Get the free Fec Form 3x

Get, Create, Make and Sign fec form 3x

How to edit fec form 3x online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fec form 3x

How to fill out fec form 3x

Who needs fec form 3x?

A Complete Guide to FEC Form 3X

Understanding the FEC Form 3X

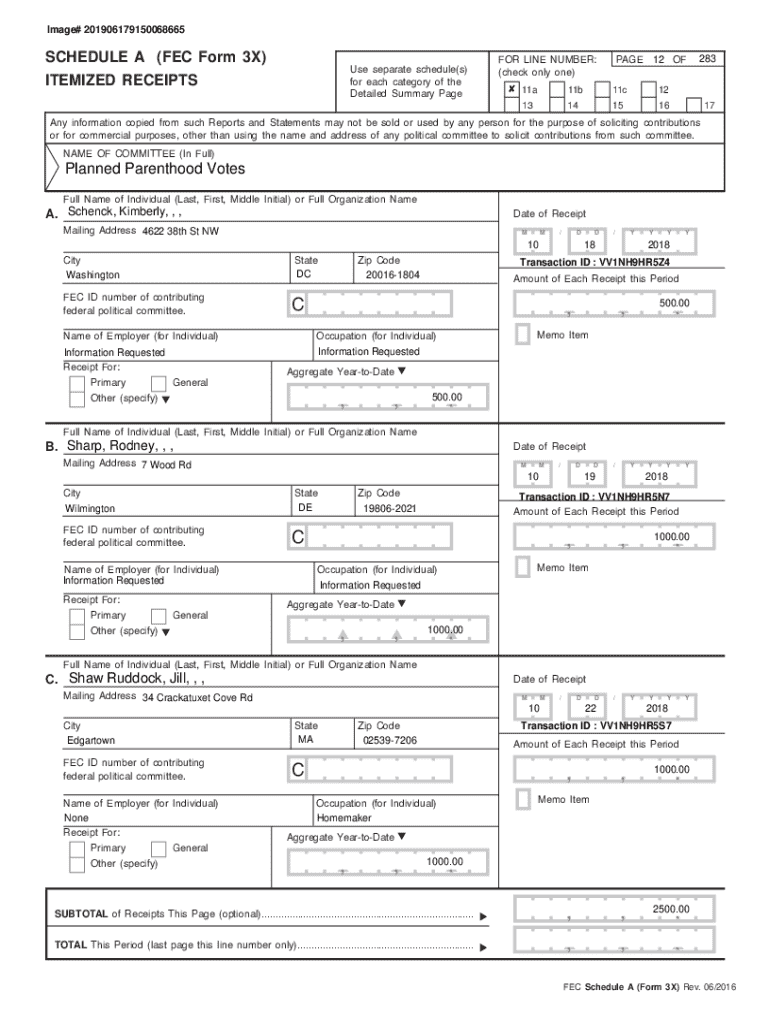

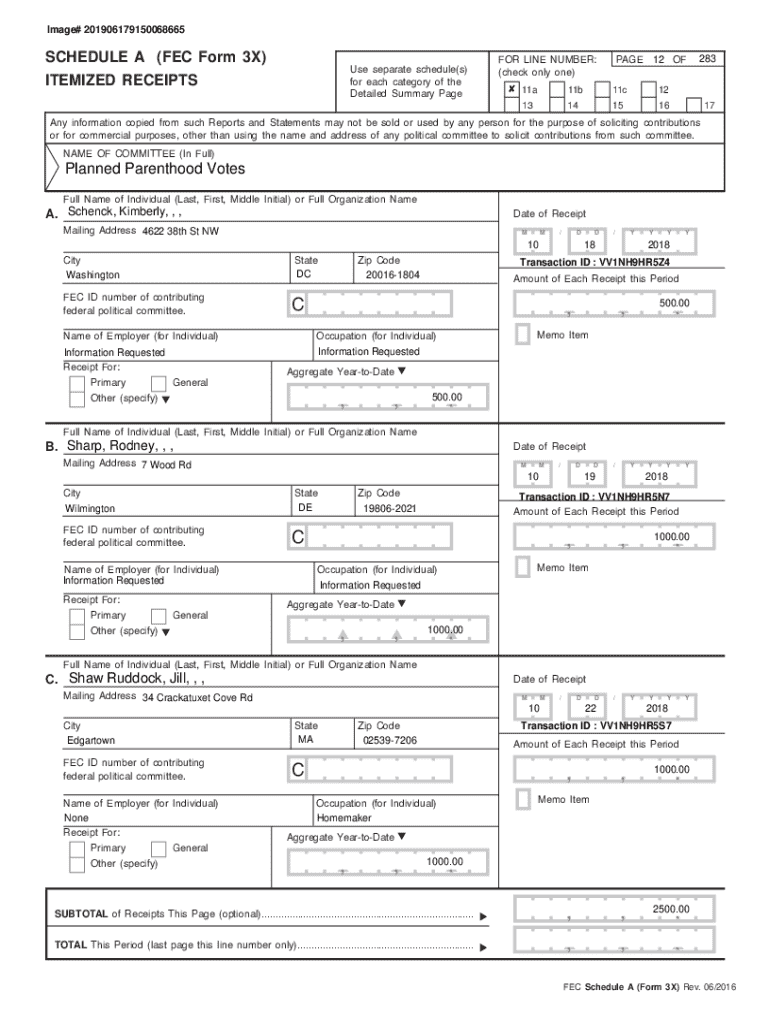

The FEC Form 3X is a critical document used in the realm of campaign finance reporting in the United States. This form is specifically designed for registered political committees that are not authorized by a candidate. Its primary purpose is to ensure transparency and accountability by tracking the financial activities of political campaigns, enabling the Federal Election Commission (FEC) to monitor compliance with federal election laws.

