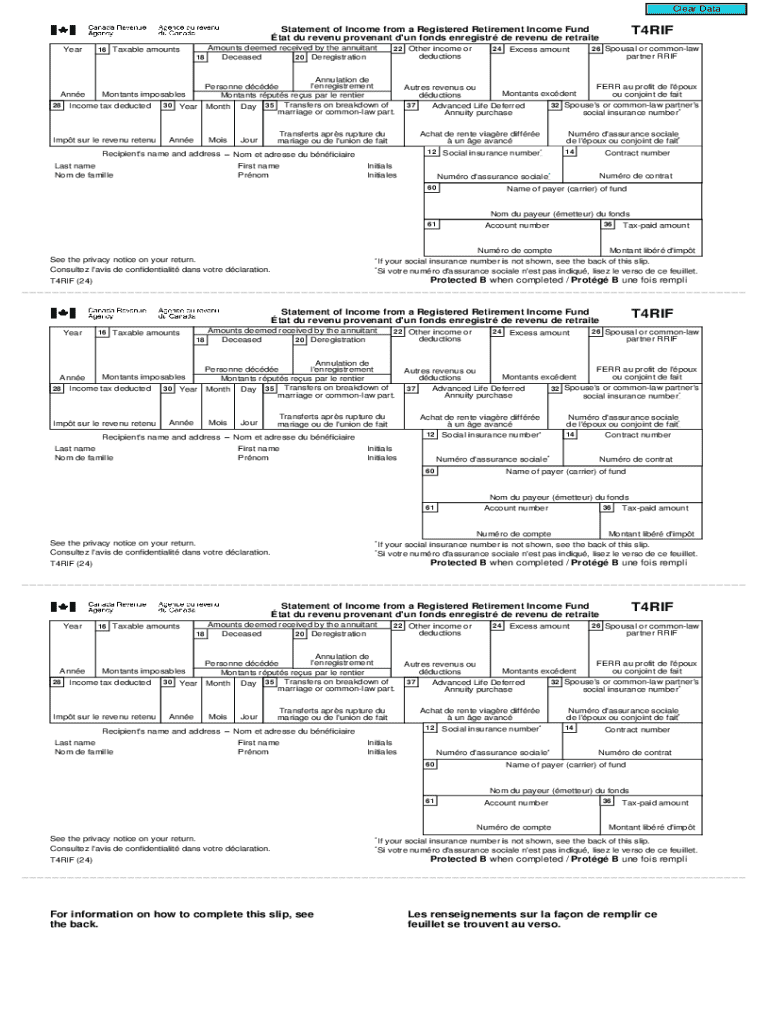

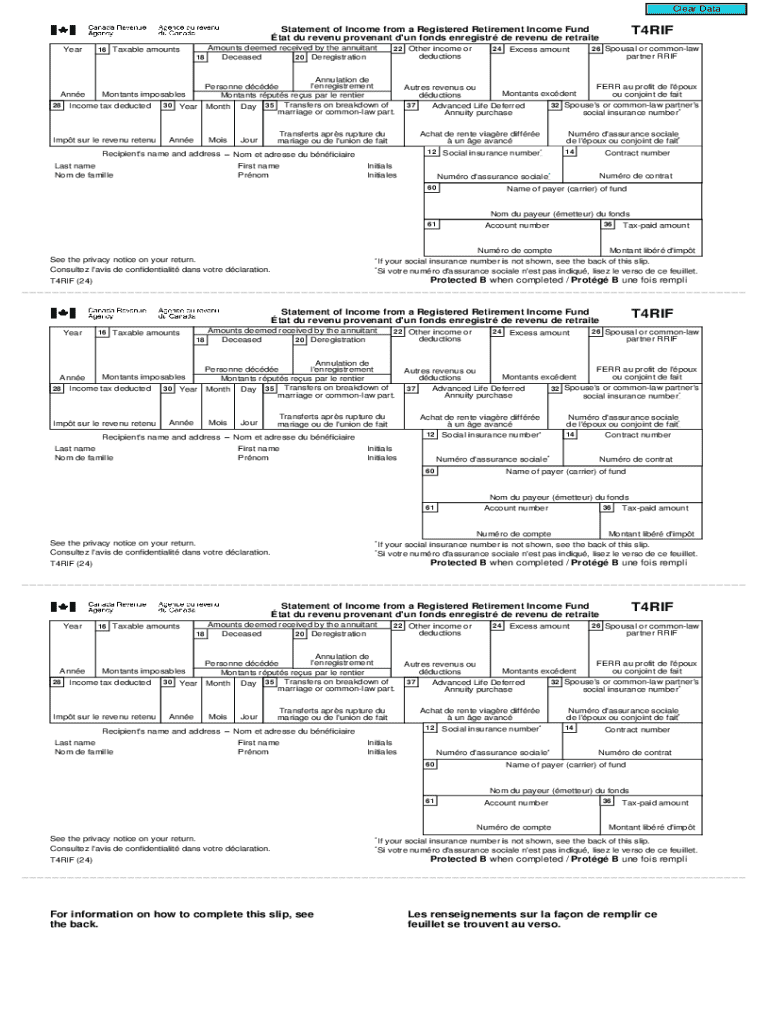

Get the free T4rif

Get, Create, Make and Sign t4rif

How to edit t4rif online

Uncompromising security for your PDF editing and eSignature needs

How to fill out t4rif

How to fill out t4rif

Who needs t4rif?

Understanding the Statement of Income from Form

Understanding the statement of income

A statement of income, often called an income statement, is a financial document that summarizes a company’s revenues and expenses over a specific period, typically quarterly or annually. This document provides a clear picture of a business’s profitability, making it essential for stakeholders looking for transparency and accountability within an organization.

