Get the free Fiiu/r 807 (ar)

Get, Create, Make and Sign fiiur 807 ar

Editing fiiur 807 ar online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiiur 807 ar

How to fill out fiiur 807 ar

Who needs fiiur 807 ar?

Comprehensive Guide to the FIIUR 807 AR Form

Understanding the FIIUR 807 AR Form

The FIIUR 807 AR Form is a critical document used across various sectors for tax preparation, filing, and compliance purposes. It facilitates the reporting of financial information, allowing both individuals and teams to meet their obligations while maintaining transparency and accuracy in their dealings. The form is essential for various stakeholders, ensuring that they can navigate the complexities of financial regulations with ease.

This form serves multiple purposes depending on the context in which it is being utilized. It could be for personal financial assessments, business tax filings, or even compliance checks by regulatory bodies. Regardless of the context, completing the FIIUR 807 AR Form accurately is instrumental in avoiding potential legal repercussions and ensuring a smooth financial operation.

Who needs to fill out the FIIUR 807 AR Form?

The target users of the FIIUR 807 AR Form primarily include individuals, business owners, financial analysts, and compliance officers. Each group has distinct scenarios in which they must fill out this form, and understanding who needs it is the first step in the process. For individuals, the form may be required for personal tax filings or financial assessments.

For teams, particularly in corporate or organizational settings, the FIIUR 807 AR Form may be necessary for reporting financial data for compliance with regulatory requirements or internal company guidelines. It’s crucial for each user to recognize their specific context to ensure proper completion and submission.

Step-by-step guide to filling out the FIIUR 807 AR Form

Before diving into the procedure of filling out the FIIUR 807 AR Form, it’s vital to prepare adequately. Pre-filling considerations can significantly influence the accuracy of the information you provide.

Pre-filling considerations

Detailed instructions for each section of the form

Filling out the FIIUR 807 AR Form requires attention to detail. Here’s a step-by-step breakdown:

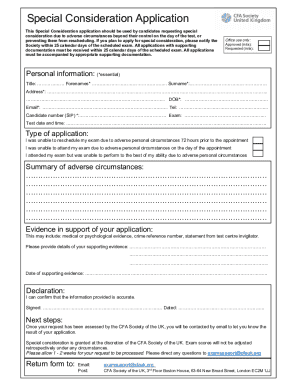

Step 1: Personal information

Begin with your personal information. This typically includes your name, address, and identification numbers. Be cautious with common pitfalls, such as typos in your name or incorrect identification numbers, as these errors can lead to future complications.

Step 2: Financial information

Next, provide your financial information, ensuring all data accurately reflects your financial status. Cross-verify figures against your documents to avoid discrepancies.

Step 3: Supporting documentation

Attach essential papers that support the information provided in the form. This could include income verification documents, previous tax returns, or any other relevant financial records.

Step 4: Review and verification

Finally, reviewing your form is crucial. Double-check all entries for accuracy, ensuring all required fields are completed. A thorough review can minimize errors that may delay processing.

Editing and managing the FIIUR 807 AR Form

Manipulating the FIIUR 807 AR Form does not need to be a cumbersome task. Utilizing powerful PDF editing tools like pdfFiller can greatly streamline your experience.

Using PDF editing tools

pdfFiller simplifies PDF editing for the FIIUR 807 AR Form by allowing users to edit text and fill out the form electronically. This convenience drastically reduces the likelihood of errors and enhances user accessibility.

Collaborative features

Additionally, pdfFiller offers collaborative features that enable teams to work together seamlessly. Users can share documents for review, leave comments, and track changes—all in real-time, which increases efficiency.

eSigning the form

Once the form is filled out and reviewed, you can electronically sign the FIIUR 807 AR Form using pdfFiller's eSigning feature. This approach not only saves time but also enhances security, as all signatures are legally binding.

Common mistakes to avoid with the FIIUR 807 AR Form

Awareness of common errors when filling out the FIIUR 807 AR Form can save you from costly repercussions. Many individuals mistakenly overlook the importance of understanding form instructions, which can lead to incomplete submissions.

Incorrectly entering information, such as financial data or personal information, can result in compliance issues, audits, or rejected filings. Paying careful attention during the completion process is essential.

Mistakes on the form can have serious repercussions, including legal implications and financial penalties. It’s best to approach the FIIUR 807 AR Form with diligence and care.

Interactive tools for FIIUR 807 AR Form users

To enhance the user experience, several interactive tools are available specifically for individuals filling out the FIIUR 807 AR Form. These tools can significantly aid in accuracy and efficiency.

Form calculator or estimator

One such tool is a form calculator or estimator. These tools assist users in making calculations related to specific financial sections of the form, ensuring that users submit accurate data.

Checklist for required documentation

Moreover, a downloadable checklist for required documentation can help you ensure that you have everything prepared before submission, streamlining the overall process.

Frequently asked questions (FAQs) about the FIIUR 807 AR Form

Users often have questions regarding specific intricacies when dealing with the FIIUR 807 AR Form. Understanding these queries can empower you in the filing process.

General questions

For instance, what is the process if you're unable to fill out certain sections? Reaching out to a tax professional or utilizing online resources can provide the necessary guidance.

Technical questions

Another common concern involves technical troubleshooting related to PDF formatting. If issues arise, pdfFiller offers comprehensive support to help resolve any technical difficulties users may face.

Additional forms related to the FIIUR 807 AR

In conjunction with the FIIUR 807 AR Form, users may encounter several related forms that are equally important. Understanding these forms can be beneficial for comprehensive financial reporting.

Overview of related forms

Forms linked to the FIIUR 807 AR include tax declaration forms and compliance-related documentation that often accompany financial reports. Having a grasp of these forms can streamline the filing process.

Where to find and access these forms

Users can easily find and access these forms through pdfFiller’s range of useful document templates, ensuring that they have all the necessary documentation at their fingertips.

How pdfFiller facilitates form management

pdfFiller revolutionizes the way users manage forms, specifically the FIIUR 807 AR Form, with its cloud-based accessibility. This feature allows individuals and teams to manage documents from any location with an internet connection.

Cloud-based accessibility

With cloud-based solutions, users no longer have to worry about the limitations of physical documents. pdfFiller ensures that every user can access their forms quickly and efficiently, fostering productivity.

Comprehensive document creation solutions

Furthermore, pdfFiller offers a suite of document creation solutions that empower users throughout their document journey. From editing to signing and collaboration, it provides a seamless experience all in one platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fiiur 807 ar from Google Drive?

Can I create an eSignature for the fiiur 807 ar in Gmail?

How do I fill out fiiur 807 ar on an Android device?

What is fiiur 807 ar?

Who is required to file fiiur 807 ar?

How to fill out fiiur 807 ar?

What is the purpose of fiiur 807 ar?

What information must be reported on fiiur 807 ar?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.