Get the free Perpetual Wealthfocus Super Plan

Get, Create, Make and Sign perpetual wealthfocus super plan

Editing perpetual wealthfocus super plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out perpetual wealthfocus super plan

How to fill out perpetual wealthfocus super plan

Who needs perpetual wealthfocus super plan?

Perpetual Wealthfocus Super Plan Form: A Comprehensive Guide

Understanding the perpetual wealthfocus super plan

The Perpetual Wealthfocus Super Plan is designed to be a robust superannuation fund that helps Australians save effectively for retirement. Superannuation, often referred to as super, acts as a retirement savings vehicle that accumulates funds over time, geared towards ensuring individuals have sufficient financial resources after they cease to work.

Understanding superannuation is crucial, as it forms the backbone of most Australians’ retirement planning strategies. By consistently contributing to a super fund, individuals can benefit from tax advantages, access to a wider range of investment options, and exert some control over their retirement savings.

Key features of the perpetual wealthfocus super plan

The Perpetual Wealthfocus Super Plan stands out due to its several key features aimed at providing a personalized retirement fund. Some highlights include:

Step-by-step guide to accessing and filling out the form

To access the Perpetual Wealthfocus Super Plan Form, it’s essential to know where to find it and how best to fill it out. Ensuring you have the form at your fingertips sets the stage for a smooth experience.

Accessing the perpetual wealthfocus super plan form

You can easily find the Perpetual Wealthfocus Super Plan form online at pdfFiller. The platform allows users to interact with PDF files efficiently, streamlining the form-filling process through its user-friendly interface. Here’s how to access it:

