Get the free Beneficiary Designation Instructions

Get, Create, Make and Sign beneficiary designation instructions

Editing beneficiary designation instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation instructions

How to fill out beneficiary designation instructions

Who needs beneficiary designation instructions?

Comprehensive Guide to the Beneficiary Designation Instructions Form

Understanding the beneficiary designation

A beneficiary designation is a legal document that specifies who will receive your assets upon your death. This designation is crucial for ensuring that your estate is distributed according to your wishes. Beyond simply naming individuals, a beneficiary designation plays a vital role in the estate planning process by bypassing probate, which can be a lengthy and costly process.

Who needs to designate a beneficiary? Primarily, individuals with retirement accounts, life insurance policies, or any other accounts where transfer on death is applicable should complete this designation. Common scenarios that necessitate this form include getting married, having children, or experiencing significant health changes.

Types of beneficiaries

Beneficiaries are categorized mainly into primary and contingent beneficiaries. Primary beneficiaries are the first in line to inherit the assets upon your death. In contrast, contingent beneficiaries inherit only if the primary beneficiaries are unable to do so, such as in the case of their own death before the asset holder.

Designating multiple beneficiaries adds flexibility to your estate planning. For instance, you might choose to divide assets among three children, specifying that each receives 33.3% of the total. There are also special considerations for minor or incapacitated beneficiaries, which typically involve setting up a trust or appointing a guardian to manage the assets until they reach a designated age.

Overview of the beneficiary designation instructions form

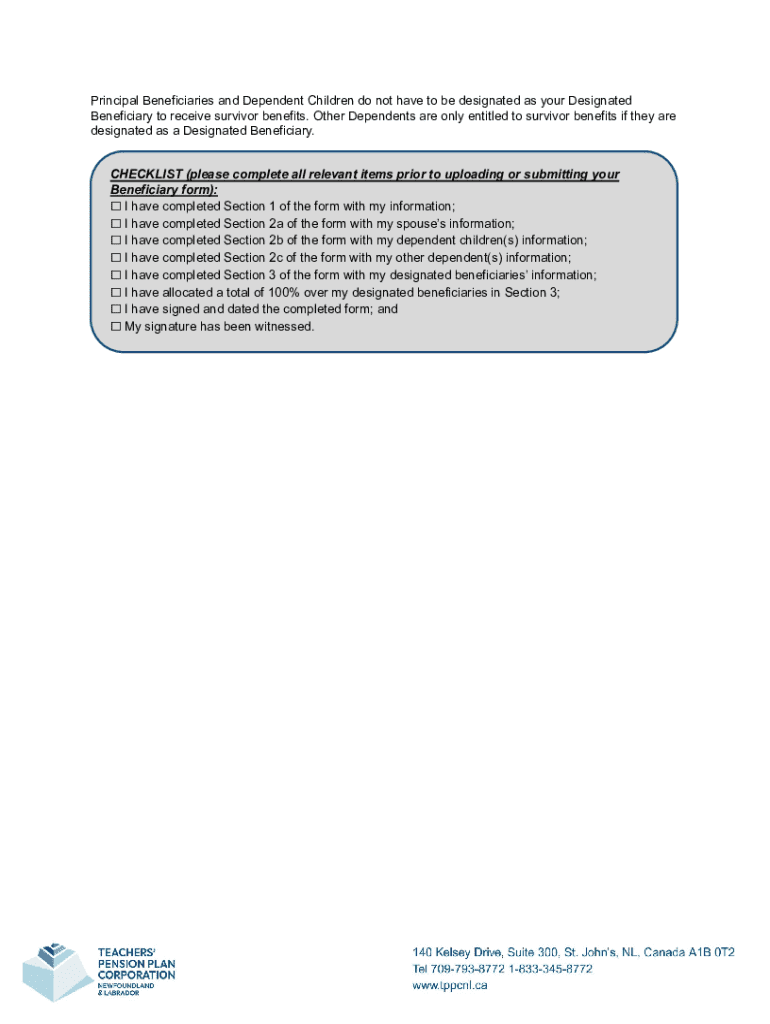

The beneficiary designation instructions form serves the primary purpose of clearly documenting your wishes regarding asset distribution. Key components included in the form typically comprise personal identification details, the names of the designated beneficiaries, their relationship to you, and the specific assets they will receive.

You can obtain the beneficiary designation instructions form through various channels: your asset manager, insurance provider, or legal counsel. Many financial institutions also offer downloadable versions directly from their websites.

