Get the free 990-ez

Get, Create, Make and Sign 990-ez

How to edit 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-ez

How to fill out 990-ez

Who needs 990-ez?

Understanding the 990-EZ Form: A Comprehensive Guide

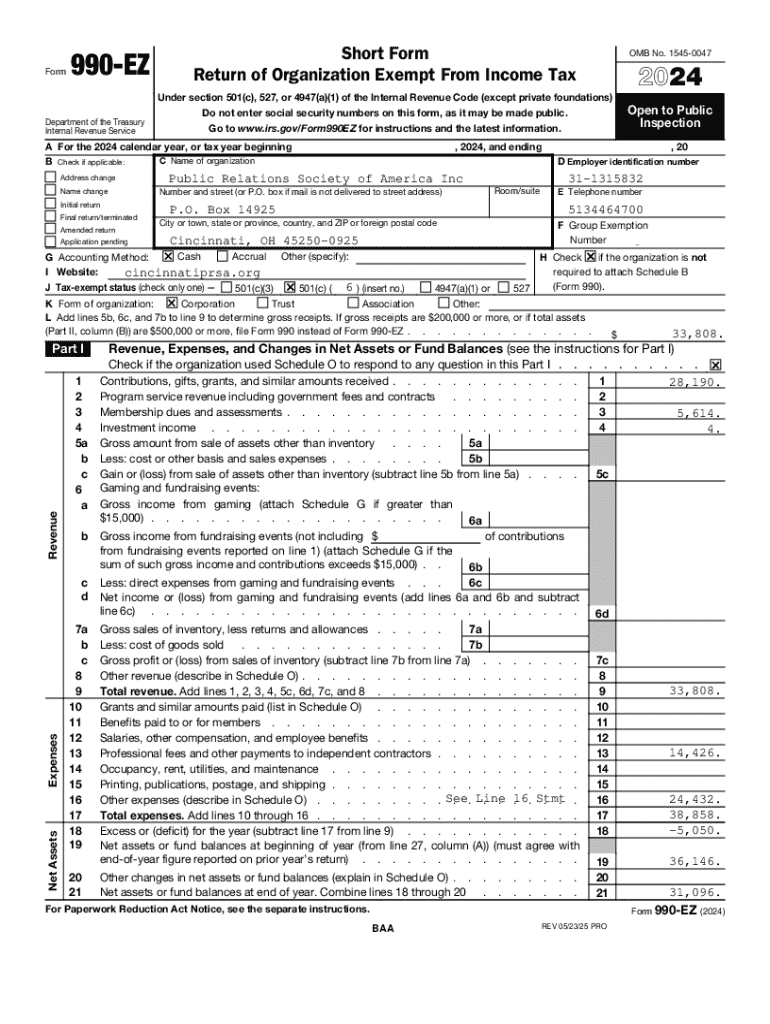

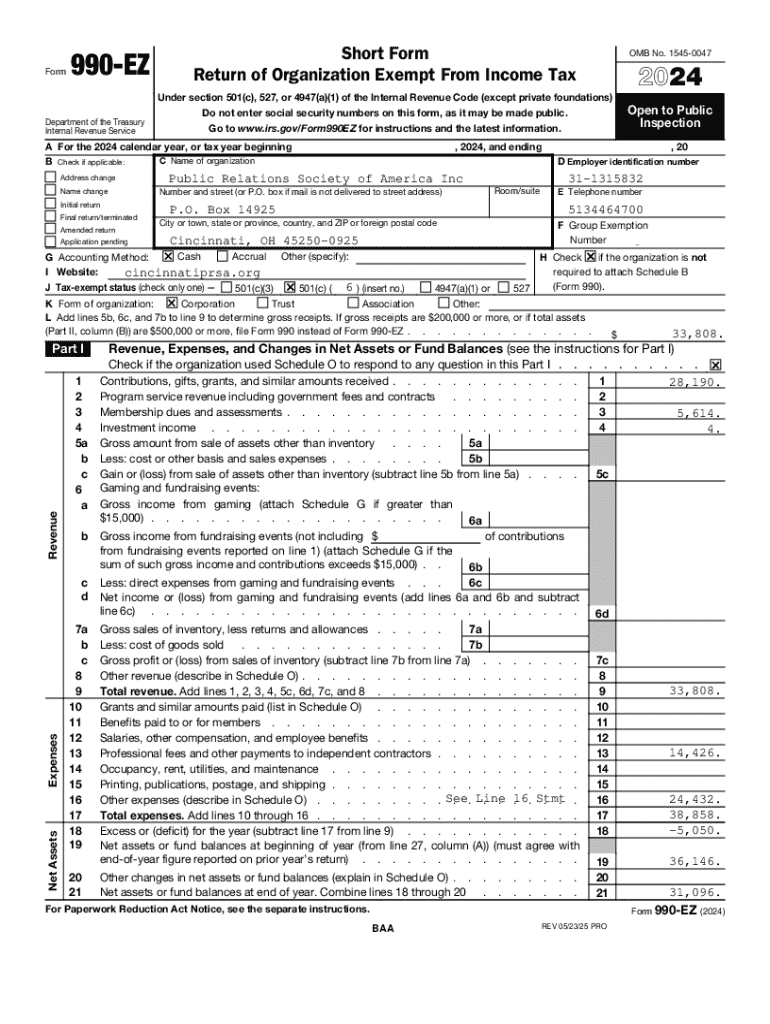

Understanding the 990-EZ form

The 990-EZ form plays a crucial role in the landscape of nonprofit reporting. This simplified tax form is primarily designed for small to medium-sized tax-exempt organizations that satisfy specific criteria.

