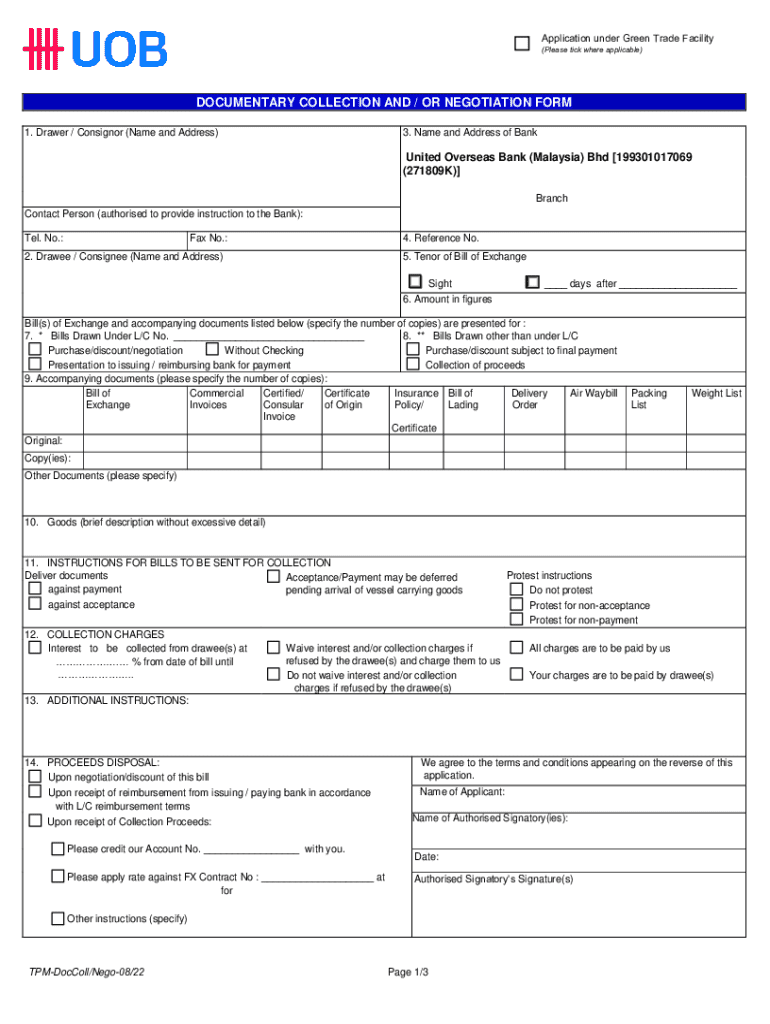

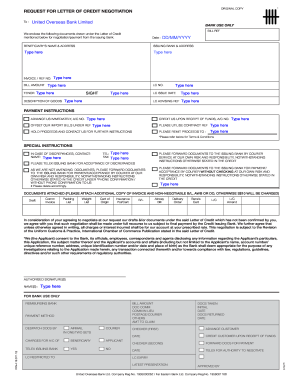

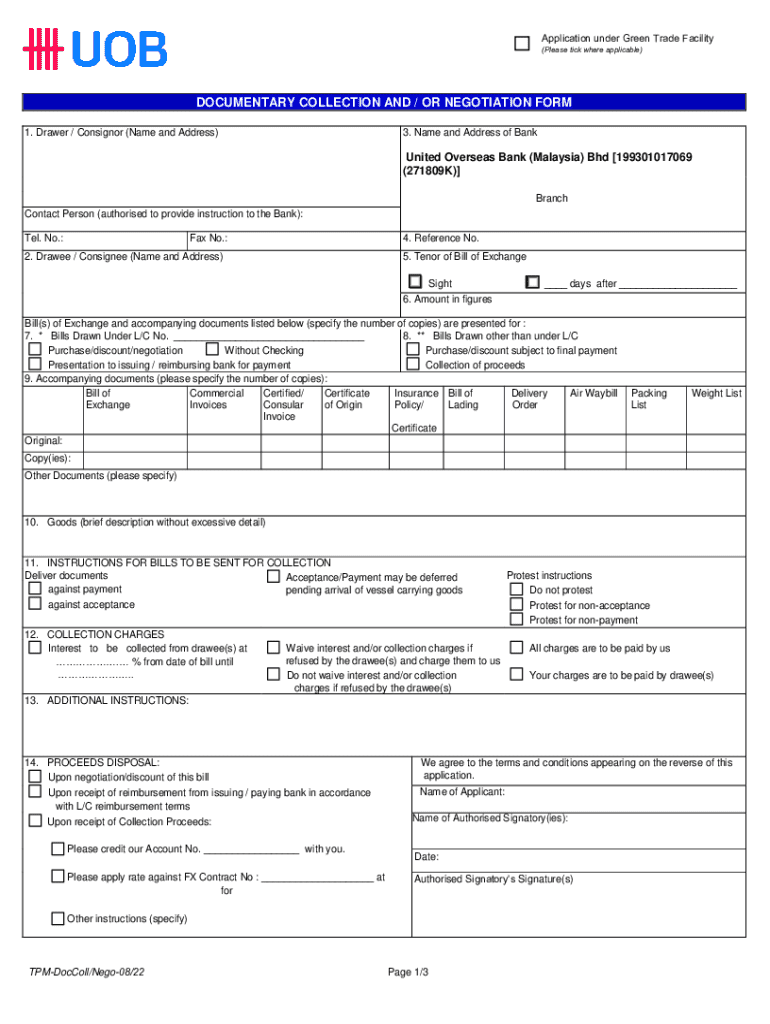

MY UOB Documentary Collection and/or Negotiation Form 2022-2026 free printable template

Get, Create, Make and Sign MY UOB Documentary Collection andor Negotiation

How to edit MY UOB Documentary Collection andor Negotiation online

Uncompromising security for your PDF editing and eSignature needs

MY UOB Documentary Collection and/or Negotiation Form Form Versions

How to fill out MY UOB Documentary Collection andor Negotiation

How to fill out application under green trade

Who needs application under green trade?

Understanding Documentary Collection and Form: A Comprehensive Guide

Understanding documentary collections

Documentary collections are a method used in international trade to facilitate transactions between exporters and importers. This financial arrangement allows the exporter to send shipping documents to the collecting bank, which then forwards them to the importer’s bank. The release of these documents, which are necessary for taking possession of the goods, hinges on the importer's payment or acceptance of a draft.

How documentary collections work

The documentary collection process initiates with the exporter preparing necessary shipping documents and instructing their bank to forward these documents to the importer's bank. This payment method is predicated on either payment against documents (D/P) or acceptance of a time draft (D/A). It's crucial that exporters and importers understand their respective roles in this process to ensure seamless transactions.

Types of documentary collections

Two main types of documentary collections exist: documents against payment (D/P) and documents against acceptance (D/A). In a D/P agreement, the documents are released only upon payment by the importer. Conversely, D/A allows the importer to receive documents with a promise to pay a future date, which may carry higher risk for the exporter.

Advantages of using documentary collections

Utilizing documentary collections provides several advantages for exporters. Firstly, they offer a degree of security that limits risk, as payment is tied directly to document transfer. Also, this method reduces costs compared to more complex mechanisms such as letters of credit, allowing businesses to streamline their transactions effectively.

Potential risks and limitations

Despite their merits, documentary collections do carry potential risks for exporters and importers. Non-payment remains a critical issue, particularly in D/A scenarios where reliance rests on the importer's ability to uphold their end of the agreement. Furthermore, delays may arise during document processing, impeding access to goods and ultimately affecting trade flow.

Legal considerations in documentary collections

