Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding Sec Form 4: A Comprehensive Guide

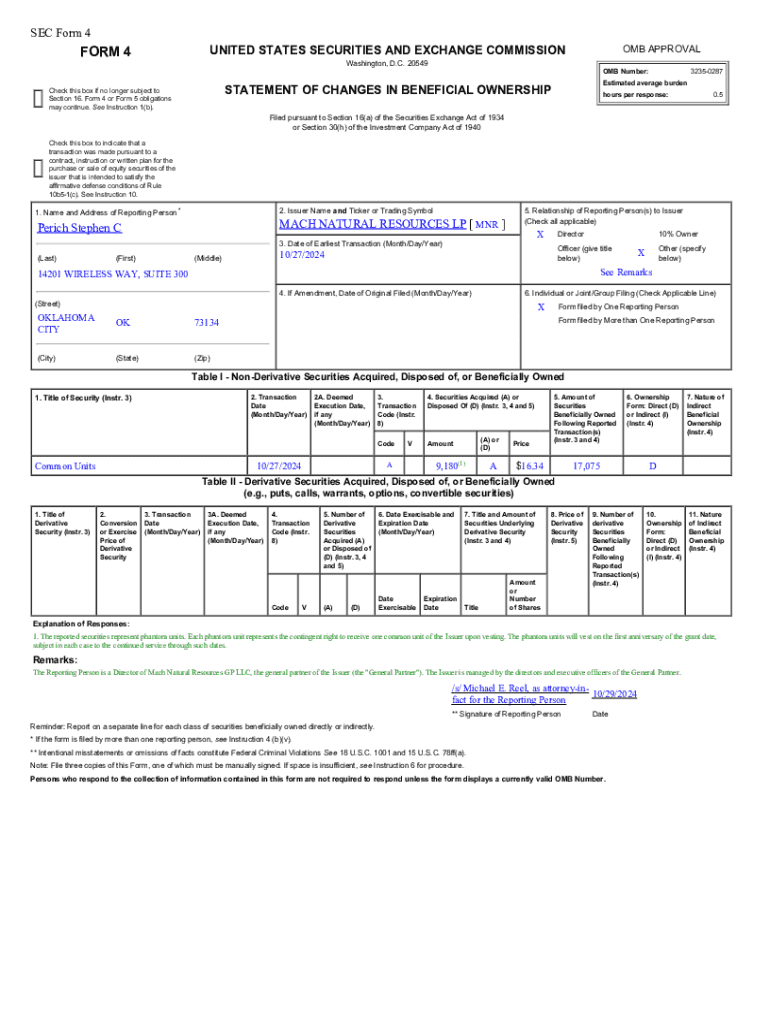

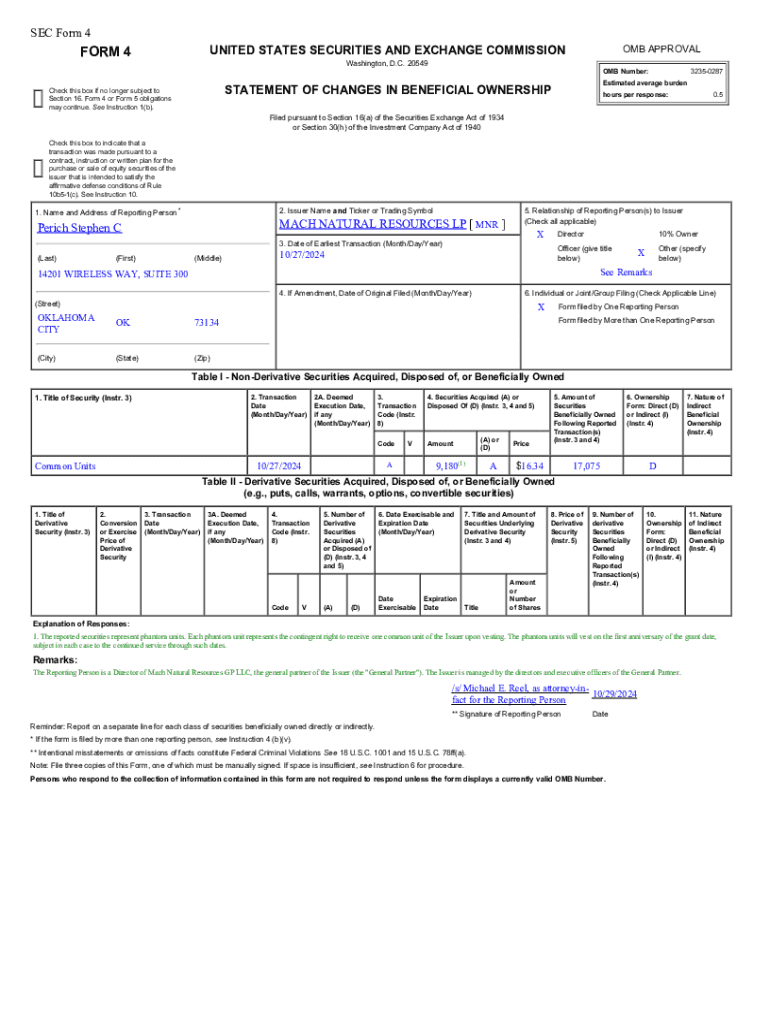

Understanding Sec Form 4

Sec Form 4 is a filing required by the Securities and Exchange Commission (SEC) for company insiders, including officers, directors, and beneficial owners of more than 10% of a company's equity securities. This form is crucial for maintaining transparency in the trading activities of these individuals, ensuring that shareholders and the market have access to relevant information that may influence stock prices.

