Get the free Business Privilege and Mercantile Tax Return

Get, Create, Make and Sign business privilege and mercantile

Editing business privilege and mercantile online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business privilege and mercantile

How to fill out business privilege and mercantile

Who needs business privilege and mercantile?

Business privilege and mercantile form - How-to Guide

Understanding business privilege and mercantile taxes

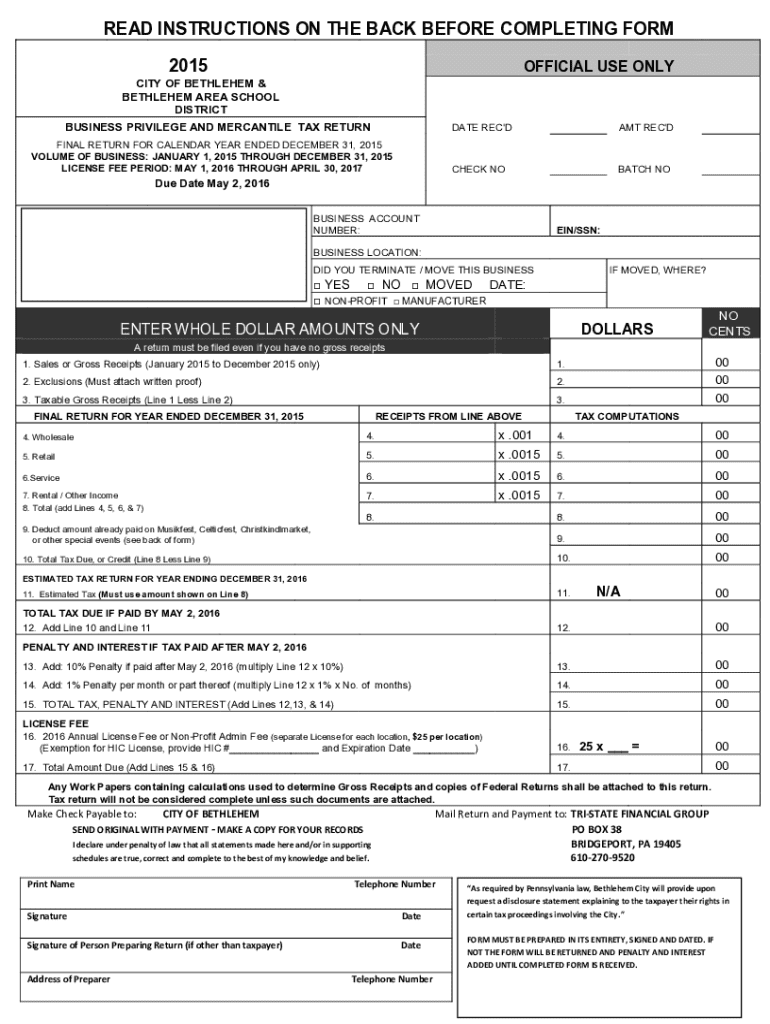

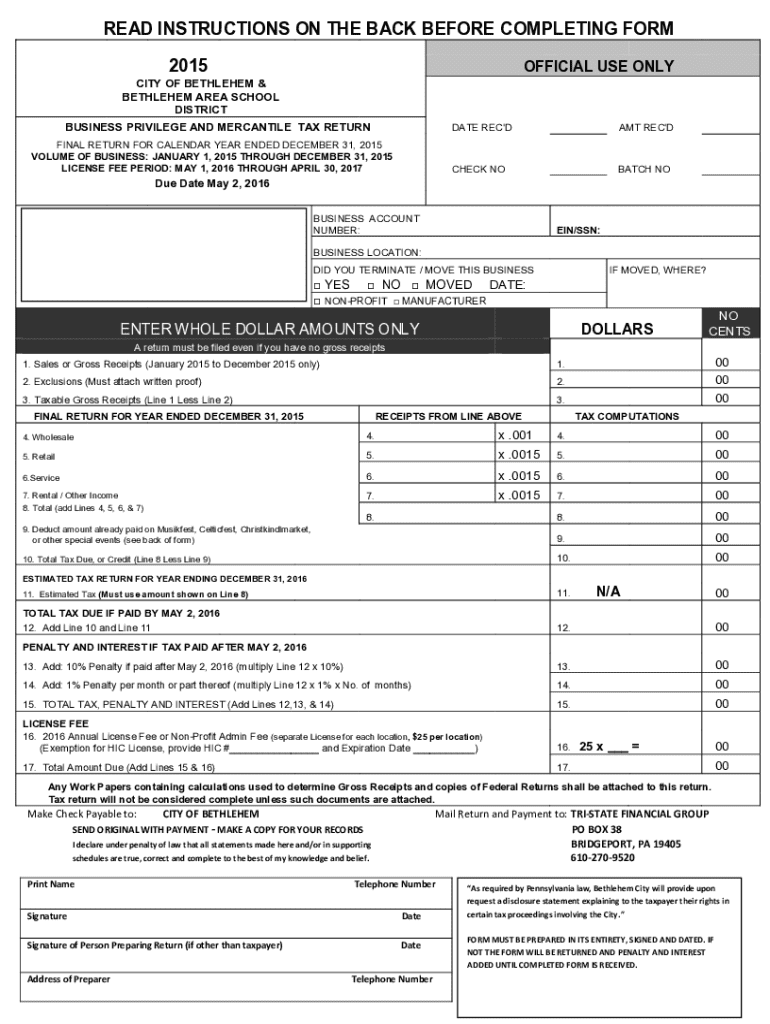

Business privilege and mercantile taxes are fundamental fiscal responsibilities for businesses that generate revenue from activities in various jurisdictions. These taxes are imposed by state and local governments on the gross receipts of businesses, making it crucial for entrepreneurs to comprehend and adhere to these regulations.