The statement of income plays a critical role in financial reporting. For businesses, it is not just about numbers; it reflects operational efficiency, cost management, and growth potential. Investors, creditors, and management rely on this statement to make informed decisions regarding investments, lending, and strategic planning.

Types of income statements

Income statements vary primarily based on their structure. Two main formats exist: single-step and multi-step income statements.

A single-step income statement consolidates all revenues and expenses into a straightforward structure, making it easy to understand. In contrast, a multi-step income statement provides a more detailed breakdown, categorizing revenues and expenses into operating and non-operating sections. This distinction helps stakeholders to analyze the financial health of a business more effectively.

Additionally, some companies may prepare comprehensive income statements, which reflect not just the net income, but also other comprehensive income, such as unrealized gains and losses.

Who needs to file a statement of income?

Both individuals and businesses may be required to file a statement of income, depending on their financial circumstances. Individuals, especially freelancers or self-employed persons, need to present their income statements when applying for loans or submitting annual tax returns.

Businesses of all sizes use income statements for a variety of reasons, particularly during financial audits and when approaching investors for capital. Certain scenarios necessitate the inclusion of a statement of income, as it helps in assessing creditworthiness and financial viability.

How to fill out a statement of income

Filling out a statement of income can be straightforward if approached methodically. For individuals, collecting all financial documents and organizing them is the first step. This includes pay stubs, invoices for freelance work, and any other documented sources of income. Record all sources of income clearly and accurately to ensure a complete picture.

Next comes documenting expenses. Individuals should keep a detailed log of all expenditures related to their income-generating activities. This step is crucial as accurate expense reporting directly impacts net income calculations.

For businesses, the process can be facilitated using accounting software, which helps in automatically categorizing income and expenses. It's vital to maintain transparency and not overlook minor entries. Understand the common pitfalls to avoid, such as mixing personal and business expenses or omitting certain revenues.

Common mistakes when completing a statement of income

Completing a statement of income requires attention to detail. Unfortunately, many individuals and businesses make common mistakes that can significantly affect their financial reporting accuracy. One prevalent issue is underestimating expenses. Whether due to oversight or lack of thorough record-keeping, incomplete expense reporting can skew net income considerably.

Another frequent mistake is not including all sources of income. This is particularly common for freelancers who might forget to report income from side gigs. Misclassifying income and expenses can also lead to discrepancies, resulting in a misleading financial portrait.

Required information for filling out the statement of income

To accurately complete a statement of income, it's essential to gather thorough documentation. This includes not only the current year’s income and expenses but also previous years’ data as a benchmark. Detailed records of receipts for all claims and transactions help substantiate figures reported in the statement.

Account statements from banks and credit cards can also provide verification for reported information. These documents serve as formal proof of income and expenditures.

Tools and resources for creating a statement of income

Creating a statement of income can be made easier with the help of various tools and resources. One standout platform is pdfFiller, which provides interactive tools for document creation and management. Users can edit existing templates, create customized income statements, and leverage features for eSigning and collaboration.

The platform allows users to streamline the preparation of income statements while ensuring that the documents remain compliant and professional. Furthermore, pdfFiller’s intuitive interface makes it user-friendly for individuals and businesses alike.

Frequently asked questions

Income statements are often accompanied by numerous questions related to their preparation and implications. A common question is what constitutes valid income. Generally, valid income includes wages, salaries, freelance earnings, dividends, and any operational revenue generated by a business. Understanding what qualifies as income ensures compliance with tax regulations.

Many wonder how often an income statement should be updated. The frequency depends largely on the nature of the business, but regular updates—ideally quarterly—help maintain oversight of financial health. Finally, inaccuracies in income statements can lead to significant legal ramifications, from penalties for inaccuracies on tax returns to loss of credibility with investors.

Download and utilize income statement forms

To aid individuals in completing their statement of income, pdfFiller provides downloadable income statement forms in multiple formats, such as PDF and Word. These forms can be easily customized to fit specific needs, allowing users to generate professional income statements effortlessly.

Navigating e-services for electronic submissions ensures streamlined processing, and pdfFiller's tools make it simple to manage the submission process via their cloud-based platform.

Utilizing statements of income for future financial planning

Statements of income play a pivotal role in future financial planning. By analyzing previous income statements, individuals and businesses can create informed budgets, predict cash flows, and assess profitability. These insights are vital for making sound business strategies and investment decisions that will steer financial success.

For entrepreneurs, understanding trends reflected in income statements can highlight areas of opportunity or necessary adjustments. Long-term financial planning hinges on the ability to track performance accurately and set realistic, achievable goals.

Additional considerations for different demographics

Different demographic segments may have unique considerations when preparing statements of income. Freelancers and self-employed individuals often need to keep meticulous records of diverse income streams to ensure financial accuracy. It's crucial for them to categorize their income effectively and maintain thorough documentation of all transactions.

Small business owners face similar challenges. They must balance personal and business finances, ensuring that their income statements are clear and accurate. Larger corporations and shareholders have standardized processes to follow, often necessitating a deeper dive into detailed financial reporting and compliance measures.

Multi-language support for statement of income

As the global economy continues to evolve, the need for documentation in multiple languages has become increasingly important. Many users may benefit from income statement documentation available in various languages, allowing for clarity in understanding their financial reporting obligations.

pdfFiller recognizes this need and provides resources tailored for non-English speaking users, ensuring that language barriers do not hinder financial reporting compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find t4rif?

How do I edit t4rif online?

How do I fill out the t4rif form on my smartphone?

What is statement of income from?

Who is required to file statement of income from?

How to fill out statement of income from?

What is the purpose of statement of income from?

What information must be reported on statement of income from?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.