Get the free Business Account Application

Get, Create, Make and Sign business account application

How to edit business account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business account application

How to fill out business account application

Who needs business account application?

Comprehensive Guide to the Business Account Application Form

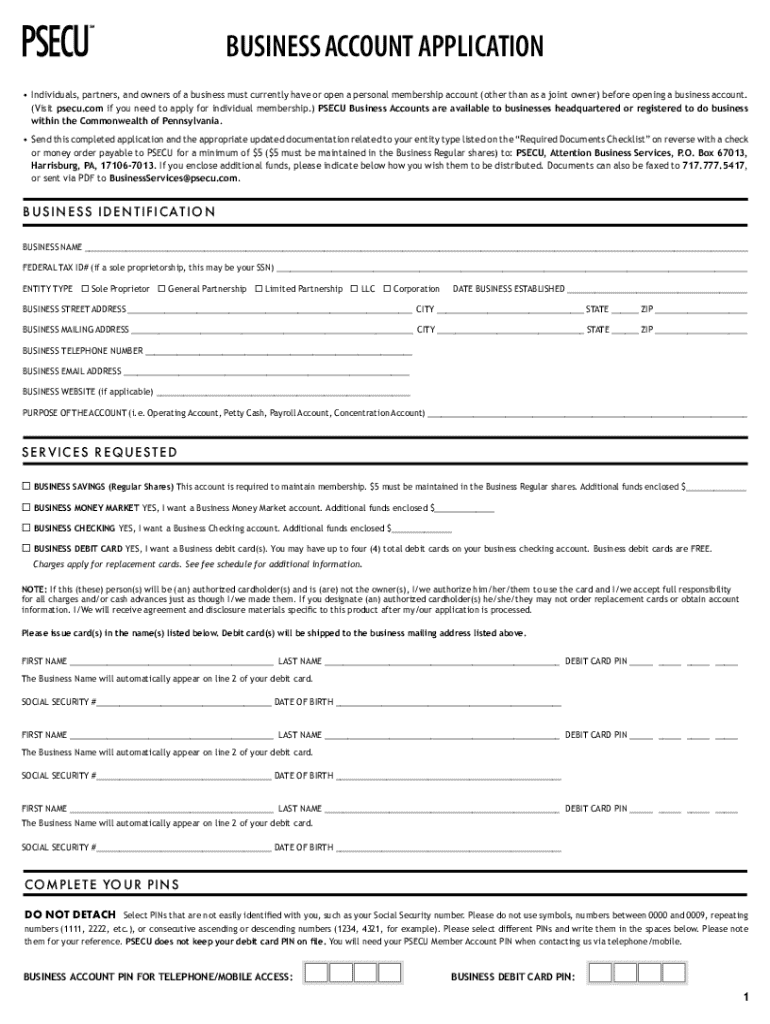

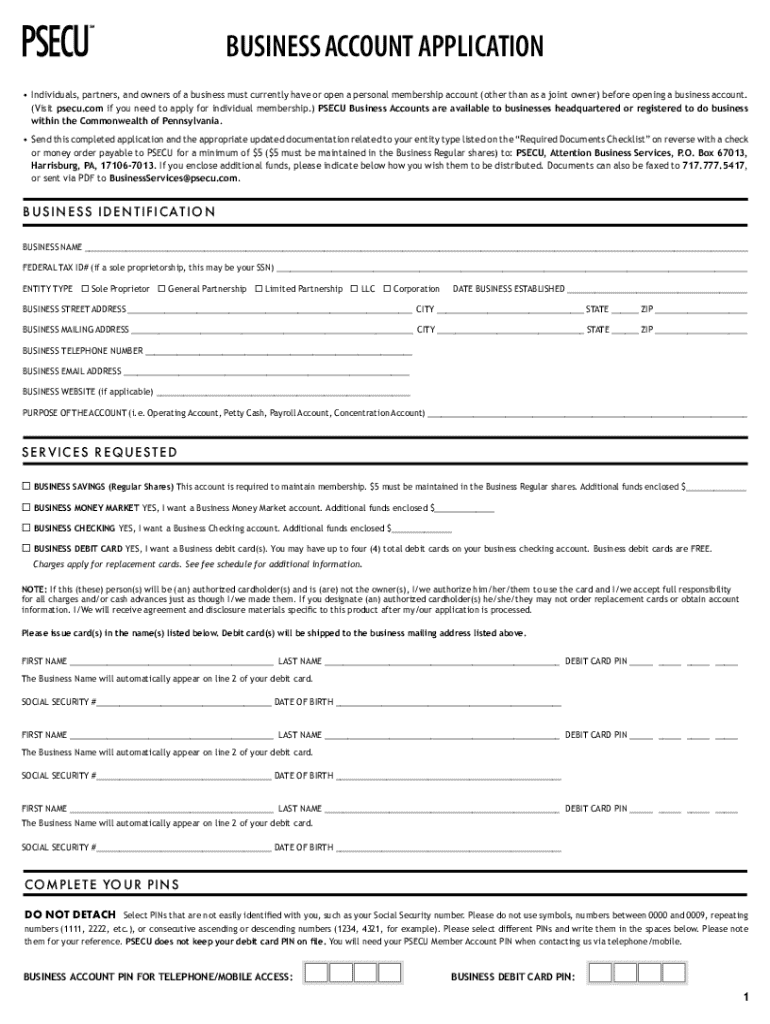

Understanding the business account application form

A business account application form is a crucial document required to open a business account with a financial institution. This form streamlines the process of gathering necessary information, enabling banks to assess risks and compliance related to your business operations. For any business—whether a startup, LLC, or corporation—access to a dedicated business bank account is essential for managing finances, enabling better cash flow management, and enhancing credibility with customers and vendors.

A business account not only helps keep personal and business finances separate, but it also offers features tailored to business needs, such as merchant services, credit lines, and bookkeeping aids. The pdfFiller platform enhances this process by offering a user-friendly interface for managing your application, ensuring that you not only fill out your form correctly but also retain it digitally for future reference.

Essential components of a business account application form

Typically, a business account application form contains several key sections that collect vital information necessary for approval. Understanding these components can prevent delays in the application process and ensure all required information is submitted.

Furthermore, submitting several supporting documents is essential for the processing of the application. These typically include proof of identity, such as a driver's license or passport, and your business license or registration documents. Providing these documents up front can significantly speed up the approval process.

Step-by-step guide to filling out the application form on pdfFiller

Filling out the business account application form via pdfFiller is streamlined and straightforward. Here’s how to efficiently complete your application online.

Editing and reviewing the application form

One of the strengths of using pdfFiller is its comprehensive editing tools. Once you’ve completed your business account application form, take advantage of these features to make necessary corrections or additions. Any annotations or comments can also be added for review.

Before submitting, it’s crucial to conduct a thorough review of the application. Develop a checklist to confirm that all parts of the form are filled out completely and accurately. This reduces the likelihood of rejection due to missing or incorrect information.

Signing the business account application form

