Get the free Paid Check Run Report

Get, Create, Make and Sign paid check run report

Editing paid check run report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out paid check run report

How to fill out paid check run report

Who needs paid check run report?

Understanding the Paid Check Run Report Form: A Comprehensive Guide

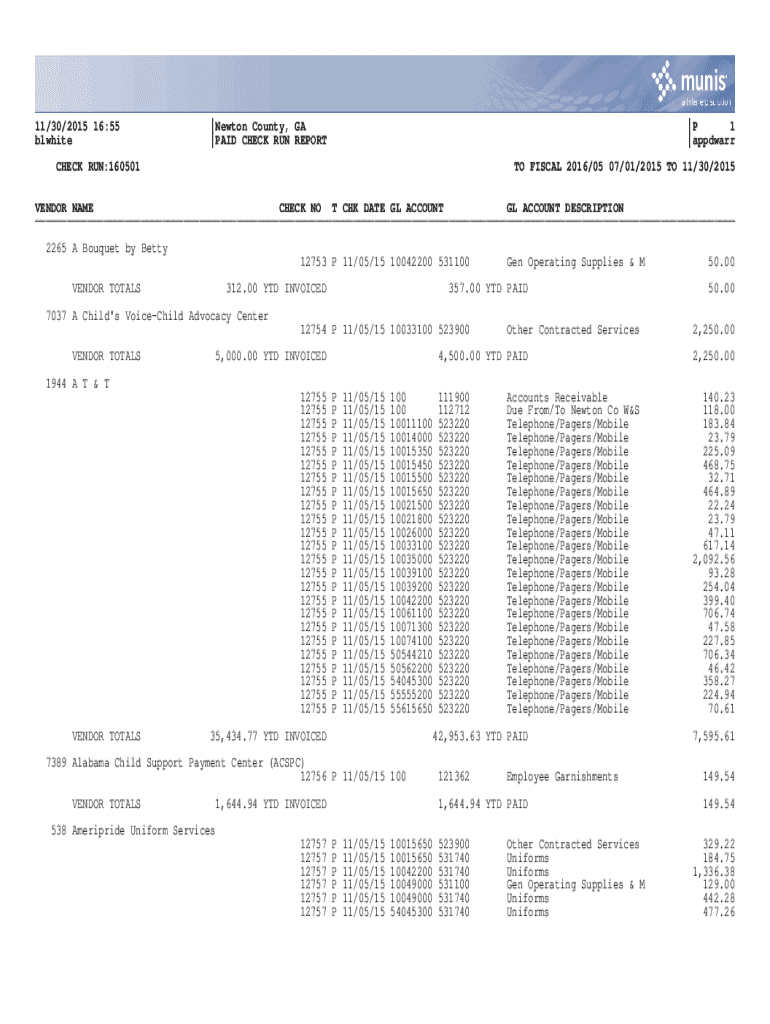

Understanding the paid check run report

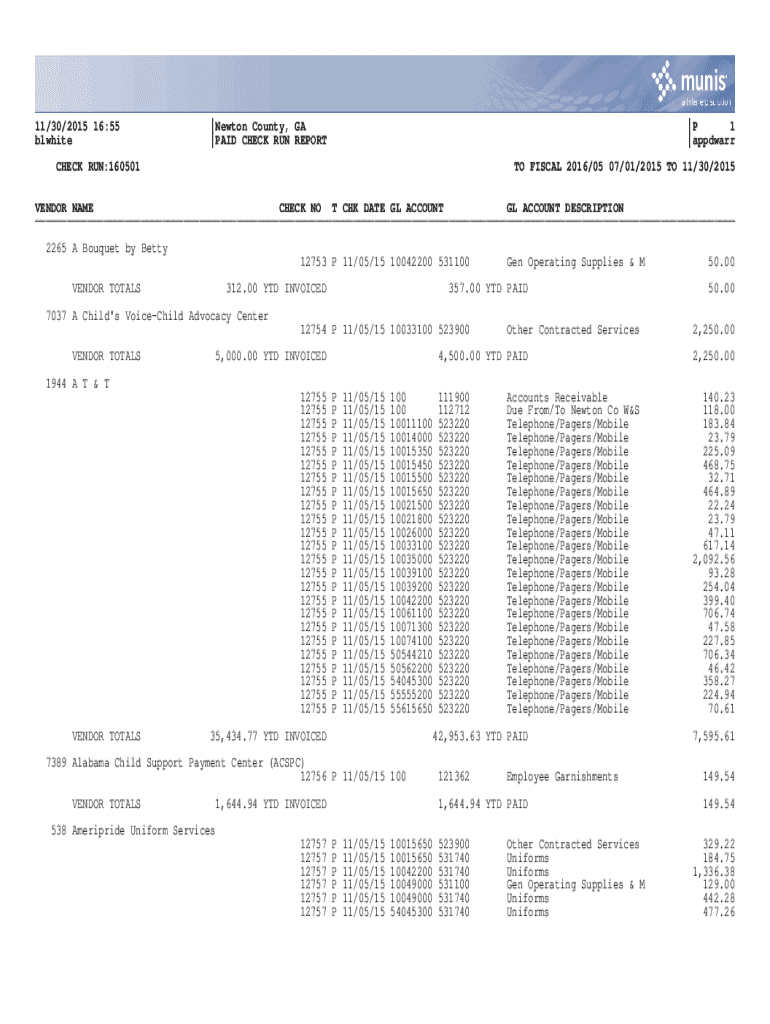

A Paid Check Run Report is an essential financial document that outlines all the checks issued for payment within a specified period. This report acts as a comprehensive summary of the amounts disbursed to vendors, employees, and other payees, providing crucial insights into a business's cash flow management.

