Get the free Multiple Trading Account (mta) Application Form

Get, Create, Make and Sign multiple trading account mta

How to edit multiple trading account mta online

Uncompromising security for your PDF editing and eSignature needs

How to fill out multiple trading account mta

How to fill out multiple trading account mta

Who needs multiple trading account mta?

Comprehensive Guide to the Multiple Trading Account (MTA) Form

Understanding multiple trading accounts

Multiple trading accounts, as the name suggests, allow traders to hold more than one trading account across various brokerage platforms. This approach is increasingly popular among both individual investors and trading teams, thanks to the flexibility and control it offers. These accounts can be tailored to different trading strategies, asset classes, or risk profiles, enabling traders to diversify their portfolios effectively.

The benefits of managing multiple trading accounts are numerous. Firstly, they provide greater security by spreading investments across different brokers. Secondly, traders can optimize their strategies by adjusting account settings according to market conditions. Additionally, diverse accounts can assist in applying different trading approaches, such as day trading, swing trading, or long-term investing, simultaneously. This versatility allows for a more comprehensive market engagement.

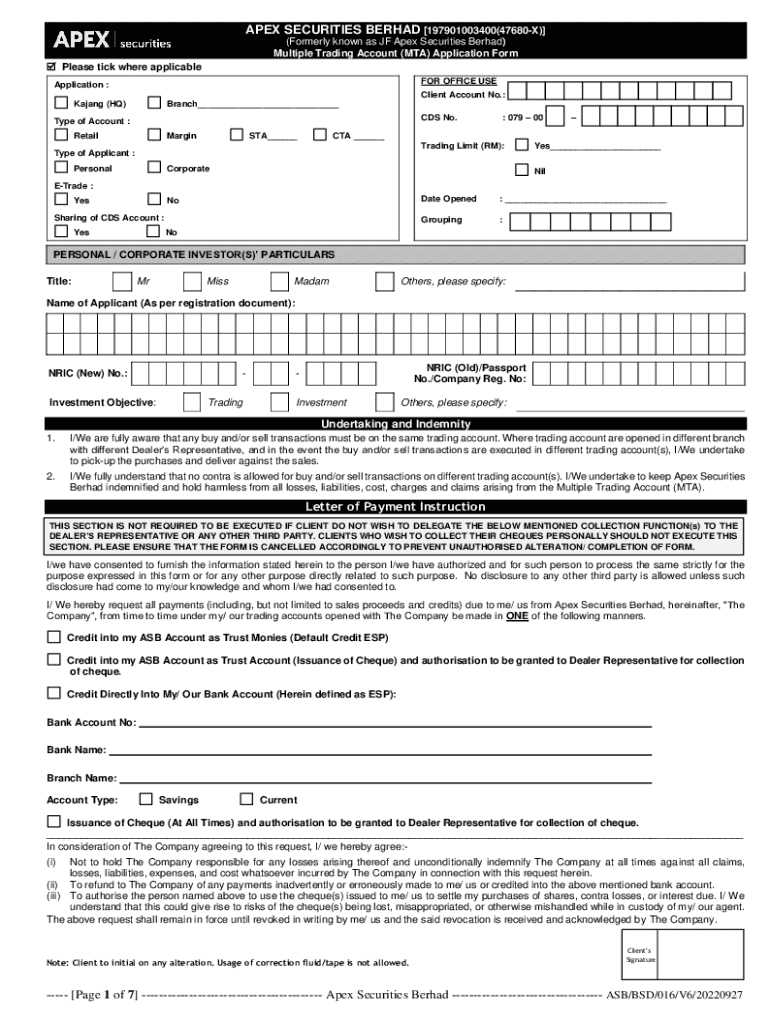

Overview of the MTA form

The Multiple Trading Account (MTA) Form is a crucial document that allows traders to officially declare their intention to manage multiple accounts under a single broker. This form plays a pivotal role in ensuring brokers are aware of all trading activities associated with a client, which facilitates smoother operations and compliance with financial regulations.

Filling out the MTA Form accurately is essential. This form helps to document trading accounts effectively and can provide beneficial insights into a trader's overall portfolio. Key information typically required on the MTA Form includes personal identification details, existing trading account information, and financial objectives that the trader aims to achieve.

Step-by-step instructions to fill out the MTA form

Filling out the MTA Form can seem daunting, but following a structured approach can simplify the process significantly. Below are detailed steps to ensure you complete the form effectively.

Step 1: Gather required information

Before accessing the MTA Form, gather essential information. Personal details like your name, address, and contact information should be readily available. Next, compile your trading account details, such as existing account numbers and names of brokerage firms. Finally, assess your financial information including investment objectives and risk tolerance, which are critical for accurately completing the form.

Step 2: Accessing the MTA form on pdfFiller

The pdfFiller platform offers a user-friendly way to access the MTA Form. Start by navigating to pdfFiller's website. You can access the MTA Form template either from a desktop or mobile device. The platform provides intuitive navigation to simplify the form-filling process.

