Get the free 2024 Form Ri-1040h - tax ri

Get, Create, Make and Sign 2024 form ri-1040h

Editing 2024 form ri-1040h online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form ri-1040h

How to fill out 2024 form ri-1040h

Who needs 2024 form ri-1040h?

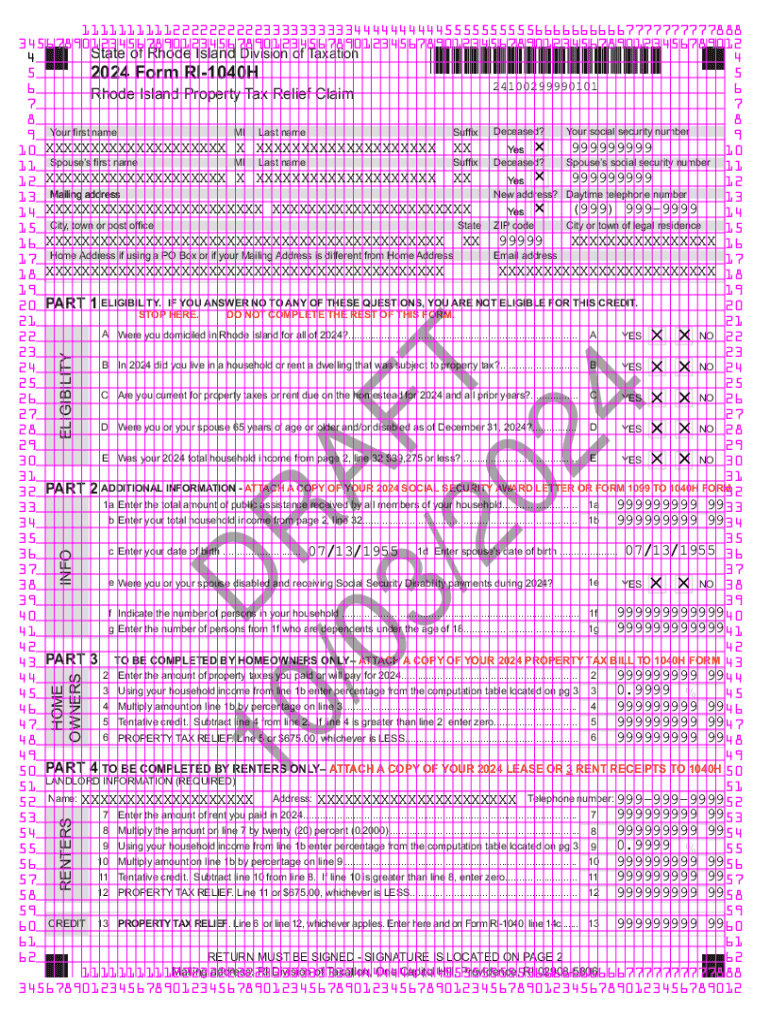

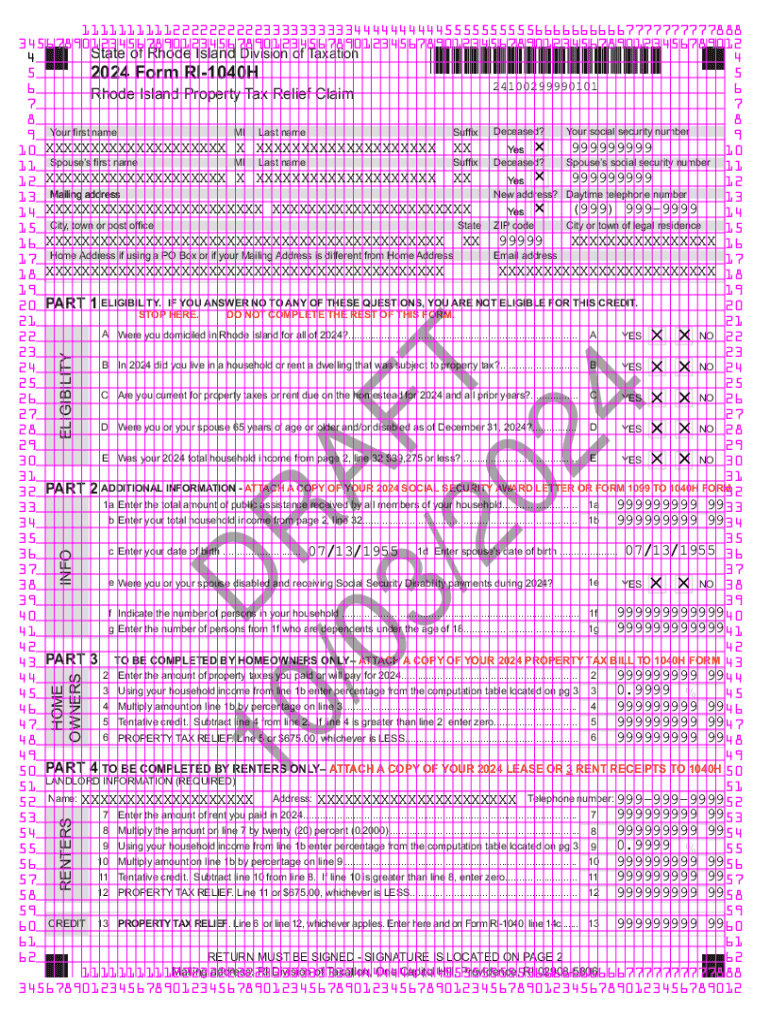

Comprehensive Guide to the 2024 Form RI-1040H: Understanding Property Tax Relief

Overview of Form RI-1040H

The 2024 RI-1040H Form is an essential document for Rhode Island residents seeking property tax relief. This form is crucial during the tax filing season as it allows qualifying individuals and families to claim rebates for property taxes paid. The inclusion of the RI-1040H Form in the tax filing process highlights the state's ongoing commitment to supporting its residents, especially those who may face financial challenges.

