Get the free Cement Masons & Plasterers 401(k) Trust

Get, Create, Make and Sign cement masons plasterers 401k

Editing cement masons plasterers 401k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cement masons plasterers 401k

How to fill out cement masons plasterers 401k

Who needs cement masons plasterers 401k?

Cement masons plasterers 401(k) form: A comprehensive guide

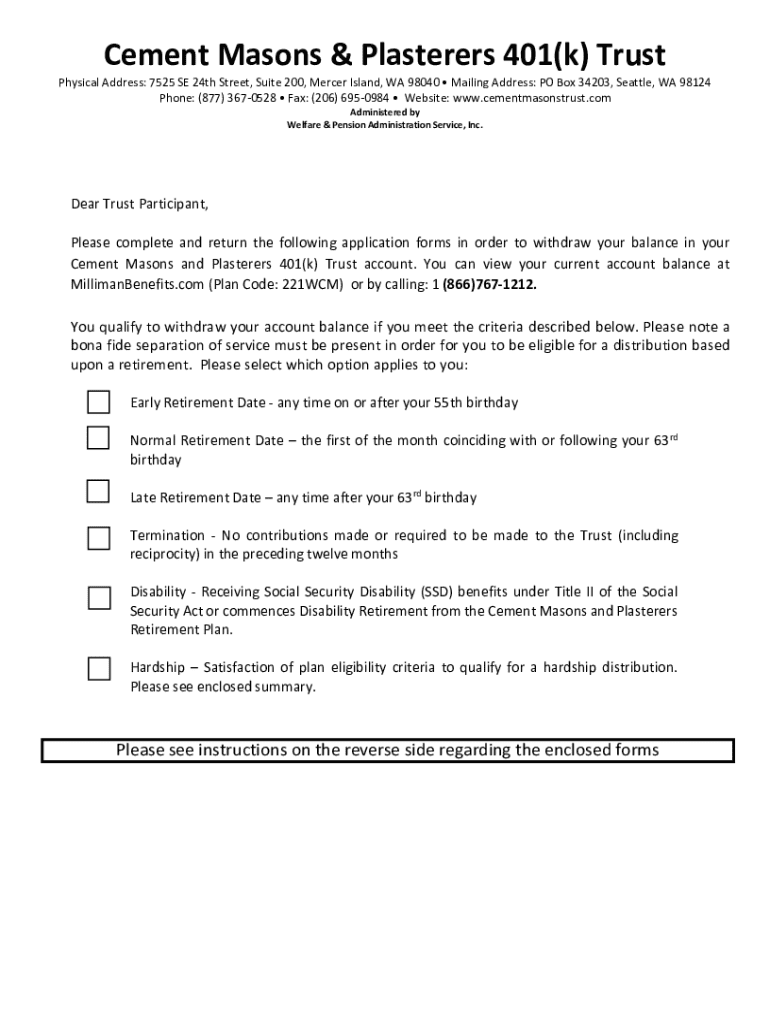

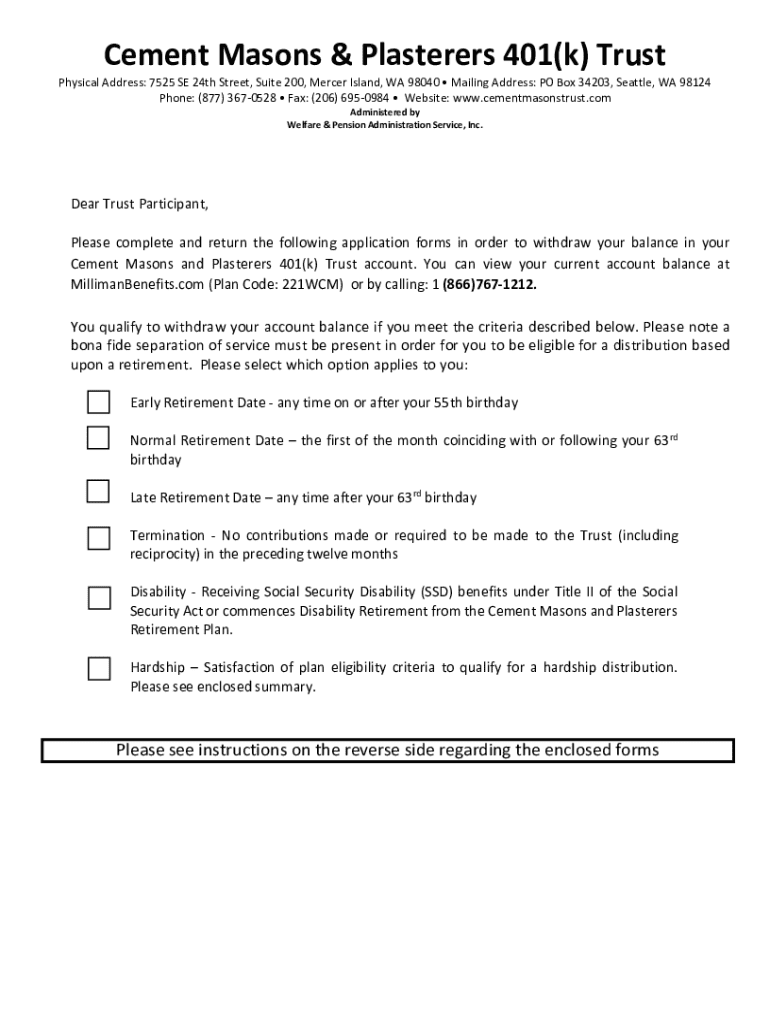

Overview of the Cement Masons and Plasterers 401(k) Plan

The Cement Masons and Plasterers 401(k) Plan aims to provide a secure retirement solution for professionals in these industries. This plan allows workers to save part of their earnings for retirement while enjoying tax advantages. Contributions are typically made through payroll deductions, enabling consistent savings over time. The 401(k) Plan not only helps secure financial stability in retirement but also incentivizes consistent investment in one's future.

Eligibility for the Cement Masons and Plasterers 401(k) Plan often requires members to be in good standing with their union and employed in a qualifying position. Additionally, this plan may feature employer matching contributions, further enhancing retirement savings potential. By participating, cement masons and plasterers can create a substantial retirement fund which is a significant step towards ensuring comfort post-retirement.

Understanding the 401(k) form

The 401(k) form for cement masons and plasterers is a critical document that outlines contributions and plan participation. Accurate submission of this form is essential as it provides the foundation for retirement savings. It's important to understand that any inaccuracies can delay contributions or result in complications regarding employer matching funds.

Common errors include incorrect personal information or failure to complete all required sections. By ensuring that the 401(k) form is filled out correctly and thoroughly, participants can avoid unnecessary delays in their retirement planning. Everyone should be diligent in reviewing the form before submission to ensure comprehensive and accurate information.

Step-by-step guide to filling out the 401(k) form

Filling out the 401(k) form accurately is crucial. Here’s a step-by-step guide to simplify the process:

Interactive tools for form management

To streamline the process of filling out and managing the 401(k) form, pdfFiller provides seamless editing capabilities. Users can upload their forms directly to the platform and edit them in real time.

Utilizing pdfFiller, you can easily correct errors and make necessary updates without the hassle of print and re-submission. Features like electronic signing can simplify the signing process, making it more efficient. eSigning your 401(k) form through pdfFiller provides a secure and convenient way to complete documentation, ensuring that all details are captured accurately.

Submitting the 401(k) form

