Get the free Application Form for Credit Facility Under Jlg/shg

Get, Create, Make and Sign application form for credit

How to edit application form for credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application form for credit

How to fill out application form for credit

Who needs application form for credit?

Your Comprehensive Guide to the Application Form for Credit Form

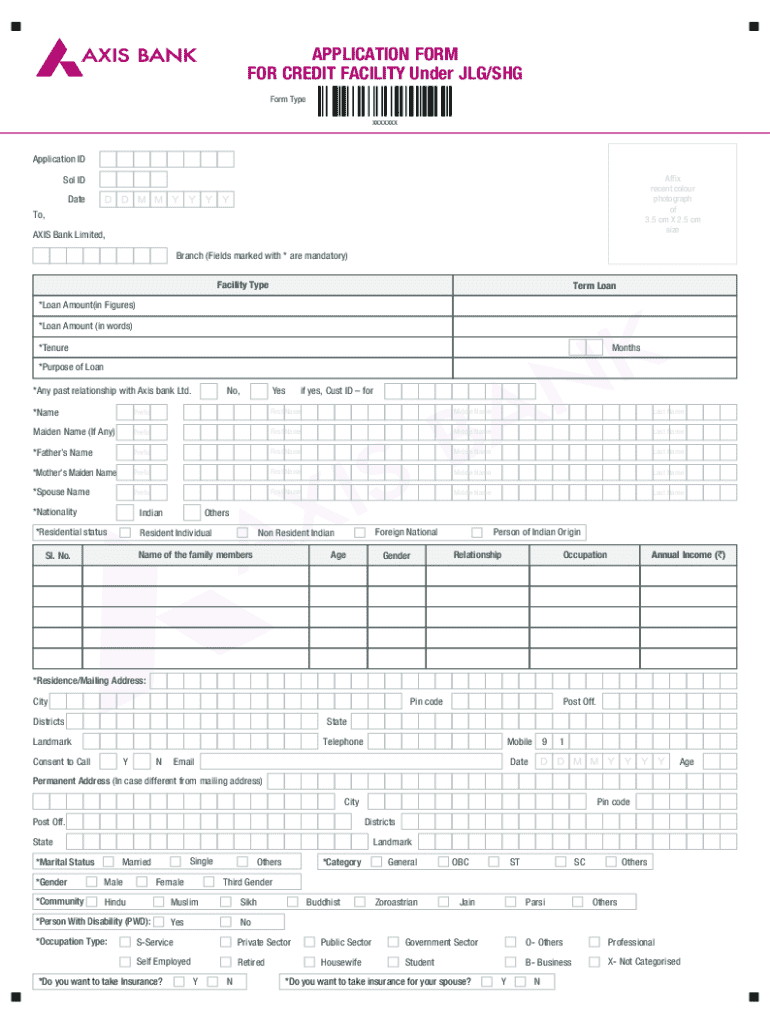

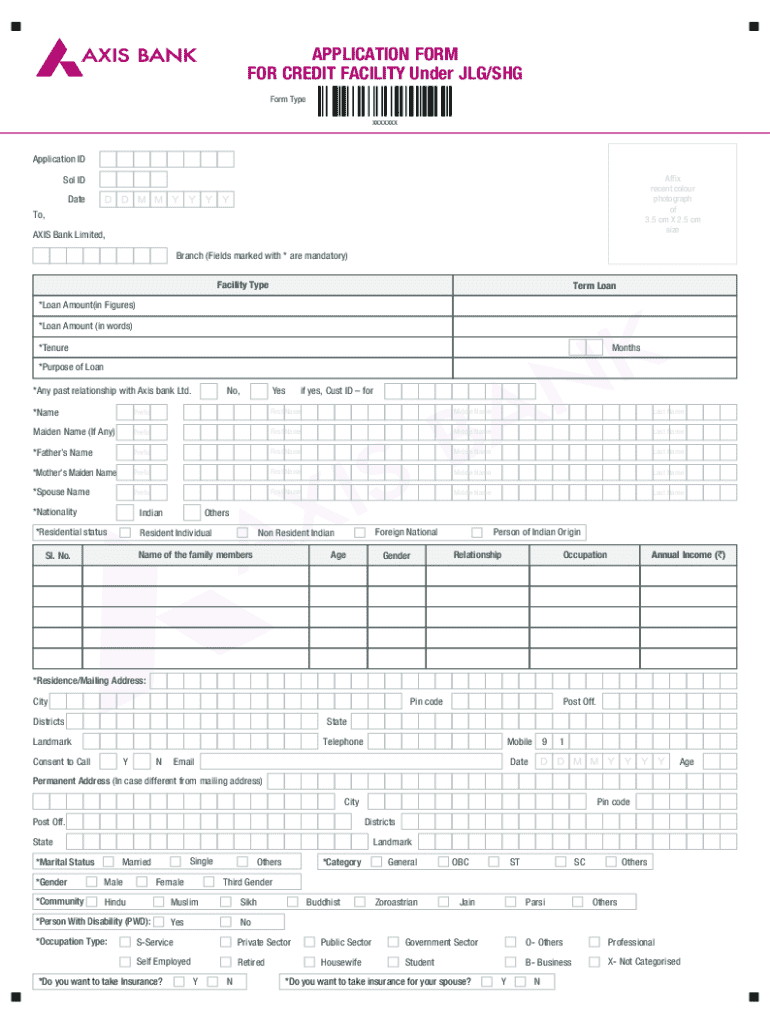

Understanding the credit application form

The credit application form is a crucial document that assesses an individual's or a business's eligibility for credit. It serves as the formal request for credit and typically includes detailed information about income, assets, liabilities, and credit history. The purpose is to gather pertinent information to evaluate the applicant's creditworthiness, which credit providers analyze to make lending decisions.