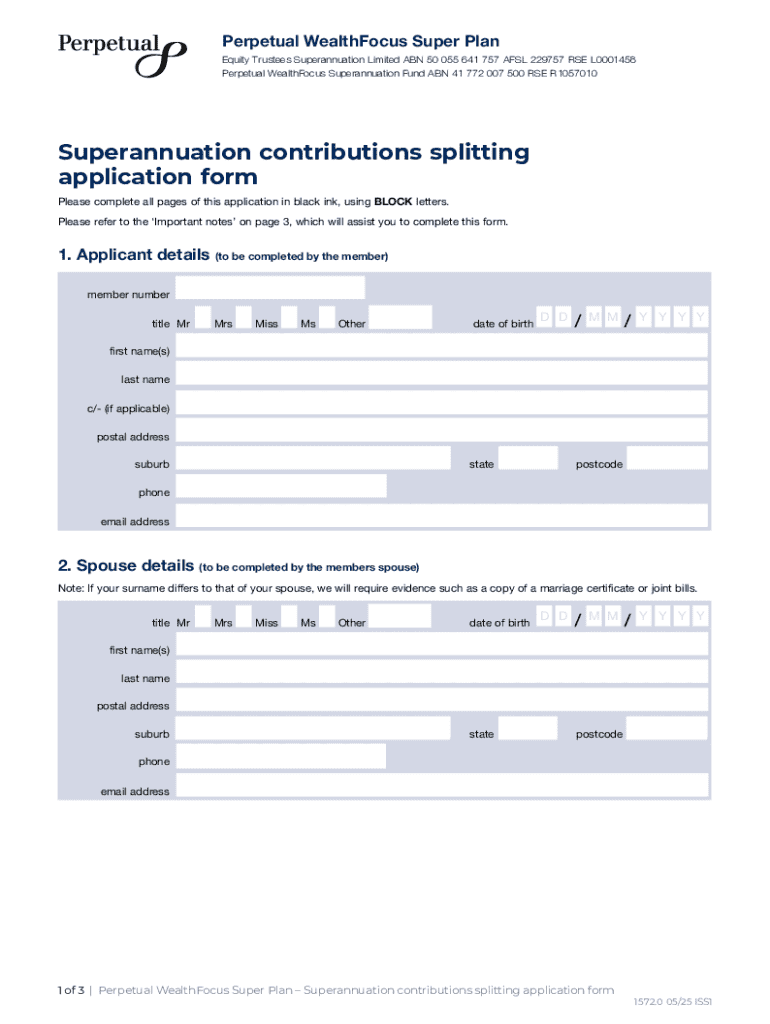

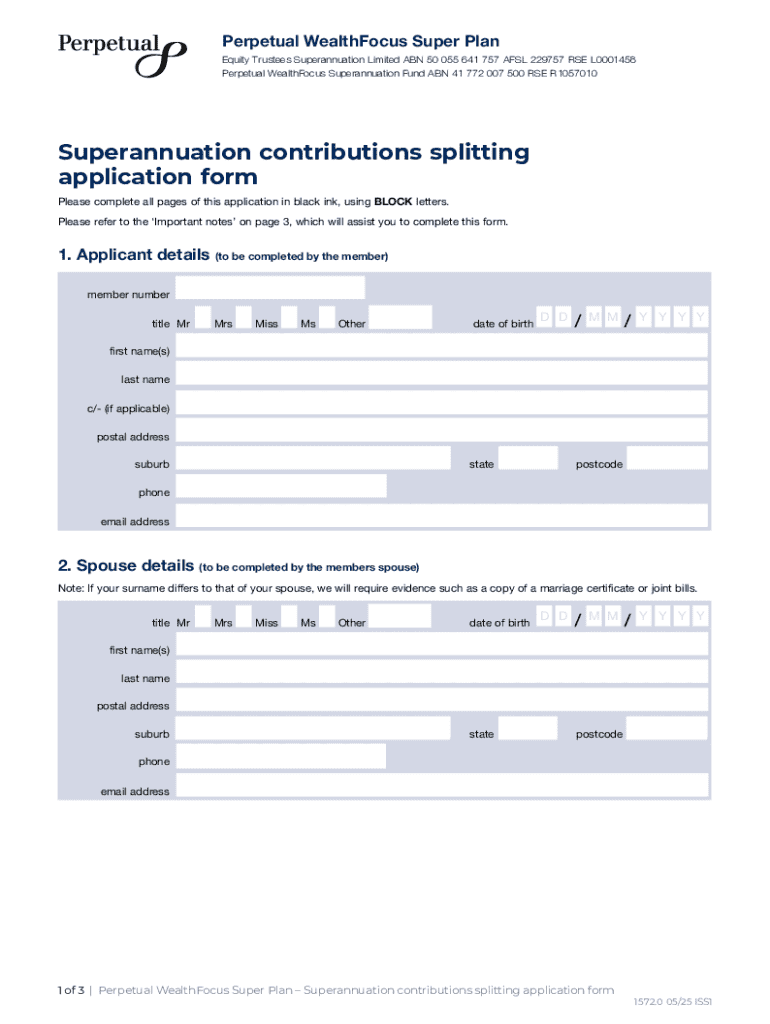

Filling out the form: A detailed breakdown

Filling out the Perpetual Wealthfocus Super Plan Form requires attention to detail. Let’s take a closer look at each section of the form:

Editing and reviewing your form

After filling out the Perpetual Wealthfocus Super Plan Form, reviewing and ensuring that all provided details are accurate is paramount to preventing potential delays in processing.

Using pdfFiller’s editing tools

pdfFiller provides an array of editing tools to enhance your form completion process. Here’s how you can make the most of these features:

Collaborative review options

For those who may want a second opinion before submitting their forms, pdfFiller allows you to invite others to review your documents. This feature promotes collaborative efforts, allowing family members or financial advisors to provide feedback and ensure that everything is in order.

Signing the perpetual wealthfocus super plan form

Once your form is complete and reviewed, the next step is to sign it, which legally binds the information you have provided.

eSigning overview

Electronic signatures (eSignatures) are legally valid in Australia, making it an efficient way to sign documents without the need for printing. Here’s how to apply an eSignature:

Alternatives for signing

If you prefer a more traditional approach, you have the option to print out your completed form, sign it manually, and then submit it according to the provided guidelines.

Managing your super account post-submission

After submitting your Perpetual Wealthfocus Super Plan Form, managing your superannuation account effectively becomes essential to ensuring your long-term financial health.

Tracking your submission status

Staying informed about your application status can mitigate any uncertainties. You can check the progress of your submission via the pdfFiller platform or by contacting support directly.

Making changes after submission

Life circumstances often change, which may require amendments to your superannuation details. Ensure to keep your information up to date—consult the guidelines on the pdfFiller website for instructions on how to make amendments post-submission.

Frequently asked questions (FAQs)

Navigating the Perpetual Wealthfocus Super Plan Form can raise various questions. Here’s a look at common queries.

Common issues encountered with the form

Some users experience challenges when filling out forms. Issues may include:

Additional support options

If you encounter persistent problems, contacting customer service for assistance will ensure you receive the help you need. pdfFiller offers various support channels, including chat support and dedicated email assistance.

Benefits of using pdfFiller for document management

With numerous document management solutions available, pdfFiller stands out as an all-in-one platform offering unique features tailored for users engaged in form management.

All-in-one solution for your document needs

pdfFiller integrates seamlessly with editing, signing, and storing PDF documents, making it easier for users to handle everything in one place. You can create, edit, and share documents efficiently, ensuring all aspects of your forms are covered.

Accessibility and convenience for users

As a cloud-based solution, pdfFiller allows you to access your documents from anywhere, at any time, on any device. This flexibility is key for individuals and teams looking to manage their documents on the go.

Next steps after completing the form

Completing the Perpetual Wealthfocus Super Plan Form is just the beginning of your financial journey towards retirement.

Planning for your superannuation future

Following the submission of your super plan, it's important to engage with your financial future actively. Monitor your account regularly, make adjustments as needed, and seek financial advice when necessary to ensure that your retirement savings are on target.

Continuous learning about financial management

Expanding your knowledge regarding financial planning can significantly enhance your investment strategy and retirement outlook. Take advantage of online resources, webinars, and personal finance courses to stay informed and empower your decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send perpetual wealthfocus super plan to be eSigned by others?

How do I execute perpetual wealthfocus super plan online?

Can I sign the perpetual wealthfocus super plan electronically in Chrome?

What is perpetual wealthfocus super plan?

Who is required to file perpetual wealthfocus super plan?

How to fill out perpetual wealthfocus super plan?

What is the purpose of perpetual wealthfocus super plan?

What information must be reported on perpetual wealthfocus super plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.