Get the free Merchant Agreement

Get, Create, Make and Sign merchant agreement

How to edit merchant agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merchant agreement

How to fill out merchant agreement

Who needs merchant agreement?

Merchant Agreement Form: A How-to Guide

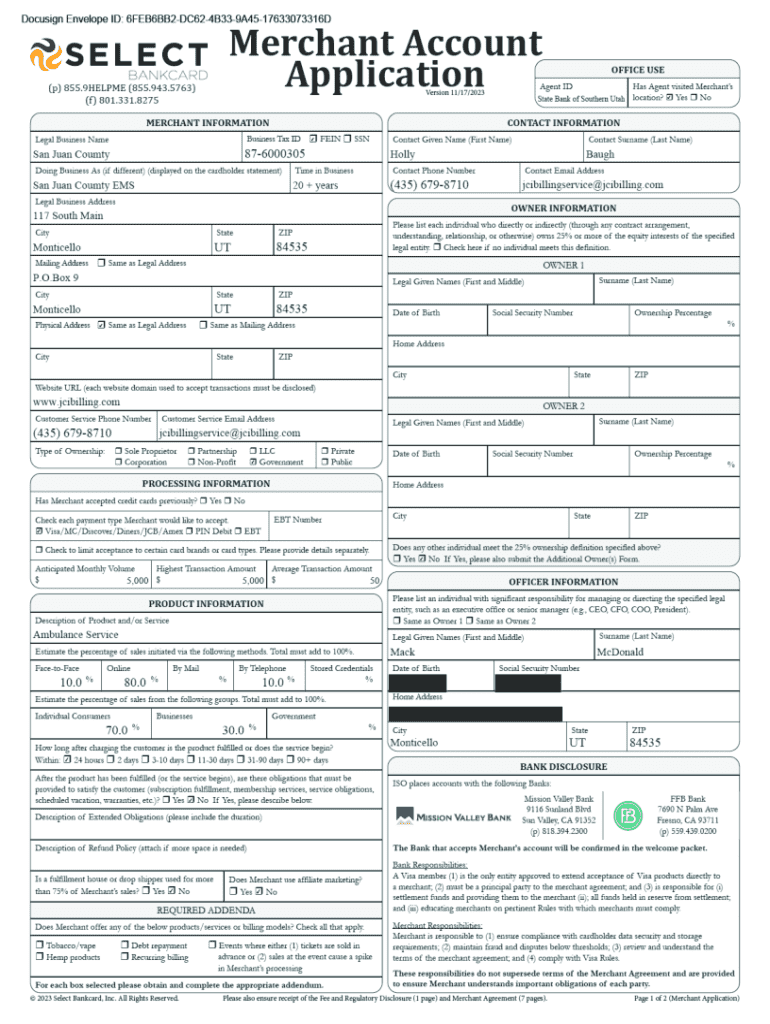

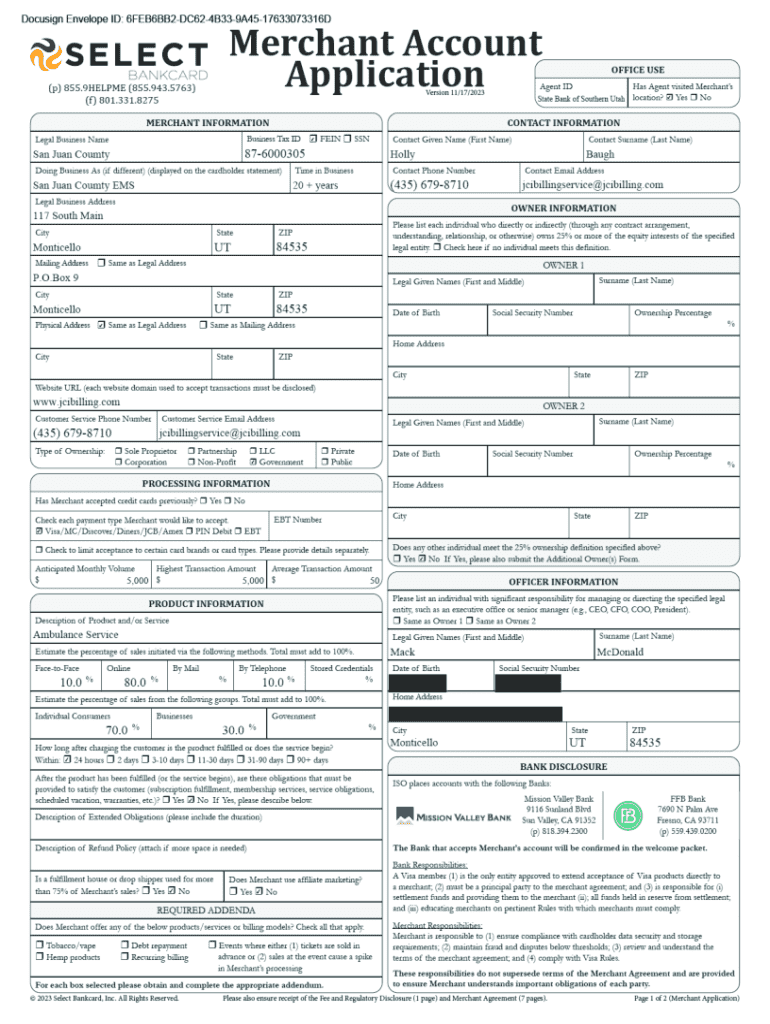

Overview of merchant agreement forms

A merchant agreement form is a binding contract between a business and a payment processor that outlines the terms of the merchant's account. This document serves several purposes, such as detailing the fees involved, the services provided, and the obligations of both parties. In the competitive world of commerce, a well-structured merchant agreement is essential for ensuring smooth transactions and protecting both the merchant and the payment processor.

The importance of having a comprehensive merchant agreement cannot be overstated. Not only does it clarify expectations and responsibilities, but it also serves as a safeguard against potential disputes. Common scenarios where a merchant agreement is required include establishing a new payment processing relationship, changing service providers, or expanding into new markets.

Key components of a merchant agreement

A merchant agreement must include several key components to ensure clarity and legal enforceability. Understanding these components is crucial for drafting an effective agreement that protects your interests.

Essential elements

Legal considerations

Steps to fill out the merchant agreement form

Completing a merchant agreement form requires careful preparation and attention to detail. Below are the essential steps to follow when filling out the form.

Preparing your information

Start by gathering all necessary business documents and data. This may include your business registration details, tax identification number, and banking information. Additionally, identify key stakeholders who need to review the agreement to ensure comprehensive input.

Completing the form

Reviewing the completed form

After filling out the form, it's crucial to double-check for any inaccuracies. A quick review can help identify typos or missing information. Consulting a legal professional is highly recommended before finalizing the agreement to ensure all elements are compliant and enforceable.

Editing and customizing your merchant agreement form

Once you have a base agreement, you may find that customization is necessary to suit your specific needs. Utilizing tools like pdfFiller makes this process easy and efficient.

Using pdfFiller for customization

pdfFiller allows users to edit PDF forms effortlessly. You can add or remove sections as necessary, ensuring the agreement reflects your unique business circumstances.

Collaboration features

A significant advantage of using pdfFiller is its collaboration capabilities. You can easily invite team members to review the changes within the document, facilitating direct commenting and suggesting edits. This feature is invaluable for ensuring collaboration and clarity throughout the process.

Signing the merchant agreement form

Signing the merchant agreement is a critical step in its execution. Understanding your options for signatures can help streamline the process.