Legal frameworks underpinning documentary collections are rooted in international guidelines, including the Uniform Customs and Practice for Documentary Credits (UCP) and the International Chamber of Commerce (ICC) publications. Jurisdictions applicable to disputes can vary, but clear agreements should outline governing laws to mitigate potential conflicts in trade.

Best practices for successful documentary collections

To enhance the efficacy of documentary collections, businesses should focus on maintaining accurate documentation from the outset. Clear communication with all parties is essential; misunderstandings can lead to delays or disputes. Engaging reliable banking partners can also help streamline processes and provide additional safeguards against potential risks.

How to fill out the documentary collection form

Filling out the documentary collection form requires careful attention to detail. Start by identifying the correct form based on your bank's requirements. Essential fields include exporter and importer details, documentation types, and payment conditions. Following submission guidelines closely can ensure that your documentation is processed without unnecessary delays.

Moving forward with documentary collections

Integrating documentary collections into trade practices can enhance transactional efficiency and security. Businesses should leverage advancements in technology, such as cloud-based document management systems offered by platforms like pdfFiller, to streamline operations. Utilizing such solutions improves collaboration and accessibility, ultimately driving success in international trade.

Access to advanced tools and resources

Accessing advanced tools and resources significantly enhances the documentary collection process. Interactive tools for document management, template access for common forms, and educational resources like webinars and articles on platforms such as pdfFiller can empower users to navigate documentary collections efficiently.

People Also Ask about

What is the difference between clean collection and documentary collection payment method?

What is documentary collection method of payment?

Who is the remitting bank for documentary collection?

Who is the payee in documentary collection?

What are the two types of documentary collection?

What is documents against payment documentary collection?

What is the difference between documentary collection and letter of credit?

What is a downside of documentary collection?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MY UOB Documentary Collection andor Negotiation to be eSigned by others?

How do I complete MY UOB Documentary Collection andor Negotiation online?

Can I create an electronic signature for the MY UOB Documentary Collection andor Negotiation in Chrome?

What is application under green trade?

Who is required to file application under green trade?

How to fill out application under green trade?

What is the purpose of application under green trade?

What information must be reported on application under green trade?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.