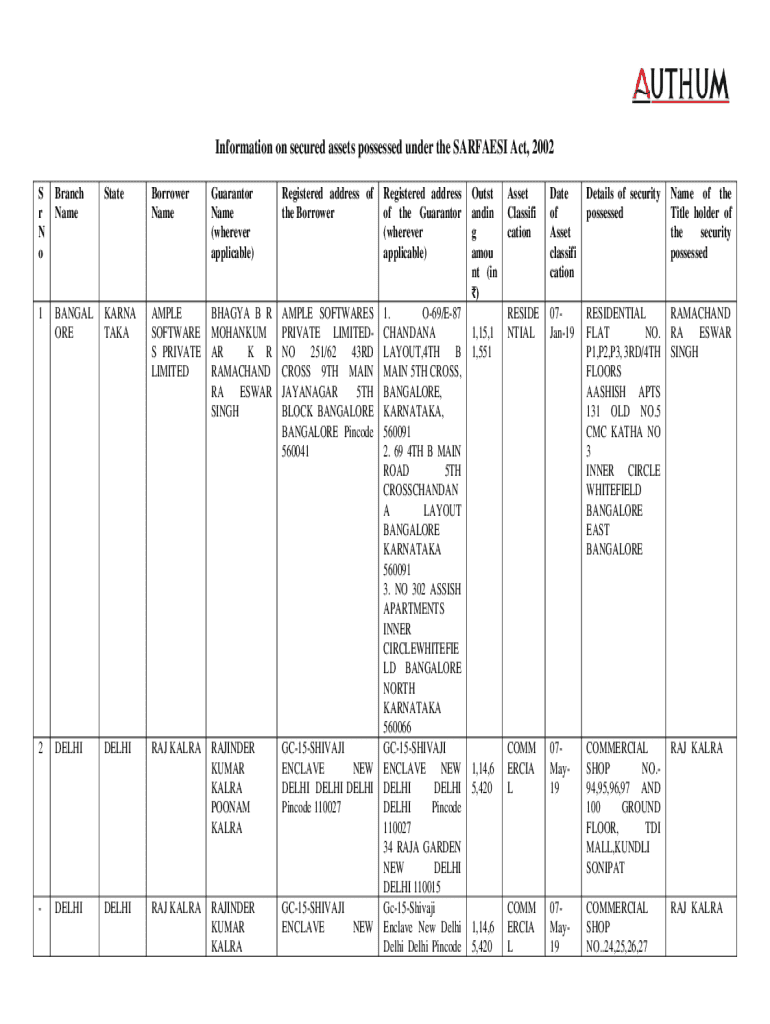

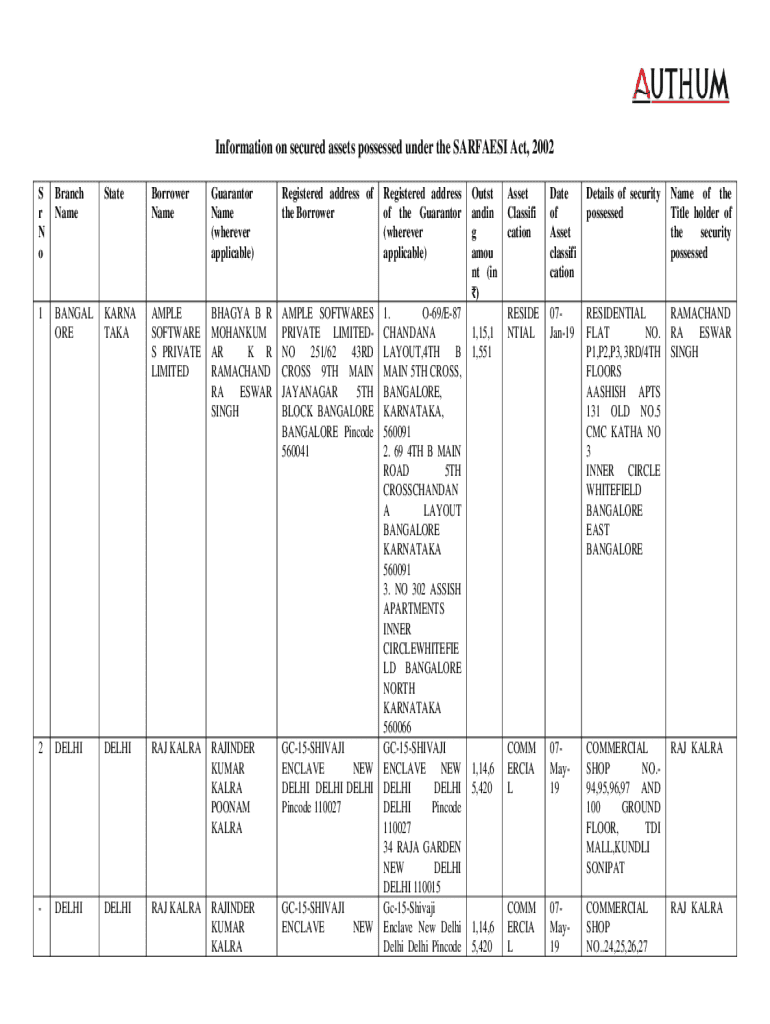

Get the free Information on Secured Assets Possessed Under the Sarfaesi Act, 2002

Get, Create, Make and Sign information on secured assets

How to edit information on secured assets online

Uncompromising security for your PDF editing and eSignature needs

How to fill out information on secured assets

How to fill out information on secured assets

Who needs information on secured assets?