Once the 401(k) form is completed, several submission methods are available to accommodate different preferences. You can choose to email the form, send it through traditional mail, or utilize an online portal if your union offers this service.

It's crucial to meet submission deadlines, as missed deadlines may impact your participation in the plan. After submission, you can expect a confirmation from your plan administrator. This acknowledgment will often outline any next steps or actions required on your part.

Managing your 401(k) contributions

Understanding contribution limits is essential for cement masons and plasterers. For 2023, the IRS set the elective deferral limit at $22,500, with a catch-up contribution of $7,500 available to those aged 50 or older. Adjusting your deferrals can be done during open enrollment or if your financial situation changes.

It’s important to monitor your contributions regularly, especially if your finances evolve. Termination of deferrals can also happen when members change jobs or retire. Ensure you're clear on the ramifications of ceasing contributions and how to best manage your retirement savings throughout your career.

Additional information on pension and health care funds

Beyond the 401(k) plan, cement masons and plasterers have access to additional benefits such as pensions and health care funds. The pension fund provides a monthly income after retirement based on years of service and salary history. It is a vital component of overall financial security.

The health care fund contributes to the well-being of members and their families, alleviating costs associated with medical expenses. For specific queries regarding these benefits, it's beneficial to contact your union’s designated resources. They can offer clarity on eligibility, benefits, and enrollment procedures.

Important resources and links

Accessing relevant forms and resources is key to effectively managing your 401(k). Most unions provide downloadable forms and templates on their websites. Additionally, frequently asked questions (FAQs) specific to the Cement Masons and Plasterers 401(k) plans can help clarify common concerns.

Furthermore, pdfFiller offers help and support for users, making document management easy and efficient. Connecting with a Local 518 Resource Center can provide guidance and insights specific to your region, ensuring that you are well-informed about your retirement planning opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cement masons plasterers 401k?

How can I edit cement masons plasterers 401k on a smartphone?

Can I edit cement masons plasterers 401k on an Android device?

What is cement masons plasterers 401k?

Who is required to file cement masons plasterers 401k?

How to fill out cement masons plasterers 401k?

What is the purpose of cement masons plasterers 401k?

What information must be reported on cement masons plasterers 401k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.