Options for electronic signatures

Electronic signatures have gained popularity due to their speed and convenience. They eliminate the need for physical documents and offer a secure method for signing agreements electronically. Moreover, electronic signatures have legal validity in many jurisdictions, making them a preferable choice for businesses.

Using pdfFiller's eSignature tool

pdfFiller provides a user-friendly eSignature tool that guides you through the signing process. Easily upload the merchant agreement, sign electronically with a few clicks, and ensure that your signature is secure and verifiable according to legal standards, thus completing the execution of your merchant agreement.

Managing your merchant agreement

Proper management of your merchant agreement is vital for its continued relevance and effectiveness. Here’s how you can efficiently keep track of your agreements.

Storing and organizing documents

Utilizing cloud storage solutions, such as those provided by pdfFiller, allows for easy access to your merchant agreements from anywhere, enhancing organization. You can categorize your documents for quick retrieval, ensuring important agreements are always available when needed.

Keeping your agreement up-to-date

Regular reviews of your merchant agreement are important in maintaining its relevance. As business needs change, consider adding amendments and updates to reflect the current operational landscape. This proactive approach ensures your agreement continues to meet your needs.

Troubleshooting common issues

Even with a well-structured merchant agreement form, issues can arise during completion and execution. Here are common problems and how to address them.

Filling errors

Mistakes like missing information or typos can undermine the effectiveness of your agreement. If you identify errors after the fact, promptly communicate with the other party to discuss revisions and make necessary adjustments.

Technical challenges

Using any digital platform can have its hiccups. If you encounter technical challenges while using pdfFiller, check their troubleshooting guides or FAQs. If problems persist, don’t hesitate to contact customer support for assistance.

Additional tips for a successful merchant agreement

Negotiating terms of a merchant agreement can be challenging; employing best practices can ease the process. Start discussions with a clear understanding of what you need, and remain open to compromise. Setting specific terms clearly in the agreement can prevent misunderstandings in the future.

Maintaining a professional tone in your correspondence and the written agreement reflects respect and diligence. Always strive for clarity and ensure that both parties have a mutual understanding of the terms laid out in the document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send merchant agreement to be eSigned by others?

How do I complete merchant agreement online?

How do I edit merchant agreement on an Android device?

What is merchant agreement?

Who is required to file merchant agreement?

How to fill out merchant agreement?

What is the purpose of merchant agreement?

What information must be reported on merchant agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.