Get the free Corporate Internet Banking (cib) Services Application Form

Get, Create, Make and Sign corporate internet banking cib

How to edit corporate internet banking cib online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate internet banking cib

How to fill out corporate internet banking cib

Who needs corporate internet banking cib?

Comprehensive Guide to Corporate Internet Banking CIB Form

Understanding corporate internet banking (CIB)

Corporate Internet Banking (CIB) refers to online banking services specifically designed for businesses and organizations. CIB facilitates the management of finances through a secure internet platform, allowing companies to perform various transactions and manage their accounts efficiently.

The importance of CIB for businesses cannot be overstated. It not only simplifies financial processes but also enhances the overall efficiency of transaction management. With CIB, businesses can execute fund transfers, manage payroll, and even pay vendors from the convenience of their offices.

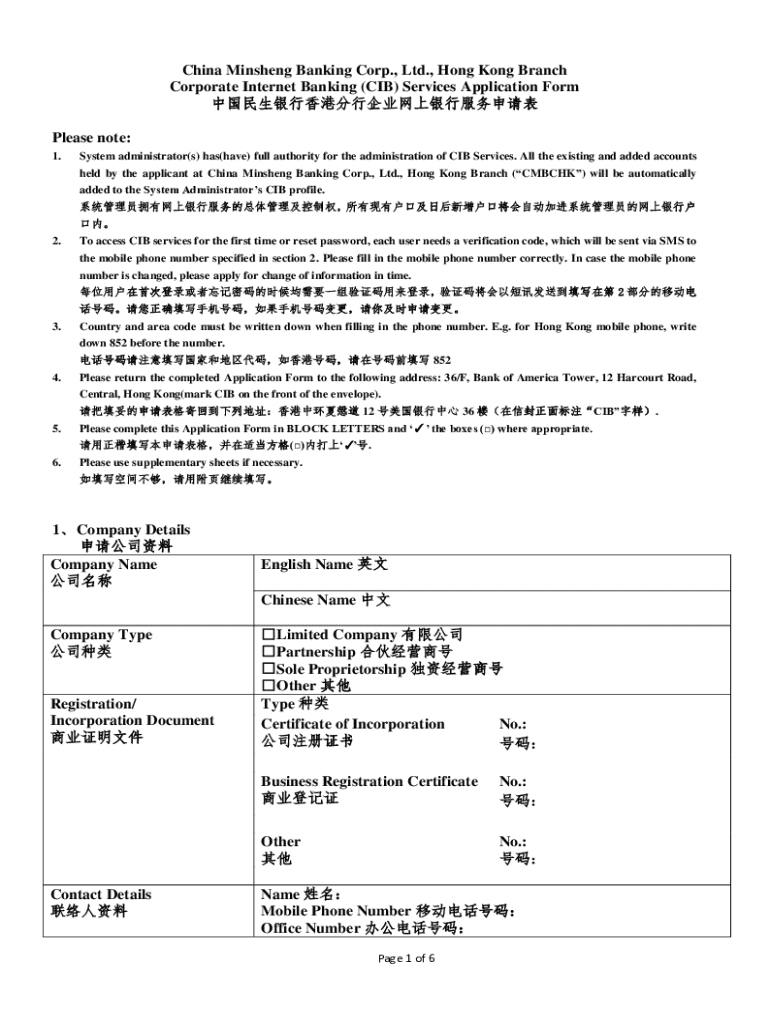

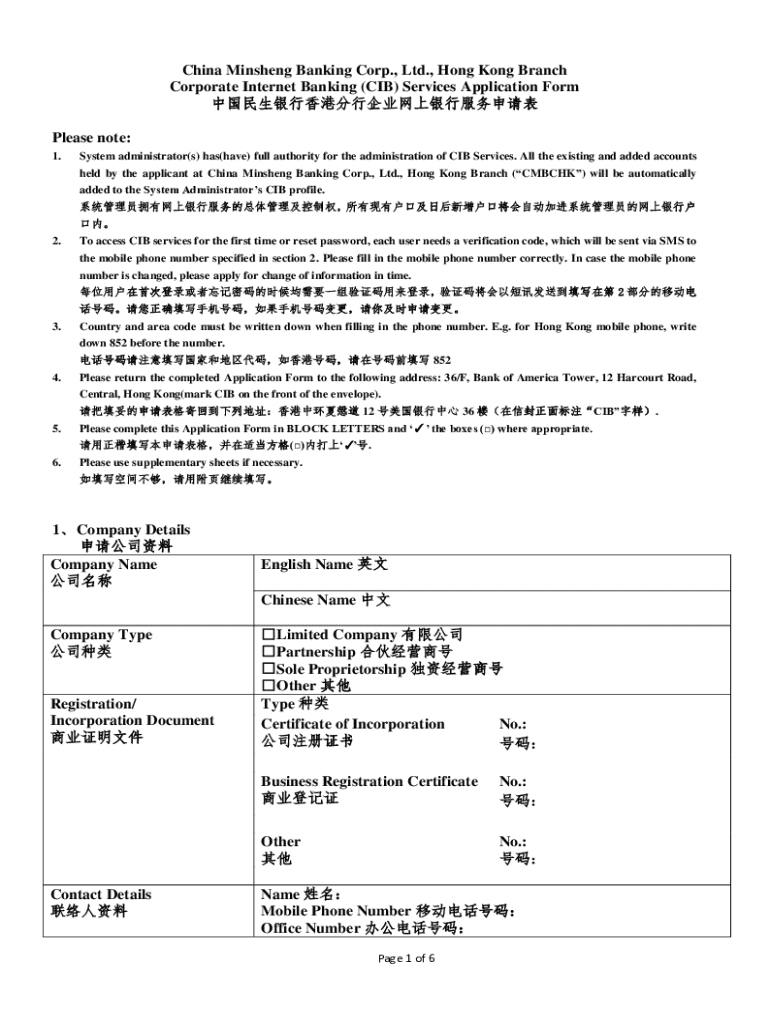

Introduction to the corporate internet banking CIB form

The Corporate Internet Banking CIB Form is a crucial document that businesses must complete to gain access to their bank's online banking services. Its primary purpose lies in streamlining the process through which a company enrolls for these services, ensuring their financial operations transition smoothly to a digital platform.

Typically, the CIB form should be completed by the individual or team responsible for managing the business's financial transactions. It is essential that the data provided is accurate and up-to-date, as incorrect information may lead to delays in account setup and service access.

Steps to access the corporate internet banking CIB form

Accessing the Corporate Internet Banking CIB Form is usually straightforward. Most banks provide this form on their official websites, allowing businesses to download or fill the form online.

If you're unable to find the form on your bank’s website, alternative options include visiting your local branch for a printed version or obtaining a PDF copy directly from customer service.

Filling out the corporate internet banking CIB form

Completing the Corporate Internet Banking CIB Form accurately is vital for a successful application. The form typically requires key information, including business identification details and authorized personnel involved in banking operations.

Sections commonly found in the CIB form include corporate details such as the registered business name and address, as well as banking preferences that specify the functions you need access to, like fund transfers or reporting features.

Editing and reviewing the CIB form

Once you've filled out the CIB Form, it’s essential to review it meticulously before submission. Any errors, whether in the business information or authorized users, can result in delays or rejections.

Common mistakes to avoid include typos in the business identification numbers or incorrect contact information. To streamline the reviewing process, using electronic tools such as pdfFiller can enhance the accuracy of your submission.