Comprehensive Guide to the Information on Secured Assets Form

Understanding secured assets

Secured assets are assets pledged as collateral to secure a loan or borrowing arrangement. Common examples of secured assets include real estate, vehicles, equipment, and other personal property that can be turned into cash through sale if the borrower fails to meet their obligations. In the financial and legal contexts, understanding secured assets is crucial as they provide lenders with assurance that they can reclaim part of their investments if borrowers default.

The importance of secured assets extends beyond providing security for lenders; they also influence the terms and conditions of credit. Borrowers with valuable secured assets might benefit from lower interest rates or more favorable repayment terms since their risk to lenders offers a layer of protection. Thus, borrowers and creditors alike must navigate the landscape of secured assets carefully.

Overview of the secured assets form

The secured assets form serves a critical role in documenting and formalizing the relationship between a lender and borrower regarding secured assets. This form is essential for legal compliance and ensures clarity between all parties involved. It becomes necessary in various situations, including loan agreements, refinancing, or transferring an existing debt from one financial institution to another.

Key components of the secured assets form typically include identifying information for all parties involved, detailed descriptions of the secured assets, and any associated liabilities. Accurate completion of all sections helps prevent disputes and provides clear evidence of obligations in legal proceedings. Completing this form accurately ensures both parties have a well-documented agreement.

Steps to complete the secured assets form

Completing the secured assets form involves a systematic approach to ensure all information is accurate and comprehensive. The first step is gathering necessary information, which includes personal details, financial data related to the loan, and a clear description of the secured assets. This preparation phase is crucial as it shapes the accuracy of the completed form.

Next, you'll need to access the secured assets form. This form is often available in multiple formats, including PDFs and online templates, making it accessible from various devices. Once you have the form, carefully fill it out. Each section should contain detailed descriptions and accurate figures, and be cautious to avoid common pitfalls like misinformation or omitted details. After completing the form, it's essential to review it meticulously. Double-checking entries can help prevent costly mistakes, and, if necessary, consider seeking assistance from legal experts or advisors to ensure compliance with applicable laws.

Editing and managing your secured assets form with pdfFiller

Managing your secured assets form has been made significantly easier through pdfFiller, which provides a user-friendly platform for document management. With pdfFiller's editing tools, you can modify your document as needed, ensuring that all information remains current and accurate. This is particularly important if your financial situation or the status of your secured assets changes over time.

In addition to editing features, pdfFiller enables users to securely insert eSignatures, facilitating the signing process without the need for physical meetings. This is a massive advantage for individuals and teams who operate remotely or require swift transaction turnarounds. You can also collaborate with your advisors or team members by sharing the secured assets form directly through pdfFiller, allowing for real-time commenting and tracking of changes, which greatly enhances communication and clarity.

Legal considerations and compliance

Understanding the legal implications surrounding secured assets forms is essential for both borrowers and lenders. Inaccurate information can lead to severe consequences, including potential legal disputes or financial loss. Compliance with local laws governing secured transactions is crucial, as regulations may vary by jurisdiction. Familiarizing yourself with these laws can save you from future complications.

There are specific instances when you should consider seeking legal assistance, such as when the complexity of your financial situation increases or when substantial assets are involved. Resources through pdfFiller can guide you in finding legal advice tailored to your needs, ensuring that you're not navigating these waters alone.

Maintaining and updating your secured assets documentation

Regularly updating your secured assets documentation is vital for maintaining accuracy and ensuring all financial records reflect your current situation. Keeping records current is not merely a best practice; it often becomes a legal necessity, especially for secured transactions that involve fluctuating asset values or changes in financial obligations. Regular audits of your documentation will help track changes in asset status and ensure timely updates to any secured assets form.

Using cloud storage solutions like pdfFiller can enhance your ability to access and manage these documents wherever you are. Cloud-based solutions provide added security and convenience, allowing you to store your forms securely and retrieve them as needed. The document management features in pdfFiller help ensure your secured assets documentation is both safe and easily accessible.

Common FAQs about the secured assets form

When filling out the secured assets form, it’s common to have questions. For instance, what happens if you make a mistake on the form? Most errors can be corrected by amending the document carefully and obtaining new signatures if necessary. Always keep copies of both the original and corrected forms for your records.

Another frequent question is whether witnesses or notarization is necessary. While some jurisdictions may require notarization to make the form legally binding, it's essential to check local laws to determine the exact requirements. Lastly, many people wonder how long they need to keep the completed form, and generally, it's advisable to retain it for at least as long as the loan remains active plus a few years afterward.

Utilizing interactive tools for enhanced understanding

Using interactive tools can enhance your understanding of the secured assets form process. For example, an interactive checklist can guide you through the essential steps of completing the form, ensuring that nothing is overlooked. This format presents the information in a straightforward and accessible manner, allowing for quick reference.

Additionally, exploring sample scenarios can provide real-world applications that illustrate how different individuals or businesses have successfully utilized the secured assets form. Case studies often bring clarity and practical understanding that enhances your grasp of the form’s implications and processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in information on secured assets?

How do I fill out information on secured assets using my mobile device?

How can I fill out information on secured assets on an iOS device?

What is information on secured assets?

Who is required to file information on secured assets?

How to fill out information on secured assets?

What is the purpose of information on secured assets?

What information must be reported on information on secured assets?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.