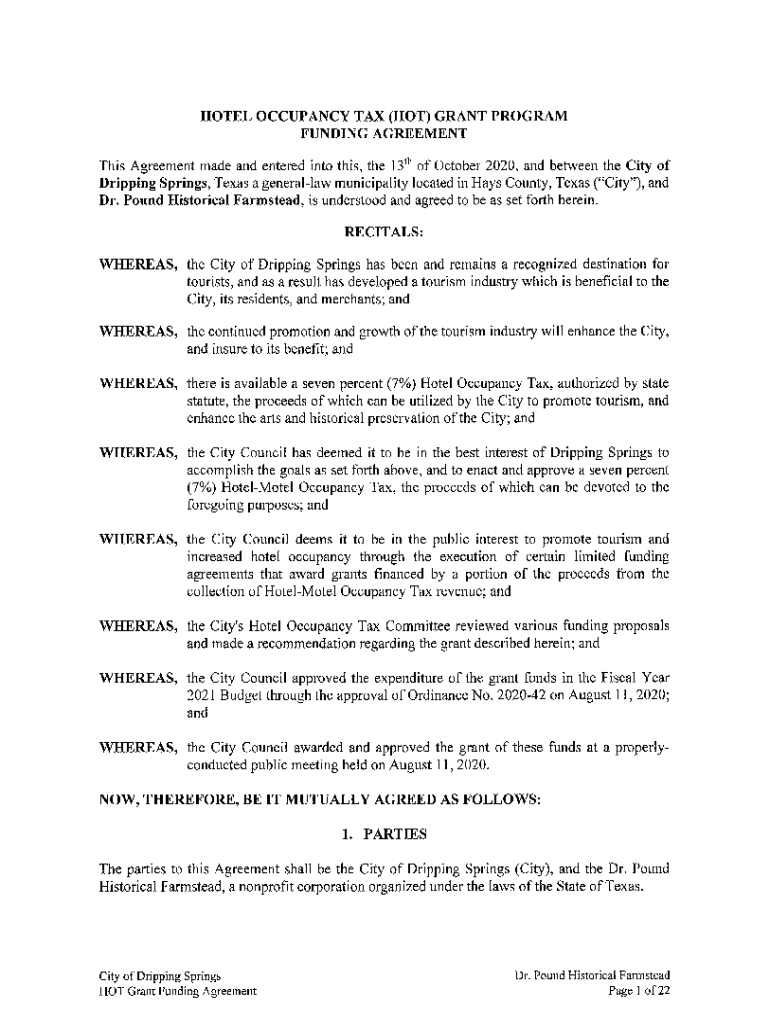

Get the free Hotel Occupancy Tax (hot) Grant Program Funding Agreement

Get, Create, Make and Sign hotel occupancy tax hot

Editing hotel occupancy tax hot online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hotel occupancy tax hot

How to fill out hotel occupancy tax hot

Who needs hotel occupancy tax hot?

Hotel occupancy tax hot form: A comprehensive how-to guide

Understanding the hotel occupancy tax (hot)

Hotel occupancy tax (HOT) is a charge applied to guests who stay at hotels, motels, and other lodgings. This tax is typically calculated as a percentage of the room rate and is used to generate revenue for local governments. The funds collected from the HOT serve various purposes, including funding tourism efforts, community infrastructure, and cultural events.

Understanding the regulations that govern the hotel occupancy tax is essential for hotel operators and guests alike. Each jurisdiction may have specific compliance requirements, making it crucial to be informed about local rules. Common misconceptions include the belief that HOT applies only to luxury hotels; however, it affects all types of accommodation providers.

Who is responsible for paying the hotel occupancy tax?

Typically, the responsibility to remit the hotel occupancy tax falls on the lodging provider. This includes hotels, motels, bed-and-breakfasts, and any other establishments offering short-term lodging. However, guests should be aware that the cost of the tax is usually passed on to them in their overall bill.

Certain exemptions may apply depending on local laws. For instance, government officials traveling for work or individuals staying for extended periods may not be required to pay the tax. For short-term rentals, like Airbnb properties, the classification can sometimes get tricky, as regulations vary widely across jurisdictions.

Rates and calculation of hotel occupancy tax

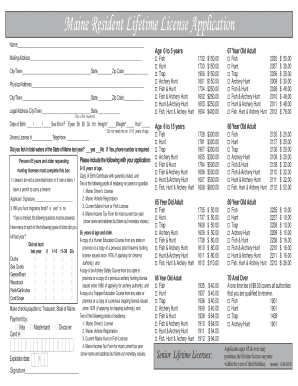

HOT rates can vary significantly by region, with some areas charging more than others. For example, urban centers typically impose higher rates than rural areas to reflect demand. It's essential to consult local regulations for current rates, which could range from 5% to over 15%.