Political committees, such as party committees and independent expenditure-only committees, need to file this form regularly to report their receipts and expenditures. Its structured approach allows for the inclusion of various financial activities, facilitating the careful examination of funds received and spent during an election cycle.

Features of the FEC Form 3X

The structure of the FEC Form 3X is meticulously designed to capture essential information regarding a political committee's financial transactions. The sections included in the form break down various components of financial reporting, such as contributions received, expenditures made, and any refunds issued. This structured approach streamlines the reporting process and enhances the usability of the form for those involved in campaign finance.

Key information required in the FEC Form 3X includes identification details, a thorough accounting of all financial activity, as well as various schedules that detail specific types of contributions and expenditures. Filing frequency is often determined by the committee's financial activities, with deadlines set to ensure timely reporting.

How to access the FEC Form 3X

Accessing the FEC Form 3X is straightforward. It is available for download directly from the Federal Election Commission's official website. Political committees can easily find the form in the 'Forms' section, ensuring that they have the most up-to-date version.

For those who prefer a more interactive experience, several online platforms enable users to complete the form digitally. pdfFiller stands out as a highly recommended solution, as it provides enhanced document management capabilities, including filling, editing, and sharing documents seamlessly.

Step-by-step instructions for completing the FEC Form 3X

Completing the FEC Form 3X can seem daunting, but breaking it down into sections can simplify the process. The first section focuses on identification, where committees must input their name, address, and other identifying information. Next, the financial activity is detailed in Section 2, outlining all monetary transactions.

Section 3, Contributions, is particularly crucial as it captures the funds received, listed in Schedule A, and any refunds in Schedule B. Finally, Section 4 deals with expenditures made by the political committee. Attention to detail is essential, as accuracy in these sections will ensure compliance and prevent issues with the FEC.

Submitting the FEC Form 3X

Once completed, submitting the FEC Form 3X can be done online or via traditional mail. The online submission process is often more efficient, allowing for instant confirmation that the form has been received. If opting for traditional mailing, it is advisable to send the form via certified mail to track its delivery to the FEC.

After submission, tracking the status of the form is crucial. The FEC provides an online tracking system to follow the progress of filings, ensuring that the committee can confirm that their information has been processed correctly.

FAQs on the FEC Form 3X

Navigating the complexities of the FEC Form 3X can raise many questions. Common concerns include filing requirements, deadlines, and troubleshooting issues with electronic submissions. Many filers often wonder how to correct inaccuracies in their filings or what the process is if they miss a deadline.

The FEC website provides extensive FAQs and guidance documents that can assist filers. Additionally, pdfFiller offers excellent resources for support, which can help answer specific questions and clarify doubts individuals may have regarding their submissions.

Recent updates and changes to the FEC Form 3X

The FEC Form 3X is subject to periodic revisions that reflect changes in federal regulations and reporting requirements. Staying abreast of these revisions is crucial for political committees to remain compliant. Recent updates may include revised reporting thresholds or modified guidelines for electronic submissions.

These changes can significantly impact how current filers manage their reporting processes. Committees should ensure that they are utilizing the most current version of the form and remain informed about alterations to regulations that may require adjustments in how they report their finances.

Related forms and resources

When dealing with campaign finance, understanding the FEC Form 3X is just one aspect of a broader compliance framework. Filers might also be required to familiarize themselves with other related forms, such as the FEC Form 1 for committee registration or the FEC Form 3 for candidates’ authorized committees. Understanding the distinctions and purposes of each can streamline the filing process.

In addition, pdfFiller offers a suite of tools that simplify document management, allowing users to store and access related forms easily. This can include templates and other resources necessary for comprehensive campaign finance management.

Collaborating and sharing the FEC Form 3X

Collaboration is key when managing campaign finance documentation. pdfFiller’s collaboration features enable teams to work together seamlessly on the FEC Form 3X. This includes inviting team members for editing, providing real-time feedback, and collecting electronic signatures where necessary. The ability to collaborate effectively can significantly enhance the accuracy of the reported data.

Best practices for document sharing include ensuring team members have clear instructions regarding the form's sections, utilizing naming conventions for file versions to avoid confusion, and setting deadlines for completion to streamline the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fec form 3x for eSignature?

How do I make changes in fec form 3x?

How do I make edits in fec form 3x without leaving Chrome?

What is fec form 3x?

Who is required to file fec form 3x?

How to fill out fec form 3x?

What is the purpose of fec form 3x?

What information must be reported on fec form 3x?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.