Compliance with these tax obligations not only ensures that businesses avoid penalties but also contributes to community infrastructure and services. It's paramount for business owners to stay informed about various related tax types, including sales tax, income tax, and franchise tax, as miscalculation or non-compliance can lead to unnecessary legal complications.

Navigating the business privilege and mercantile form

The business privilege and mercantile form is a crucial document mandated by the local government that allows businesses to report their revenue and determine tax liabilities. Accurately completing this form is a vital step for compliance and involves understanding who needs to file it.

Businesses operating within a jurisdiction that requires these taxes must fill out the form. Typically, this includes retail businesses, service providers, and manufacturers. Depending on the regulatory requirements, filing deadlines may vary significantly based on business type and revenue thresholds.

Step-by-step guide to filling out the form

Completing the business privilege and mercantile form might seem daunting at first; however, following a systematic approach can simplify the process. The first step is to gather all the necessary information, which includes detailed business details, financial records, and any prior submissions.

After gathering the information, accessing the form through pdfFiller is straightforward. You can use their platform to find and fill in the business privilege and mercantile form. This online tool offers various interactive features that facilitate easy editing and collaboration.

Signing and submitting your business privilege and mercantile form

Once the business privilege and mercantile form is completed, the next key step is signing and submitting it. Utilizing an electronic signature system like pdfFiller greatly enhances the ease of the process, allowing for secure and quick sign-offs without the need for paper.

There are two main submission methods: online or physical submission. Online methods are generally more efficient and provide immediate confirmation of submission, ensuring you can track your compliance without delays. It's highly recommended to opt for this modern approach to save time and reduce error risks.

Collaborating with teams on business privilege forms

Collaboration among team members during the completion of the business privilege and mercantile form can enhance accuracy and efficiency. pdfFiller allows users to share the document easily, enabling team members to access the same version.

The platform’s real-time collaboration features promote concurrent work on forms, meaning feedback can be provided instantaneously. Team members can comment on specific lines or sections, making it easier to track the changes made.

Managing your documents post-submission

Once you submit your business privilege and mercantile form, it's vital to manage your documents effectively. Keeping a well-organized repository of tax documents ensures you can retrieve past filings easily, which can be incredibly beneficial during audits or financial reviews.

Using cloud-based solutions like pdfFiller allows you to access your documents anytime, anywhere. It's also wise to set reminders for future filings to ensure you remain compliant, avoiding the potential for late penalties.

Frequently asked questions related to business privilege and mercantile taxes

As businesses encounter the complexities of business privilege and mercantile taxes, a number of common queries arise. Understanding the requirements and processes can make a significant difference in ensuring compliance and reducing frustration.

Among the most commonly asked questions are details about filing frequency, penalties for late submissions, and methods for appealing tax assessments. If you miss a deadline, it’s essential to understand the potential consequences and the steps to rectify the situation swiftly.

Troubleshooting common issues

Errors can occur during the submission process of the business privilege and mercantile form. Whether it’s incorrect entries or technical issues, knowing how to address them is crucial. Systems may generate error messages that can cause delays if not properly addressed.

For businesses facing delinquent payments or penalties, immediate communication with local tax authorities is often the best route. They can provide potential solutions or arrangements to help ease any penalties incurred.

Real stories: Successes and challenges in filing

Learning from those who have navigated the business privilege and mercantile form submission can provide valuable insights. Testimonials from users of pdfFiller showcase the diversity of experiences and highlight both the ease and challenges of the filing process.

For instance, one small business owner reflected on the time savings achieved by using pdfFiller’s collaborative features, allowing their team to tackle the form collectively and efficiently. Conversely, others have shared experiences of confusion regarding tax liabilities that could have been easily avoided with better preparation and guidance.

Additional tools and features from pdfFiller for business owners

pdfFiller offers an array of tools beyond the business privilege and mercantile forms to support business owners in their documentation needs. Users can explore a variety of templates and integrated solutions that enhance document management while streamlining processes.

With features such as form automation, bulk editing, and customizable templates, pdfFiller stands out as a comprehensive solution for busy entrepreneurs seeking to maximize their productivity and minimize administrative burdens.

Staying informed: Changes to tax laws and forms

Tax laws are not static; they evolve over time, and staying informed is essential for any business owner. Recent amendments in the business privilege and mercantile tax legislation may impact how businesses report their taxes and maintain compliance, requiring vigilance.

Utilizing pdfFiller's resources can ensure you are updated with the latest changes, helping navigate adjusted filing deadlines or altered tax obligations that can directly affect your business operations. Subscribing to alerts or newsletters can further assist in maintaining compliance.

Contacting pdfFiller for support

For individuals or teams seeking assistance, pdfFiller offers various support channels to ensure users can get the help they need. Whether it’s through live chat, email, or comprehensive help guides, resources are readily available.

Engaging with the pdfFiller community can also provide insights from fellow users, adding to the collective knowledge and improving the experience while dealing with the business privilege and mercantile form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business privilege and mercantile without leaving Chrome?

Can I create an electronic signature for the business privilege and mercantile in Chrome?

Can I create an electronic signature for signing my business privilege and mercantile in Gmail?

What is business privilege and mercantile?

Who is required to file business privilege and mercantile?

How to fill out business privilege and mercantile?

What is the purpose of business privilege and mercantile?

What information must be reported on business privilege and mercantile?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.