Get the free 990-pf

Get, Create, Make and Sign 990-pf

Editing 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-pf

How to fill out 990-pf

Who needs 990-pf?

990-PF Form: How-to Guide for Private Foundations

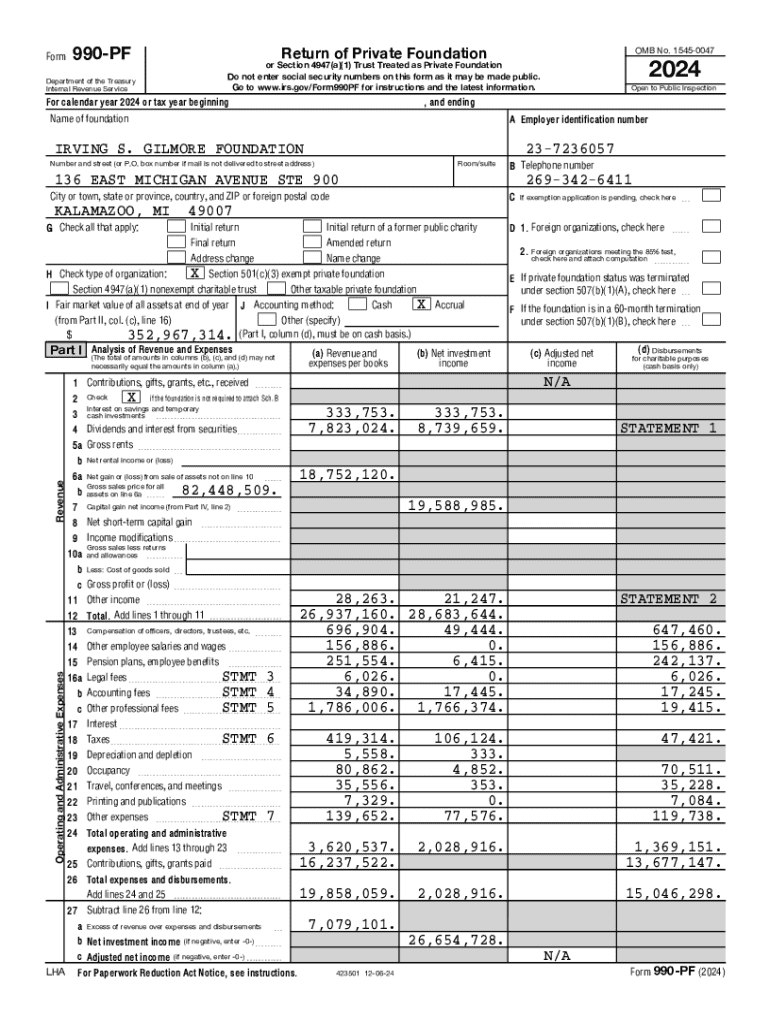

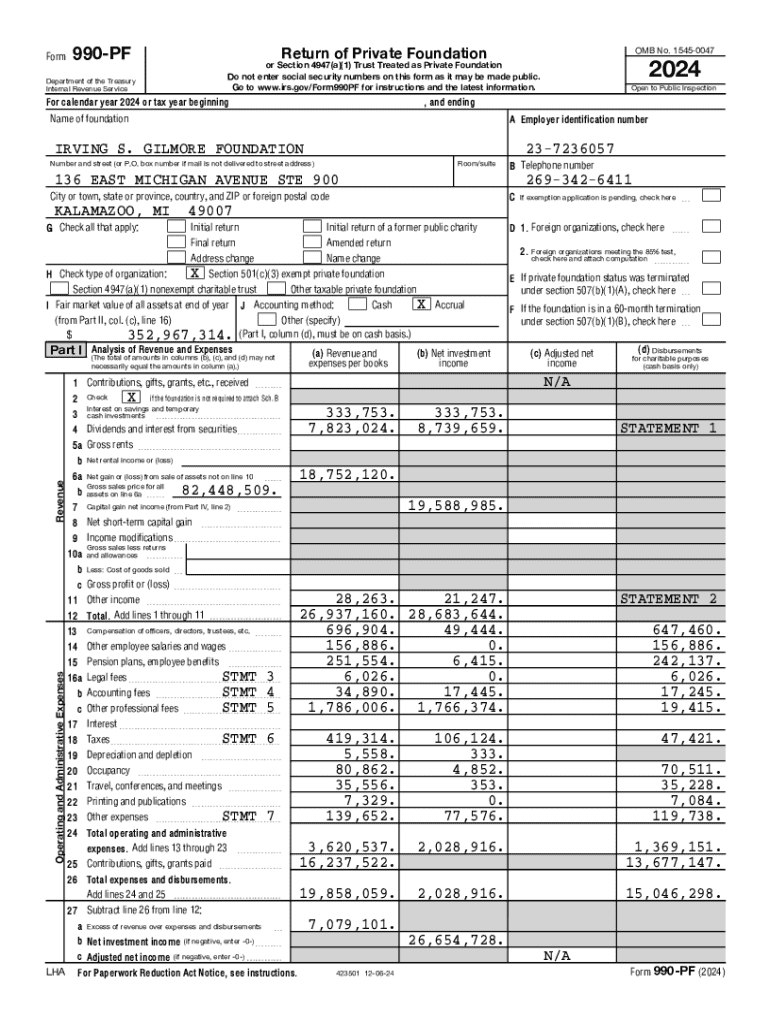

Overview of Form 990-PF

Form 990-PF is a crucial document that every private foundation in the United States must file annually with the Internal Revenue Service (IRS). This form is not only a requirement but also serves as an essential transparency tool, helping to detail a foundation's financial activity, including revenue, expenses, and grants made throughout the tax year. Properly completing Form 990-PF is vital for maintaining the foundation's tax-exempt status and ensuring compliance with federal regulations.

For private foundations, this form is significant as it allows stakeholders—including donors, beneficiaries, and the general public—to understand how funds are allocated. It details the foundation's charitable spending, investment incomes, and operational costs, thereby fulfilling IRS requirements and showcasing the foundation's work to stakeholders.

Who needs to file Form 990-PF?

Private foundations—typically established by individuals, families, or corporations to fund charitable activities—are required to file Form 990-PF if their assets exceed $500,000 or if they have any taxable income. The IRS defines a private foundation as an organization that primarily makes grants to charitable organizations rather than conducting its own charitable programs. While public charities file a different version of the 990 form, private foundations are uniquely governed under the 990-PF template.

Some exemptions may apply; for instance, certain smaller foundations with less than $500,000 in assets are not required to file but may still choose to do so for transparency purposes. Understanding these eligibility criteria is crucial because failing to file when required can lead to penalties and jeopardize a foundation's tax-exempt status.

