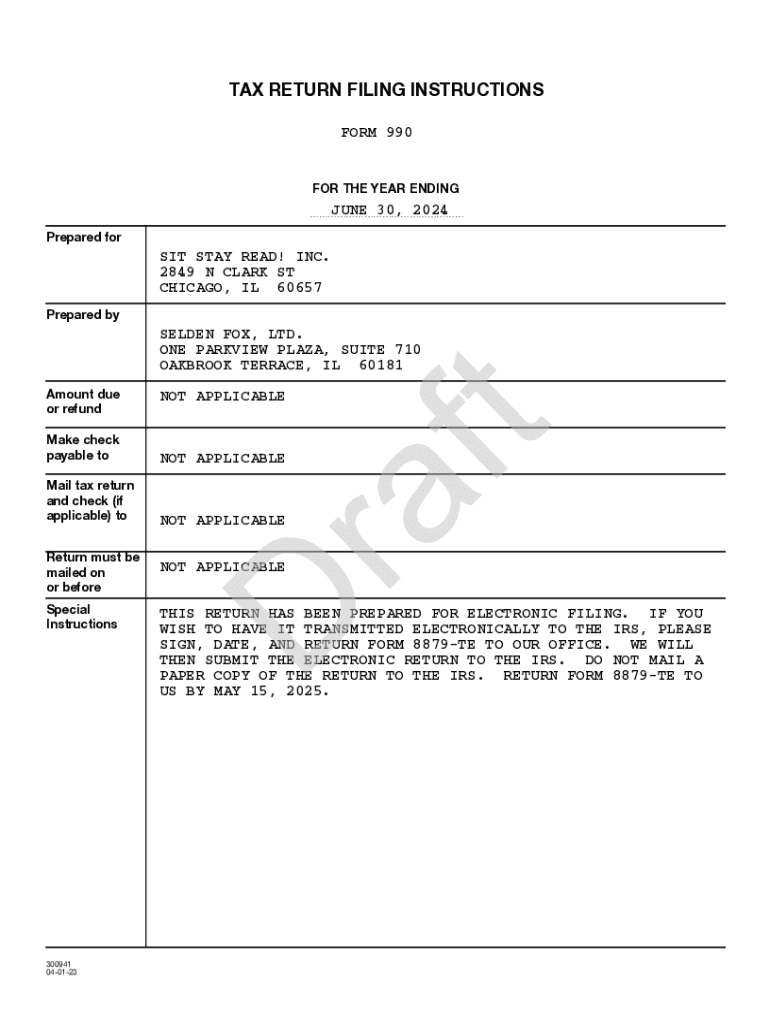

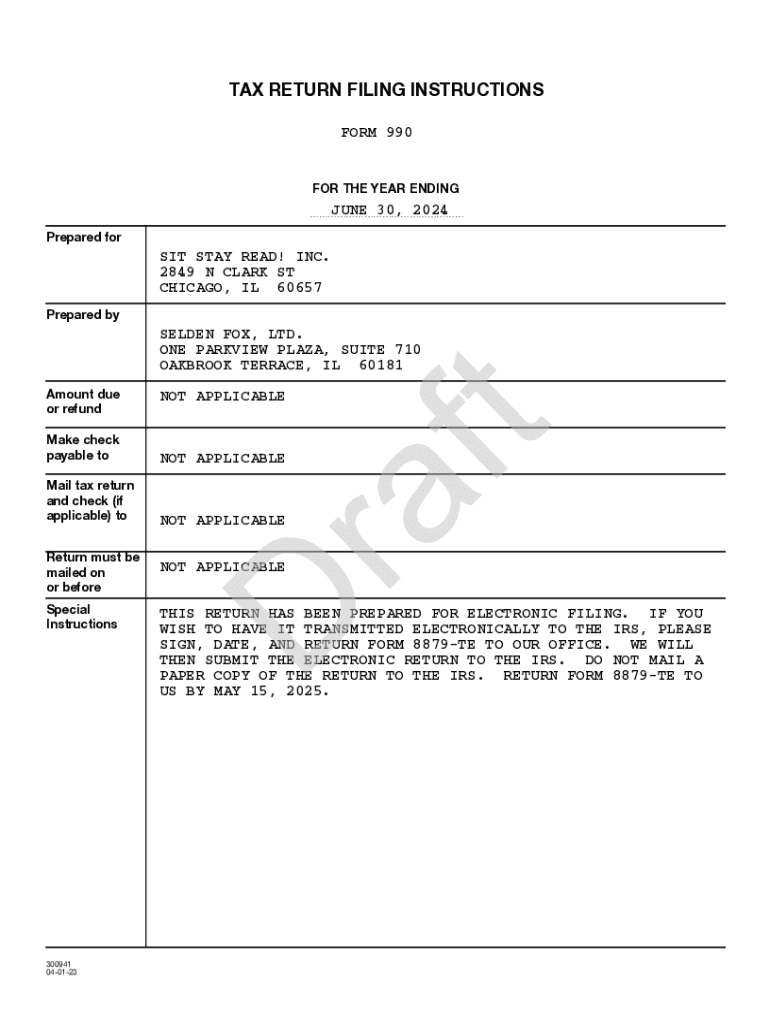

Get the free Tax Return Filing Instructions Illinois Form Ag990-il

Get, Create, Make and Sign tax return filing instructions

Editing tax return filing instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax return filing instructions

How to fill out tax return filing instructions

Who needs tax return filing instructions?

Your Complete Guide to Tax Return Filing Instructions Form

Overview of tax return filing

Tax return filing is a crucial process for individuals and businesses alike, ensuring compliance with tax laws while facilitating the proper allocation of public resources. Timely filing of your tax return can prevent penalties and interest that may arise from late submissions. Notably, the IRS enforces strict deadlines for tax return submissions, usually falling on April 15 each year for individual taxpayers. It is essential to plan ahead, understand these deadlines, and gather the necessary documentation to avoid last-minute stress.

Different taxpayers may need to file various types of tax returns, including 1040, 1040A, and 1040EZ, depending on income levels, age, and filing status. Each of these forms corresponds with specific conditions and requirements, making understanding your obligations vital for compliance and maximization of potential refunds.

Understanding the tax return filing instructions form

The tax return filing instructions form serves as a comprehensive roadmap guiding taxpayers through the complex maze of tax return completion. It outlines the necessary steps and provides detailed information about what needs to be included in your submission. Through adherence to these instructions, individuals significantly decrease the likelihood of errors that could lead to audits or delays in processing.