To calculate the hotel occupancy tax, the basic formula is: Room Rate x HOT Rate = HOT Owed. For example, if a hotel's room rate is $200 and the local HOT is 10%, the calculation would be $200 x 0.10 = $20 in tax owed, which is added to the overall bill.

Filing the hotel occupancy tax

When it comes to filing the hotel occupancy tax, it’s essential to be fully compliant with local regulations. Generally, anyone collecting the HOT is required to file a periodic return. The reporting period and filing deadlines can vary by jurisdiction. A typical schedule may include quarterly or monthly filing, depending on the volume of business.

Completing the HOT form requires specific information, including total room revenue, collected taxes, and the business's identification details. Common pitfalls include miscalculating the tax owed or failing to file on time, which can result in penalties. It’s crucial to keep accurate records and double-check calculations.

Payment of hotel occupancy tax

Payment methods for hotel occupancy tax are typically straightforward. Many jurisdictions offer electronic filing options, allowing for online payments. This method is often preferred due to its convenience and efficiency. Additionally, manual payment options may still be available for those who prefer to settle their tax obligations in person or via mail.

Every jurisdiction has key deadlines and due dates to adhere to when filing and paying the HOT. Failing to meet these deadlines can result in late fees and accrued interest, which can compound quickly. Understanding these timelines is essential to maintaining compliance.

Exemptions and special circumstances

Exemptions to the hotel occupancy tax can vary based on specific state and local regulations. For instance, government employees or individuals under certain circumstances, like long-term stays, may not have to pay the HOT. It is vital to familiarize oneself with local rules to determine eligibility for exemptions.

Claiming these exemptions typically requires providing adequate documentation and, in some cases, completing a specific form designated by local tax authorities. Non-profit organizations also have unique rules regarding their exemption from this tax, which can further complicate the process if not correctly understood.

Understanding refunds and adjustments

Requesting a refund for overpaid hotel occupancy taxes can be a straightforward process if done correctly. Required documentation typically includes original receipts and justification for the refund request. Adjustments can also be made on previously filed taxes if errors were discovered post-filing.

Common issues arise from incomplete documentation or failure to follow through on required procedures, leading to rejected refund requests. Hence, detailed attention to the filing process and subsequent adjustments is key to navigating this aspect of the HOT.

Resources for managing hotel occupancy tax

Managing hotel occupancy tax requires access to reliable resources. Various online tools can assist business owners in calculating taxes accurately, conducting proper reporting, and ensuring that they keep compliant. Resources provided by state and local governments can often clarify specific duties and obligations for lodging establishments.

Consulting with tax professionals can also provide relief, especially for businesses unfamiliar with tax laws. They can offer tailored advice and guarantee that forms are filled out correctly. Frequently asked questions about HOT often include issues pertaining to compliance and best practices for record-keeping.

Best practices for hotels and lodging businesses

Maintaining accurate records is crucial for hotel occupancy tax compliance. Establishments should implement comprehensive tracking systems for all transactions involving room rentals to monitor tax collected effectively. Training staff on tax compliance ensures that everyone understands the necessity of accurate reporting and the implications of failure to comply.

Leveraging technology, such as pdfFiller, can significantly streamline documentation management, aiding in the efficient oversight of forms and compliance requests. Engaging with local tourism boards can also provide helpful insights into specific tax policies that affect your business operations.

Frequently asked questions about hotel occupancy tax

Comprehending hotel occupancy tax regulations and processes can sometimes prompt numerous queries. Simplifying answers to these common questions is beneficial, especially for busy hotel managers. Typical questions include details about filing processes, rates in specific areas, and potential exemptions.

For further assistance, local and state government resources often provide contact information, allowing lodging operators to connect with tax authorities directly via email or phone. Clear communication with tax authorities is crucial for resolving any concerns regarding HOT compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify hotel occupancy tax hot without leaving Google Drive?

Where do I find hotel occupancy tax hot?

Can I edit hotel occupancy tax hot on an Android device?

What is hotel occupancy tax hot?

Who is required to file hotel occupancy tax hot?

How to fill out hotel occupancy tax hot?

What is the purpose of hotel occupancy tax hot?

What information must be reported on hotel occupancy tax hot?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.