Get the free Understanding Your Bill

Get, Create, Make and Sign understanding your bill

How to edit understanding your bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding your bill

How to fill out understanding your bill

Who needs understanding your bill?

Understanding Your Bill Form

Overview of the understanding your bill form

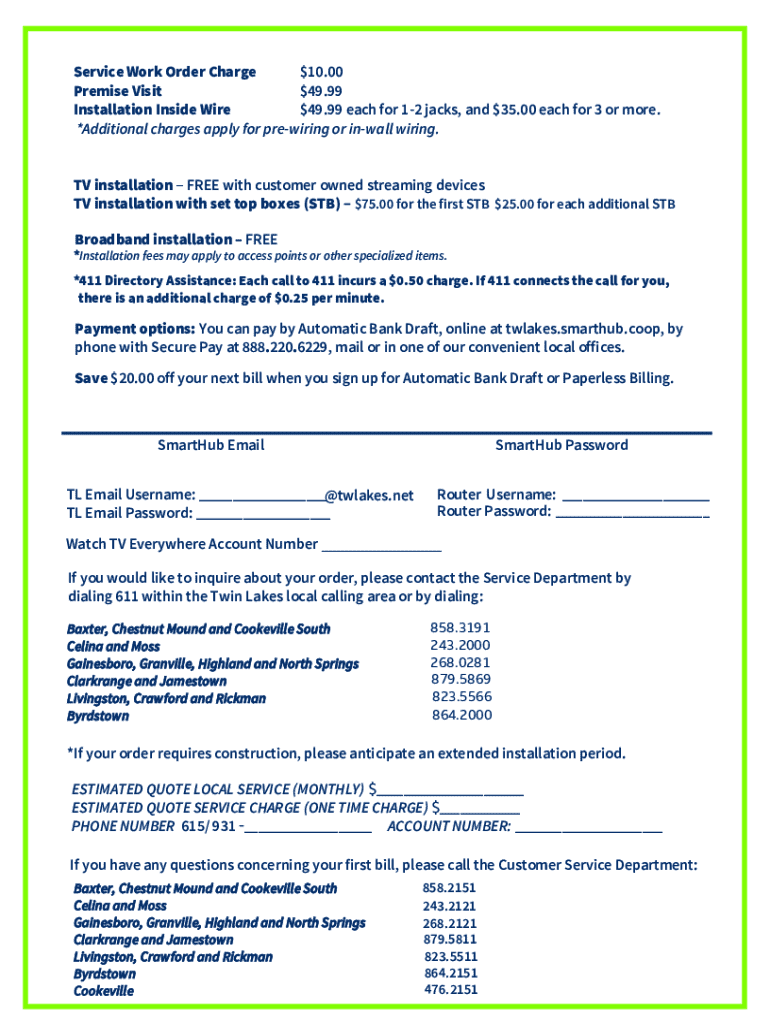

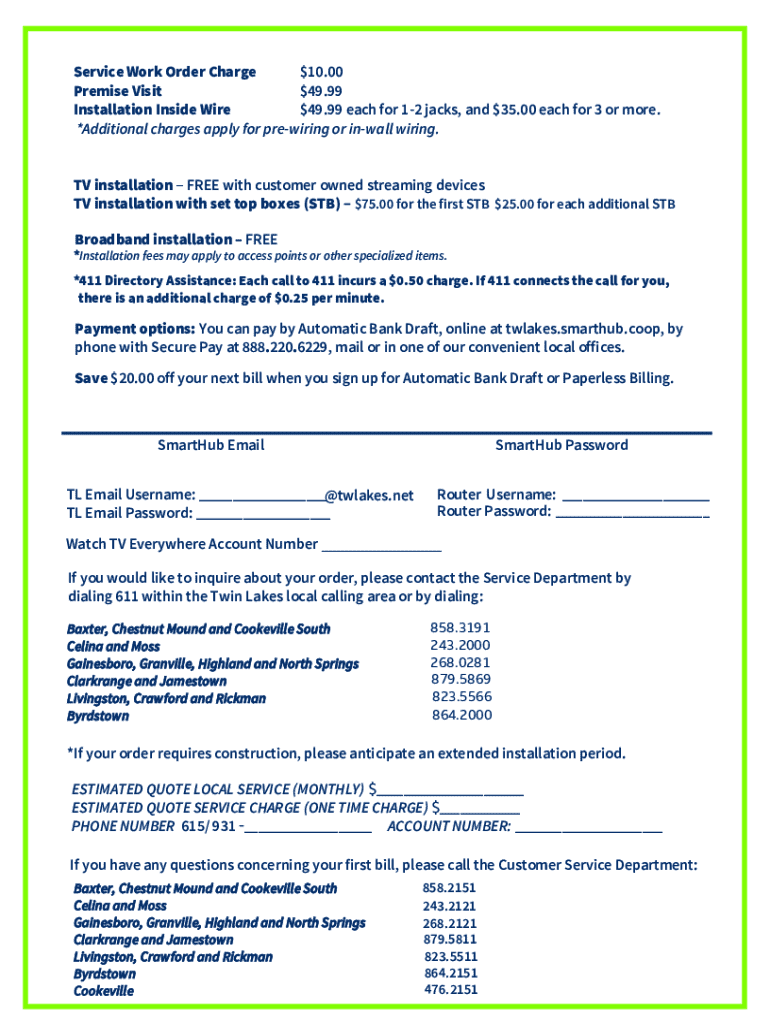

Billing documents, often seen as mere routine paperwork, play a crucial role in personal finance management. The main purpose of a bill form is to provide a detailed breakdown of charges incurred during a specified billing cycle. A clear and concise bill form allows consumers to understand their expenses, monitor their usage, and maintain control over their financial obligations. The importance of clarity in these documents cannot be overstated, as it reduces confusion, enhances compliance, and fosters transparency between providers and consumers.

Key features that enhance understanding include itemized charges, usage information, and payment history. With clear billing formats, consumers can easily assess discrepancies, budget for upcoming expenses, and make informed decisions about their financial habits. When billed correctly, these documents empower users, enabling them to manage their resources effectively. Recognizing and understanding your bill form is foundational for anyone looking to engage with their financial world more intelligently.

Navigating the bill form

Navigating a bill form may seem daunting at first, but it becomes more straightforward when broken down into key sections. Start with the header information, where you will find the name of the service provider, account number, and any relevant contact information. Monitoring these details ensures you address any specific inquiries promptly.