Typically, the form includes sections on gathering required documents, detailed instructions for completing specific parts of your tax return, and additional information on allowable deductions and credits. Familiarizing yourself with this form can streamline the tax-return process, ensuring every aspect is covered.

Step-by-step guide to filling out the tax return filing instructions form

Preparation before filling out the form

Before diving into the tax return filing instructions form, it’s crucial to prepare adequately. Start by gathering all necessary documents, including your W-2s, 1099s, and any receipts for deductible expenses. Verify your filing status and confirm all personal information, such as your Social Security number and address, are accurate. Knowing the types of forms you'll need based on your income sources — whether you are a freelancer receiving 1099s or a traditional employee with W-2s — is key to a smooth filing process.

Navigating the form fields

As you move through each section of the tax return filing instructions form, be attentive to the specific information required. The form often breaks down into easily digestible parts, each designated for different types of information, such as personal details, wages, and deductions. Ensure that you input your data accurately; missing information can lead to significant delays or even audits. Common mistakes include transposing numbers or selecting the wrong filing status, so take your time.

Calculation of income and deductions

For reporting your income, include all your earnings, taking care to calculate correctly and report accurately. Remember, various allowable deductions and credits can help lower your taxable income significantly. These might include expenses for education, medical bills, and even some charitable contributions. Engaging with interactive tools can assist you in performing these calculations intuitively, ensuring compliance and accuracy in your submitted forms.

