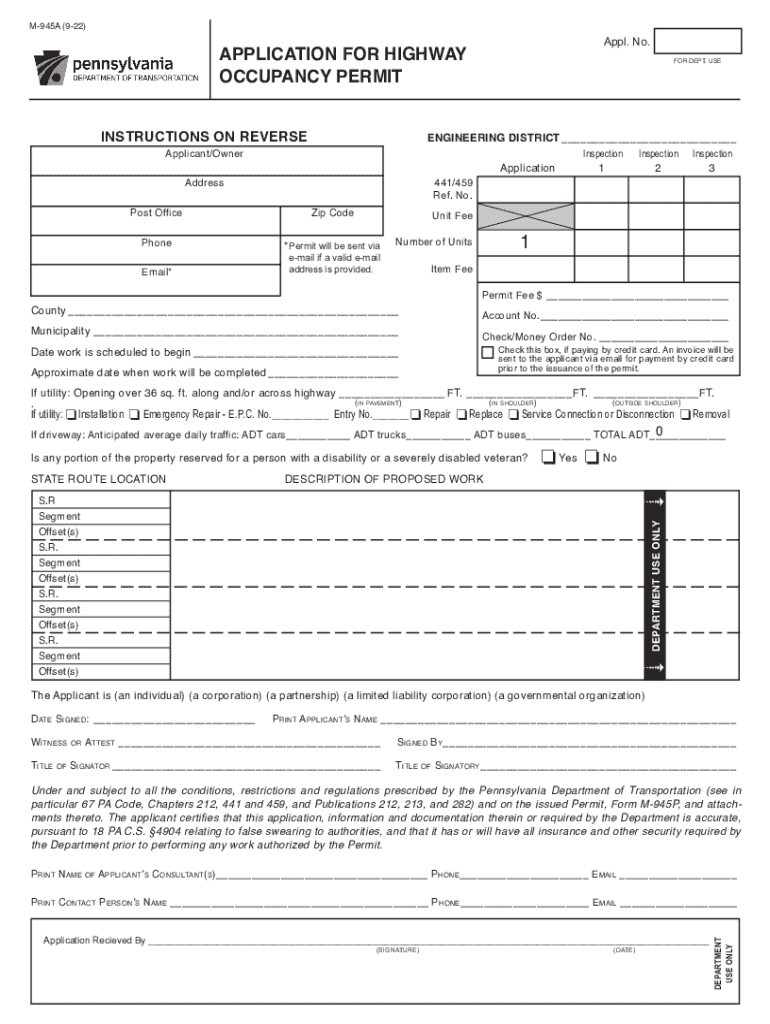

What is m-945a?

Who is required to file m-945a?

How to fill out m-945a?

What is the purpose of m-945a?

What information must be reported on m-945a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.