Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

Editing form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Guide to Form 990-EZ: Essential Insights for Nonprofits

Understanding Form 990-EZ: The Essential Nonprofit Tax Document

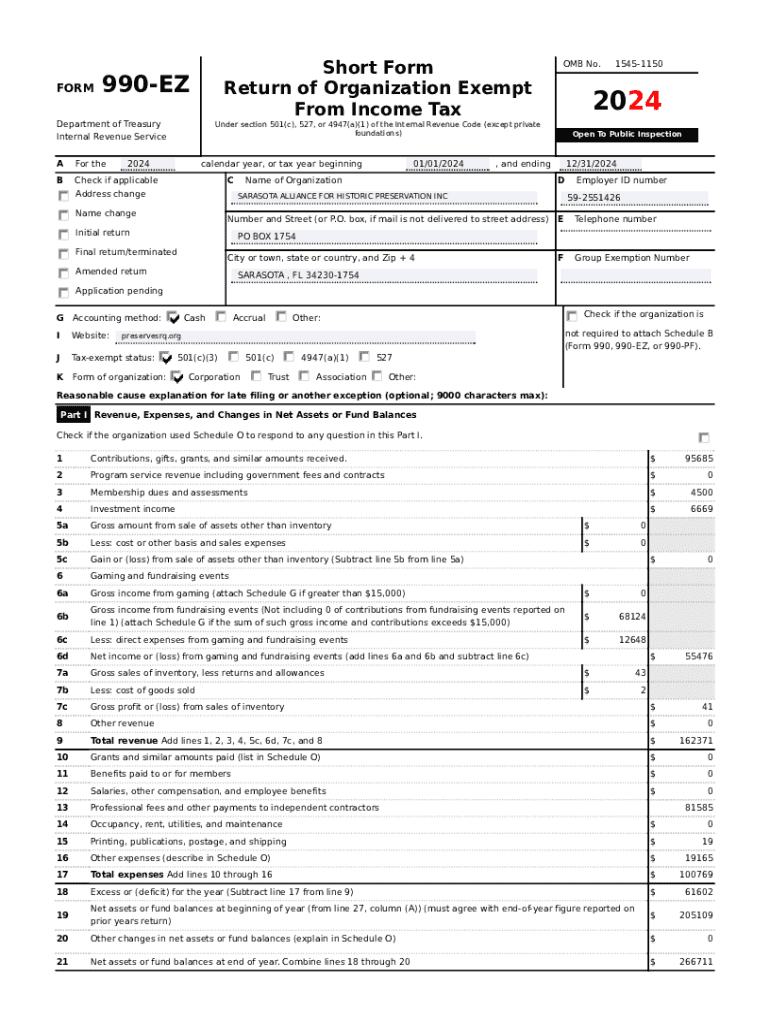

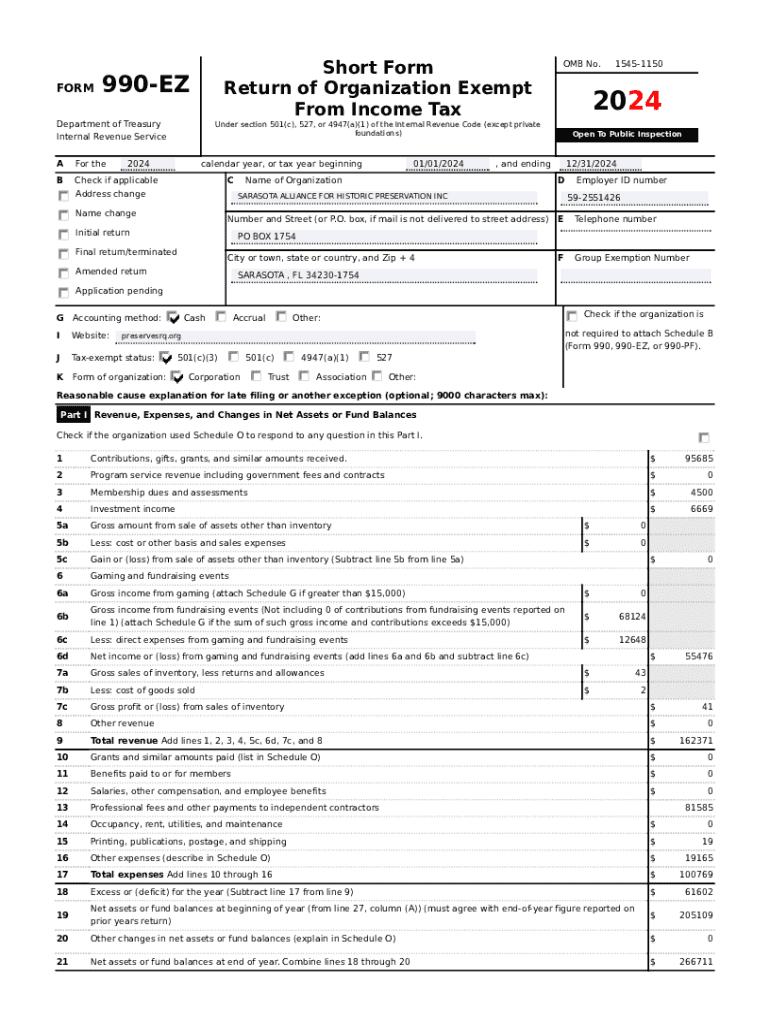

Form 990-EZ is an important tax document required by the Internal Revenue Service (IRS) for certain nonprofit organizations. This shorter version of the full Form 990 is designed for most tax-exempt organizations with gross receipts between $200,000 and $500,000 and total assets under $2.5 million. It provides a streamlined reporting process while maintaining transparency in nonprofit finances.

Organizations must file Form 990-EZ if they fall under the threshold requirements. The main difference between Form 990 and Form 990-EZ lies in complexity and filing requirements, where Form 990-EZ is a simplified option intended for smaller entities. Furthermore, the IRS mandates strict compliance with various requirements, asserting that transparency is non-negotiable in maintaining tax-exempt status.

Key filing components of Form 990-EZ

Filing Form 990-EZ requires accurate financial statements and organizational details. Specifically, taxpayers must gather income, expense statements, and balance sheets, laying the groundwork for proper disclosure. Key organizational information includes the name, address, and tax identification number of the nonprofit organization.

The structure of Form 990-EZ consists of several parts:

Important dates and deadlines for filing Form 990-EZ

The deadline for filing Form 990-EZ is typically the 15th day of the 5th month after the end of your organization's accounting period. For many organizations, this means the due date is May 15th if the fiscal year ends on December 31st. Applying for an extension can be crucial when more time is needed, and nonprofits can file Form 8868 to request an automatic extension of six months.

Failing to file on time can lead to penalties, so it’s essential to maintain a calendar with these important dates marked. Organizations may incur a fine of $20 per day, up to $10,000 for late filings, making punctuality vital to preserving non-profit status.

The step-by-step process for e-filing Form 990-EZ

E-filing Form 990-EZ can streamline the process and reduce errors. Here’s an easy guide to navigate through this essential task:

Enhancing your filing experience with pdfFiller

pdfFiller offers exclusive tools tailored specifically for nonprofits, improving the filing experience immensely. With cloud-based document management features, users can effectively manage their forms without worry. Collaboration tools enable teams to work simultaneously on the forms, leading to more efficient filing.

