Get the free Year 3 Annual Report

Get, Create, Make and Sign year 3 annual report

How to edit year 3 annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out year 3 annual report

How to fill out year 3 annual report

Who needs year 3 annual report?

Your Complete Guide to the Year 3 Annual Report Form

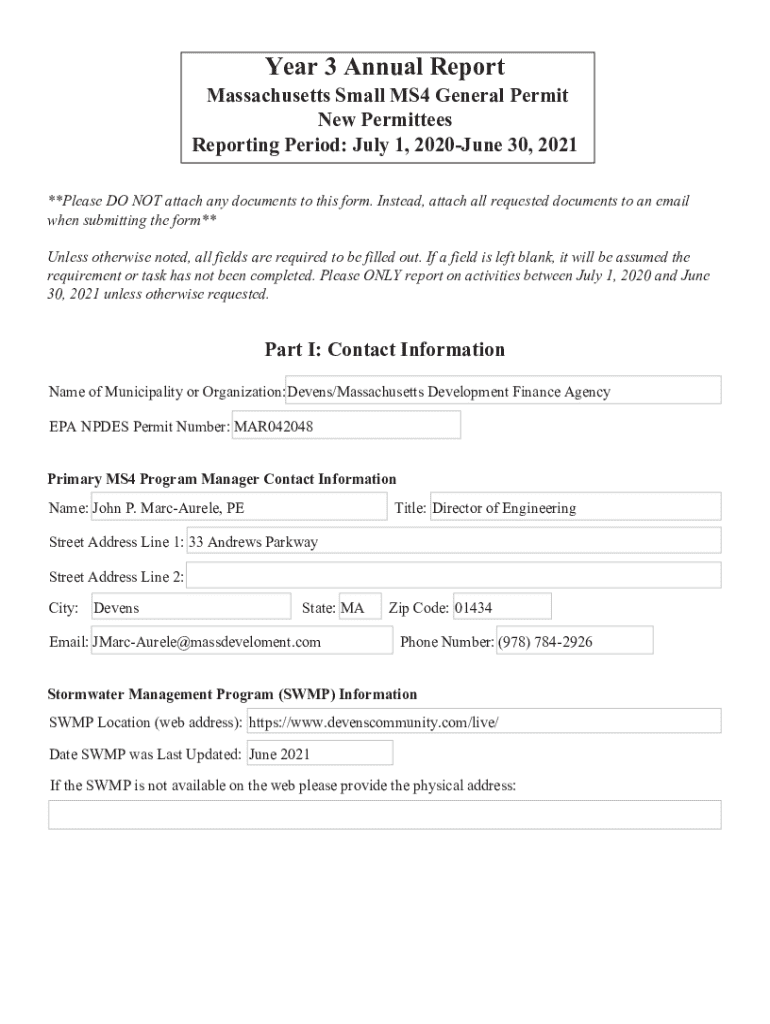

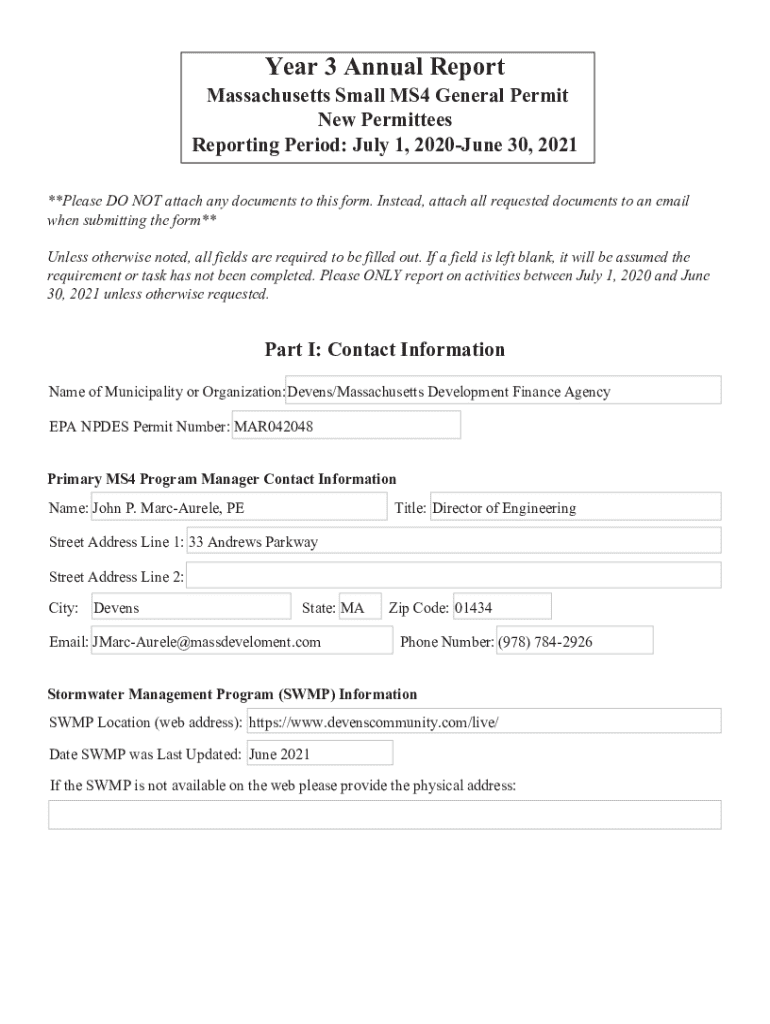

Overview of the Year 3 Annual Report Form

The Year 3 Annual Report form serves as a critical document for businesses as it summarizes a company’s performance and financial health after its third year of operation. This report is not just a formality; it provides stakeholders with insights into the company's progress, challenges, and strategic direction. Understanding the essence and compliance requirements of this report is fundamental for any entity hoping to maintain operational integrity and transparency.