Property tax relief is not just a financial benefit but also a critical component of state policy that aims to alleviate the burden of taxes on homeowners. These rebates can significantly impact a family’s financial stability, allowing them to allocate funds toward other necessary expenses—such as healthcare, education, and daily living costs.

Key changes for 2024

For 2024, the RI-1040H Form has undergone several updates. Noteworthy among these are the newly introduced sections that provide more detailed guidance on eligibility and documentation requirements. The changes also aim to simplify the application process, reducing the time and effort needed to submit the necessary information.

Additionally, there have been revisions to the eligibility criteria, adapting to the current economic landscape. These updates help ensure that more residents who are struggling with property taxes can receive the necessary support. Understanding these changes is vital for anyone looking to navigate the filing process effectively.

Understanding the eligibility requirements

Who qualifies for the RI-1040H? The eligibility for this form is primarily based on specific criteria, which include the following:

Special considerations are also taken into account for individuals in unique circumstances, such as veterans or those with disabilities. These groups may have different guidelines that can further facilitate their eligibility for property tax relief.

How to complete the 2024 form RI-1040H

Completing the 2024 Form RI-1040H can be a straightforward process if followed step-by-step. Here’s how to do it effectively:

Tools for filling out your form

Utilizing pdfFiller to fill out the 2024 Form RI-1040H offers numerous advantages. With interactive features designed for ease of use, pdfFiller allows users to edit, sign, and manage their documents seamlessly. The platform ensures that you can fill out the form accurately and efficiently, with built-in prompts guiding you through each section.

Moreover, pdfFiller's eSignature feature enables you to sign the form electronically, which can expedite the submission process. You can also collaborate with family members or advisors in real-time, enhancing overall communication and ensuring that every detail is correct before finalizing your submission. Accessing cloud-based solutions further enhances your experience, allowing you to manage the form from anywhere securely.

Submitting the form

Once you have completed the 2024 Form RI-1040H, several filing options are available. Residents can choose to submit the form online using state tax portals, which is usually the most efficient method. Alternatively, you can mail the completed document to the appropriate tax office or deliver it in person to ensure it is received by the deadline.

It's vital to keep in mind the important deadlines for submission. Typically, the forms must be filed by the same date as individual income tax returns, which is usually on or around April 15th. Planning ahead and keeping track of these dates can help prevent any last-minute rush and associated stress.

Common pitfalls and tips to avoid them

Filing the 2024 RI-1040H Form can come with its challenges. Frequent mistakes encountered by filers often include miscalculating the tax relief amount, failing to provide complete property details, or not adhering to the updated eligibility criteria. Such errors can lead to delays or even denial of claimed tax relief.

To ensure successful submission, consider these best practices: double-check all entries, refer to the latest instructions provided with the form, and utilize tools like pdfFiller, which offer validation prompts. Engaging in thorough preparation can significantly increase your chances of a smooth filing experience.

Frequently asked questions (FAQs)

Questions often arise regarding the RI-1040H, including concerns about eligibility, the process of amendments, and general clarifications. Common queries involve what to do if your income increases after filing or how to amend a submitted form. Having access to accurate resources online or contacting state tax help centers can provide you with the information needed.

For those seeking further assistance, official Rhode Island state tax resources and helplines are valuable tools. They can offer specific guidance tailored to your situation, ensuring you understand your rights and responsibilities as a taxpayer.

Related tax forms and resources

In addition to the RI-1040H Form, there are other relevant forms connected to property tax relief. These may include individual tax return forms that also accommodate applications for various deductions and credits.

Direct links to government resources can help you access official forms, detailed guidelines, and updates on tax obligations. Being aware of these additional resources can help create a comprehensive financial plan that encompasses all available relief options.

User testimonials and success stories

Many users of pdfFiller have shared success stories regarding their experiences in filing the RI-1040H. For instance, individuals have highlighted how the platform simplified the often-complex documentation process, allowed them to avoid common pitfalls, and ensured that their forms were submitted correctly and on time. The ease of use and reliability of pdfFiller's tools not only saves time but also alleviates stress during tax season.

Such testimonials serve as encouragement for first-time filers, showcasing real-life benefits that come from leveraging modern document management solutions like pdfFiller. Users leave informed and confident, knowing they can access help and information anytime during their filing journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 form ri-1040h online?

Can I create an eSignature for the 2024 form ri-1040h in Gmail?

How do I complete 2024 form ri-1040h on an Android device?

What is 2024 form ri-1040h?

Who is required to file 2024 form ri-1040h?

How to fill out 2024 form ri-1040h?

What is the purpose of 2024 form ri-1040h?

What information must be reported on 2024 form ri-1040h?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.