Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Comprehensive Guide to Form 8-K: Understanding, Filling, and Managing

Understanding Form 8-K

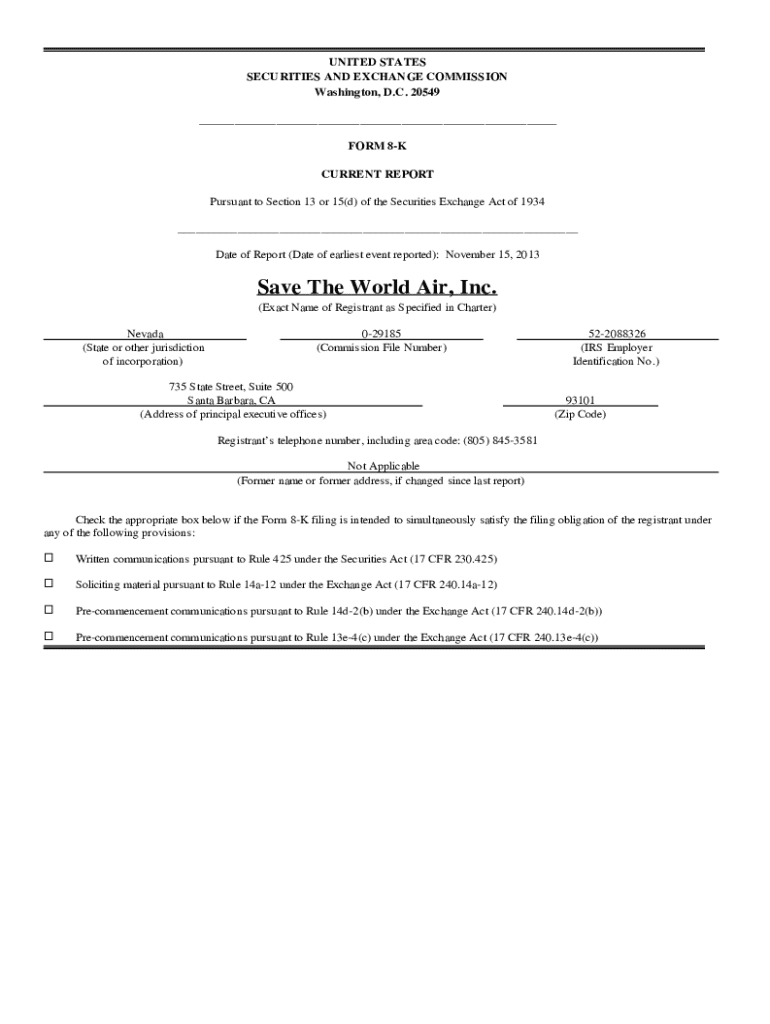

Form 8-K, known as the Current Report, is a crucial component of the Securities and Exchange Commission (SEC) filings for public companies. Its primary purpose is to inform investors and the market of significant events that occur between the quarterly and annual reports, thereby ensuring transparency and accountability. This form encompasses a range of material events, from acquisitions to changes in corporate governance, making it an essential tool for investors seeking timely information about a company's performance and strategy.

For public companies, the importance of Form 8-K cannot be overstated. It not only aids in maintaining regulatory compliance but also helps in fostering investor confidence. By providing timely updates, companies can mitigate misinformation and potential stock volatility. The regulatory requirements for filing this form demand that companies act quickly, typically requiring a submission within four business days of the triggering event.

Key components of Form 8-K

Form 8-K is divided into specific sections, each designed to capture various types of information relevant to the event being reported. Understanding these components is vital for accurate reporting. The form begins with General Information, covering the nature of the event, followed by Financial Information, which includes disclosures about earnings and financial statements. Security Holder Matters address governance issues, while Other Events provide a catch-all for various occurrences that may be material to investors.

