Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Form ADV: A Comprehensive Guide

Understanding Form ADV

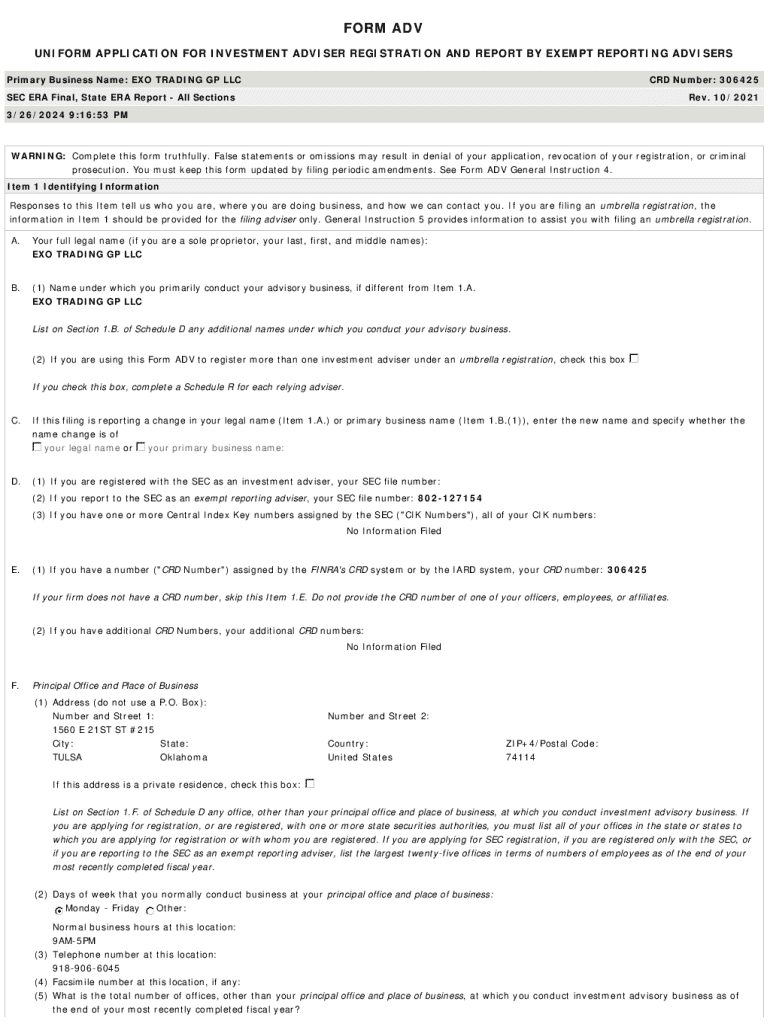

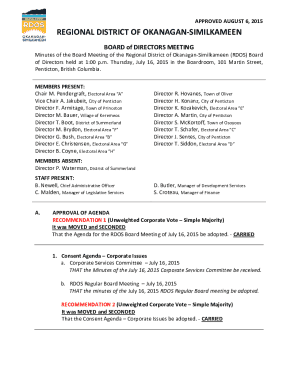

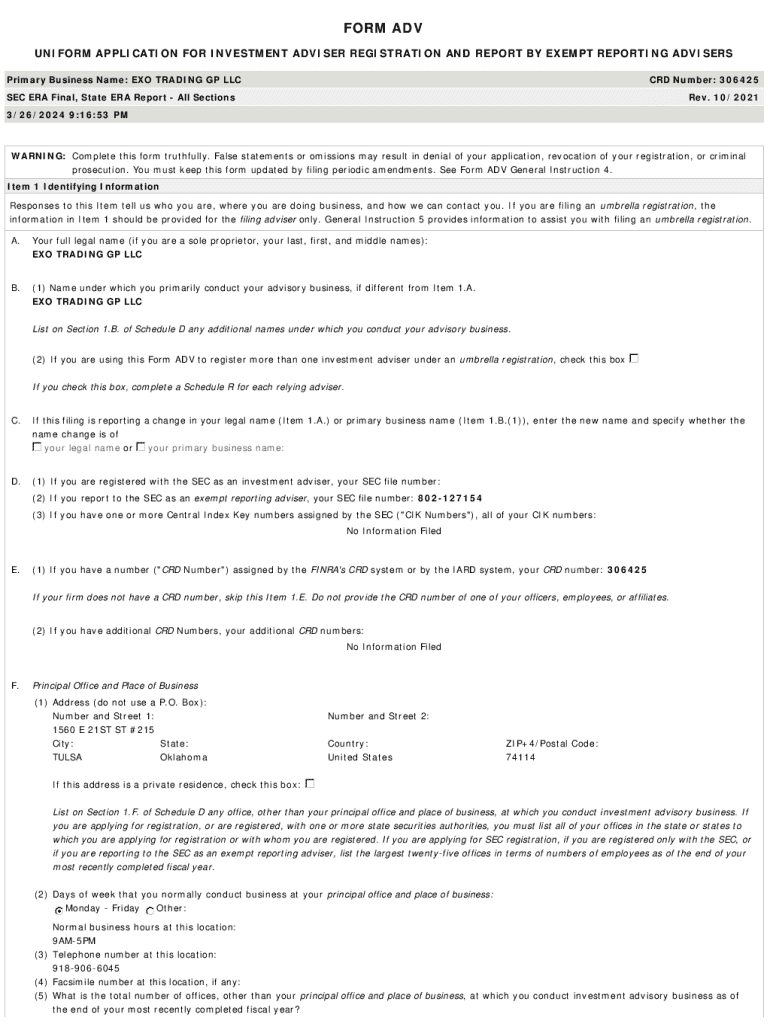

Form ADV is a crucial document in the financial industry that serves as the primary registration form for investment advisors. Its purpose is to provide essential information about the advisor's business, services, and compliance history, ensuring that potential clients can make informed decisions. There are two main components of Form ADV: Part 1, which elicits basic information about the advisory firm, and Part 2, which consists of narrative brochures detailing the advisor's services, fees, and conflicts of interest.

For investment advisors, the importance of Form ADV cannot be overstated. It is a regulatory requirement enforced by the Securities and Exchange Commission (SEC) and state regulators. The form facilitates transparency and promotes investor protection by ensuring that advisory firms disclose their practices, thereby helping clients understand the services they are considering.

Who needs to file Form ADV?

Eligibility to file Form ADV is primarily determined by whether an individual or firm meets the SEC's definition of an investment advisor. This includes entities that receive compensation for providing advice about securities. Generally, both individual advisors and firms that manage over $100 million in assets must file Form ADV.

However, there are exemptions to consider. Advisors managing less than $25 million generally need to register with the state instead of the SEC, while there are other exemptions based on the nature of advisory services, such as certain private fund advisors or those providing advice only to family members.

Preparing to complete Form ADV

Before attempting to fill out Form ADV, it's essential to gather the necessary documentation. Advisors need to compile a range of information, including their business structure, ownership details, financial statements, and any regulatory history. This preparatory stage is critical as inaccurate or incomplete information can lead to delays in the filing process.

Common challenges that arise during this stage often include difficulty in compiling financial reports or ensuring that all owners are accurately represented. Advanced planning can mitigate these obstacles. Having easy access to corporate records and maintaining updated financial statements are practical steps to ensure a seamless completion process.

Step-by-step guide to filling out Form ADV

To successfully complete Form ADV, advisors can follow these structured steps:

Tips for effective completion and submission