Notably, personal and business credit application forms differ significantly. Personal forms focus on individual financial health such as personal income, whereas business forms require information about the company’s financial performance and structure. Understanding these differences is essential when applying for credit, as it affects how lenders evaluate your request.

Credit applications are vital for maintaining financial health, helping to establish a credit history for individuals and businesses alike. A good credit application can significantly increase the chances of loan approval, thereby enhancing financial opportunities.

Essential elements of a credit application form

To fill out a credit application effectively, certain information is typically required from individual applicants and businesses. Individuals need to provide personal details such as name, address, and social security number. Additionally, financial information detailing income, assets, and existing debt obligations is crucial.

For businesses, the application requires a deeper dive into financial health, including the business name, structure, and Employer Identification Number (EIN). This information helps lenders assess the business's operational status.

Creating an effective application form for credit

An effective application form for credit not only asks the right questions but is also designed for clarity and ease of use. Consideration of design aspects, such as layout and font size, can greatly impact user experience. Keeping the form intuitive ensures applicants feel confident when completing it.

Additionally, incorporating essential questions that assess creditworthiness without overwhelming the applicant is crucial. By using pdfFiller’s templates, users can easily customize forms to meet specific requirements, streamlining the credit application process further.

Filling out the application form: step-by-step guide

Filling out a credit application form can seem daunting, but following a few structured steps simplifies the process. First, gather all necessary documents and information such as your income statements, tax returns, and any current loans or financial obligations.

Next, access the application via pdfFiller. The platform provides a user-friendly interface where you can enter your information accurately. After filling out the form, take the time to review your application to ensure all details are correct before submission. Finally, submit your application for review; your attention to detail here can significantly impact the approval process.

Common challenges in the credit application process

Many applicants encounter challenges when submitting credit applications, particularly with traditional paper forms. Common issues include errors during filling, misplacement of documents, and delays in processing due to incomplete submissions.

Furthermore, many may struggle to navigate complex questions or know what information is truly required. Understanding common pitfalls, such as unclear reporting of income or neglecting to disclose debts, can help applicants address potential rejections proactively.

The benefits of using digital credit application forms

Utilizing digital credit application forms offers several advantages. Automation significantly enhances efficiency, reducing the time spent on paperwork and increasing accuracy. Digital platforms like pdfFiller improve the process with easy editing, allowing applicants to make quick adjustments without starting from scratch.

Moreover, robust collaboration features enable easy sharing with financial advisers or team members. Secure eSignature capabilities further speed up the approval process, allowing for immediate acceptance and confirming compliance with legal standards.

Expert tips to increase approval chances

To enhance the likelihood of being approved for credit, present your financial information as accurately and transparently as possible. Ensure that your income and assets are clearly stated, and consider providing additional documentation if necessary.

If you have a negative credit history, it may be beneficial to include references or a personal statement explaining your financial situation. Learning to address such challenges positively can dramatically impact how lenders perceive your application.

Case studies: successful credit applications via digital platforms

Examining real-world examples reveals how digital platforms can assist individuals and businesses during the credit application process. For individuals, utilizing streamlined online forms has helped borrowers overcome barriers by simplifying information gathering and submission.

Businesses, on the other hand, have leveraged digital solutions to expedite the application processes. By efficiently collecting necessary information and documents, businesses have improved their chances of receiving timely funding all while maintaining a comprehensive overview of their applications.

FAQs about the credit application process

One common question is what happens after submitting a credit application. Typically, lenders review the application, perform credit checks, and may contact you for further information. This process can vary, but understanding the general flow can alleviate anxiety.

Many applicants inquire about the duration of the credit application process. This timeframe often depends on the lender; while some can provide immediate reactions, others may take several days. Before applying, consider actions you can take to strengthen your creditworthiness, and make sure you know what to do if your application is denied to approach your next steps confidently.

The future of credit applications: trends and innovations

Advancements in technology, particularly AI and machine learning, are transforming how credit assessments occur. In the not-so-distant future, these innovations may provide even deeper insights into credit risks, refining approval processes.

The financial landscape is embracing digital transformation, and credit applications are no exception. Trends indicate that the next decade may involve faster, more efficient processes, improving borrower experiences and lenders' decision-making capabilities.

About pdfFiller

pdfFiller is a cloud-based platform designed to simplify document management, including credit application forms. The suite of features includes seamless editing, eSignature capabilities, and collaborative tools that empower users to take control of their documents efficiently.

By using pdfFiller, applicants can create and manage credit application forms effortlessly, allowing for organized tracking and easy access to all pertinent information. Testimonials among users underscore real-life successes transformed by the efficiency and capability of the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the application form for credit electronically in Chrome?

Can I edit application form for credit on an iOS device?

How do I fill out application form for credit on an Android device?

What is application form for credit?

Who is required to file application form for credit?

How to fill out application form for credit?

What is the purpose of application form for credit?

What information must be reported on application form for credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.