Get the free St-5 (rev. 10/2016)

Get, Create, Make and Sign st-5 rev 102016

How to edit st-5 rev 102016 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out st-5 rev 102016

How to fill out st-5 rev 102016

Who needs st-5 rev 102016?

Comprehensive Guide to the ST-5 Rev 102016 Form

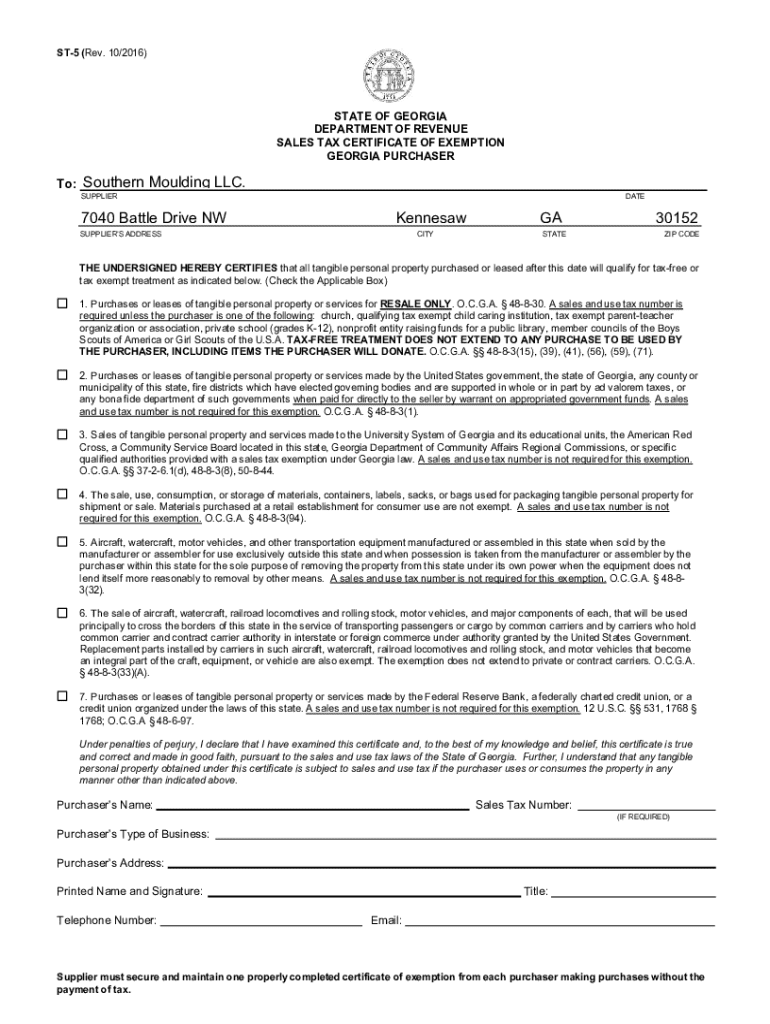

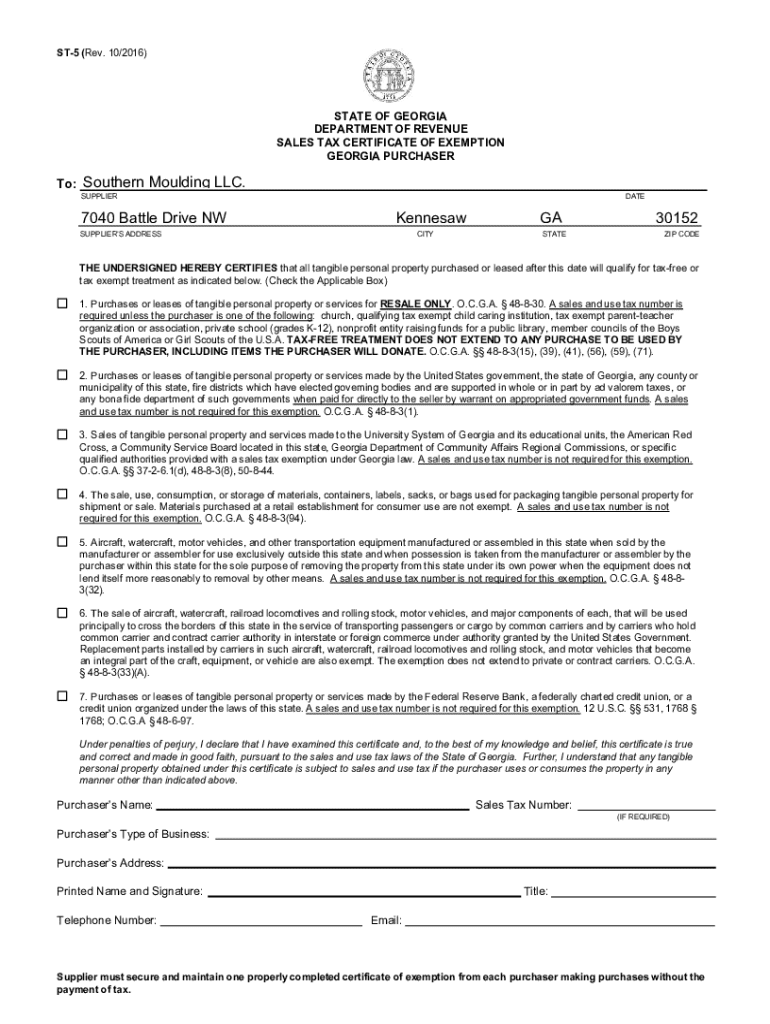

Understanding the ST-5 Rev 102016 form

The ST-5 Rev 102016 form, also known as the Certificate of Exemption, is a crucial document utilized by both individuals and businesses in various taxation situations. This certificate allows qualifying entities to claim an exemption from sales tax on specific purchases, effectively reducing their financial liabilities. Understanding who qualifies for the ST-5 is essential for both compliance and financial planning.

