Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

How to edit form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Form 5500-SF Form How-to Guide

Understanding the Form 5500-SF

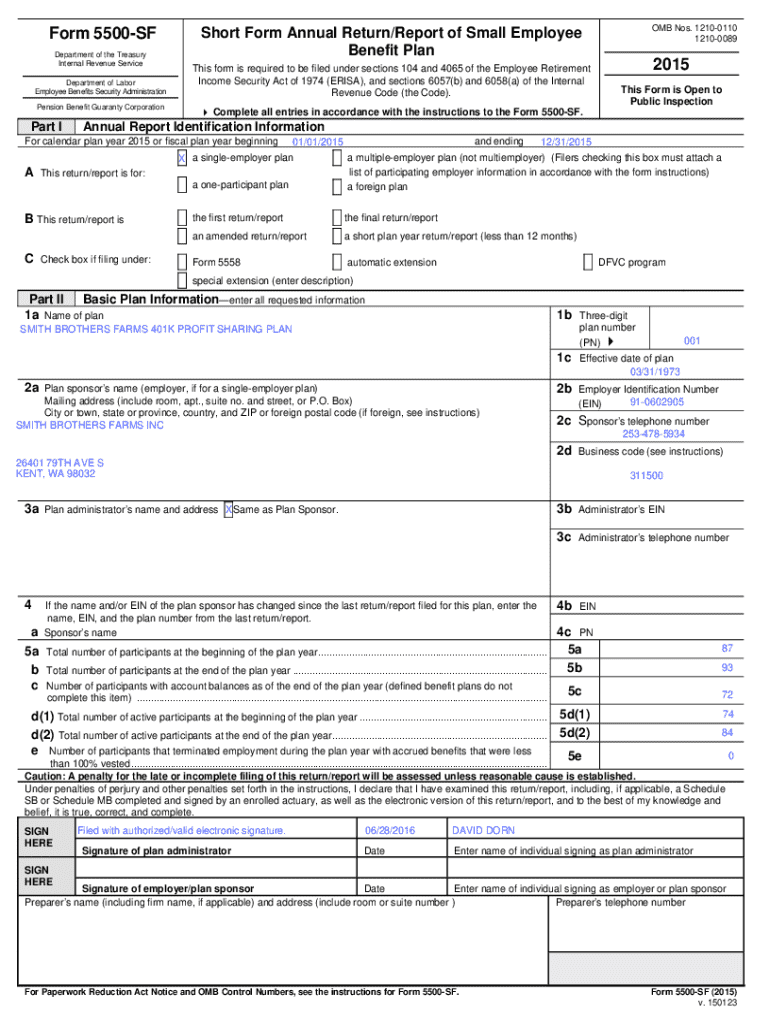

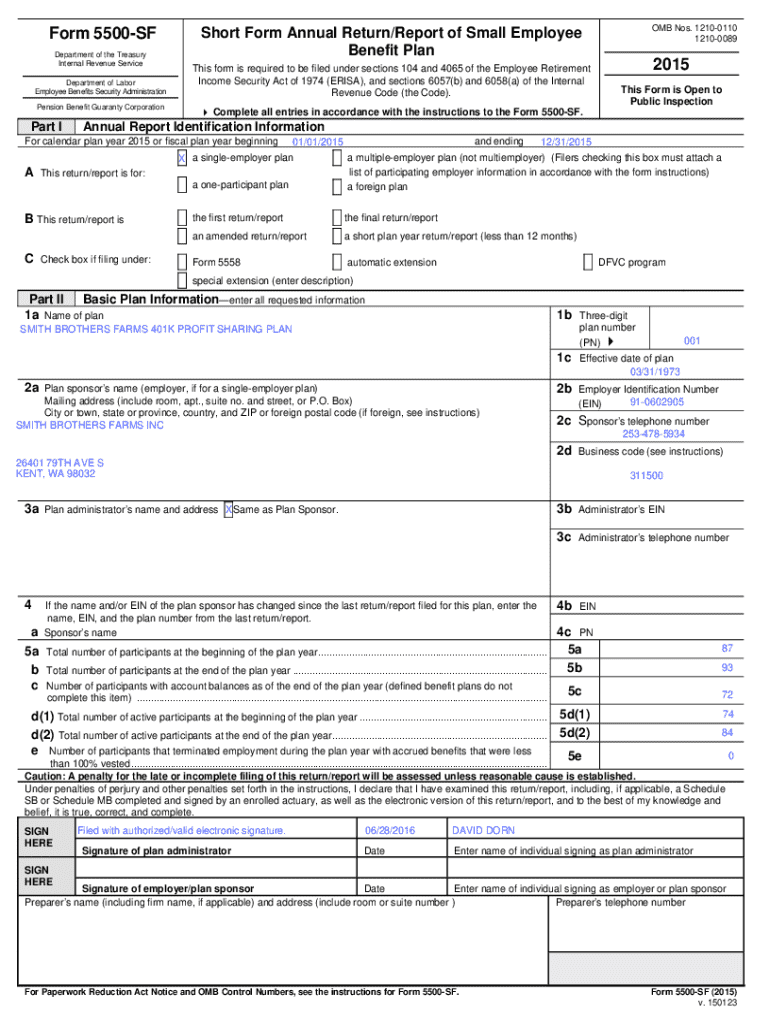

Form 5500-SF, or the 'Short Form Annual Return/Report of Employee Benefit Plan,' serves as a critical document that simplifies the filing process for small employee benefit plans. Designed for use by small plans in compliance with Section 103 of the Employee Retirement Income Security Act (ERISA), this form allows these plans to provide necessary information to the Department of Labor (DOL) and the Internal Revenue Service (IRS) efficiently.