Understanding these sections is vital. The account details section usually contains personal information that must be accurate for billing purposes. Knowing the billing cycle dates helps anticipate when a bill will arrive, while the clear due date emphasizes the importance of making payments on time to avoid penalties.

Breakdown of key sections

Once you've familiarized yourself with the layout of your bill, dive into the detailed breakdown of key sections. The summary of charges typically features both base service charges and any additional usage charges that may apply. It’s essential to understand these components to grasp how much you're paying for your service.

The detailed charges overview section categorizes charges further into fixed and variable charges, making it easier to understand where your money is going. Additionally, be aware of any taxes and fees included, which can vary by jurisdiction, impacting your total amount due.

Don’t overlook the payment history section; it’s crucial for recognizing past payments you've made and how any outstanding balances affect your current bill. This insight helps you manage future payments more effectively.

Managing your bill and usage

Effective bill management requires proactive tracking of your monthly usage. Start by reviewing past bills to identify patterns in your consumption. Utilizing tools—such as budgeting apps—can aid in estimating future bills based on historical data, allowing for better financial planning.

Setting a budget based on your average monthly usage can prevent unexpected expenses. Consider incorporating a buffer for price fluctuations, particularly during seasonal changes in utility bills or service rates. By establishing a system that monitors your usage and incoming bills, you’ll be in a position to adjust your habits proactively, ultimately leading to savings.