Editing and reviewing your tax return with pdfFiller

Once your tax return document is filled out, using pdfFiller for editing can dramatically simplify your workflow. This platform allows you to access your document easily and offers a suite of interactive tools for refining your entries in real-time. Whether adding comments, adjusting figures, or correcting fields, the editing capabilities provided by pdfFiller significantly enhance the process.

Moreover, if you’re collaborating with a tax professional, pdfFiller's secure sharing options make it easy to send documents back and forth. This collaboration lessens the stress of ensuring nothing is overlooked, allowing for a comprehensive review of your tax return before submission.

eSigning and securing your tax return

eSigning your tax return not only adds an extra layer of security but also streamlines the submission process. With pdfFiller, eSigning is straightforward; simply follow the provided step-by-step guide to apply your digital signature seamlessly. This method not only saves time but ensures compliance with the regulations that require signatures on official tax documents.

Securing your document is equally vital. pdfFiller upholds strict data protection regulations, ensuring your information remains confidential. Using their platform, you can rest assured that your sensitive financial information is well protected through encryption and access controls.

Submitting your tax return

Taxpayers have various methods to submit their returns; the choice between e-filing and paper submissions often boils down to personal preference or specific circumstances. e-filing is generally the preferred method among modern taxpayers due to its speed and convenience. Through pdfFiller, you can directly e-file your return following the prescribed steps, simplifying the process considerably.

On the other hand, if you choose to file a paper return, ensure it’s mailed to the correct address based on your geographic location and the type of return you’re submitting. After your submission, knowing how to track your return or confirm receipt will provide peace of mind as you move forward.

FAQs on tax return filing

Many questions arise during the tax filing process. For instance, if you discover an error after submitting your return, it's crucial to know how to amend it correctly. The IRS provides Form 1040X for amendments, and doing this as soon as you notice the discrepancy can save time and potential penalties.

Furthermore, understanding the audit process is equally essential. Every taxpayer has rights, including the right to be informed of the reasons for an audit and to seek professional guidance before responding to the IRS. This knowledge can reduce anxiety and help you prepare appropriately.

Resources for ongoing support

For taxpayers seeking continuous support beyond the filing season, various resources are available. pdfFiller offers a vast repository of tax documents and forms through its platform, allowing users to access essential templates and save them for future reference. Additionally, the IRS website houses comprehensive guidelines, while local tax offices often provide in-person assistance.

Subscribing for updates on tax filing tips can also keep you informed about changes in tax laws that affect your filing process, ensuring you’re always in the know regarding your tax obligations.

Contacting support

Should you encounter any issues while navigating your tax return filing process, reaching out to pdfFiller's customer support team can provide resolution. Their staff is trained to assist with specific inquiries and navigate potential hurdles you may face. Beyond direct support, participating in community forums and user groups can expand your understanding through shared experiences among fellow users. In some instances, professional tax advisors associated with pdfFiller are available to provide personalized assistance catered to your unique needs.

Explore further: additional forms & instructions

As you delve deeper into the world of tax filing, you may require additional forms and specific instructions. pdfFiller categorizes related forms, making it easy to find what you need without sifting through irrelevant options. Whether you’re looking to order physical forms or download digital copies, pdfFiller provides a comprehensive solution tailored to your requirements.

Language assistance

Understanding tax forms can be daunting, especially for non-native speakers. pdfFiller addresses this barrier by offering forms and instructions in multiple languages. This accessibility ensures that each taxpayer is equipped to complete their return without the additional struggle of language barriers.

Your rights as a taxpayer

Every taxpayer is protected under specific rights, including the right to privacy and the right to appeal an IRS decision. Becoming familiar with these rights can empower you when dealing with tax obligations and any disputes that may arise. Tools and resources are readily available to help taxpayers understand their obligations and protections, guiding them through the intricate tax landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax return filing instructions from Google Drive?

Where do I find tax return filing instructions?

How do I make edits in tax return filing instructions without leaving Chrome?

What is tax return filing instructions?

Who is required to file tax return filing instructions?

How to fill out tax return filing instructions?

What is the purpose of tax return filing instructions?

What information must be reported on tax return filing instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.