The importance of the ST-5 form cannot be understated. For individuals and businesses operating in sectors where exemptions apply, such as agriculture, manufacturing, or certain nonprofit activities, this form is indispensable for legal tax exemption processing. Without it, unprocessed exemption claims can result in unnecessary expenses and potential audits.

Navigating the form: Key sections

Navigating the ST-5 Rev 102016 form requires attention to detail, particularly in its specific sections. The form is structured in a way that ensures all necessary information is captured. Each part of the form has distinct requirements, making it important to comprehend what is asked for to avoid delays or denial of the exemption.

The personal information section necessitates accurate details, including names, addresses, and tax identification numbers. Incorrect or missing information can lead to significant delays in processing. The exemption clauses highlight the specific areas under which the purchase qualifies for a tax exemption; understanding these clauses is critical for ensuring compliance.

Step-by-step instructions to complete the ST-5 form

Completing the ST-5 Rev 102016 form can be streamlined with the right approach. Initially, gather all necessary documents and information. This preparation stage is essential to ensure that all relevant details are readily available for the form's completion.

When filling out the form, accuracy is paramount. Each section requires careful attention. For the personal information part, ensure that your names and addresses match exactly as they appear in your official documents. Common pitfalls include miswritten tax ID numbers or typos in names, which can cause substantial delays.

As you navigate to the exemption clauses, closely review the eligibility criteria for exemptions. Familiarize yourself with the definitions and scenarios where exemptions apply to prevent any misunderstanding that could lead to an incorrectly filed form.

Once completed, review the form thoroughly against a checklist to ensure no sections are missed and that all documentation is attached.

How to submit the ST-5 form

The submission of the ST-5 Rev 102016 form can be completed through various methods. Many users now prefer the online submission process, which is often the fastest and provides confirmation of receipt. However, traditional mailing is still an option for those who prefer physical documentation.

In-person submission is available in some jurisdictions, allowing you to present your form directly to a tax office. Regardless of the submission method, it is critical to be aware of specific deadlines to avoid late penalties, which can be costly.

Many jurisdictions have specific deadlines for submission. Missing these deadlines can result in late fees or the denial of your exemption claims.

Interactive tools and resources

Leveraging interactive tools can significantly ease the process of filling out the ST-5 Rev 102016 form. One user-friendly resource is pdfFiller, which not only allows for seamless form editing but also includes features for electronic signatures. This functionality enhances efficiency, especially for teams collaborating on a single document.

Furthermore, utilizing cloud-based solutions ensures easy access and secure storage of your completed forms. Users can manage their documents from anywhere, facilitating collaboration and ensuring that everyone involved is on the same page.

Tips for successful exemption applications

Securing successful exemption applications through the ST-5 Rev 102016 form requires understanding common pitfalls. Frequent mistakes include incomplete forms and failure to attach necessary supporting documentation. Such issues can delay processing and lead to denials.

Best practices for documentation involve ensuring that all claims are substantiated with relevant invoices or proof of eligibility. When preparing your submission, also familiarize yourself with the review process so you know what to expect after submission. Awareness of how long reviews typically take will help in managing your financial expectations.

Additional support

Support is crucial when navigating the complexities of the ST-5 Rev 102016 form. Whether you have specific questions or require clarification, contacting support can illuminate potential issues or concerns. Most tax authorities provide dedicated resources to handle inquiries regarding forms and exemptions.

Moreover, FAQs are often compiled by tax agencies, providing valuable insights into common questions about the ST-5. Troubleshooting common online submission issues is another vital resource, especially for new users who may encounter technical difficulties.

Related forms and documents

Understanding the landscape of related forms can be beneficial for individuals and organizations seeking various exemption options. The ST-5 is specifically tailored, but alternatives exist that serve different needs across diverse sectors. Familiarity with the function and purpose of these related forms can aid in selecting the right document for your situation.

It is also crucial to stay updated on any revisions to these forms or associated processes, as tax regulations frequently shift. Being proactive in keeping track of changes ensures compliance and maximizes your chances of successfully claiming exemptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send st-5 rev 102016 to be eSigned by others?

Can I create an eSignature for the st-5 rev 102016 in Gmail?

Can I edit st-5 rev 102016 on an iOS device?

What is st-5 rev 102016?

Who is required to file st-5 rev 102016?

How to fill out st-5 rev 102016?

What is the purpose of st-5 rev 102016?

What information must be reported on st-5 rev 102016?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.