Each section of the form plays a critical role in conveying necessary information. For instance, if a company announces a merger or acquisition, it must detail the terms under General Information and provide the financial implications under Financial Information. Attachments and exhibits enhance the narrative with supporting documents, while proper signatures authenticate the submission. Ensuring completeness in submitting all required sections is paramount for compliance.

When is Form 8-K required?

Certain events trigger the obligation to file Form 8-K. These include significant corporate changes like the acquisition or disposition of assets, bankruptcy declarations, and critical shifts in control or leadership. Companies ought to be vigilant about the nature of their activities, as failure to file timely reports can lead to penalties and diminished investor trust.

The SEC mandates that companies file Form 8-K within four business days following the event. Complying with this timeline is essential to avoid reputational harm. Additionally, companies should be aware of common pitfalls, such as incomplete disclosures or misunderstandings of what constitutes a material event, to ensure compliance.

How to access and fill out Form 8-K using pdfFiller

Accessing Form 8-K through pdfFiller streamlines the filing process. Users can start by locating the Form 8-K on the pdfFiller platform, where various templates are readily available. The intuitive design allows users to fill out the form easily, ensuring that all necessary sections are completed accurately.

To fill out the Form 8-K, follow these steps: First, input your basic company information, including the name, SEC Central Index Key (CIK), and reporting period. Next, complete the sections regarding financial releases and any financial statements that need to be disclosed. Lastly, ensure you add any relevant attachments, such as agreements or financial documents, as exhibits to provide context and support for your filings.

Managing and submitting Form 8-K

Once the Form 8-K is completed, pdfFiller provides robust options for managing your document. You can save and edit your form within the platform, making collaboration straightforward, especially in team environments. eSigning options are also available, allowing you to obtain necessary approvals swiftly.

The final submission process to the SEC is facilitated through pdfFiller, ensuring compliance with all necessary regulations. Users can track submissions directly through the platform, which simplifies record-keeping and facilitates adherence to filing deadlines.

Post-filing actions and considerations

After submitting Form 8-K, it's crucial to keep track of any changes that may arise. Ongoing communication with stakeholders regarding updates or additional filings can help maintain confidence. Keeping abreast of industry developments and monitoring Form 8-K filings from competitors can also provide strategic insights that will enrich your investor relations.

Utilizing insights drawn from Form 8-K filings can provide substantial leverage in managing investor relationships. By being proactive and transparent about corporate matters, companies can not only enhance their credibility but also strengthen investor loyalty over time.

Historical context and evolution of Form 8-K

Form 8-K has undergone significant changes since its inception, reflective of evolving regulatory frameworks and market demands. Understanding the historical context of Form 8-K enhances one's comprehension of its current requirements and best practices. Over the years, landmark cases have shaped how public companies report material events, reinforcing the emphasis on transparency and timely disclosures.

By analyzing key changes in the regulatory landscape surrounding Form 8-K, companies can better appreciate the rationale behind strict filing requirements. These historical insights can guide firms in refining their compliance strategies and ensuring they meet current deadlines effectively.

Tools and best practices for effective document management

Leveraging pdfFiller’s features offers a comprehensive solution to document organization, particularly for regulatory forms like Form 8-K. With tools for version control, users can manage multiple iterations of the form ensuring all changes are documented and tracked effectively.

Staying updated with SEC rules and continually training teams on efficient document management practices further enhances compliance. By creating a structured approach to managing filings, companies can mitigate risks associated with delayed or inaccurate submissions.

Interactive features on pdfFiller for enhanced document engagement

pdfFiller’s platform offers interactive features that greatly improve document engagement. Real-time collaboration and feedback options mean multiple stakeholders can contribute to Form 8-K submissions without the inefficiencies of back-and-forth emails. This collaborative approach not only speeds up the process but also enhances accuracy.

Furthermore, customizable templates for frequently used items common in Form 8-K can streamline future filings. Engaging with stakeholders through built-in communication tools ensures clarity and cohesion, making the filing process seamless.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8-k for eSignature?

Where do I find form 8-k?

Can I create an eSignature for the form 8-k in Gmail?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.