Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Complete the 8-K Form: A Comprehensive Guide

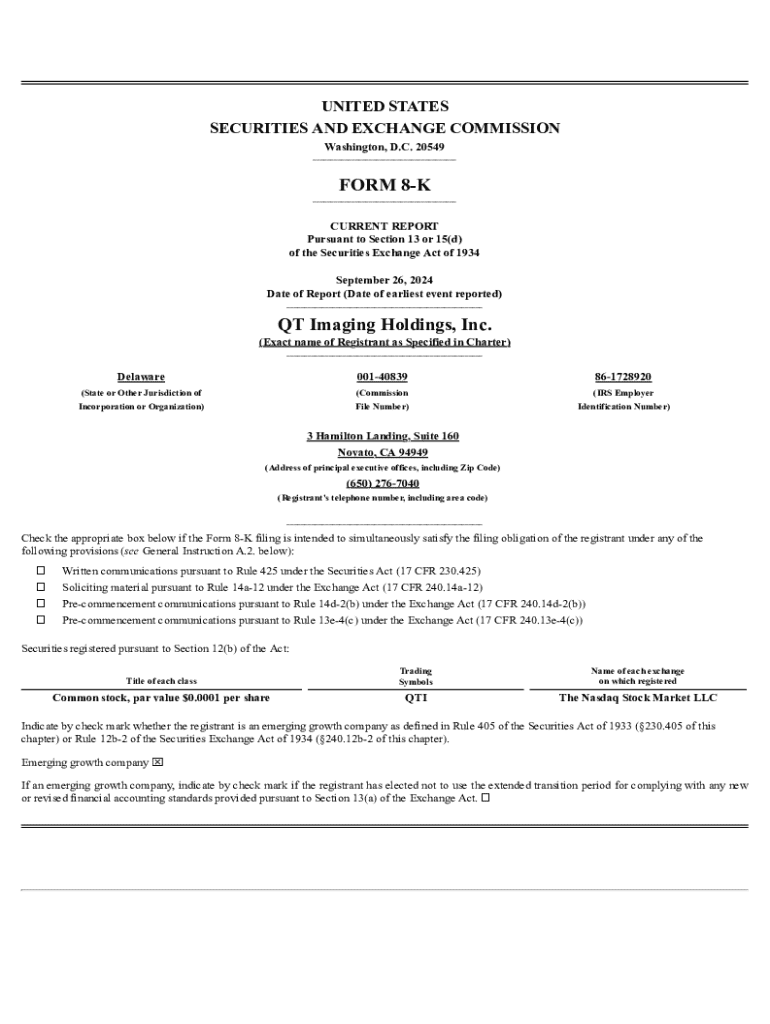

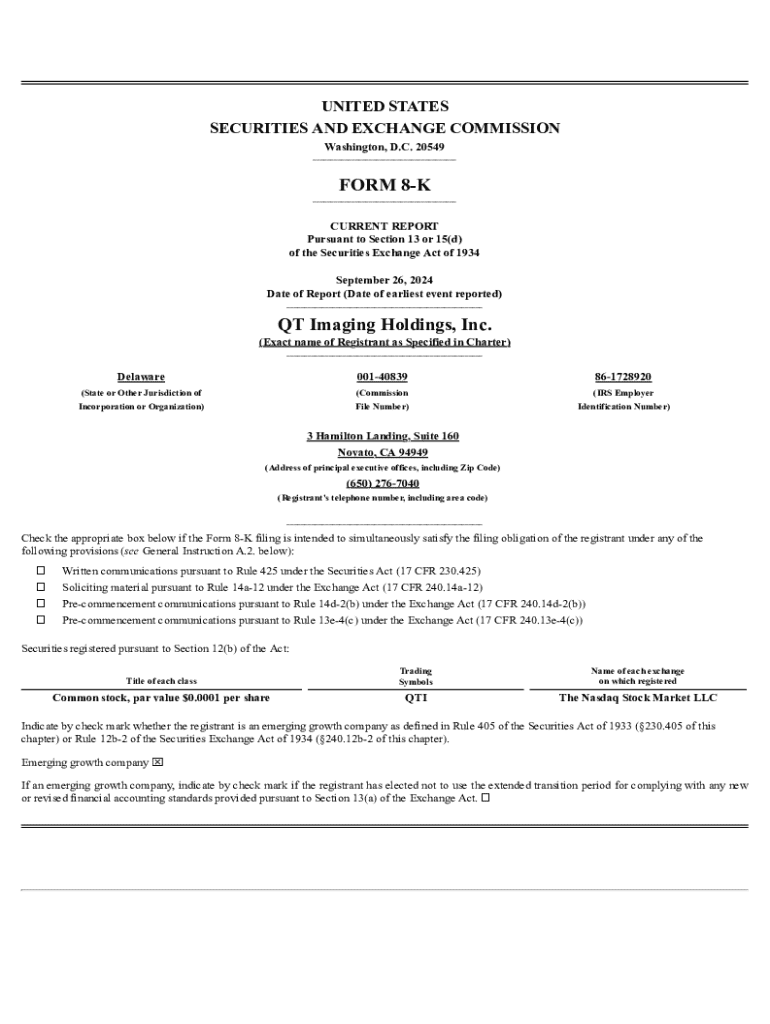

Understanding the Form 8-K

The Form 8-K is a critical document that publicly traded companies must file with the Securities and Exchange Commission (SEC) to report major events that shareholders should be aware of. Unlike other forms required by the SEC, the 8-K is designed to inform investors promptly about significant corporate events after they occur.