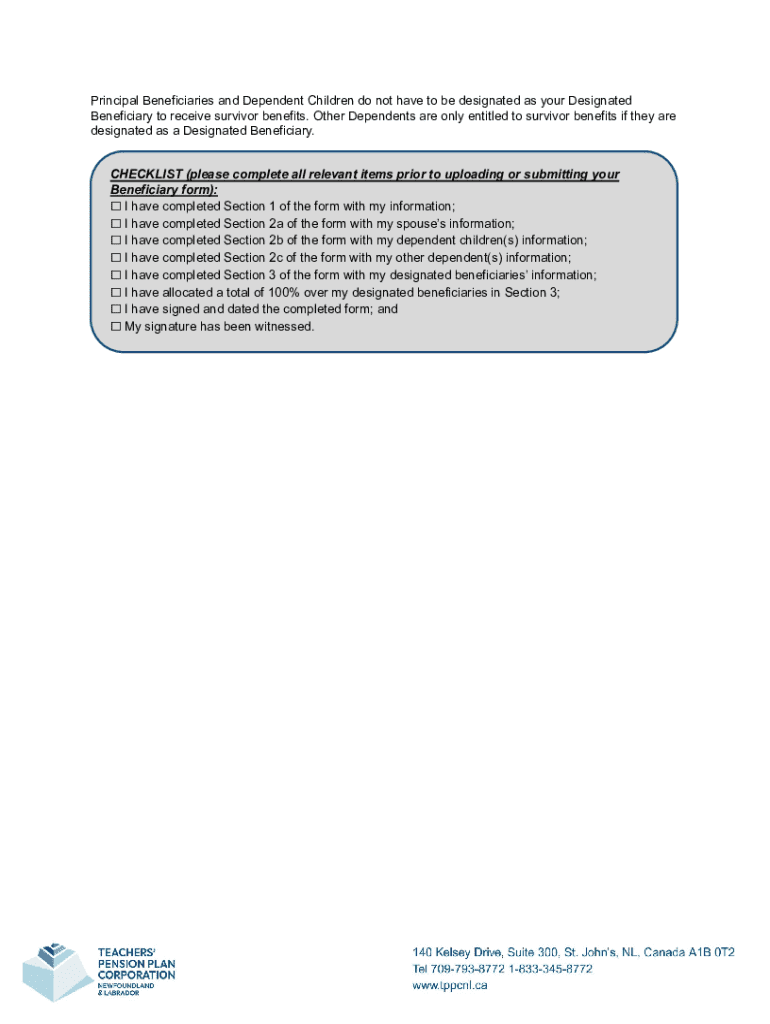

How to fill out the beneficiary designation instructions form

Filling out the beneficiary designation instructions form is an important task that you should approach with care. Start with your personal information, including your full name, address, social security number, and any account numbers relevant to the asset you are designating.

Next, specify the details of each beneficiary. Include full names, contact information, and their relationships to you. Take your time providing any additional instructions or notes that could clarify your intentions, such as indicating whether the inheritance should be distributed equally among multiple beneficiaries or allocated in a specific manner.

Ensure accuracy and clarity in your submission to avoid complications in the future. Double-check for any errors before submitting the form to your financial institution.

Managing and updating your beneficiary designation

It's essential to review and update your beneficiary designation regularly. Major life events such as marriage, divorce, or the birth of a child are perfect opportunities to reassess your designations. Keeping your beneficiary information current is vital in ensuring that your assets are distributed according to your wishes.

To update your beneficiary designation, request a new form from your asset manager or financial institution. Fill it out with the necessary changes, and keep a copy for your records. Notify the beneficiaries about any changes so that everyone is aware of their status.

Submitting your beneficiary designation instructions form

When you're ready to submit your beneficiary designation instructions form, you typically have several options available. The most common methods include submitting by mail, email, or fax, depending on the policies of your financial institution.

After submission, it’s prudent to confirm that your form has been received and processed. Follow up with the relevant institution to ensure your details are accurately recorded. After submission, you can expect that your designated assets will be honored upon your passing.

Important considerations regarding beneficiary designations

Understanding the legal requirements surrounding beneficiary designations is critical. Different states may have unique rules governing who can be a beneficiary and the allowable proportions of distribution. Familiarize yourself with these regulations to avoid potential legal disputes.

It's also essential to understand the tax implications of your beneficiary designations. Depending on the nature of the asset, beneficiaries may be liable to pay taxes which could affect the total inheritance amount. In certain cases, using trusts can provide enhanced control over how and when the assets are distributed, potentially leading to tax advantages.

Frequently asked questions (FAQs)

You might wonder what to do if you wish to change your beneficiary designation after submission. Generally, this can be done at any time by submitting a new beneficiary designation instructions form. Can you designate a trust as a beneficiary? Absolutely, doing so can allow for greater control over how the assets are managed. What should you do if your beneficiary has passed away? In such instances, it's crucial to update your designation immediately to reflect the change, possibly by naming contingent beneficiaries.

Related forms and additional resources

In addition to the beneficiary designation instructions form, you may encounter other related forms, such as the Change of Beneficiary Form. Understanding these documents can further enhance your estate planning efforts. Additionally, seeking out state-specific requirements and guidelines will ensure that your designations align with local laws.

There are also interactive tools available online for document creation and management that can simplify the completion of your forms. Explore pdfFiller’s offerings to access tailored solutions for all your document needs.

Ensuring your documents are secure and accessible

In a digital age, it's crucial to leverage technology for document security. Using a cloud-based solution for document management offers several benefits. It allows for easy access from anywhere and ensures that your important forms, like the beneficiary designation instructions form, are securely stored and retrievable.

To securely store your beneficiary designation form, consider password protection and multi-factor authentication options. By employing these strategies, you'll be able to maintain both the accessibility and confidentiality of your documents.

Leveraging pdfFiller for your document needs

pdfFiller provides a robust platform for managing all your document needs, including the beneficiary designation instructions form. With features designed for editing and eSigning, users can undergo the entire document process seamlessly. The collaborative tools available on pdfFiller also facilitate teamwork and support efficient management of beneficiary designations within teams.

Additionally, accessing your documents anytime, anywhere through pdfFiller empowers you to stay organized and maintain your estate planning with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify beneficiary designation instructions without leaving Google Drive?

Where do I find beneficiary designation instructions?

How do I complete beneficiary designation instructions online?

What is beneficiary designation instructions?

Who is required to file beneficiary designation instructions?

How to fill out beneficiary designation instructions?

What is the purpose of beneficiary designation instructions?

What information must be reported on beneficiary designation instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.