Get the free Superannuation Contributions Splitting Application Form

Get, Create, Make and Sign superannuation contributions splitting application

Editing superannuation contributions splitting application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out superannuation contributions splitting application

How to fill out superannuation contributions splitting application

Who needs superannuation contributions splitting application?

Superannuation Contributions Splitting Application Form: A Comprehensive Guide

Understanding superannuation contributions splitting

Superannuation contributions refer to the payments made into a superannuation fund to build retirement savings. Contributions can be made by employers, employees, or even by the self-employed. Contributions splitting allows one partner to transfer a portion of their superannuation contributions to their spouse’s super account. This can be advantageous as it helps couples manage their super balances more equitably.

The primary purpose of contributions splitting is to foster a collaborative approach to retirement planning. By splitting contributions, both partners can work toward equal superannuation balances, which is particularly beneficial for couples where one partner may have a significantly lower super balance due to varying income levels or time spent out of the workforce.

Who can benefit from contributions splitting?

Not everyone is eligible for contributions splitting. Generally, couples who are legally married or in a recognized de facto relationship can benefit from this mechanism. Age also plays a role, as only those who are under age 65 at the time of the application can split contributions.

In addition to age restrictions, employment status may impact eligibility. For instance, both partners should ideally have an active superannuation fund, and the spouse receiving the split must not be receiving a pension from their super fund. It's important for couples to understand these requirements before proceeding.

Additionally, not all superannuation funds are eligible for contributions splitting. It’s essential to check with your super fund about their policies and whether they allow contributions splitting. Funds such as industry or retail super funds often have specific guidelines that need to be followed.

The contributions splitting process

Successfully splitting contributions involves a structured process. Here is a step-by-step guide to navigate the contributions splitting efficiently.

Online submissions are generally faster and more efficient than paper submissions. Most superannuation funds provide an online platform for application submissions, which reduces the chances of delays or lost paperwork. After submitting your application, it's crucial to allow some time for processing; typically, this can range from a few weeks to a couple of months.

