Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-to Guide

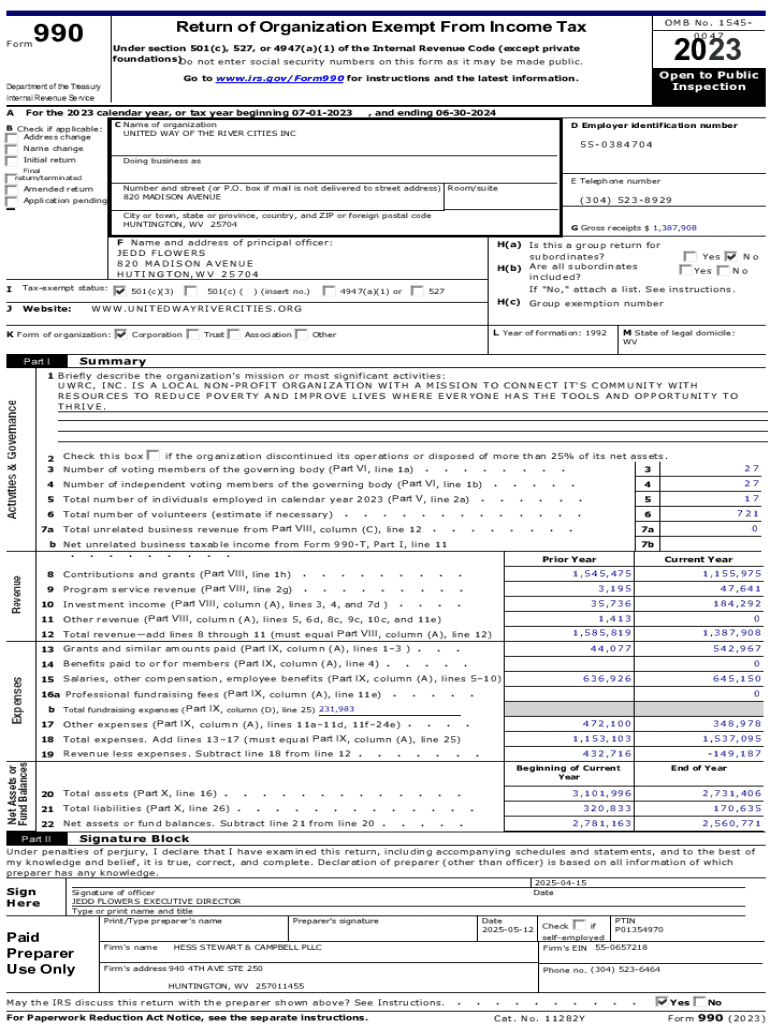

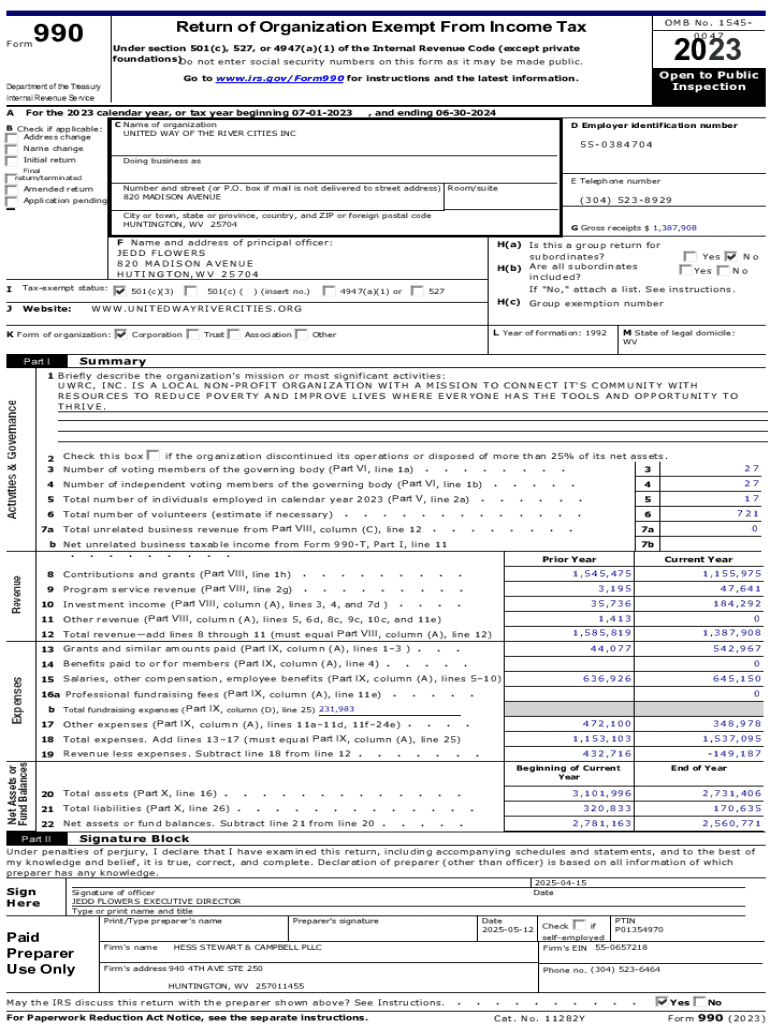

Understanding Form 990: An overview

Form 990 is an essential document for tax-exempt organizations in the United States, primarily used to provide the IRS and the public with information about a nonprofit's financial activities. This form plays a crucial role in ensuring transparency and accountability in the nonprofit sector. With varying levels of complexity corresponding to different organization sizes and types, Form 990 encompasses key elements that reflect an organization's operations, governance, and programmatic achievements.

For nonprofit organizations, filing Form 990 is a critical requirement that informs stakeholders about financial health, governance structures, and overall mission impact. It includes significant components such as income, expenses, assets, and liabilities, allowing the public to evaluate the organization. Furthermore, the form contains specific schedules that provide detailed information about compensation for officers, fundraising activities, and other significant disclosures.

Variants of Form 990

Form 990 has several variants designed to accommodate different types of tax-exempt organizations, ensuring that each entity can fulfill its reporting requirements without unnecessary burden. Understanding these variants is vital for compliance and effective reporting.

Filing requirements for Form 990

Determining who must file Form 990 is critical for compliance and to avoid potential penalties. Generally, most tax-exempt organizations with gross receipts exceeding $200,000 or total assets exceeding $500,000 are required to file the full Form 990. However, exceptions exist for smaller organizations, which may qualify to file simpler forms.

