Get the free Nebraska Uranium Severance Tax Return

Get, Create, Make and Sign nebraska uranium severance tax

How to edit nebraska uranium severance tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska uranium severance tax

How to fill out nebraska uranium severance tax

Who needs nebraska uranium severance tax?

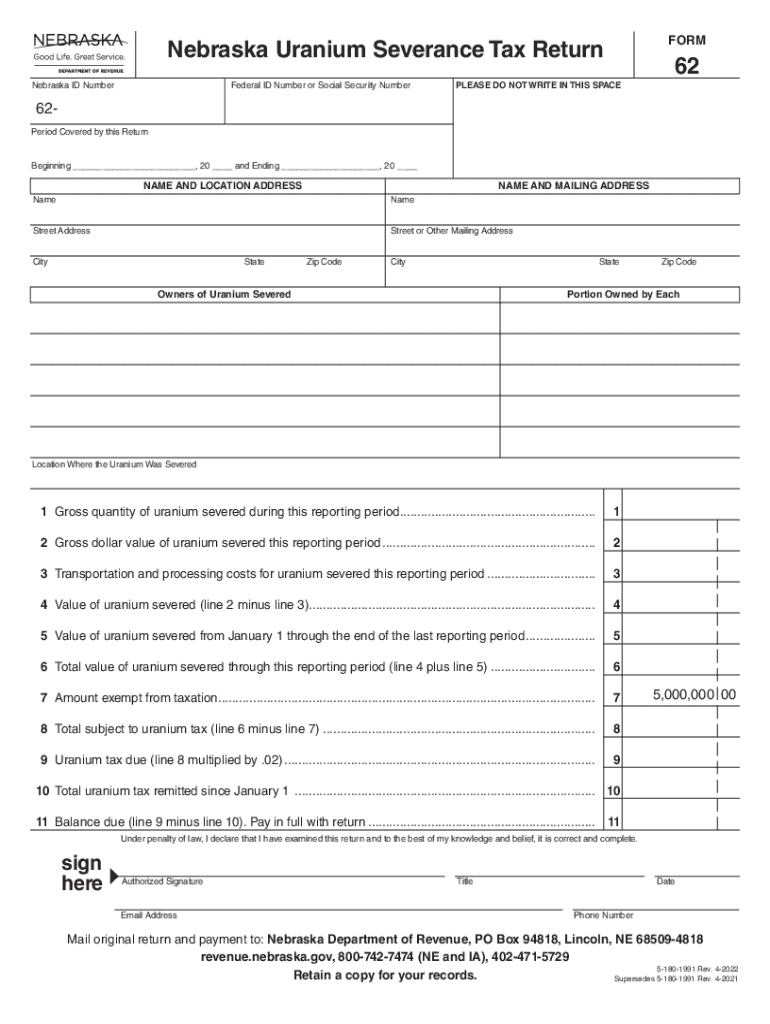

A comprehensive guide to the Nebraska uranium severance tax form

Overview of the Nebraska uranium severance tax

The Nebraska uranium severance tax is a critical component of the state's tax system, specifically designed to levy charges on the extraction of uranium, a significant natural resource within Nebraska's boundaries. This severance tax is a form of taxation imposed on the extraction companies, reflecting a percentage of the value of the resource extracted. Given the state's rich deposits of uranium, its proper taxation is vital not only for generating revenue but also for ensuring responsible resource management.

Uranium plays an essential role in Nebraska's energy sector, primarily providing fuel for nuclear reactors. As the world moves towards sustainable energy solutions, Nebraska's uranium reserves garner growing interest. The state’s severance tax policies focus on regulating the extracted resource effectively, thus benefiting both the economy and the environment.