Timely submission of the Year 3 Annual Report is imperative. Many organizations fail to recognize that late filings can lead to penalties and hinder their credibility in the market. Not only does this documentation fulfill regulatory requirements, but it also serves as a tool for promoting trust among investors, customers, and the community.

Common uses of the Year 3 Annual Report include providing a comprehensive overview for potential investors, offering transparency for regulatory authorities, and serving as a resource for stakeholders who wish to understand the company’s operational and financial status.

Key components of the Year 3 Annual Report form

The Year 3 Annual Report requires essential components to adequately convey the company's operations. Key elements that must be included are: - **Company Identification:** This section requires basic details such as the company name, registration number, and contact information. - **Financial Statements:** Comprehensive financial reports including balance sheets, income statements, and cash flow statements are vital. These documents allow stakeholders to assess financial stability and performance comprehensively. - **Management Discussion and Analysis:** This narrative should provide insights into the financial results, covering aspects like the company’s plans, challenges faced, and operational shifts in the market.

In addition to the essential sections, optional areas can enhance the report. These may include: - **Future Outlook:** Discussing projections for future performance can positively influence investor confidence. - **ESG Considerations:** Addressing Environmental, Social, and Governance factors shows stakeholders that the company is committed to sustainability and ethical practices.

Filing process for the Year 3 Annual Report

Filing your Year 3 Annual Report can seem daunting, but breaking it down into manageable steps can simplify the process. Here’s a structured approach:

Electronic submission streamlines the process significantly. Using pdfFiller for submission offers additional advantages, such as ease of access and real-time collaboration. You can directly submit the Year 3 Annual Report by creating an account, uploading your completed form, and following the guided steps that pdfFiller prompts.

Understanding deadlines and penalties

Filing deadlines for the Year 3 Annual Report differ by jurisdiction. It is crucial to verify your local regulations to ensure compliance. Missing deadlines can lead to severe consequences, not only financially but also reputationally. Potential outcomes of late filing include: - **Financial Penalties:** Depending on the severity of the delay, fines can accumulate, impacting the company’s bottom line. - **Impact on Business Reputation:** Stakeholders might view delays as signs of mismanagement, which can erode trust and confidence in leadership.

Editing and managing your Year 3 Annual Report

Once you've drafted your Year 3 Annual Report, utilizing pdfFiller’s editing tools enhances the document’s quality. You can effortlessly add or remove sections to better align with your reporting needs. If last-minute changes are necessary, pdfFiller allows for easy integration of updates, ensuring your report reflects the most current information.

Version control is another vital aspect of managing your annual report. pdfFiller provides options to track changes over time, ensuring stakeholders can review the evolution of the report, which can be particularly beneficial during audits or assessments.

Electronic signatures and confirmation

In today’s fast-paced environment, eSignatures have become indispensable. They ensure that documents like the Year 3 Annual Report are legally binding and easily verifiable. With pdfFiller, signing your Year 3 Annual Report form is a straightforward process. You can create your eSignature effortlessly and place it on the required sections of the document.

Understanding the confirmation process post-submission is also crucial. After filing your report, pdfFiller provides a confirmation of the successful submission, along with any tracking information, ensuring that you have a clear record for your business needs.

Common issues and troubleshooting

While filing the Year 3 Annual Report, many users encounter challenges. Common issues might include error messages during submission. Often, these errors stem from incomplete fields or incorrect formatting. A quick solution is to double-check all entries before final submission.

In case of losing access to your document, pdfFiller allows users to recover documents through their account interface. Support is readily available to assist when issues arise, ensuring that your document management experience is smooth.

Resources for assistance

To navigate the complexities of the Year 3 Annual Report form filing, pdfFiller offers a variety of resources. Interactive tutorials available on the site demonstrate how to utilize editing tools effectively, ensuring users feel confident in their reporting tasks.

For personalized assistance, contacting pdfFiller’s support team can be highly beneficial. Additionally, community forums can provide insights from fellow users who have faced similar challenges, letting you learn from collective experiences.

Additional considerations for a successful Year 3 Annual Report

Creating a successful Year 3 Annual Report extends beyond mere compliance. Incorporating best practices in financial reporting ensures accuracy and clarity. Feedback from stakeholders can reveal critical insights that enhance the report's relevance and impact.

Furthermore, leveraging the findings from the annual report can guide future planning. By analyzing operational trends and financial data, businesses can make informed decisions that promote growth. This strategic use of the annual report not only solidifies compliance but transforms it into a tool for actionable insight.

Conclusion: enhancing your business’s narrative

The Year 3 Annual Report is more than a regulatory requirement; it is a compelling narrative that articulates the journey of a business. It plays a pivotal role in shaping business strategy and building transparency and trust among all stakeholders. By leveraging the tools available at pdfFiller for seamless editing, signing, and submission, you can ensure that your report not only complies with regulations but also enhances the credibility and appeal of your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send year 3 annual report to be eSigned by others?

How do I complete year 3 annual report online?

Can I create an electronic signature for signing my year 3 annual report in Gmail?

What is year 3 annual report?

Who is required to file year 3 annual report?

How to fill out year 3 annual report?

What is the purpose of year 3 annual report?

What information must be reported on year 3 annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.