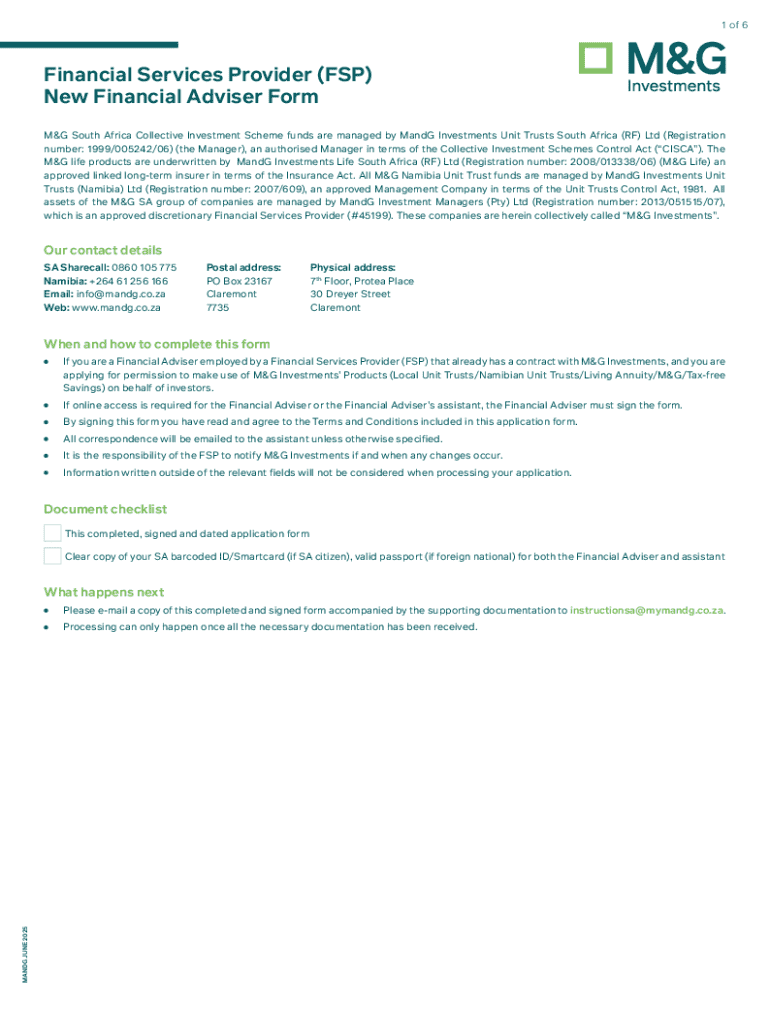

Get the free New Financial Adviser Form

Get, Create, Make and Sign new financial adviser form

How to edit new financial adviser form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new financial adviser form

How to fill out new financial adviser form

Who needs new financial adviser form?

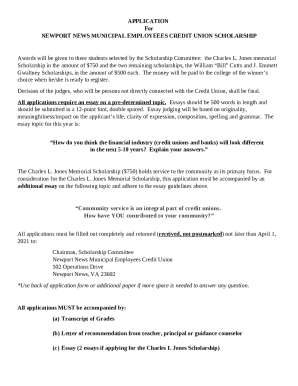

Understanding the New Financial Adviser Form: A Comprehensive Guide

Understanding the new financial adviser form

The new financial adviser form plays a critical role in streamlining compliance processes within financial advisory firms. It is designed to collect essential information that not only meets regulatory requirements but also establishes trust with potential clients.

This document aids regulatory bodies in maintaining high standards within the financial sector by ensuring that financial advisers are appropriately qualified. From an operational perspective, having a well-structured form enhances the onboarding experience for new advisers.

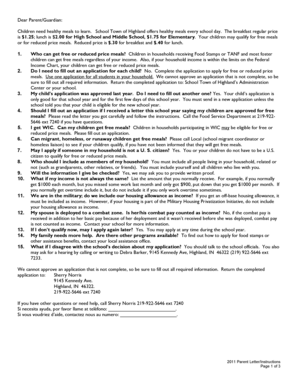

Who needs to fill out the form

The new financial adviser form is essential for multiple groups within the financial sector. First and foremost, it is required for new financial advisers seeking registration with relevant regulatory bodies. This ensures that they meet the professional standards necessary to provide financial advice.

Additionally, existing advisers may need to update their information through this form, especially if there are changes in their personal or professional circumstances. Finally, firms onboarding new advisers must utilize this form to ensure consistency and compliance across their operations.

