Get the free Motor Vehicle Excise Abatement Application

Get, Create, Make and Sign motor vehicle excise abatement

Editing motor vehicle excise abatement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor vehicle excise abatement

How to fill out motor vehicle excise abatement

Who needs motor vehicle excise abatement?

A comprehensive guide to the motor vehicle excise abatement form

Understanding motor vehicle excise abatement

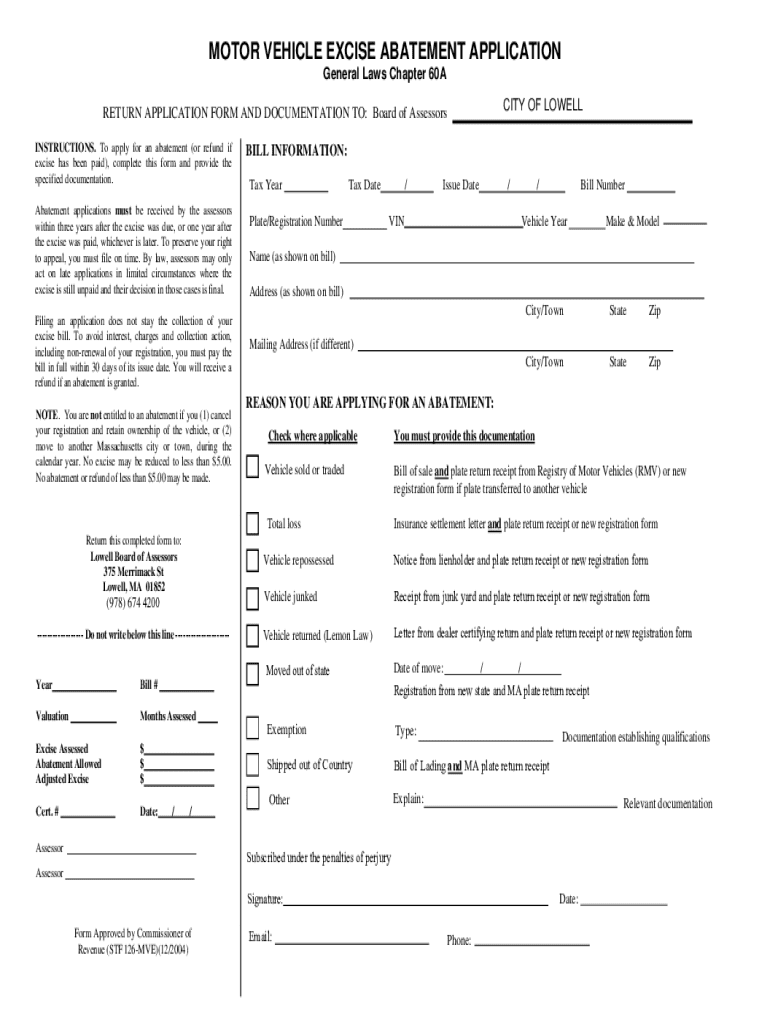

Motor vehicle excise tax abatement is a process that allows taxpayers to reduce or eliminate the motor vehicle excise tax owed for specific qualifying reasons. This tax is typically assessed annually based on the assessed value of the vehicle, and while it serves as an important source of revenue for local governments, not all vehicles or owners have to pay this fee in its entirety. Understanding the abatement process can lead to significant savings.

To be eligible for an abatement, specific criteria must be met. Common conditions include circumstances where a vehicle has been sold, stolen, or declared a total loss by an insurance company. Additionally, taxpayers who have moved the vehicle out of state or to another jurisdiction may also qualify. Knowing these conditions ensures that individuals can take advantage of the potential tax relief.

