Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Your Comprehensive Guide to Form 990-EZ

Understanding Form 990-EZ

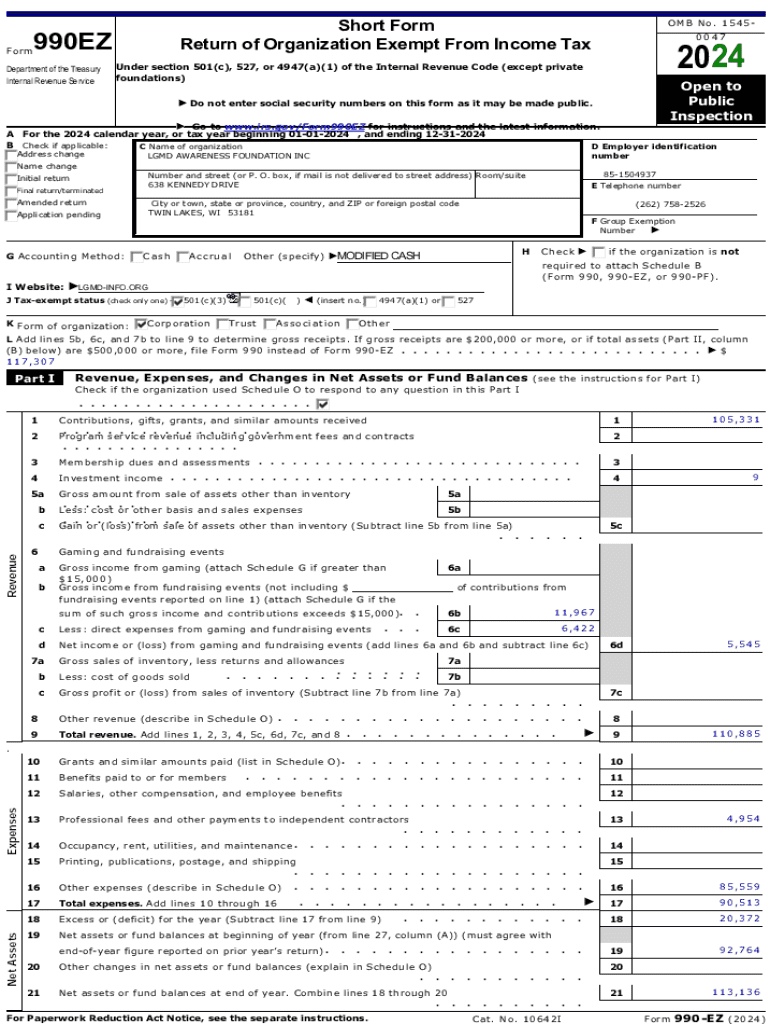

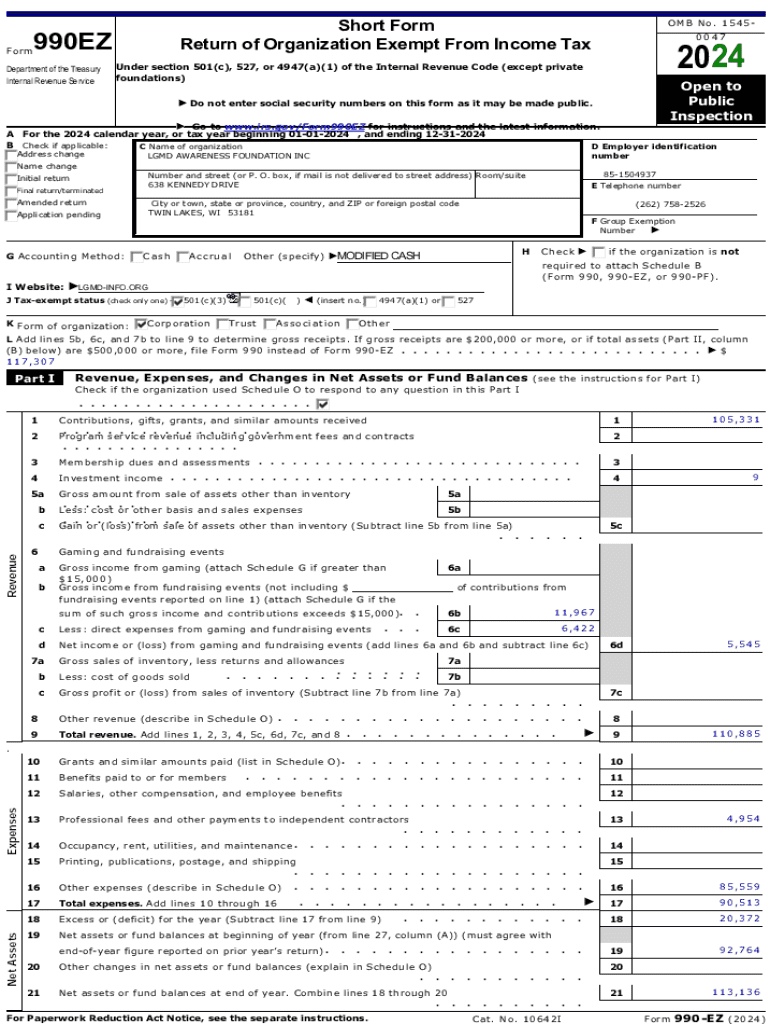

Form 990-EZ is a streamlined version of the IRS Form 990, designed specifically for small to mid-sized tax-exempt organizations. It serves as an annual reporting return that offers the IRS and the public insight into the financial health, governance, and operations of nonprofits. By providing detailed financial information, Form 990-EZ plays a critical role in assuring transparency and accountability within the nonprofit sector.

The significance of Form 990-EZ cannot be overstated. It simplifies the filing process for smaller organizations, allowing them to report their income, expenses, and program activities without the extensive detail required by the full Form 990. Importantly, understanding the nuances between Form 990 and Form 990-EZ is essential; while the former is mandatory for larger organizations with gross receipts over $200,000 or assets exceeding $500,000, Form 990-EZ caters to those with gross receipts between $50,000 and $200,000, and assets under $500,000.

Who needs to file Form 990-EZ?

Organizations that must file Form 990-EZ typically fall into specific criteria. Mainly, those with annual gross receipts between $50,000 and $200,000 and total assets below $500,000 are required to file. Additionally, certain religious organizations and state institutions may also be exempt from this requirement, emphasizing the need to evaluate individual circumstances.

Small nonprofits often face unique challenges regarding compliance with tax regulations. For these organizations, filing Form 990-EZ not only fulfills IRS requirements but also builds trust with donors by demonstrating their commitment to transparency and fiscal responsibility. It's crucial for these organizations to stay informed about updates in tax law, ensuring they meet their obligations without unnecessary complications.

