Get the free 2025-2026 Parent Non-filer Statement

Get, Create, Make and Sign 2025-2026 parent non-filer statement

How to edit 2025-2026 parent non-filer statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 parent non-filer statement

How to fill out 2025-2026 parent non-filer statement

Who needs 2025-2026 parent non-filer statement?

Your Comprehensive Guide to the 2 Parent Non-Filer Statement Form

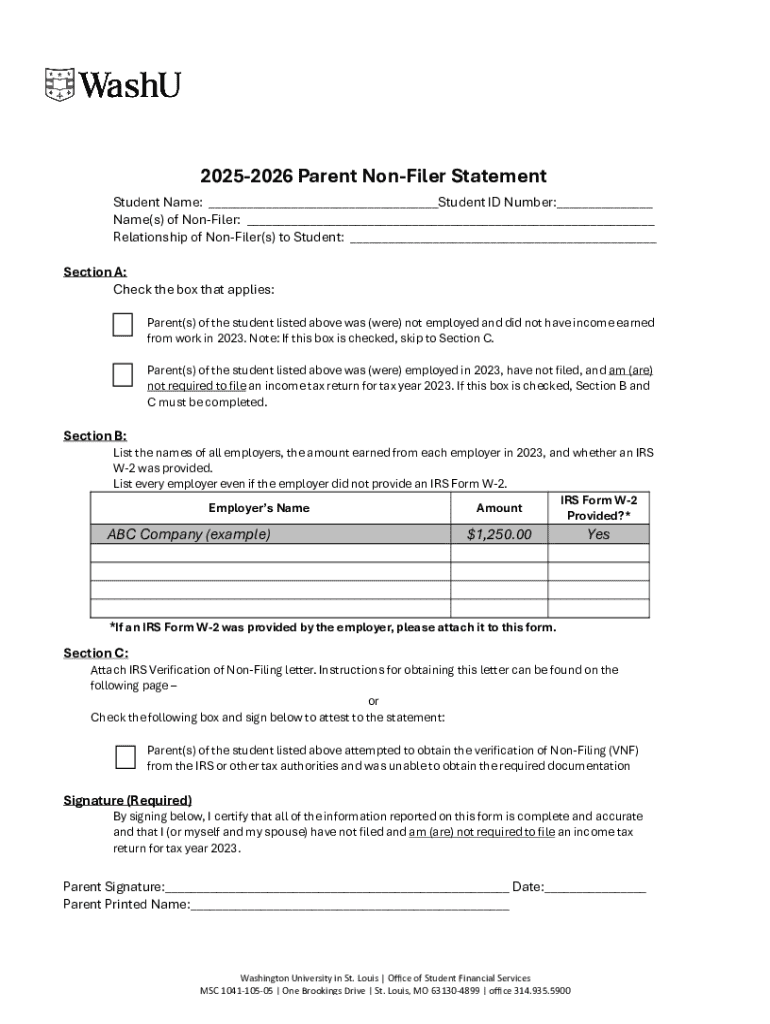

Overview of the 2 Parent Non-Filer Statement Form

The 2 Parent Non-Filer Statement Form is a critical document for parents who do not need to file a tax return but still must provide information for financial aid purposes. This form helps educational institutions assess a student's financial need without traditional tax documentation. It serves as an official account of non-filing status, ensuring transparency concerning financial situations.

Parents who should utilize the 2 Parent Non-Filer Statement Form typically include those with low income, recent graduates, or families facing financial hardships that exempt them from filing. Submitting this form timely is essential, as deadlines may vary by institution but generally align with financial aid applications, often due in early spring.

Understanding non-filing status

Being classified as a non-filer simply means that you are not required to submit a federal tax return due to your income level or other financial factors. This status holds implications for both tax responsibilities and financial aid eligibility. It is crucial for families, especially those with college-bound students, to recognize how their filing status can impact future aid opportunities.

Common reasons parents might not file include earning below the federal minimum income tax threshold, being recently unemployed, or lacking adequate financial documentation. These situations can arise from various circumstances, such as layoffs, illness, or changes in family dynamics. Understanding your specific situation is vital when filling out the 2 Parent Non-Filer Statement Form.

Gathering necessary information

Before diving into the completion of the Parent Non-Filer Statement Form, ensure you have all necessary documents on hand. Required identification details include Social Security numbers and dates of birth for both parents, which are pivotal for accurately filling in the form. This information will safeguard your identity while ensuring the application matches the information on file with the financial aid office.