Interactive tools for understanding your bill

Leveraging interactive tools can simplify the comprehension of your bill form. Online calculators allow users to estimate charges based on input variables, helping you visualize potential costs before they appear on your bill. This foresight enables better financial planning and can reduce anxiety about unexpected expenses.

Another valuable resource is accessing past bill archives through your service provider’s portal. These archives help users track their cost trends over time. Features that simplify bill comprehension may also include interactive breakdowns of charges and transparent descriptions of fees, further enhancing your understanding and management of your bill.

Common billing questions addressed

It's common for consumers to have questions regarding their bills. For instance, why might my bill be higher than expected? Often, unexpected increases come from higher usage, seasonal adjustments, or newly added charges. To mitigate this concern, review your usage patterns and compare them with previous periods.

Understanding each component of your bill is essential. This includes recognizing the difference between estimated and actual billing. An estimated bill is based on previous consumption patterns, while an actual bill reflects your accurate usage. Being aware of these differences helps prevent confusion when reviewing your charges.

Making payments

Once you understand your bill form, it’s essential to know your options for making payments. Many service providers now offer multiple online payment platforms, including websites and mobile apps for increased flexibility. Take advantage of these modern payment methods to avoid missing due dates.

Establishing a payment plan can help if you encounter financial difficulties. Many providers may offer flexible solutions to assist customers in managing their obligations.

Additional support and resources

For consumers needing further assistance with billing inquiries, reaching out to customer service is a reliable option. Most providers offer support through various channels, including chatbots, phone lines, and email. Familiarize yourself with these contact methods to get timely help.

Additionally, FAQs regarding billing disputes are often available on service provider websites. Leverage educational webinars and tutorials offered to gain a clearer understanding of managing bills more effectively. Such resources empower consumers, equipping them with knowledge to navigate their financial responsibilities.

Understanding your rights as a consumer

As a consumer, it’s essential to be aware of your rights concerning billing practices. Understand that providers must adhere to specific regulations regarding accuracy, transparency, and consumer protection. This insight empowers you to advocate for yourself and ensure fair treatment.

In the unfortunate event of a billing error or fraud, numerous resources are available for reporting such incidents. Contact local consumer protection agencies, and familiarize yourself with your rights as outlined in consumer advocacy literature. Knowing your rights not only protects you but also builds a foundation for more equitable billing practices in the industry.

Encouraging energy efficiency to lower costs

One way to manage bills more effectively is by encouraging energy efficiency in your home. Simple adjustments in usage can lead to significant cost reductions. For example, consider using energy-efficient appliances or implementing smart thermostats to minimize excessive energy consumption.

Service providers may offer programs for energy audits or efficiency upgrades, providing incentives for customers to reduce overall costs. Utilize your bill form to track performance impacts when you make changes in your habits. This proactive approach helps you maintain lower bills while creating a more sustainable living environment.

Frequently encountered scenarios

Navigating fluctuating bills is a challenge many consumers face. Variables such as seasonal changes, usage spikes, and rate adjustments can influence your total due. If you experience sudden changes in your bill, compare it against your historical data to identify patterns. Such awareness allows for better management strategies.

Remember, addressing these issues promptly mitigates potential penalties and service interruptions.

Staying informed

Keeping your contact information up-to-date with your service provider is critical to receiving timely notifications about changes to service, tariff adjustments, and important communications. Many providers now utilize various channels, including emails and texts, to enhance communication.

Stay informed about budgeting assistance opportunities within your community. Many local non-profits and organizations offer resources designed to help residents manage their finances more effectively. Always take advantage of these resources to bolster your financial literacy and adapt your budgeting strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my understanding your bill in Gmail?

How can I edit understanding your bill from Google Drive?

Can I edit understanding your bill on an iOS device?

What is understanding your bill?

Who is required to file understanding your bill?

How to fill out understanding your bill?

What is the purpose of understanding your bill?

What information must be reported on understanding your bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.