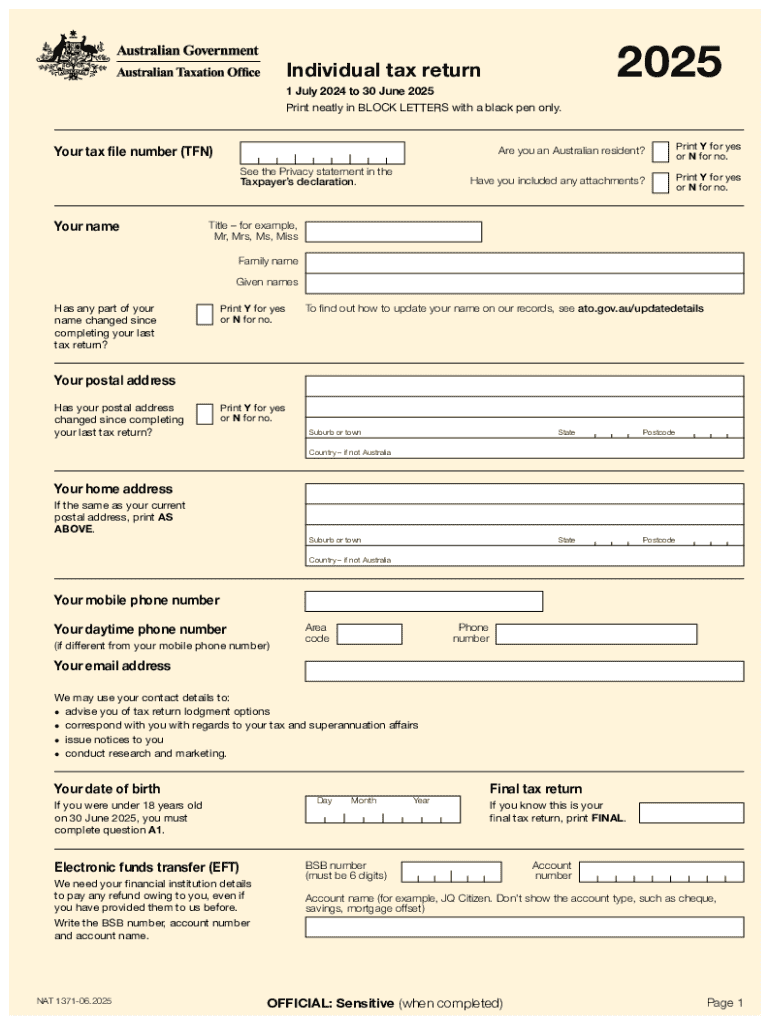

Get the free Individual Tax Return

Get, Create, Make and Sign individual tax return

Editing individual tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual tax return

How to fill out individual tax return

Who needs individual tax return?

Individual Tax Return Form - How-to Guide

Understanding the individual tax return form

The individual tax return form is a crucial document for financial management in the United States. It allows taxpayers to report their income, claim deductions and credits, and ultimately determine their tax obligations. Filing an accurate and timely tax return can affect everything from eligibility for loans to retirement planning. Hence, understanding the form is essential.

Key components of the individual tax return form often include personal information, income sources like wages or dividends, adjustments to income, and details regarding deductions and credits. Familiarizing yourself with each section not only clarifies the filing process but ensures that you maximize your potential refunds.

Eligibility criteria can vary but generally include criteria such as income thresholds, marital status, and whether you are claimed as a dependent by someone else. For instance, single filers must meet certain income levels before being required to file a return.

Pre-filing preparations

Preparing for tax season begins months in advance. Organizing your finances and gathering necessary documents early can significantly streamline the filing process. Here are some critical items to gather before you begin your individual tax return:

Choosing the right method for filing is equally crucial. You have several options: eFiling through platforms like pdfFiller, traditional paper filing, or hiring a tax professional. Each has its pros and cons, but many find that eFiling provides a quicker, more efficient experience.

Step-by-step guide to completing your individual tax return

Filling out your individual tax return can be daunting, but breaking it down step-by-step helps simplify the process. Start by selecting the appropriate form—typically Form 1040 for most individuals. Begin at the top and move through each section methodically.

A common mistake to avoid is rushing through the personal information section. Double-check your name and Social Security Number; a small typo can lead to big problems. Next, accurately report your income sources, and make sure to include all forms of income, whether it's self-employment earnings or investments.

Using pdfFiller’s tools significantly enhances your filing experience. The editing features make it easy to adjust entries, eSigning capabilities allow for quick submission, and the collaboration tools let you consult with tax advisors effectively.

Additional considerations while filing

When filing your individual tax return, understanding deductions and credits plays a vital role in maximizing your return. Several common deductions are available, such as those for student loan interest, mortgage interest, or unreimbursed medical expenses.

On the credit side, taxpayers can often qualify for credits like the Earned Income Tax Credit (EITC) or Child Tax Credit, which can greatly reduce their tax liabilities. Accurately calculating these requires attention to detail but can also significantly impact your refund amount—especially when using pdfFiller's interactive tools.

Remember that state-specific considerations can affect your filing. State tax laws can differ widely; for example, some states have no income tax while others may have complex rules regarding deductions. Using pdfFiller not only aids in federal filings but also helps locate and fill out necessary state-specific forms.

After submission: What happens next?

After you've clicked 'submit', monitoring the status of your tax return becomes a priority. You can track your return's progress using pdfFiller, which offers features that notify you regarding your filing and any updates from the IRS. It's crucial to keep an eye on your refund status, especially if you're expecting a significant return.

If the IRS contacts you regarding inquiries or audits, it's essential to respond promptly. Slow responses can lead to adverse implications. Keep organized documentation, as being prepared can ease fears associated with audits. pdfFiller’s document management features allow you to store all correspondence securely.

Managing responsibilities post-filing

After the frantic pace of tax season, how you manage your documents moving forward is vital. Best practices dictate that you store your tax documents safely. Using cloud-based services like pdfFiller not only organizes your documents but also allows easy access from anywhere.

Planning for the next tax year should also begin as soon as your current return is filed. Consider strategies for improving your filing experience next year, including maintaining accurate financial records and reviewing tax law changes that might affect you. Keeping organized records can lead to smoother filing when tax season rolls around again.

Frequently asked questions (FAQs) about individual tax returns

Filing taxes brings many queries, especially for those who may be new to the process. Here are some frequently asked questions regarding individual tax returns:

Navigating special situations

For individuals who are self-employed or freelancers, filing your individual tax return can involve additional forms, such as Schedule C for profit or loss from business. This form allows you to detail your income and expenses effectively, ensuring you claim every eligible deduction.

When it comes to partnerships and joint filings, there are specific rules and implications to consider. Filing jointly can yield beneficial tax rates, but you must also be aware that both partners are responsible for tax liabilities. Understanding the difference between filing jointly and separately can save you money, depending on your individual financial circumstances.

Leveraging pdfFiller for a streamlined tax return experience

Using pdfFiller for your individual tax return offers numerous benefits. Having a cloud-based platform means you can access your forms anytime and anywhere, providing flexibility during the busy tax season. Moreover, pdfFiller integrates with various other financial tools, streamlining the overall process.

Many users have shared their testimonials about how pdfFiller has revolutionized their tax filing experience. With easy editing, secure signing, and convenient collaboration options, the platform has made what once seemed like a daunting task a straightforward process for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my individual tax return in Gmail?

How do I edit individual tax return on an iOS device?

How do I fill out individual tax return on an Android device?

What is individual tax return?

Who is required to file individual tax return?

How to fill out individual tax return?

What is the purpose of individual tax return?

What information must be reported on individual tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.