Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Comprehensive Guide to Form 8-K Form

Overview of Form 8-K

Form 8-K is a crucial document required by the Securities and Exchange Commission (SEC) that companies must file to disclose major corporate events or changes that shareholders should know about. It acts as an immediate source of information, ensuring that investors are kept up-to-date on significant developments in a company's operations.

The importance of filing Form 8-K lies in its ability to provide transparency and maintain investor confidence. False or delayed disclosures can lead to significant legal ramifications for companies and diminish investor trust.

Understanding Form 8-K structure

Form 8-K is structured with distinct sections that cover various aspects related to the company's disclosure. It provides a comprehensive overview through several mandatory items that companies are obliged to fill out based on recent events.

To navigate these sections effectively, it is advisable to familiarize oneself with the language and key deadlines associated with each type of disclosure.

When is Form 8-K required?

Certain events trigger the mandatory filing of Form 8-K. Companies must be vigilant to ensure compliance and protect shareholders from unexpected news.

Timely filing is paramount; delayed disclosures can lead to regulatory scrutiny and affect stock prices adversely.

Reading and interpreting Form 8-K

Interpreting the financial information contained within Form 8-K is critical for stakeholders. Essential metrics include market reactions to these reports, which can significantly influence stock performance.

Common jargon such as 'Material Definitive Agreement' or 'Item 2.01' refers to specific aspects that stakeholders should understand. Familiarity with these terms can help investors interpret the potential impact of disclosures.

Form 8-K items in detail

Form 8-K contains several specific items that require detailed disclosures about essential corporate events. Each item serves a unique purpose, giving stakeholders a better picture of the company's position.

For instance, Item 2.01 may be used when a technology firm acquires a startup, impacting its market strategy.

Historical context of Form 8-K

Understanding Form 8-K's evolution highlights its significance in corporate governance. Introduced in 1934, it has undergone revisions to adapt to the changing landscape of business transactions.

In contrast to other SEC forms like Form 10-K (annual report) and Form 10-Q (quarterly report), Form 8-K is distinguished by its immediacy and requirement for timely reflection of significant events.

Benefits of filing Form 8-K

The benefits of filing Form 8-K are manifold, primarily revolving around investor relations and regulatory compliance. Transparent communication fosters trust among stakeholders, leading to a stronger market reputation.

Failure to file can lead to penalties and critical backlash within the market, affecting a company's credibility and stock prices.

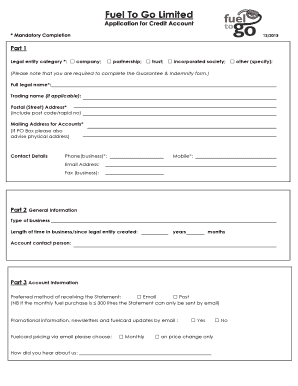

Interactive tools and resources for Form 8-K

For those involved in drafting and filing Form 8-K, several online resources and tools can streamline the process. Utilizing platforms like pdfFiller can notably enhance efficiency.

Frequently asked questions about Form 8-K

Understanding common queries regarding Form 8-K can alleviate confusion and clarify compliance expectations.

Sector-specific insights on Form 8-K

Different industries have unique conditions that may necessitate the filing of Form 8-K. For instance, tech companies might file due to rapid mergers or innovations, whereas healthcare firms may need to report regulatory compliance changes.

News & updates related to Form 8-K

Keeping track of the latest updates and news involving Form 8-K is critical for compliance. Recent regulatory changes or significant filings provide insight into how the market reacts to such disclosures.

Notable filings often lead to market shifts and investor reconsideration of previous valuations, thus emphasizing the importance of this form in corporate governance.

Subscribe for news, updates, and insights

Staying informed about changes regarding Form 8-K and other financial documentation is essential for professionals in the financial sector. By subscribing to relevant updates, users can position themselves better to adapt to regulatory changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 8-k?

Can I sign the form 8-k electronically in Chrome?

How can I fill out form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.