Key filing deadlines

Filing deadlines for Form 990-PF are generally the 15th day of the 5th month after the close of the foundation's tax year. This means for most organizations with a calendar year ending December 31, the form is due May 15 of the following year. If a foundation's fiscal year does not align with the calendar year, the due date will change accordingly.

The IRS provides options for filing extensions, which can be beneficial for organizations needing extra time to ensure complete and accurate submissions. It's vital for foundations to keep track of these deadlines to avoid late fees and compliance issues.

Comprehensive breakdown of the 990-PF form

Understanding the structure of Form 990-PF is critical for accurate completion. The form is divided into several parts, each serving a specific purpose. The first part includes basic administrative information about the foundation, while subsequent sections delve deeper into management details, financial data, and relationships with other entities.

The key sections include:

Common pitfalls include misreporting income or expenses, failing to disclose required information about foundation managers, and neglecting to include relevant attachments. These errors can lead to penalties and more complex amendments, so attention to detail is crucial.

Step-by-step guide to completing Form 990-PF

Completing the 990-PF form can seem daunting, but a systematic approach can simplify the process. Begin by gathering all necessary documentation, including financial statements, previous tax returns, and records of grants made. Each section of the form should be filled out meticulously, ensuring that all data is accurate and up-to-date.

Here’s a simplified guide for filling out the 990-PF:

Utilizing tools like pdfFiller can enhance the filing experience by providing templates and interactive guides that simplify the process.