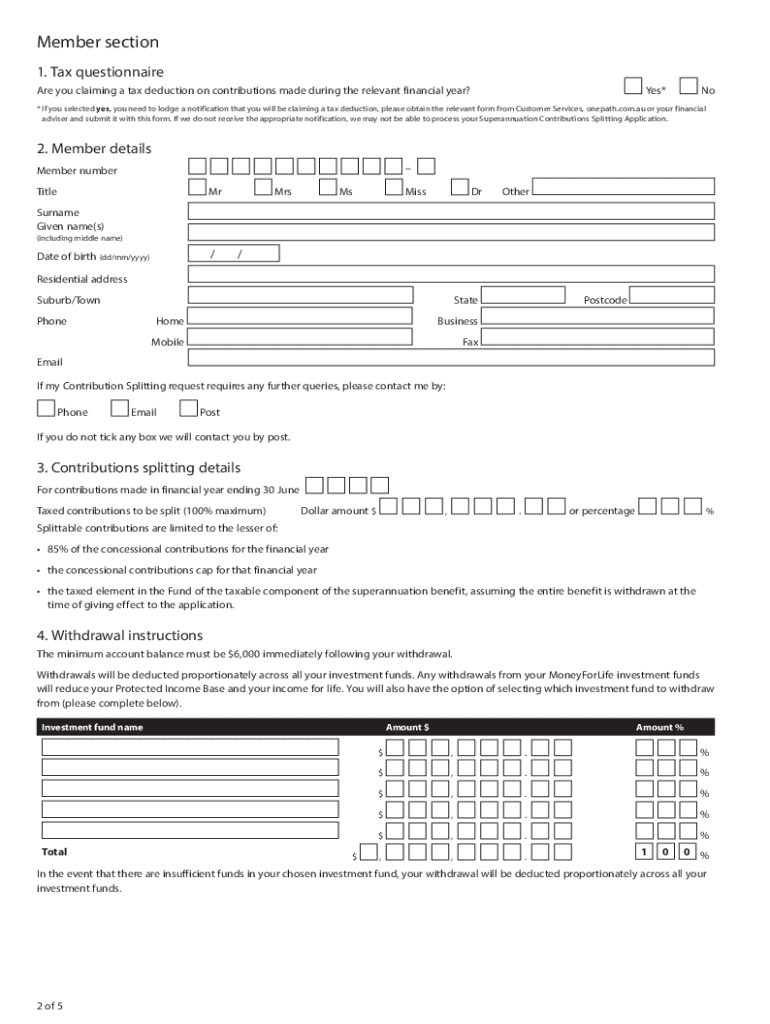

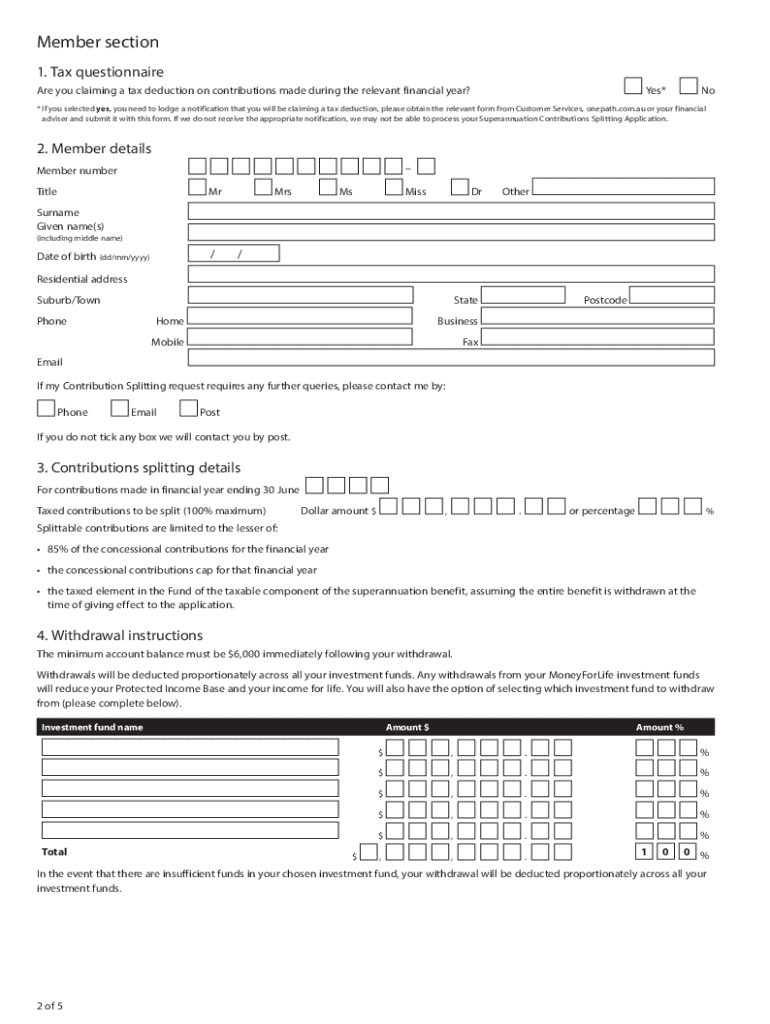

Completing the superannuation contributions splitting application form

Filling out the superannuation contributions splitting application form is a straightforward process when you know what to look for. The form is generally divided into several key sections to ensure all necessary information is captured.

While filling out the form, it’s crucial to be thorough and accurate. Common mistakes include providing inaccurate super fund details or missing required signatures. Double-checking before submission can save you time and frustration down the line.

Tools and resources for managing your superannuation

For individuals looking to simplify their documentation process, various tools are available that streamline the management of superannuation contributions, particularly contributions splitting. One such platform is pdfFiller, which provides an array of interactive tools designed to facilitate document management.

pdfFiller offers fillable templates specifically for contributions splitting, ensuring that users can easily create and customize their forms without hassle. Additionally, its eSigning features allow for secure submission of the completed documents, reducing the need for physical paperwork.

Frequently asked questions (FAQs)

As the process of contributions splitting might raise several queries, addressing some of the frequently asked questions can help clarify uncertainties for potential applicants.

Real-life scenarios and testimonials

Understanding the real impact of contributions splitting can be illustrated through various cases. For instance, couples in which one partner took time off work for childcare found contributions splitting an invaluable tool in equalizing their retirement savings. By transferring contributions, they effectively managed their superannuation profiles and ensured a more balanced future.

Personal testimonials from users of pdfFiller reiterate the importance of easily accessible tools for managing this aspect of their finances. Many emphasize how using platforms that allow for seamless document management made the contributions splitting process significantly less stressful. Having access to expert opinions also outfitted partners with crucial knowledge on preparing for retirement.

Next steps after submitting your application

Once your contributions splitting application has been successfully submitted, monitoring the application status becomes crucial. Staying informed about the progress can help alleviate any concerns regarding your superannuation adjustments.

If your application is denied or further information is requested, be prepared to act swiftly. Gathering any additional evidence or revisiting the form to correct inaccuracies can expedite the process. Understanding your updated superannuation balance is essential, as it directly impacts your retirement planning.

Final thoughts on superannuation contributions splitting

Contributions splitting not only fosters collaboration between partners, but it also encourages a proactive approach to managing retirement finances. By understanding the intricacies of the superannuation contributions splitting application form and how to navigate the process, couples can work toward more balanced retirement outcomes.

Ongoing management of superannuation and frequent reviews of contributions are vital in ensuring both partners are on track for their future. Engaging with tools like pdfFiller can further streamline this journey, empowering individuals and teams to take charge of their retirement planning effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit superannuation contributions splitting application from Google Drive?

Can I sign the superannuation contributions splitting application electronically in Chrome?

How can I edit superannuation contributions splitting application on a smartphone?

What is superannuation contributions splitting application?

Who is required to file superannuation contributions splitting application?

How to fill out superannuation contributions splitting application?

What is the purpose of superannuation contributions splitting application?

What information must be reported on superannuation contributions splitting application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.