Filing deadlines for Form 990-EZ

The IRS establishes an annual deadline of May 15th for Form 990-EZ submissions for organizations operating on a calendar year. Timeliness is essential; missing this deadline can lead to penalties, including fines up to $20 per day, capped at $10,000 or 5% of the organization's gross receipts, whichever is less. Ensuring timely submission is not just about compliance; it's vital for maintaining the organization's good standing with the IRS and stakeholders.

If additional time is needed to gather necessary information, organizations can request a six-month extension by filing Form 8868. Understanding key dates and having a systematic approach to managing deadlines can significantly reduce the stress associated with filing. Here are essential dates to consider: - Regular Filing Deadline: May 15 - Extension Request Deadline: May 15 - Extended Filing Deadline: November 15

E-Filing Form 990-EZ: A step-by-step guide

Preparing for e-filing

Before starting the process of e-filing Form 990-EZ, gathering the necessary information and documents is paramount for a smooth experience. Essential documents include recent financial statements, a list of board members, and details of program activities and expenses. Setting up an account on a platform like pdfFiller is simple and provides a user-friendly interface for filling out the form.

Filling out Form 990-EZ online

Using pdfFiller provides access to interactive tools that enhance the e-filing process. Each section of Form 990-EZ is intuitive, with prompts that guide users through complex items such as revenue sources or expense categorization. Taking advantage of these interactive sections ensures that the information is accurate, comprehensive, and compliant with IRS standards.