For finance teams and businesses alike, the significance of the Paid Check Run Report cannot be overstated. It serves as a formal record that facilitates tracking of expenditures and helps in monitoring budget compliance. Additionally, it plays a pivotal role in maintaining financial transparency, ensuring that all stakeholders are aware of monetary transactions.

Benefits of using the paid check run report

Utilizing a Paid Check Run Report provides a multitude of benefits for organizations aiming to enhance their financial processes. One of the most significant advantages is improved financial transparency. By having a detailed report, businesses gain clear visibility into their cash flow, aiding in better decision-making.

Another advantage is the streamlining of payment processes. Automated generation of these reports minimizes the time spent on manual entries, allowing finance teams to focus on more strategic tasks. This increased efficiency directly correlates with improved budget management, as organizations can align their check runs with budget forecasts.

Moreover, accurate reporting is indispensable for compliance and audit purposes. Maintaining a well-documented process signifies adherence to regulations, thus preparing companies for any scrutiny from governing bodies.

How to create a paid check run report

Creating a Paid Check Run Report involves several key steps that ensure accuracy and completeness. First, gathering the necessary information is crucial. This involves collaborating with relevant departments such as accounts payable and finance to collect data related to payments made.

Once the data is gathered, organizing it for easy access is important. Utilizing templates can significantly improve efficiency. Pre-made templates are available, but customization is often necessary to suit specific business needs. Ideal templates should include core components like payee details, amounts, and transaction descriptions.

Filling out the report should be performed with strict accuracy. Entering data methodically and double-checking for errors prevents future discrepancies. To further ease the process, tools like pdfFiller can be employed. It offers functionalities to generate reports quickly and utilize cloud storage for easy access.

Editing and finalizing the paid check run report

An effective Paid Check Run Report is one that is thoroughly edited and finalized. Utilizing collaborative editing features allows multiple team members to review and contribute to the report simultaneously. This not only enhances accuracy but also speeds up the review process.

Version control and tracking changes are critical in maintaining document integrity. Besides, incorporating electronic signatures can streamline the approval process. ESignatures are legally recognized and offer a swift means of document approval, ensuring that the report is finalized in a timely manner.

Lastly, establishing a checklist for the final review guarantees that all aspects have been examined properly. Peer reviews act as a second layer of verification, significantly reducing the chances of errors ending up in the final document.

Managing and sharing the paid check run report

Proper management of the Paid Check Run Report extends beyond its creation. Best practices for report storage include utilizing cloud-based storage systems which offer easy retrieval and enhance security. Organizing reports into specific folders or categories simplifies future access.

When sharing the report with stakeholders, it's essential to consider data privacy and access permissions. pdfFiller equips users with methods to share reports securely, ensuring that sensitive financial information is protected while still being accessible to authorized personnel.

Additionally, archiving old reports is vital for maintaining historical data. A well-structured archiving system allows businesses to refer back to previous reports when needed, which is useful for audits and retrospective financial analysis.

Common challenges and solutions

Despite the structured approach to creating a Paid Check Run Report, challenges can arise. One common issue includes data inconsistencies, often stemming from manual entry errors. Regular training for team members on data entry procedures can mitigate this problem.

Managing multiple check runs can also present difficulties. A strategy to consolidate various reports into one comprehensive document can simplify analysis and management. Furthermore, adjustments to reporting practices may be necessary during changes in company structure or processes, reinforcing the importance of flexibility in financial operations.

Real-world examples and case studies

Numerous organizations have successfully implemented Paid Check Run Reports, showcasing the practicality of these tools across various industries. For instance, a manufacturing business utilized such reports to streamline its payment processes, leading to a noticeable reduction in processing time and improved relationships with suppliers.

By examining lessons learned from case studies, businesses can adopt best practices tailored to their needs. Moreover, testimonials from users of pdfFiller indicate that the platform's features have significantly contributed to efficiency and accuracy in generating and managing check run reports.

Frequently asked questions (FAQs)

As the usage of Paid Check Run Reports becomes more commonplace, several questions frequently arise. One common query relates to the best format for such reports. Typically, a clear, tabulated format is recommended, as it allows for easy reading and comparison of data.

Another common inquiry pertains to how often these reports should be generated. Factors such as business size and transaction volume will dictate frequency, with many companies opting for weekly or monthly cycles. Integrating tools like pdfFiller with existing financial software can also enhance reporting efficiency, providing seamless functionality for users.

Lastly, if a mistake is made post-submission, it’s vital to refer back to the report's versioning feature. This allows users to correct errors accurately while maintaining a clear audit trail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit paid check run report on a smartphone?

How do I fill out the paid check run report form on my smartphone?

Can I edit paid check run report on an Android device?

What is paid check run report?

Who is required to file paid check run report?

How to fill out paid check run report?

What is the purpose of paid check run report?

What information must be reported on paid check run report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.