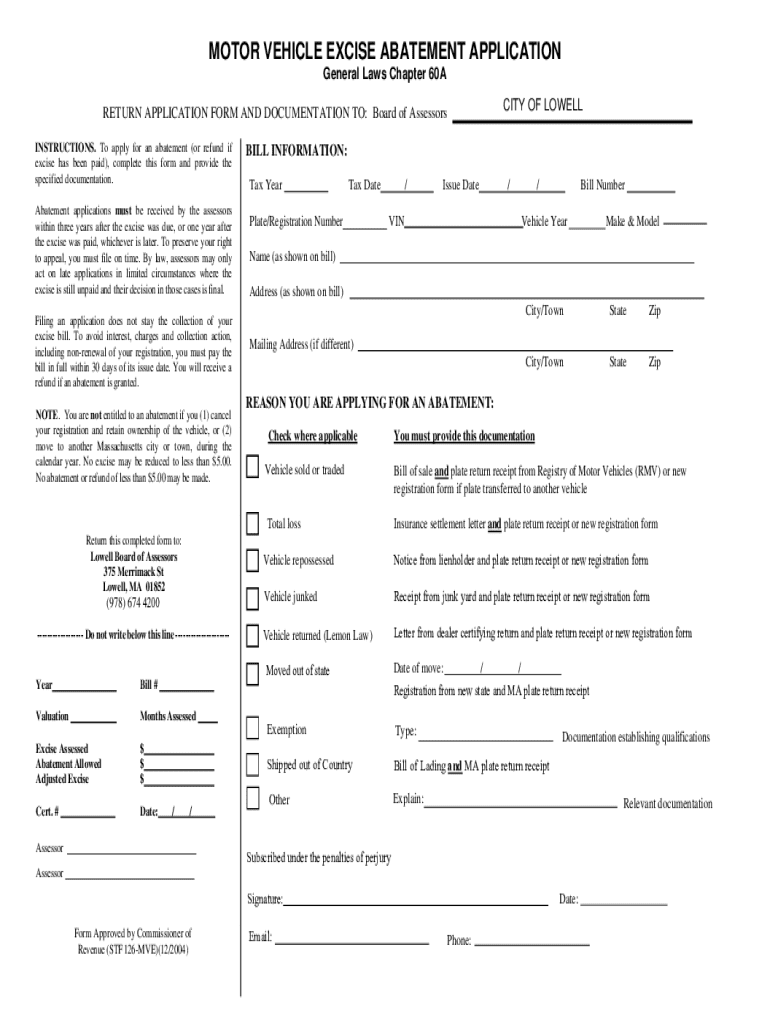

Overview of the motor vehicle excise abatement form

The motor vehicle excise abatement form is a specific document created for taxpayers to formally request a reduction or waiver of their excise tax. Each state may have its own version of this form, and its details are crucial for ensuring accuracy in submissions. Understanding its role in the application process is essential for anyone looking to alleviate their tax burden.

Obtaining the motor vehicle excise abatement form is straightforward. Most local tax assessor’s offices provide the form online for easy access. For those preferring traditional methods, paper forms are usually available at municipal offices. This dual-access model ensures every taxpayer can efficiently request an abatement.

Step-by-step instructions for filling out the form

Filling out the motor vehicle excise abatement form requires attention to detail and accuracy. The initial section typically involves personal information, where you must provide essential identification details including your name, address, and contact information. Ensuring that every entry is correct helps prevent delays in processing your request.

Next comes the vehicle information section, which requires specific details about the vehicle for which you're requesting abatement. This includes the make, model, year, and vehicle identification number (VIN). It is crucial that this information is accurate; mistakes could lead to rejection of your application.

Editing and customizing the form

Utilizing tools like pdfFiller makes the process of editing and customizing the motor vehicle excise abatement form efficient and user-friendly. With options to modify text fields, adjust layouts, and add comments or documentation, you gain the flexibility to tailor the form to your needs. This helps in ensuring all necessary information is presented effectively.

It's essential to check your work for accuracy and completeness. Missing information can lead to your form being returned or denied, complicating the process further. Collaboration features in tools like pdfFiller also allow teams to work together, reducing errors and increasing efficiency.

Signing the form

Once the motor vehicle excise abatement form is filled out, the next step is to sign it. There are multiple options available—users can opt for traditional physical signatures or electronic signatures using platforms like pdfFiller. Considering the growing acceptance of eSignatures, it is crucial to verify that they are legally recognized in your state to ensure that your submission will be valid.

When utilizing pdfFiller, the signing process is streamlined. The platform provides clear steps for adding your eSignature accurately, allowing for a quick and efficient completion of your application.

Submitting your motor vehicle excise abatement form

Submitting your completed motor vehicle excise abatement form can be done either online or via traditional mail. If submitting online, ensure you have all necessary documentation and follow the submission guidelines provided on your local authority’s website. For paper forms, mail them to the specified address provided on the form, along with any required enclosures.

It's wise to keep a copy of your submission for your records. After submission, you can typically expect a processing time that varies based on your municipality, so being informed about what to expect can help manage your expectations.

Post-submission: tracking and managing your request

After submitting the motor vehicle excise abatement form, staying informed about your application status is key. Most local agencies provide online tools or contact points to verify whether your application has been received and is being processed. Utilizing these resources can help minimize uncertainty during the waiting period.

In the unfortunate event your request is denied, understanding the reasons for denial is essential. You typically have the option to either reapply or appeal the decision. Having documentation ready when following up can significantly improve your chances of a successful appeal.

Frequently asked questions (FAQs)

Navigating the motor vehicle excise abatement process can raise several questions. Common issues faced during the application process often include mistakes on the form, incorrect documentation, or not meeting eligibility criteria. If you discover errors after submission, reaching out promptly to the relevant authority can often lead to corrections before a decision is made.

For additional queries, including technical assistance with the form or process, contacting local tax offices or utilizing available resources can provide the necessary clarity. Being proactive helps ensure a smoother experience overall.

Useful documents & resources

To assist with the motor vehicle excise abatement process, having the right resources at your fingertips is crucial. Official tax guidelines often provide comprehensive information on eligibility criteria and conditions for abatement. Additionally, utilizing templates and examples of completed forms can serve as helpful references, ensuring your submission is accurate.

Furthermore, keeping contact information for support services readily available allows for quick resolution of queries. The more informed you are, the smoother your experience with the abatement process will be.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in motor vehicle excise abatement?

Can I create an eSignature for the motor vehicle excise abatement in Gmail?

How do I fill out the motor vehicle excise abatement form on my smartphone?

What is motor vehicle excise abatement?

Who is required to file motor vehicle excise abatement?

How to fill out motor vehicle excise abatement?

What is the purpose of motor vehicle excise abatement?

What information must be reported on motor vehicle excise abatement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.