Nonprofit organizations should also be aware of specific deadlines for filing Form 990. Typically, the due date is the 15th day of the 5th month after the organization’s fiscal year ends. Extensions can be requested, which often provide an additional six months for filing. Keeping track of these deadlines is crucial for maintaining compliance.

Preparing to fill out Form 990

Before you dive into filling out Form 990, organizational preparedness is essential. Gathering the right documentation is key to ensuring a smooth filing process. Essential documents include financial statements, lists of board members, information on programs and services offered, and compensation details for key employees.

Organizing financial records will save time and improve accuracy. Create a checklist to ensure all necessary data is accounted for and sort documentation by category (income, expenses, assets, etc.). Understanding common terminologies and sections within the form can also significantly streamline the preparation process.

Step-by-step instructions for completing Form 990

The process of completing Form 990 involves navigating its various sections. Understanding each part is crucial for accurate reporting. The form begins with a summary section that outlines key financial figures and organizational info.

Subsequent sections delve into specific areas such as program accomplishments and financial data. Each part must be completed carefully to ensure compliance with IRS regulations. Common mistakes include omitting required schedules or misreporting financial figures—both of which can complicate the filing process.

How to file Form 990

Choosing the right filing method for Form 990 is essential. The IRS has streamlined electronic filing options through its Modernized e-File (MeF) system. This method is not only efficient but also helps ensure compliance by reducing errors in data entry.