Step 3: Filling out the MTA form

When filling out the MTA Form, input your personal and trading account information accurately. It’s essential to check for common pitfalls such as spelling errors or incorrect account numbers, as these can lead to complications in the future. Thoroughness in this section ensures that your accounts are linked seamlessly and prevents erroneous data entry.

Step 4: Reviewing and editing the MTA form

Use pdfFiller’s editing features to review your completed MTA Form. These tools allow you to highlight sections for modifications, ensuring that every detail is perfect before submission. Once satisfied, you can save your changes and choose to revisit the form later for further adjustments if necessary.

Step 5: Signing the MTA form electronically

For a seamless experience, pdfFiller provides an eSignature feature that enables you to sign the MTA Form electronically. Digital signatures have the same legal standing as handwritten ones, making this process both efficient and secure.

Step 6: Submitting the MTA form

After signing, you’ll need to submit the MTA Form. pdfFiller offers various submission options, including online delivery and physical mailing. Always confirm submission receipt, either by checking for a confirmation email or keeping a copy of your submission for your records.

Interactive tools to enhance the experience

pdfFiller incorporates several tools that can enrich your experience with the MTA Form. The preview feature allows you to visualize the completed form, ensuring it meets your expectations before finalizing any submission. Collaboration tools enable you to share the form with team members for input or joint review, facilitating improved accuracy and teamwork.

Furthermore, pdfFiller’s document management tools help you organize and store your MTA Forms efficiently. With a centralized system, you can retrieve forms easily and manage your documents effectively without the hassle of searching through mountains of paperwork.

Managing multiple accounts after form submission

Once the MTA Form has been submitted, it's essential to maintain organization across your multiple trading accounts. Implementing a structured approach for record-keeping is beneficial. Consider using spreadsheet software or financial management tools to track balances, performance metrics, and transaction histories. This practice can help streamline your monitoring process and enhance decision-making.

Additionally, applying best practices related to risk management is crucial when dealing with multiple accounts. Strategies might include setting specific limits on investment allocations per account or diversifying your trading styles to mitigate losses across different avenues. pdfFiller offers helpful tools to manage your documents, keeping your records tidy and organized while ensuring you can always access the necessary information.

Frequently asked questions (FAQs) about MTA forms

Navigating the MTA Form process may lead to several questions. One common inquiry is, 'What if I need to update my information after submission?' Most brokers allow changes, but the procedure will vary, so check with your broker’s customer support.

Another frequent question is: 'Can I use the MTA Form for different types of trading accounts?' Yes, the MTA Form accommodates various account types, ensuring that all trading strategies can be represented. Processing time for the MTA Form can also vary, and it’s prudent to inquire directly with your brokerage about typical timelines. Should you encounter difficulties, utilize the customer support section on pdfFiller or your broker's assistance channels.

Additional considerations

Understanding the regulatory framework surrounding multiple trading accounts is vital. Regulatory compliance ensures that your trading activities conform to legal standards, thereby protecting your interests. Always verify that your broker adheres to these regulations to mitigate risks associated with trading.

Security is another critical consideration when managing multiple accounts. Implementing strong password protocols, utilizing two-factor authentication where possible, and routinely monitoring account activity can significantly enhance security measures, safeguarding your investments against unauthorized access.

Lastly, future-proofing your trading strategy with multiple accounts allows you to adapt to market changes efficiently. Keeping abreast of market trends and considering diversification of investment avenues can enhance your portfolio's longevity in the dynamic trading landscape.

User feedback and success stories

Many users have shared positive experiences with the MTA Form through pdfFiller. One user noted that the simplicity of the process enabled them to manage their portfolio better, leading to improved trading performance overall. Testimonials indicate that trading with multiple accounts has encouraged users to experiment with diverse trading strategies, ultimately yielding satisfying results.

For instance, a case study revealed that a small investment team utilizing the MTA Form to coordinate multiple accounts improved their collective decision-making and optimized returns by capitalizing on emerging market trends. Their story highlights the effectiveness of well-managed trading accounts when aligned with flexible trading strategies.

Explore additional features on pdfFiller

Beyond the MTA form, pdfFiller provides a robust range of document creation solutions tailored for various requirements. Investors can browse through numerous relevant templates, ensuring they find the right tools for their trading needs. Whether you require an investment tracking sheet or compliance documentation, pdfFiller has you covered.

Further, pdfFiller offers subscription options that enhance user experiences with more advanced features, allowing for extensive document modification and management capabilities. By exploring these offerings, you can further optimize your trading processes and elevate your investment strategies seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send multiple trading account mta to be eSigned by others?

Can I sign the multiple trading account mta electronically in Chrome?

Can I edit multiple trading account mta on an Android device?

What is multiple trading account mta?

Who is required to file multiple trading account mta?

How to fill out multiple trading account mta?

What is the purpose of multiple trading account mta?

What information must be reported on multiple trading account mta?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.