Reviewing and signing your form

Once the form is completed, an internal audit checklist can help ensure accuracy. Items to consider include verifying financial figures, cross-referencing with previous reports, and confirming that all board members are accurately listed. PdfFiller allows users to securely sign documents electronically, adding a layer of convenience.

Submitting your form

The submission process through pdfFiller is straightforward. After verifying the form for accuracy, users can submit their Form 990-EZ directly through the platform. Post-submission, it's crucial to track your submission status to confirm receipt and address any potential issues promptly.

Common questions about Form 990-EZ

Many organizations have pressing questions regarding their obligations around Form 990-EZ. Common queries include what penalties exist for late filing. The IRS can impose fines of $20 for each day the form is late, with substantial caps based on gross receipts. If an organization discovers an error in a previously filed Form 990-EZ, it is essential to amend the return promptly, using the appropriate IRS guidelines.

Another common inquiry involves reporting unrelated business income. If an organization has unrelated business income, it must file Form 990-T alongside Form 990-EZ to report the taxable amounts. Familiarizing oneself with these requirements can help organizations maintain compliance and avoid penalties.

Supported schedules and forms related to Form 990-EZ

When filing Form 990-EZ, organizations may need to attach various schedules that provide additional details about their operations and finances. Important schedules include Schedule A, which outlines public charity status and public support; Schedule B, which details significant contributors; and Schedule C, which provides information regarding donor advisories. Understanding the relevance of these schedules is critical, as they enrich the data furnished to both the IRS and the public, thus increasing transparency.

For organizations that require comprehensive reporting, the need for these schedules can add complexity. By ensuring a thorough grasp of which schedules apply, organizations can better prepare for the requirements specific to their operations.

Additional resources for nonprofits

Numerous resources are available to aid nonprofits in navigating the Form 990-EZ filing process. PdfFiller provides an array of tools and templates significant for document management. Additionally, accessing instructional videos can offer further guidance, equipping organizations with crucial knowledge about the complexities of tax filings. Understanding related forms, such as Form 990, Form 990-N, Form 990-PF, and Form 990-T, enhances the organization's overall compliance strategy.

By taking advantage of these resources, nonprofits can strengthen their operational integrity and ensure mission alignment with community expectations.

Tips for successful filings and compliance

For an effective filing process, organizations should adhere to best practices for maintaining accurate records. This includes regularly updating financial statements, documenting board meetings, and storing digital copies of previous returns. Choosing the right method for preparation, whether through in-house resources or professional assistance, can make the difference between a successful filing and costly mistakes.

Collaboration among team members can also ensure accountability. Keeping lines of communication open and distributing tasks related to filing helps to create a comprehensive understanding of the necessary requirements.

Benefits of using pdfFiller for your Form 990-EZ

Utilizing pdfFiller for managing Form 990-EZ filings offers remarkable benefits. Its cloud-based platform ensures that all documents are organized and easily accessible, facilitating collaboration among team members no matter their location. This level of document management is vital in today’s dynamic nonprofit environment where teams often work remotely.

Furthermore, pdfFiller's user-friendly interface simplifies the e-filing process, allowing users to focus on filling in accurate information and understanding the nuances of their reports rather than getting bogged down by technical difficulties.

Key insights for e-filing Form 990-EZ

Understanding the IRS's mandate on electronic filing is crucial for compliance. While paper forms are still accepted, e-filing is strongly encouraged. The IRS is progressively moving towards digital solutions, signaling that future filings may require electronic submission to maintain compliance. Organizations should stay informed about these changes, including potential legislative updates that may affect Form 990-EZ in the coming years.

The importance of timely filing cannot be overstated; in addition to avoiding penalties, timely filings contribute to the overall health of the organization, enhancing eligibility for funding and improving public trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990-ez in Gmail?

How do I make edits in form 990-ez without leaving Chrome?

Can I edit form 990-ez on an iOS device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.