Step-by-step process for completing the new financial adviser form

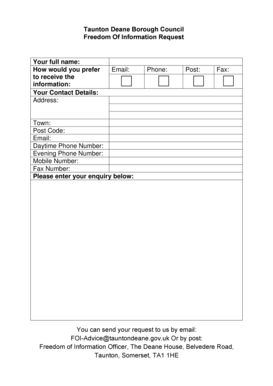

Completing the new financial adviser form requires a careful collection of necessary information and documentation. Begin with personal identification details, including your full name, address, and social security number. This information is crucial for verifying your identity, which assures regulatory bodies of your legitimacy.

In addition to personal information, you will need to provide details regarding your financial background—this includes any relevant work experience, educational qualifications, and any necessary licensing or certifications. Following these steps will facilitate a smoother application process and enhance the likelihood of approval.

Filling out the form: a detailed walkthrough

The new financial adviser form consists of multiple sections, each requiring specific information. Here’s a breakdown:

When filling out these sections, be mindful of common mistakes such as typos or inaccuracies. Providing a detailed and truthful account will help in achieving quicker processing times and avoid potential rejections.

Consider the following tips to ensure the information you provide is as accurate as possible:

Interactive tools to assist with the form

Utilizing online tools can significantly enhance your experience when completing the new financial adviser form. Online form fillers and PDF editors help streamline the information entry process, allowing you to make edits easily and quickly.

One efficient tool is pdfFiller, which not only facilitates easy editing but also enables you to save your progress as you work. This platform provides a user-friendly interface that encourages accuracy and efficiency.

eSignature options for fast submission

After filling out the new financial adviser form, you'll need to provide a signature to validate it. Electronic signatures are widely accepted and significantly cut down on submission time. When utilizing pdfFiller, you can securely eSign documents with a few clicks, making it an efficient choice.

Ensure your eSignature meets all legal requirements to avoid complications down the line. With pdfFiller, you eliminate the need for physical copies and the associated delays.

Managing your new financial adviser form effectively

Once your form is completed and signed, secure storage is essential. Utilizing cloud storage solutions offers numerous benefits, such as easy access to your form whenever needed and enhanced data security. Ensuring that your documents are stored safely protects against loss and unauthorized access.

pdfFiller also allows you to manage your documents effectively with its collaborative features. This means you can share the form with team members for feedback or revisions, further enhancing the submission process.

What happens after submission?

Post-submission, the new financial adviser form enters the review process conducted by regulatory bodies. This stage typically includes background checks and verification of the provided information. Expect varying timelines based on the specific requirements of different regulatory agencies.

In cases where additional information is requested, respond promptly to avoid delays in your application process. Once approved, advisers can begin setting up client accounts and engaging in continued education to stay abreast of compliance requirements.

Troubleshooting common issues

Technical glitches with the online form are not uncommon. Issues such as incompatibility with certain browsers or devices can arise. Recognizing these problems early on can save you significant time and frustration. Research available troubleshooting resources or contact customer support if you encounter difficulties.

Another issue to watch out for is discrepancies or inaccuracies in the submitted information. If a rejection occurs, rectify errors promptly before resubmission. Keeping a comprehensive record of your submission can assist in swiftly addressing any issues.

Best practices for future applications

To streamline future applications, staying updated with compliance changes is vital. Regulatory standards can evolve, impacting how forms need to be filled out. Make it a habit to regularly review and update your personal information on file, ensuring it reflects any life or career changes.

Utilizing pdfFiller not only assists with the current application but also allows for ongoing document management. This includes creating templates for frequently used forms, making future submissions faster and simpler.

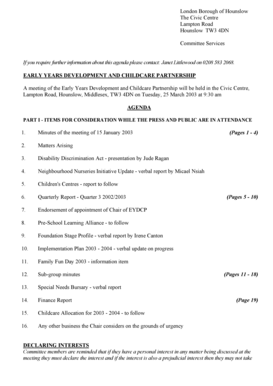

Unique considerations for teams

For teams applying together, collaboration becomes key. It is important to manage roles effectively to ensure that all necessary tasks are carried out efficiently. Keeping track of multiple application deadlines is essential to prevent any last-minute rushes.

Sharing responsibilities among team members can lead to a more organized and efficient process, especially when it comes to gathering required documentation. Leveraging the collaborative features of pdfFiller can facilitate this teamwork.

Expanding your document management skills

As you become more familiar with the new financial adviser form and the functionality of pdfFiller, consider exploring additional features that can further enhance your document management capabilities. The platform offers various templates and customization options that can be useful when developing industry-specific forms.

Creating workflows or checklists for future forms can simplify the acquisition of necessary information and documentation, improving both efficiency and accuracy in your submissions. To bolster your skills further, take advantage of the training resources available on pdfFiller, including tutorials and community support networks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new financial adviser form without leaving Google Drive?

How do I execute new financial adviser form online?

How do I edit new financial adviser form on an iOS device?

What is new financial adviser form?

Who is required to file new financial adviser form?

How to fill out new financial adviser form?

What is the purpose of new financial adviser form?

What information must be reported on new financial adviser form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.