Get the free Cardholder Dispute

Get, Create, Make and Sign cardholder dispute

Editing cardholder dispute online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cardholder dispute

How to fill out cardholder dispute

Who needs cardholder dispute?

Cardholder Dispute Form: A Comprehensive How-to Guide

Understanding cardholder disputes

A cardholder dispute arises when you challenge a charge on your credit or debit card statement, typically due to unauthorized use or dissatisfaction with a product or service. Disputes are an essential consumer protection tool, safeguarding individuals from being wrongly charged. Understanding why disputes happen can empower consumers to take action effectively.

Common reasons for disputing a charge include fraudulent transactions, where your card information has been used without your consent, service issues such as goods not being delivered, and billing errors where the amount charged is incorrect. Timely reporting of these discrepancies is crucial, as most banks and financial institutions have strict timeframes for filing disputes. Documenting your interactions and maintaining a record of charges will also facilitate a smoother dispute process.

Before you fill out the cardholder dispute form

Before embarking on filling out a cardholder dispute form, it is vital to gather all essential information. Collect transaction details such as the date, amount, and merchant name, as this information is crucial for processing your dispute effectively. Ensure you have your personal account information readily available to avoid unnecessary delays.

Next, assess the validity of your dispute. Determine whether the charge is genuinely disputable based on your knowledge of the transaction. Additionally, each bank or card issuer has a specific timeline for when disputes must be filed, often spanning between 30 to 120 days post-transaction. Be aware of these deadlines to strengthen your case.