The primary purpose of the Form 8-K in corporate communication is transparency. It allows companies to disclose critical information to the market and stakeholders swiftly. Compliance with the 8-K requirements is not just about regulatory adherence; it is about maintaining investor trust and providing a clear understanding of a company's material changes.

When to file Form 8-K

According to SEC regulations, there are several circumstances that necessitate the filing of a Form 8-K. Companies are required to file this form when specific, material corporate events occur that might influence investors' decision-making. These events can include significant corporate transactions, such as mergers and acquisitions, changes in the executive team, restatement of financial statements, or sizeable asset transactions.

The SEC outlines that companies must submit Form 8-K within four business days following the triggering event. This timeline emphasizes the need for timely communication, as delays can lead to compliance issues and a loss of investor confidence. Companies should have robust internal processes to ensure that such filings are made promptly.

Reading and interpreting Form 8-K

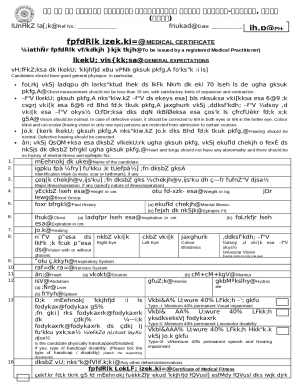

Understanding how to read and interpret the Form 8-K is crucial for stakeholders, including investors and analysts. The standard structure of a Form 8-K includes critical header information, item numbers, detailed descriptions, and a signature block, making it easier for readers to identify the nature of the disclosures.

Key sections within the Form 8-K are particularly important for stakeholders. For instance, Item 1.01 pertains to material definitive agreements, while Item 4.01 addresses changes in the registrant's certifying accountant. These items can significantly impact the perceived stability and direction of the company.

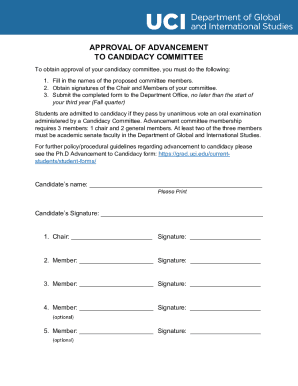

Filling out the Form 8-K

Filling out the Form 8-K can be straightforward if you follow a structured approach. Begin by gathering all necessary information related to the event requiring disclosure. Accurate data collection is essential, as incomplete or incorrect information can lead to compliance issues.

Next, identify the relevant item number that corresponds to your event. Once this is done, provide a clear and concise description, ensuring all key details are included. If applicable, incorporate any required financial disclosures, focusing on clarity and precision. Finally, ensure that necessary signatures are obtained before submission.

Filing format and submission process

Form 8-K must be filed electronically using the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. The format requirements include specific structuring of the documents, and adherence to these standards is mandatory for successful submission. When preparing the form, ensure that you adhere to all EDGAR format requirements to avoid rejections.

Submission must occur within four business days of the event, underscoring the need for efficiency in filing. After submission, companies can track the filing through the SEC website, where they can also receive confirmation of acceptance. This tracking process provides assurance to filers regarding the status of their submission.

Post-filing considerations

Once the Form 8-K has been filed, organizations should manage and archive their submissions strategically. Maintaining an organized archive of filed 8-K forms ensures quick access and reference in the future. Companies must also monitor any responses or subsequent events as these can further impact stakeholders’ perspectives on the company's activities.

Using the data disclosed in the Form 8-K can enhance stakeholder communication, emphasizing the importance of transparency. Companies should leverage these filings to reinforce trust and integrity with investors, answering questions that may arise from the disclosures.

Historical context of Form 8-K

Historically, the Form 8-K has undergone significant changes to improve regulatory transparency. Initially introduced in the 1960s, the regulations surrounding the Form have evolved, particularly after the 2002 Sarbanes-Oxley Act, which aimed to increase the accountability of financial disclosures. Significant changes often reflect broader economic trends and the growing need for corporate transparency.

Notable occurrences have marked the timelines of Form 8-K filings, such as high-profile mergers or scandals, which have led to more stringent reporting requirements. In recent years, there’s been a trend of increased filings, reflecting heightened corporate activity and regulatory scrutiny, which further emphasizes the ongoing importance of compliance.

Leveraging technology for Form 8-K management

Technology has become an essential ally for companies in managing their Form 8-K filings effectively. Various tools and platforms are available that help in drafting, filing, and archiving these critical documents. Among these, cloud-based platforms that allow collaborative editing and electronic signatures significantly enhance the filing process.

pdfFiller stands out as a robust solution that simplifies Form 8-K management. Its features streamline the filing process, allowing for collaborative editing and easy integration of eSignatures. Additionally, pdfFiller provides document tracking and management capabilities that ensure all stakeholders are in the loop, efficiently managing corporate disclosures with ease.

Conclusion: Mastering Form 8-K for greater compliance and transparency

Mastering the completion and management of the Form 8-K is not only about fulfilling regulatory requirements, but it is also crucial for fostering trust with investors and maintaining corporate integrity. Adherence to detail and timeliness in filings can prevent compliance issues and establish a reputation of transparency that resonates with shareholders.

Ultimately, as the corporate landscape evolves, so too does the importance of effective communication through tools like the Form 8-K. Companies that leverage technology and stay proactive regarding their filings are better positioned to maintain investor confidence in an ever-changing market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k for eSignature?

How do I edit form 8-k straight from my smartphone?

How do I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.