Moreover, smart AI assistance is available to help with complex sections of Form 990-EZ, reducing the burden of navigating intricate tax language. Security is paramount, and pdfFiller ensures safety with options for e-signing, ensuring your information is protected and legally binding.

Frequently asked questions about Form 990-EZ

Navigating the complexities of Form 990-EZ can lead to numerous questions. Here are some of the most common inquiries from nonprofits:

Helpful tips for a successful filing experience

While e-filing Form 990-EZ simplifies the process, common pitfalls can still arise. To ensure a smooth filing experience, avoid these frequent mistakes:

User testimonials often praise pdfFiller for its ease of use and streamlined filing process, making it a favored platform among nonprofits aiming for compliance.

Exploring additional resources on nonprofit tax compliance

For a well-rounded understanding of nonprofit tax compliance, other forms may also be relevant. Commonly used forms include Form 990-N for very small organizations, Form 990-T for unrelated business income, and Form 990-PF for private foundations.

Participating in webinars and accessing video tutorials can further simplify the e-filing process, providing visual guidance. Knowledge base articles contain specific insights, supporting nonprofits in staying updated on compliance requirements.

Support and customer service at pdfFiller

When challenges arise during the filing, pdfFiller offers robust customer support to assist users. Accessing help is straightforward, with various options available for resolving inquiries.

World-class customer support is always within reach, addressing needs through chat, email, or phone. Additionally, community forums allow users to share experiences, learn from peers, and foster a supportive environment for nonprofit organizations.

Maximizing pdfFiller features for nonprofits

pdfFiller provides numerous features specifically designed for nonprofits managing multiple returns. Efficient team management systems streamline collaboration across teams filing Form 990-EZ.

Furthermore, the platform offers bulk upload options for larger organizations, saving time and ensuring consistency across submitted forms. Regular updates ensure users receive the latest tools for enhancing their e-filing experience, ultimately simplifying the compliance process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990-ez?

Can I create an electronic signature for the form 990-ez in Chrome?

Can I create an electronic signature for signing my form 990-ez in Gmail?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.