Income documentation is essential, even if you are not filing taxes. This can include W-2s and 1099 forms reflecting any earnings you may have had. If you do not have these documents readily available, consider asking previous employers for copies or accessing your earnings records through the IRS. Additionally, be prepared to report any other income sources, such as rental income or alimony.

Step-by-step instructions for completing the form

Filling out the 2 Parent Non-Filer Statement Form requires attention to detail, as inaccuracies can lead to delays or complications in the financial aid process. Start with the header information, where you will input both parents' names, addresses, and contact details. Make sure all spelling is correct, as discrepancies can create issues.

Next, clarify your income status. In the income information section, report earnings from any sources accurately, ensuring you also include dependents and relevant financial details. If you have assets or property, document these, as they may influence the financial assessment. The final critical section requires signatures and the date of completion, which confirm the validity of the information provided. Remember, an unsigned or improperly dated form can result in rejection.

Editing and managing your form

With pdfFiller’s powerful editing tools, you can ensure that your 2 Parent Non-Filer Statement Form is polished and error-free before submission. Using these tools, you can easily correct any mistakes and manage your document efficiently. Ensure you review every section carefully; missing or incorrect information could delay your financial aid application.

Once you are satisfied with the content, saving and downloading your completed form securely is crucial. pdfFiller allows users to export documents directly to your preferred file format, ensuring compatibility with your submission method. If you're sending your form electronically, double-check the version you're submitting matches the latest updates from your institution.

Submitting your non-filer statement

Submitting the 2 Parent Non-Filer Statement Form can be done through various methods, including online submissions via your institution's financial aid portal or traditional paper submissions through the mail. When choosing your method, consider which option is most convenient and secure.

After submission, follow up to check the status of your form. Most institutions provide a method for tracking your financial aid documents. If there are any issues with your submission, such as missing information or discrepancies, it's crucial to respond promptly and provide any additional details requested by the financial aid office.

Follow-up actions and assistance

If your 2 Parent Non-Filer Statement Form is rejected or requires additional information, it’s essential to act quickly. Most institutions will provide a reason for rejection or highlight missing information. Address these concerns by providing the necessary documentation or clarifications promptly.

Should you find yourself needing help with the form, numerous resources are available. Educational institutions have dedicated financial aid offices that can assist with questions. Additionally, consult online resources or community groups for peer advice. Reporting common pitfalls in submissions, like incomplete information or missed deadlines, can also help guide you successfully.

Resources for families and students

After submitting the Parent Non-Filer Statement, understanding the verification processes that may follow is important. Institutions can request additional documentation or clarification to verify information reported. Ensure to keep records of all communications and submissions and know where to find assistance as necessary.

Parents and students can also benefit from FAQs available on financial aid websites for common questions about the non-filer process and student financial aid. Familiarity with these resources will ease the navigation of the financial aid landscape, and empower families to manage their financial support effectively.

Additional considerations

Completing the 2 Parent Non-Filer Statement Form correctly can directly impact financial aid eligibility for your child. Providing accurate information is essential to avoid repercussions that may affect future opportunities for educational support. Families experiencing special circumstances, such as divorce or unemployment, should ensure this information is documented in their submissions.

Moreover, understanding how your specific non-filing status may influence broader financial aid considerations is crucial. For instance, if your child is dependent on your income, proper documentation can ensure they receive the maximum possible aid based on their and your financial situation.

Leveraging pdfFiller for document security and management

When it comes to managing sensitive documents like the 2 Parent Non-Filer Statement Form, pdfFiller provides robust security features to ensure your information remains protected. Utilizing cloud-based solutions means that you can access your documents anywhere while maintaining strict security protocols to guard against unauthorized access.

Additionally, pdfFiller offers collaboration features where parents and students can work together seamlessly on documents. This collaboration ensures that errors are minimized and everyone is informed throughout the process, making the completion of necessary forms smoother and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2025-2026 parent non-filer statement from Google Drive?

How do I complete 2025-2026 parent non-filer statement on an iOS device?

How do I fill out 2025-2026 parent non-filer statement on an Android device?

What is 2026 parent non-filer statement?

Who is required to file 2026 parent non-filer statement?

How to fill out 2026 parent non-filer statement?

What is the purpose of 2026 parent non-filer statement?

What information must be reported on 2026 parent non-filer statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.