Signing your application is a vital step in the submission process. On pdfFiller, you can easily create an e-signature, which holds legal validity much like traditional handwritten signatures. E-signatures are generally accepted by financial institutions, ensuring your application remains on the cutting edge of technology.

Submitting your application form

After successfully completing and signing your business account application form, it’s time to submit it. pdfFiller provides multiple submission methods for convenience. You can email the completed application directly or submit it through the financial institution’s online portal.

Once submitted, it’s essential to confirm your application’s submission and monitor its status. Keeping a record of the submission confirmation will help you follow up when necessary, allowing you to check back with the institution after the given processing timeline has elapsed.

Managing your business account application on pdfFiller

Utilizing pdfFiller offers an organized way to manage your business account application. The platform provides features that allow you to track your application’s progress post-submission. You can also revisit your document for edits or resubmission as needed.

Common issues and troubleshooting

Navigating the business account application process can sometimes lead to roadblocks. Common issues include submitting incorrect information or documents. Fortunately, pdfFiller equips users with resources to address these challenges effectively.

By leveraging these resources, you can effectively manage your business account application and resolve issues expeditiously.

Frequently asked questions about business account application forms

Uncertainty around business account application forms is common. Here are answers to some frequently asked questions that may arise during your application process:

Understanding these aspects of the application can alleviate concerns and guide you through the process more effectively.

The advantages of using pdfFiller for your business forms

pdfFiller's platform not only simplifies the business account application form process but also provides a comprehensive document management solution. Its cloud-based accessibility means you can work on your application from anywhere, making it especially beneficial for teams and individuals on the go.

Collaboration tools within the platform enhance team efficiency, allowing multiple users to interact with the document simultaneously. This leads to improved accuracy and faster turnaround times, enhancing your overall experience during the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business account application without leaving Google Drive?

How do I edit business account application on an Android device?

How do I fill out business account application on an Android device?

What is business account application?

Who is required to file business account application?

How to fill out business account application?

What is the purpose of business account application?

What information must be reported on business account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.