Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding Form 10-Q

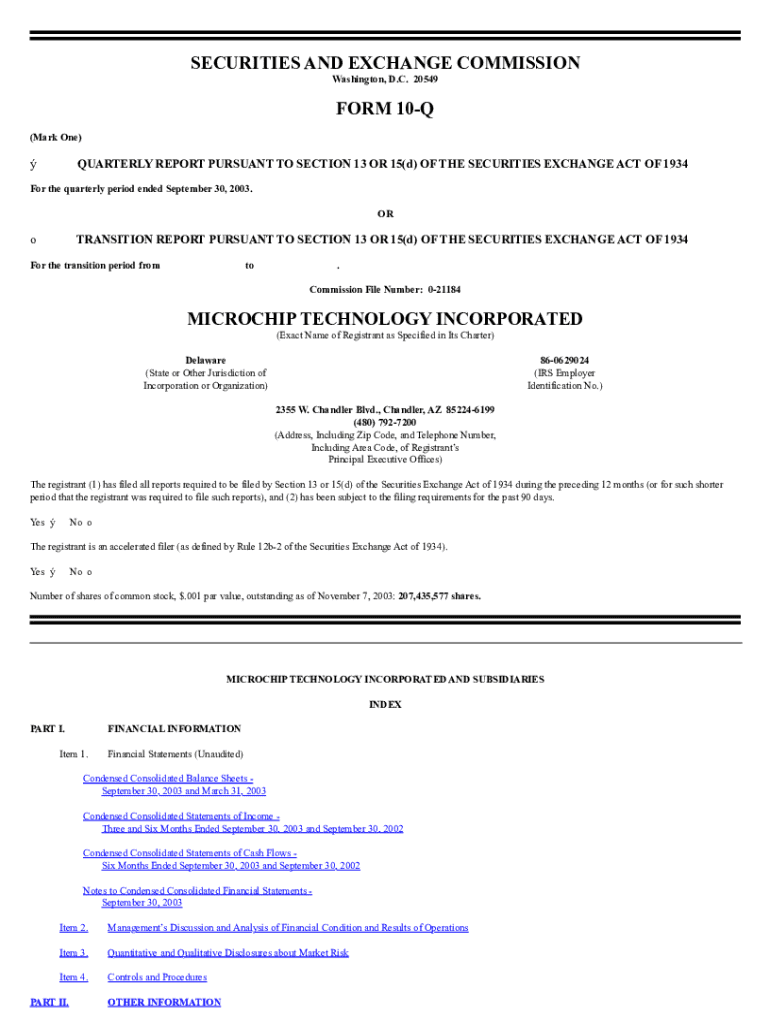

Form 10-Q is a quarterly report submitted by publicly traded companies to the Securities and Exchange Commission (SEC). Unlike the annual report, which provides comprehensive details about a company's performance over the entire year, the Form 10-Q focuses on the company's performance for the most recent fiscal quarter. Its main purpose is to keep investors informed about financial status and operations, ensuring transparency in the market.

The importance of Form 10-Q for investors cannot be overstated. This document gives insight into a company's ongoing financial health, operational challenges, and strategic direction. For companies, the timely filing of Form 10-Q reflects their commitment to regulatory compliance and transparency, potentially impacting their stock performance and investor relations.

Key components of Form 10-Q

Form 10-Q consists of several critical components, each serving a unique purpose. It includes comprehensive financial statements, which are crucial for assessing the company's performance over the quarter. Key financial statements found in the Form 10-Q include the quarterly balance sheet, an overview of the income statement, and the cash flow statement.

In addition to financial statements, the form features Management’s Discussion and Analysis (MD&A), where leadership provides context for the numbers in the financial statements. Companies also include a business description and quantitative and qualitative disclosures about market risk, emphasizing potential risks and the organization's response measures.

Detailed breakdown of 10-Q items

Form 10-Q includes several specific items that must be addressed by the company. Here’s a breakdown of these typical items:

Key filing deadlines for Form 10-Q

Understanding filing deadlines for Form 10-Q is essential for companies to maintain compliance with SEC rules. The deadlines for filing are based on the type of filer:

Staying aware of these deadlines is crucial, as missing them can lead to penalties and diminished investor trust.

Navigating Form 10-Q compliance

Companies frequently face challenges regarding Form 10-Q compliance. This can stem from complicated financial reporting requirements and maintaining accurate records. Understanding these challenges helps mitigate risks. Common pitfalls include miscommunication between departments, which might lead to discrepancies in data or missing disclosures.

Consequences of missing filing deadlines can range from fines to increased scrutiny by the SEC. To avoid late filings, companies should employ project management techniques, create reminders for important dates, and establish a checklist for essential data. Regular audits of financial information can also minimize last-minute discrepancies.

How to access and review Form 10-Qs

Accessing Form 10-Q is straightforward thanks to various online tools. The SEC EDGAR database is the primary source, allowing users to search any public company's filings. Each section can be downloaded or reviewed directly online for ease of access.

Additionally, many companies host their investor relations pages where they publish their 10-Q forms. When searching, be specific with your queries and use the company name and the quarter to streamline the process. Understanding the layout of Form 10-Q is crucial; it typically starts with a table of contents, leading into the substantive sections outlined above.

How pdfFiller enhances your Form 10-Q experience

pdfFiller revolutionizes how businesses manage their Form 10-Q filings. With robust editing capabilities, users can amend PDFs directly, ensuring that all financial data is accurately reflected. The eSigning feature promotes efficiency by allowing authorized individuals to sign documents electronically without the back-and-forth of physical paperwork.

Collaboration tools are additionally beneficial for teams working together on draft filings. Leaders can provide feedback in real-time, streamlining the review process. Plus, the cloud management system ensures effortless access to documents from anywhere, making it easy to keep records organized and secure.

Practical steps to fill out a Form 10-Q using pdfFiller

Filling out a Form 10-Q using pdfFiller can be simplified into a few straightforward steps:

Following these steps not only improves efficiency but also ensures that compliance requirements are met.

Best practices for filing your Form 10-Q

To ensure a smooth filing process, adopting best practices for preparing your Form 10-Q is essential. Accurate record-keeping forms the backbone of any financial report. Companies should maintain meticulous records throughout the quarter to prevent scrambling for data at the last minute.

Additionally, regular updates and reviews can help identify discrepancies early in the preparation process. Establishing a timeline with specific checkpoints aids in keeping everyone accountable. Finally, fostering collaboration among teams responsible for compiling the necessary data enhances accuracy and completeness of the filing.

FAQs about Form 10-Q

Form 10-Q can often raise questions among those involved in preparing or reviewing it. Common inquiries include how to file electronically, what happens if the form is filed late, and if there are differences between a 10-Q and an annual report (Form 10-K).

Clarifying misconceptions, for example, that Form 10-Q is simply a cut-down version of 10-K, is crucial, as 10-Q filings provide ongoing snapshots of a company’s performance that differ significantly from the annual comprehensive overview.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 10-q?

How do I edit form 10-q straight from my smartphone?

Can I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.