By providing essential financial information to the IRS, the 990-EZ upholds transparency and accountability within the nonprofit sector. The document demonstrates how organizations use their resources to support their mission and serve their communities.

Who should use the 990-EZ form?

Eligibility for using the 990-EZ is determined by the organization's gross receipts and total assets. Most organizations with gross receipts under $200,000 and total assets under $500,000 qualify for this simplified form. Notably, organizations such as charitable foundations, educational entities, and cultural nonprofits often benefit from using the 990-EZ.

One of the distinctive advantages of using the 990-EZ form lies in its reduced compliance burden. Organizations can file quickly, which conserves time and resources, allowing them to focus more on their core missions rather than extensive paperwork.

Differences between Form 990 and Form 990-EZ

The primary differences between Form 990 and Form 990-EZ are their length and complexity. Form 990 is more extensive, requiring detailed disclosures about a nonprofit’s governance, financials, and operations, whereas the 990-EZ streamlines this process significantly.

Organizations often wonder which form to choose. Factors include revenue size, complexity of operations, and the specific reporting requirements dictated by funders. If your organization falls within the eligibility criteria and does not require complex disclosures, Form 990-EZ is an efficient option.

Preparing to file the 990-EZ form

To successfully prepare and file the 990-EZ, organizations should gather essential documentation such as revenue statements, expense reports, and balance sheets. An accurate portrayal of the organization's financial health will facilitate a smoother filing process.

Common use cases involve nonprofits receiving donations well below the $200,000 threshold or those that primarily rely on volunteer support rather than complex operational infrastructure. Understanding these characteristics is crucial for thoughtful planning and compliance.

Line-by-line instructions for filling out the 990-EZ form

The 990-EZ form is divided into three parts, each requiring precise reporting. Part I focuses on the summary of revenue, expenses, and changes in net assets—critical for financial tracking. Ensure that all income sources and expenditures are accurately recorded.

Part II, the statements regarding activities, requires disclosure of the nonprofit’s activities and accomplishments. This is where nonprofits illustrate how they fulfill their mission, providing transparency and insight into their operational goals.

Finally, Part III outlines financial data including functional expenses, providing the IRS with insight into how funds are utilized. A detailed report not only aids in compliance but can also enhance credibility with donors.

FAQs about the 990-EZ form

Common questions often arise about the 990-EZ form, such as whether organizations with gross receipts over $200,000 can file this form. The answer is no; those organizations must file Form 990 instead.

Filing the 990-EZ can indeed offer advantages for future filings, particularly if an organization keeps its receipts within this limit consistently. This keeps reporting simpler and less resource-intensive over time.

E-filing the 990-EZ form

E-filing is becoming increasingly popular due to its efficiency and accessibility. Utilizing platforms such as pdfFiller enables organizations to file their 990-EZ form quickly while ensuring accuracy, helping to prevent common filing errors.

When choosing to e-file, organizations can enjoy numerous benefits such as faster processing times, immediate confirmation of receipt, and easier tracking of the filing status. This method also facilitates a streamlined approach to any follow-up correspondence with the IRS.

Post-filing considerations

Understanding filing deadlines is crucial to maintain compliance. Typically, the 990-EZ must be filed by the 15th day of the 5th month after the end of the organization’s fiscal year. Failure to meet this deadline can result in penalties or, worse, a loss of tax-exempt status.

Additionally, it's essential to manage your nonprofit’s compliance effectively. This encompasses keeping precise records of all documentation submitted, adequately responding to any inquiries from the IRS, and maintaining transparency with stakeholders regarding financial reporting.

Tools and resources for successfully using the 990-EZ form

Engaging with interactive tools and calculators can enhance your experience with the 990-EZ form. Platforms like pdfFiller offer helpful resources that simplify the process, making it user-friendly and efficient.

Additionally, utilizing templates and guided forms can streamline the preparation process, ensuring all sections of the 990-EZ are completed accurately. Having access to resources reduces the stress of filing and enhances the quality of submissions.

Conclusion: Empowering your nonprofit with pdfFiller

Utilizing pdfFiller’s platform provides a seamlessly integrated solution for document management. By streamlining workflows for filling out, signing, and managing forms like the 990-EZ, nonprofits can focus more on their missions rather than administrative burdens.

The ability to collaborate and efficiently manage documents all within one cloud-based platform empowers organizations to remain compliant and maintain transparency with stakeholders, ensuring future sustainability and growth.

Additional relevant forms

Understanding the 990-EZ form also opens the door to other related forms such as Form 990-N, Form 990-PF, and Form 990-T. These forms cater to various nonprofit entities and cater to different reporting regulations, thus ensuring a comprehensively managed compliance system.

Having insights into these forms can further assist organizations in navigating the complexities of their financial and compliance obligations effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 990-ez online?

How do I make edits in 990-ez without leaving Chrome?

Can I create an eSignature for the 990-ez in Gmail?

What is 990-ez?

Who is required to file 990-ez?

How to fill out 990-ez?

What is the purpose of 990-ez?

What information must be reported on 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.