The significance of the Form 5500-SF lies in its obligation for small employee benefit plans to disclose financial conditions, investments, and operations, fostering trust and security among participants.

Who needs to file Form 5500-SF?

Filing Form 5500-SF is not a matter of choice; certain entities are required to fulfill this obligation. Mainly, any small employee benefit plan with fewer than 100 participants at the start of the plan year must file this form. This includes various plans such as health and welfare plans, pension plans, and certain 401(k) plans. Organizations like sole proprietorships, partnerships, and corporations managing employee benefit plans fall under this category.

Key components of Form 5500-SF

Understanding the components of Form 5500-SF is essential for accurate reporting. The form is structured into several distinct parts, each designed to capture critical information about the plan and its financial status.

Part : Annual report identification information

This section requires basic identifiers for the plan, including the plan name, plan sponsor information, and the plan year. Failing to provide accurate details can lead to processing delays.

Part : Basic plan information

Essential details regarding the plan's type and structure are included here. Types of plans may range from defined benefit plans to health and welfare plans, and understanding these distinctions is crucial.

Part : Financial information

This key section entails reporting on the financial condition of the plan, including assets and liabilities. Accurate financial reporting is vital, as discrepancies can trigger audits.

Part : Plan characteristics

In this section, the form captures characteristics specific to the plan type, which may include demographics of participants and any changes throughout the year.

Part : Compliance questions

Compliance inquiries cover aspects like audits and investment procedures, ensuring that the plan adheres to regulatory standards.

Part : Pension funding compliance

This part deals with pension funding requirements, crucial for defined benefit plans, which must meet specific funding levels to protect participants.

Part : Plan terminations and transfers of assets

Filing requirements during plan terminations or transfers are outlined here, ensuring that any asset movements comply with established protocols.

Filing process for Form 5500-SF

The filing process for Form 5500-SF involves several essential steps, beginning with preparation. Gathering necessary documents such as plan financial statements, participant data, and compliance information is crucial for a smooth submission.

How to prepare for filing

Start by establishing a DOL account to maintain ongoing compliance and facilitate filing. This account serves as a central hub for all filings and deadlines.

How to submit Form 5500-SF

The most efficient method to submit Form 5500-SF is electronically through the DOL’s EFAST2 system. This system is user-friendly and guides you through the steps to fill out and submit your form. While the electronic submission is largely straightforward, there are common errors to look out for, including incorrect participant counts and inaccuracies in financial data.

Filing deadlines and extensions

The deadline for filing Form 5500-SF is typically the last day of the seventh month after the end of the plan year. Organizations can apply for an extension using Form 5558. Be aware that extensions apply to the filing deadline but not to any required plan contributions.

Handling delinquent filings

If a deadline is missed, it’s essential to take prompt action. The Delinquent Filer Voluntary Compliance Program (DFVCP) can provide relief by allowing organizations to file late with reduced penalties and enhanced compliance terms.

Common mistakes and troubleshooting

Errors during the filing of Form 5500-SF can lead to serious compliance repercussions. Understanding frequent pitfalls can help prevent mistakes and ensure accurate filings.

Frequent errors in Form 5500-SF filing

To ensure accuracy, take the time to review all data before submission. Utilizing checklists can be beneficial to resolve potential discrepancies.

FAQs on Form 5500-SF

Common inquiries often focus on specific eligibility requirements and filing intricacies. Many ask about the distinctions between different forms, especially concerning exempt plans. Recognizing which plans are subject to filing and which can exempt terminates the confusion.

Additional considerations

Once Form 5500-SF is filed, organizations must stay aware of ongoing compliance requirements. Failing to meet these could lead to significant penalties, ultimately affecting the plan’s standing.

Maintaining compliance post-filing

Staying compliant involves regularly reviewing plan documents and ensuring any changes are reflected in future filings. The need for continuous education on updates to regulations ensures both plan sponsors and participants are adequately protected.

Resource links for further assistance

For those seeking additional guidance on compliance, it’s beneficial to consult the DOL website or engage with experts specializing in employee benefits. These resources can help clarify any uncertainties surrounding Form 5500-SF.

Leveraging pdfFiller for Form 5500-SF

pdfFiller emerges as a pivotal tool for individuals and teams navigating the complexities of Form 5500-SF. Its features simplify document creation, editing, and e-signing, making the process far more manageable.

How pdfFiller simplifies Form 5500-SF management

Using a cloud-based platform, pdfFiller enhances collaboration by allowing multiple users to access and edit documents concurrently. This adaptability aids in gathering necessary information swiftly while ensuring data accuracy.

User testimonials and success stories

Numerous clients have shared their success stories, highlighting how pdfFiller has streamlined their filing processes and helped avoid unnecessary penalties, illustrating the platform's comprehensive value in managing important documents like the Form 5500-SF.

Staying informed

Regular updates on Form 5500-SF changes are vital for compliance. Staying abreast of these updates ensures that organizations are always aligned with the latest regulatory expectations, preventing possible penalties that could arise from outdated practices.

Updates on Form 5500-SF changes

Subscribing to newsletters or maintaining connections with professional organizations can provide timely insights about Form 5500-SF adjustments and general compliance best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 5500-sf?

Can I sign the form 5500-sf electronically in Chrome?

Can I create an electronic signature for signing my form 5500-sf in Gmail?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.