The importance of Sec Form 4 cannot be overstated as it helps in health monitoring, compliance, and regulatory oversight of insider trading activities. Every transaction by insiders must be reported within two business days, making timely and accurate filings essential to avoid penalties and maintain investor trust.

Individuals required to file Sec Form 4 include executive officers, directors, and substantial shareholders of publicly traded companies. The filing is mandated with each transaction that involves the buying or selling of securities, ensuring that all market participants have equal access to this vital data.

Detailed components of Sec Form 4

Sec Form 4 is divided into several sections that capture comprehensive information about those involved in transaction activities. A clear understanding of its components is essential for accurate reporting.

Common terminologies to understand include 'beneficial ownership,' which refers to the rights held by an individual to vote or sell shares, and 'insiders,' which are those with access to non-public information that could influence stock prices.

Steps to complete Sec Form 4

Filling out Sec Form 4 involves several key steps to ensure accuracy and compliance. Here's how to navigate the process efficiently:

Common challenges when filing Sec Form 4

Filing Sec Form 4 can present several challenges, especially for first-time filers or those unfamiliar with the process. Common errors, such as incorrectly reporting transaction codes or missing deadlines, can lead to significant penalties. It’s vital to understand the implications of these errors as the SEC can impose fines for late or inaccurate filings.

Filers might also struggle with navigating the online filing system, which can be complex. If uncertainties arise, it may be beneficial to seek guidance from professionals well-versed in SEC regulations. This proactive step can prevent unnecessary errors and mitigate potential penalties.

Tools and resources for managing Sec Form 4 filings

Managing Sec Form 4 filings can be streamlined through various tools and resources. pdfFiller provides interactive tools designed specifically for Form 4, facilitating filling and editing processes. Users can take advantage of features such as eSigning options and collaborative capabilities, making it easy to work with team members on compliance-related tasks.

Cloud-based solutions like pdfFiller enhance document management by allowing users to access their forms from anywhere. This accessibility ensures that filing deadlines are met, and documents remain organized. Utilizing these tools can significantly reduce administrative burdens and improve compliance efficiency.

Best practices for ongoing compliance with Sec Form 4

To maintain compliance and avoid pitfalls associated with Sec Form 4 filings, several best practices can be adopted. Setting reminders for filing deadlines is crucial; implementing automated reminders ensures that no deadlines are missed.

Additionally, consistently tracking changes in ownership is essential. Staying informed on personal transactions and documenting them immediately can simplify the filing process. Integrating solutions like pdfFiller can aid in ongoing updates and document storage, making it easier to stay compliant without the added stress of disorganization.

Recent trends and insights on insider trading

Recent market movements have shown a direct link to Form 4 filings, as investors and analysts closely monitor insider trading activities for signs of market sentiment. Increased buying by insiders can signal confidence, while selling might predict potential issues. Understanding these trends is vital for investors aiming to leverage insider information.

Analyzing insider trading patterns reveals insights into company performance and investor behavior. Recent case studies highlight the importance of accurately filing Form 4, demonstrating how timely disclosures have affected stock performance positively. Keeping abreast of these trends enhances investment strategies and encourages proactive market engagement.

Related financial documents

In addition to Sec Form 4, other important forms exist in the SEC landscape, including Form 3 and Form 5. Form 3 is an initial filing that indicates beneficial ownership, while Form 5 is filed to report certain transactions that may have been omitted in Form 4.

Understanding the differences among these forms and their respective filing requirements is crucial for comprehensive compliance. Resources are available through the SEC website for accessing these forms, detailing what is required for each, thus helping filers maintain thorough documentation and compliance across all necessary filings.

Engage with interactive tools

Utilizing pdfFiller’s tools can significantly ease the process of filling out and managing Sec Form 4. With user-friendly interfaces that simplify the completion and submission of forms, users benefit from guided workflows that reduce errors and enhance compliance.

Testimonials from users highlight successful Form 4 management through pdfFiller, demonstrating its effectiveness in improving accuracy and adherence to deadlines. The interactive features and cloud capabilities foster collaboration, making it easier for individuals and teams to adhere to insider trading regulations seamlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sec form 4 from Google Drive?

How can I edit sec form 4 on a smartphone?

How do I complete sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.