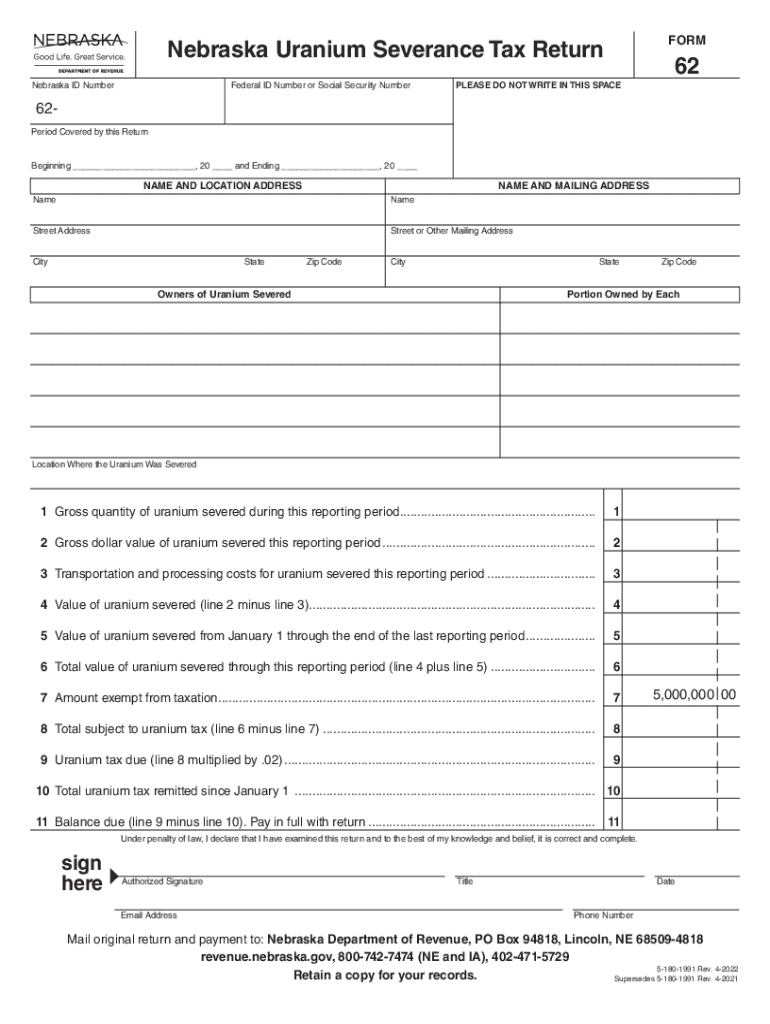

Understanding the Nebraska severance tax form

The Nebraska uranium severance tax form serves as the official document required for reporting and remitting severance taxes due to uranium extraction. This form must be filed periodically, typically on a quarterly basis, aligning with the production cycle of uranium. By submitting this form, operators disclose their production figures, calculate the tax owed, and ensure compliance with state regulations.

Key sections of this form often include company identification, production details, and tax calculation methods. Each section's significance is pivotal for ensuring accuracy, transparency, and adherence to local tax regulations. Filing the form correctly impacts not only operational costs but can also influence the sustainability practices within the extraction sector.

Eligibility criteria

Eligibility for filing the Nebraska uranium severance tax form primarily includes entities actively engaged in uranium extraction operations within the state. Typically, mining companies or entities involved in processing uranium must file this form. However, small-scale operations or certain exploratory projects may have exemptions or different reporting guidelines.

Step-by-step instructions for completing the form

To successfully complete the Nebraska uranium severance tax form, gather all required information and documentation beforehand to facilitate a smoother process. Essential documents include production data, estimates of extracted uranium, and pertinent company details, such as business licenses and tax identification numbers. Accurate data ensures precise calculations and compliance.

When filling out the form, follow these detailed breakdowns by section:

Avoid common pitfalls in form completion by double-checking entered data, especially numerical values that impact tax calculations. Verify that required attachments, such as supporting documentation, are included before submission to minimize delays.

Filing and submission process

Once the Nebraska uranium severance tax form is completed, it is crucial to understand where to submit it. Filers can choose between online submissions through the Nebraska Department of Revenue's website or submitting a paper version by mail. It’s important to be aware of significant deadlines to avoid penalties. Typically, filings are due within 30 days following the end of each quarter.

To ensure your submission is correctly processed and acknowledged, tracking the submission's status is necessary. Online submissions often provide a confirmation receipt immediately, while mailed forms might take longer. Always retain proof of submission as a safeguard against discrepancies.

Payment of severance tax

Understanding the various payment options available for the Nebraska uranium severance tax is crucial for compliance. Accepted methods typically include electronic funds transfer (EFT), credit card payments, or physical checks sent by mail. Companies must choose the method that best suits their operational capabilities and preferences.

Established schedules dictate when payments are due. Companies typically remit taxes annually, quarterly, or on another timeline defined by their production levels. Meticulous record-keeping of tax payments, including receipts and confirmations, is important for future reference and tax audits.

Resources for assistance

Navigating the complexities of the Nebraska uranium severance tax form can be challenging, but various resources are available for assistance. The Nebraska Department of Revenue's Severance Tax Division is your primary contact for inquiries regarding the filing and payment of severance taxes. Their website offers detailed guides and updates to help filers stay compliant and informed.

Additionally, several professional organizations specialize in tax consultancy and provide tailored help for resource extraction businesses. Utilizing online forums and attending local tax workshops can also provide valuable insights and solutions to common issues.

Additional insights on severance tax trends in Nebraska

Historically, uranium production in Nebraska has undergone fluctuating phases of boom and bust, significantly impacting economic policies within the state. The evolving landscape of extraction must be closely monitored, especially as technologies and environmental regulations shift. As the demand for nuclear energy grows, states including Nebraska may consider revising severance tax structures to ensure competitive extraction and encourage sustainable practices.

Recent legislative actions have focused on ensuring that tax revenues positively contribute to local communities and ecological sustainability. Future outlooks suggest an increased focus on balancing resource extraction with environmental stewardship, pushing for further refined tax regulations that can adapt to changing energy landscapes.

Interactive tools and formats

With advancements in technology, tools like pdfFiller can significantly streamline the process of completing the Nebraska uranium severance tax form. Users can create, edit, and manage the form using this cloud-based platform, which simplifies collaboration among team members working on compliance documents. The ability to track changes and access forms from anywhere saves time and reduces errors.

pdfFiller also offers electronic signing options, which can expedite the approval process. These features are particularly beneficial for companies that may require multiple signatures or have teams working in diverse locations, ensuring everyone stays aligned and compliant with state regulations.

Conclusion

Ensuring the accurate filing and payment of the Nebraska uranium severance tax is indispensable for companies involved in uranium extraction. Not only does it fulfill legal obligations, but it also contributes to sustainable resource management practices that benefit the community and environment. Leveraging digital tools such as pdfFiller can simplify document management, making compliance more accessible and efficient.

Ultimately, companies are encouraged to familiarize themselves with the severance tax guidelines and utilize available resources to navigate this complex landscape effectively.

Additional form references

For those seeking more information on similar tax forms and related documents in Nebraska, several resources can provide the necessary insights. It is important to stay informed about broader tax obligations associated with resource extraction, including any state-specific nuances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in nebraska uranium severance tax?

How do I edit nebraska uranium severance tax on an iOS device?

How do I edit nebraska uranium severance tax on an Android device?

What is nebraska uranium severance tax?

Who is required to file nebraska uranium severance tax?

How to fill out nebraska uranium severance tax?

What is the purpose of nebraska uranium severance tax?

What information must be reported on nebraska uranium severance tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.