To avoid common pitfalls while completing Form ADV, attention to detail is paramount. Advisors should double-check all information for accuracy, as mistakes can lead to rejections or delays in approval. It's also helpful to ensure that all language is clear, avoiding jargon that may confuse readers.

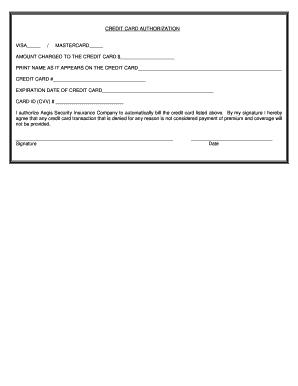

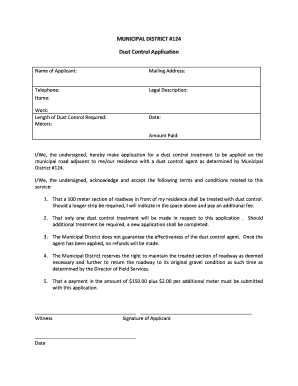

Utilizing digital tools like pdfFiller can further streamline the filling process. pdfFiller offers features that allow users to fill, edit, and e-sign forms seamlessly. This platform makes it easy to share documents for collaboration, enhancing efficiency in the submission process and ensuring compliance with regulatory requirements.

After submission: What to expect

Once Form ADV is submitted, the review process will commence. Regulators typically assess filings to ensure compliance within a given timeframe. Advisors should be prepared for inquiries or requests for additional information during this stage.

It's vital to keep your Form ADV updated. Amendments are necessary whenever significant changes occur, such as changes in business structure, ownership, or regulatory history. The implications of non-compliance can be severe, including potential penalties or revocation of advisory registration.

FAQs about Form ADV

Interactive tools for managing Form ADV

pdfFiller provides a suite of interactive features that simplify the management of Form ADV. Users can quickly edit, sign, and share documents, making collaboration among team members easy. This is particularly useful for firms with multiple stakeholders involved in the process.

In addition to filling out forms, pdfFiller offers a centralized resource center for document management. By utilizing tracking features, advisors can monitor submissions, updates, and compliance efforts, ensuring that all necessary documents are current and organized.

Success stories: Empowering advisors with pdfFiller

Advisors have shared impressive outcomes from utilizing pdfFiller for their Form ADV submissions. Many report having streamlined compliance processes, reduced the time spent on documentation by over 50%, and experienced minimal regulatory concerns post-submission.

Testimonials often highlight the ease of use and the significant improvement in efficiency that pdfFiller brings to advisors’ day-to-day operations. Advisors appreciate the peace of mind that comes with knowing their documentation is accurate and professionally presented.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form adv online?

How do I make edits in form adv without leaving Chrome?

How can I edit form adv on a smartphone?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.