For those planning to file on paper, it's crucial to follow the IRS guidelines regarding formatting and submission. Organizations may also opt to file through third-party software platforms that offer user-friendly solutions. These platforms often provide tools for tracking submission and confirming receipt by the IRS.

Understanding public inspection regulations

Compliance with public inspection regulations is a critical aspect of nonprofit governance. Form 990 is generally available for public access, reflecting an organization’s commitment to transparency. Furthermore, organizations are required to make their Form 990 available upon request, allowing potential donors, partners, and the public to obtain insights into their operations and financial health.

Accessing Form 990 for organizations is typically straightforward. Individuals can view or request copies through the organization’s website or various state-specific online databases. Being transparent about financial matters through Form 990 can bolster trust and readiness to engage with stakeholders.

Monitoring your Form 990 filing

Post-filing, organizations need to monitor submission dates and maintain accurate records of their filings. Keeping track ensures compliance with IRS deadlines and facilitates timely corrections if necessary. Nonprofits should routinely verify that their filings are up-to-date and in line with current requirements.

Organizations should also develop a system for tracking the status of their filings. Whether using spreadsheets or project management tools, having a consistent method allows nonprofits to stay organized. In cases where errors are identified post-filing, organizations must understand the process for making corrections and submitting amended forms to the IRS.

Penalties for non-compliance

Non-compliance with Form 990 filing requirements can result in severe penalties. Late filings can incur fees that escalate based on how overdue the form is. Moreover, organizations failing to file entirely over multiple years may risk losing their tax-exempt status. It's essential for nonprofits to be aware of these potential consequences to avoid financial ramifications.

To safeguard against these issues, organizations should institute a compliance calendar and remind board members about filing obligations. This proactive approach can help prevent fallout from misunderstandings regarding the importance and implications of Form 990 reporting.

Analyzing Form 990 for charity evaluation research

Form 990 serves not only as a compliance document but also as a valuable tool for analyzing a charity's financial health. By reviewing key indicators included in Form 990, stakeholders can evaluate how effectively a nonprofit utilizes its resources. This empowers potential donors to make informed decisions based on concrete data regarding how funds are allocated and the impact on program delivery.

Organizations can interpret financial statements within Form 990 to determine sustainability and program effectiveness. Tools built into platforms like pdfFiller enhance this process, facilitating comprehensive analyses and ensuring potential donors are engaged with transparent data.

Fiduciary reporting and responsibilities

Board members carry fiduciary responsibilities related to Form 990 filings. Their duty is to ensure compliance and accuracy in proposals and reporting. Engaging in the process actively reinforces a culture of accountability, ensuring sound governance and public trust in the organization.

Adopting best practices for governance includes routine reviews of financial documents, risk assessments, and strategic planning sessions aimed at preparing for Form 990 obligations. Emphasizing transparency and accountability through a board-approved process is also essential in instilling confidence in stakeholders.

Additional resources for navigating Form 990

Navigating Form 990 may seem daunting, but numerous resources can aid organizations in the process. Interactive tools designed for filling out Form 990 simplify data entry, ensuring compliance and accuracy throughout the filing process. Additionally, expert blogs and articles provide insights into evolving regulations and best practices.

Organizations seeking in-depth knowledge may benefit from attending in-person workshops and online webinars focused on Form 990. These educational opportunities enhance understanding and can provide answers to specific queries related to unique organizational challenges.

Frequently asked questions about Form 990

Throughout the Form 990 filing process, various questions may arise. Common queries involve specific scenarios such as what to do if your organization qualifies for a simpler form or how to rectify discrepancies in filed information. Understanding these nuances is crucial for compliance and effectiveness in reporting.

Resources such as expert forums and consultation services can provide additional help, clarifying confusing aspects of the form and enhancing preparedness for upcoming filing deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990 in Chrome?

How do I edit form 990 on an iOS device?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.