Signing the corporate internet banking CIB form

After filling out the CIB Form, signing it is the next step. Understanding the legality of eSignatures is crucial, as they are often accepted by banks given certain conditions of consent and intent.

Using platforms like pdfFiller makes it easy to eSign the form. The step-by-step process typically involves reviewing the document for final touches before applying your electronic signature.

Submitting the corporate internet banking CIB form

The submission of the Corporate Internet Banking CIB Form can be done through various methods, primarily online submission or via email. Online submission typically requires uploading the completed form directly to the bank's secure portal.

After submitting the form, be prepared to receive a confirmation of receipt from your bank, which will guide you on the expected timeline for account setup and other follow-up actions.

Managing your corporate internet banking access

Once your corporate internet banking account is active, managing access is critical. You may need to request changes to your financial access, such as adding or removing authorized users, which can generally be done through your bank's online platform.

Effective document management is also an essential aspect of corporate internet banking. Utilizing tools like pdfFiller can greatly enhance collaboration among your team while ensuring all financial documents are securely stored and easily accessible.

Troubleshooting common issues

Challenges can arise while completing the Corporate Internet Banking CIB Form. Frequently encountered issues include technical errors in submission or accidental errors in form completion. A proactive approach involves knowing how to address these problems effectively.

If you encounter any issues, contacting your bank's support channels is always advisable. Additionally, leveraging helpful resources from platforms like pdfFiller can provide guidance through common troubleshooting steps.

Benefits of using pdfFiller for corporate banking documents

Adopting pdfFiller as your go-to resource for corporate banking documents can yield numerous benefits. By streamlining document creation and management, it enhances overall efficiency in handling corporate banking tasks.

Furthermore, the platform ensures accessibility from anywhere and boasts strong security features, which are critical for handling sensitive financial data. Notably, pdfFiller’s collaborative tools facilitate team efficiency, making it an invaluable asset in managing your corporate banking needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit corporate internet banking cib online?

Can I create an electronic signature for signing my corporate internet banking cib in Gmail?

How do I complete corporate internet banking cib on an Android device?

What is corporate internet banking cib?

Who is required to file corporate internet banking cib?

How to fill out corporate internet banking cib?

What is the purpose of corporate internet banking cib?

What information must be reported on corporate internet banking cib?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.