Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form - Comprehensive How-to Guide

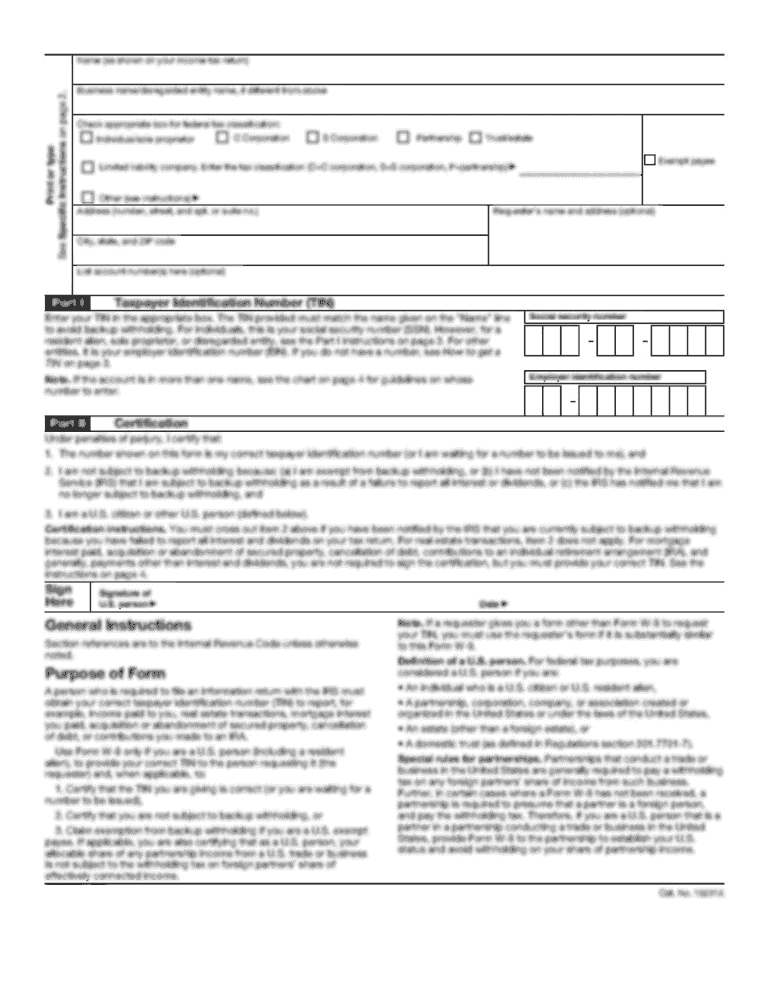

Understanding Form 990

Form 990 is a key document that non-profit organizations must file annually with the Internal Revenue Service (IRS). It serves as a public disclosure form that provides extensive information about a nonprofit's financial health, governance, and programmatic activities. In essence, Form 990 enhances transparency for tax-exempt organizations and informs stakeholders about how funds are used, fostering public trust.

The importance of Form 990 can't be overstated; it not only aids in tax compliance but also promotes accountability to donors, grantors, and the general public. For many stakeholders, such as potential donors and community members, Form 990 is a crucial tool for evaluating an organization’s effectiveness, financial stability, and integrity.

Types of organizations required to file

Specific types of organizations must file Form 990, including charities, foundations, and other tax-exempt entities. This includes 501(c)(3) organizations, which are recognized as charitable entities by the IRS, as well as other classifications like 501(c)(4) social welfare organizations. In total, any tax-exempt organization that meets the criteria based on gross revenue and financial activities is required to file Form 990.

Key components of Form 990

Form 990 consists of multiple sections that provide structured and comprehensive information. Each section is designed to illuminate different aspects of the organization’s operations and finances, forming a complete picture of their societal contributions.

The schedules A through R delve into various components, such as revenue sources, compensation, fundraising efforts, and other operational insights. Each schedule is crafted to enable transparency and clarity about the organization’s activities and financial practices.

Navigating financial information

Financial statements are crucial in Form 990, detailing the organization’s revenue, expenses, and net assets. It is essential for organizations to accurately report all sources of income, including donations, grants, investments, and any other revenue-generating activities.

Filing requirements and deadlines

Determining who must file Form 990 requires an understanding of specific thresholds. Organizations earning over $50,000 in gross receipts annually are mandated to submit this form, while those below this threshold can opt for the simplified Form 990-N. However, certain organizations, such as churches and specific educational institutions, are typically exempt from this requirement.

Filing deadlines are set on the 15th day of the 5th month following the end of the organization's fiscal year. Organizations can request a six-month extension by filing Form 8868, but must also ensure they remain compliant regarding necessary disclosures.

Filing modalities

Submitting Form 990 can be done in two primary ways: online or via mail. The IRS encourages e-filing as it streamlines processing and is more efficient. Organizations can file directly through the IRS e-Postcard system or through authorized software.

Before submitting, a detailed checklist of required documentation includes financial statements, governance policies, and other key records. This pre-filing step is crucial for ensuring accuracy and compliance while filing Form 990.

Penalties for non-compliance

Failing to file Form 990 or submitting it late can result in severe penalties for organizations, including monetary fines that escalate based on how late the filing is. For organizations, these financial repercussions can affect their operational budgets and credibility.

Public inspection regulations

Form 990 is not only an internal document but also one that is accessible to the public. This provision ensures transparency, allowing stakeholders, including donors and researchers, to inspect filed forms. These documents can typically be accessed on the IRS website or through various third-party services that consolidate nonprofit data.

Historical context and evolution

The origins of Form 990 date back to the 1940s, established as a means for the IRS to monitor the activities of tax-exempt organizations. Over the years, it has undergone significant revisions to adapt to the evolving landscape of nonprofit governance and transparency. Initially simplified, it has expanded into the multi-part form we know today, addressing various facets of financial reporting and operational practices.

Utilizing Form 990 for research

Form 990 is an invaluable resource for researchers and donors, offering insights into nonprofit organizations' financial and operational health. By systematically analyzing the data presented in these filings, stakeholders can assess financial stability, mission effectiveness, and overall impact on their communities.

Interactive tools for managing Form 990

pdfFiller provides an efficient, cloud-based solution for managing Form 990. Its platform allows users to fill out, edit, and eSign documents seamlessly, ensuring that all required components are accurately completed and submitted on time.

By utilizing such tools, organizations can streamline their filing processes, reduce errors, and maintain compliance with IRS regulations easily.

Conclusion of insights

Form 990 is more than just a tax form; it is a foundational element of nonprofit transparency and accountability. Understanding its components, filing requirements, and implications is crucial for any organization seeking to maintain compliance while building trust with stakeholders.

Post-filing requirements, such as keeping Form 990 available to the public and integrating feedback from its insights, are vital to ongoing success. The careful navigation of this process ensures viability and fosters confidence within the communities served.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 990 without leaving Chrome?

Can I create an electronic signature for the form 990 in Chrome?

Can I edit form 990 on an iOS device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.