Additional requirements and considerations

Beyond the requirements set by the IRS, private foundations must also adhere to state-specific regulations, which can differ significantly. Some states may impose additional reporting requirements or fees, and understanding these obligations is essential to avoid penalties. Failure to comply with state laws can lead to audits and complications in maintaining tax-exempt status.

Moreover, charitable foundations must ensure that their activities align with their stated charitable purposes. Engaging in activities outside of their charitable mission can lead to regulatory scrutiny. It's important for foundations to be informed about the specific charitable regulations governing their operations.

Penalties for late or incorrect filing

Filing Form 990-PF late or inaccurately can result in significant penalties for private foundations. The IRS imposes fines based on how late the form is submitted; the longer the delay, the higher the potential fine. If a foundation fails to file for three consecutive years, it risks automatic revocation of its tax-exempt status, an outcome that can have serious financial implications.

Common concerns regarding late submissions include potential fines and the possibility of being flagged for an audit. Foundations are encouraged to file their forms correctly and timely to avoid these repercussions. To mitigate risks, setting up reminders and using comprehensive filing tools can streamline the submission process.

Filing extension options for Form 990-PF

Private foundations can request extensions to delay their filing of Form 990-PF. An automatic 6-month extension can be granted by submitting IRS Form 8868 before the original due date of Form 990-PF. This extension provides foundations with additional time to compile necessary information and ensure the accuracy of their submissions.

It's essential to note that even with an extension, the foundation must still comply with tax payment obligations, if any. Planning ahead is crucial to fully utilize extension options without incurring penalties.

How to submit Form 990-PF electronically

E-filing Form 990-PF is becoming increasingly popular and is encouraged by the IRS. Electronic submissions can be done through approved software providers or directly through the IRS filing platform. To e-file, a foundation needs to prepare the completed 990-PF, ensuring all information is accurate and comprehensive.

Using pdfFiller not only simplifies the process of completing the form but also aids in securing the information during submission. Electronic filing reduces the risk of lost documents and expedites processing times, allowing foundations to receive confirmations of filing more promptly.

Frequently asked questions (FAQs)

Foundations often have questions about Form 990-PF, including its filing requirements, deadlines, and penalties for errors or late submissions. Addressing common concerns can demystify the process and ensure compliance.

Some frequently asked questions include:

Tools and resources for successful filing

Utilizing the right tools can simplify the process of completing and filing Form 990-PF. pdfFiller offers a variety of resources to aid in document creation and management. These tools include templates, interactive guidance, and secure e-signing features that streamline the filing process.

Helpful resources available include links to key IRS guidelines, community forums for support, and templates specifically designed for Form 990-PF. Using these resources can improve filing accuracy and efficiency.

User experiences and success stories

Many foundations have found success through the efficient use of pdfFiller for completing Form 990-PF. User testimonials often highlight how the platform’s templates and tools have simplified their filing processes, particularly for organizations with limited resources.

For example, a small family foundation reported how using pdfFiller allowed them to complete their form accurately and submit it ahead of time, saving them from potential penalties. Such user experiences underscore the necessity of leveraging advanced tools to enhance compliance and simplify document management.

Advanced topics in Form 990-PF compliance

As the landscape of nonprofit regulation evolves, staying updated on advanced compliance issues related to Form 990-PF is essential for private foundations. Recent IRS updates may affect filing requirements or deadlines, and understanding these changes ensures foundations remain compliant.

Additionally, engaging in ongoing education and awareness around compliance can help foundations anticipate and respond to regulatory shifts.

Transitioning from paper to digital: advantages

Many foundations are shifting from paper-based documentation to digital platforms for enhanced efficiency. Utilizing a cloud-based platform for Form 990-PF allows for greater accessibility and collaboration, enabling team members to work on the form in real-time from different locations.

By transitioning to digital tools like pdfFiller, foundations can reduce the risks associated with paper forms, such as loss, damage, or delays in submission. The training resources and customer support available can streamline this transition and foster a more efficient workflow.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 990-pf in Gmail?

How can I edit 990-pf from Google Drive?

Can I edit 990-pf on an Android device?

What is 990-pf?

Who is required to file 990-pf?

How to fill out 990-pf?

What is the purpose of 990-pf?

What information must be reported on 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.