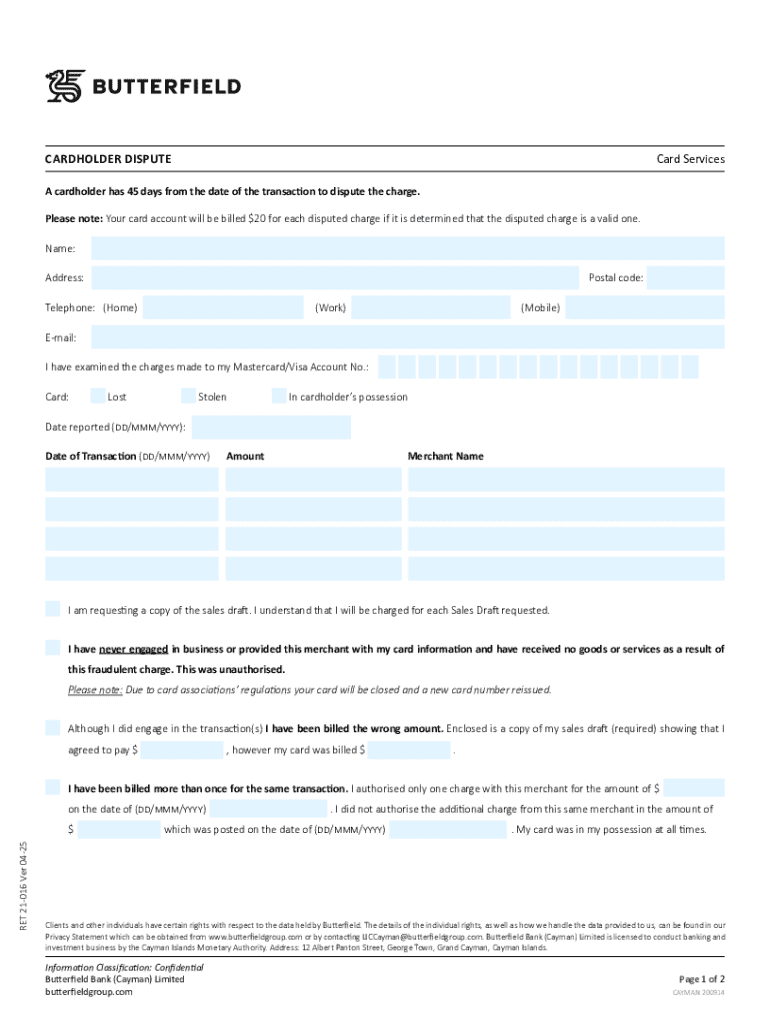

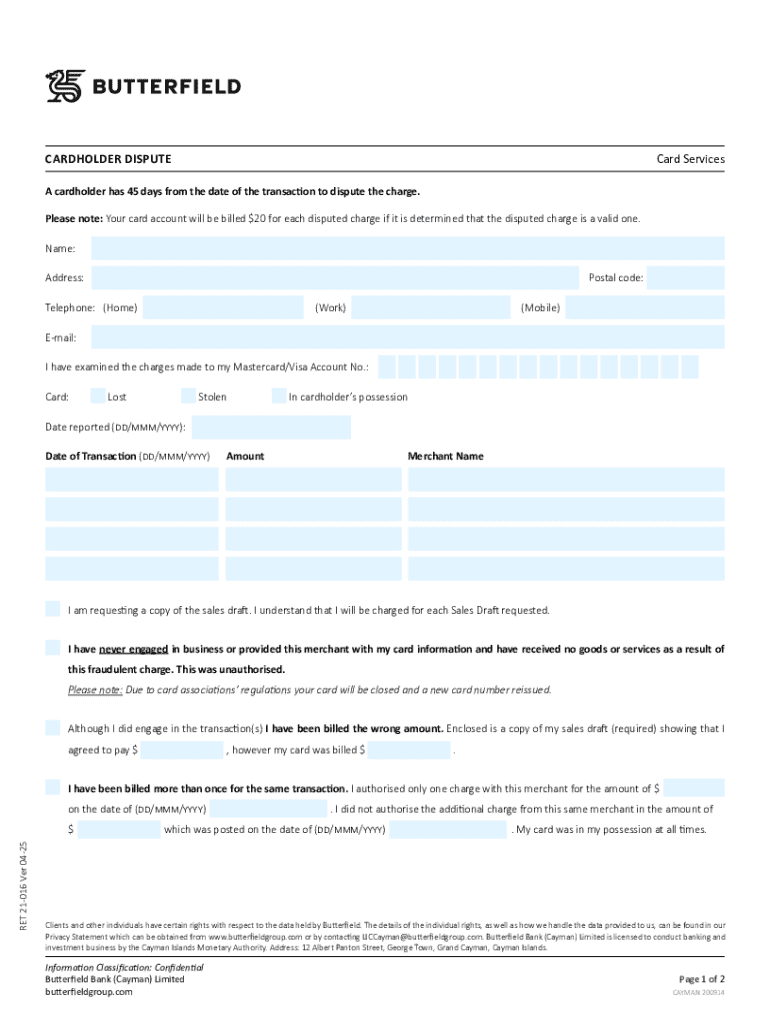

Overview of the cardholder dispute form

The cardholder dispute form is designed to capture essential details surrounding your dispute. Key components of the form typically include a personal information section where you input your name, card number, and contact details. It also has a section for describing the disputed transaction, specifying the reason for the dispute, and a section for attaching supportive documentation.

The form often comes in various formats, which can be filled out online through your bank’s website or printed for manual completion. Utilize pdfFiller to access a customizable template of the cardholder dispute form, which can be edited, signed, and managed seamlessly.

Step-by-step guide to completing the cardholder dispute form

To fill out the cardholder dispute form correctly, follow these straightforward steps:

Tracking your dispute progress

Once your cardholder dispute form is submitted, tracking its progress is essential to ensuring a resolution. Follow up with your bank to confirm receipt of your dispute and inquire about the next steps. This proactive engagement can expedite the process and provide you with insight into any required actions from your side.

During the dispute investigation, expect various communication from your bank. They may request further information or documentation. It's important to obtain a reference number at the time of your submission; this serves as your tracking tool for inquiries regarding the status of your dispute.

Common pitfalls and tips for a successful dispute

Navigating the dispute process can sometimes be tricky, and avoiding common pitfalls is key to successfully resolving your issue. Typical mistakes include submitting incomplete information and not adhering to deadlines, both of which can hinder the resolution process.

To improve your chances of a favorable outcome, keep a detailed record of all communications related to your dispute. Respond promptly to any requests from your bank, maintaining an open line of communication to facilitate the resolution process.

Utilizing pdfFiller for document management

Using pdfFiller to manage the cardholder dispute form offers a plethora of benefits. Users can fill out and edit their documents online with ease, ensuring they have the right formats at their fingertips.

This platform provides features like electronic signatures for convenient authorization, secure storage for your documents, and collaboration tools designed for team use. pdfFiller enhances the experience by simplifying document management, making the process of dealing with disputes much more efficient.

Additional information related to cardholder disputes

If your dispute is denied, it’s not the end of the road. Options include contacting consumer protection agencies or considering other channels such as alternative dispute resolution. Familiarizing yourself with your rights as a cardholder is essential; resources are available online to guide you through this process.

Understanding your rights helps protect you in future transactions and provides insight into your options if things don’t go as planned. Performing due diligence during this entire process is vital to safeguarding against unjust charges.

Frequently asked questions (FAQ)

As with any financial process, questions often arise regarding the intricacies of cardholder disputes. Here are clarifications on some frequently asked questions:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cardholder dispute to be eSigned by others?

Can I sign the cardholder dispute electronically in Chrome?

How do I fill out the cardholder dispute form on my smartphone?

What is cardholder dispute?

Who is required to file cardholder dispute?

How to fill out cardholder dispute?

What is the purpose of cardholder dispute?

What information must be reported on cardholder dispute?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.